A business can expect a big impact on its profits if it doesn't account for the depreciation of its assets. The first recovery year for the 5-year property placed in service during the short tax year extends from August 1 to July 31. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. If you sell, exchange, or otherwise dispose of the property, do not figure the recapture amount under the rules explained in this discussion. During the year, you made substantial improvements to the land on which your paper plant is located. Basis adjustment due to recapture of clean-fuel vehicle deduction or credit. However, to determine whether property qualifies for the section 179 deduction, treat as an individual's family only their spouse, ancestors, and lineal descendants and substitute "50%" for "10%" each place it appears. Expenses generally paid by a buyer to research the title of real property. Your section 179 deduction is generally the cost of the qualifying property. Subcategories of accumulated depreciation - equipment and accumulated depreciation - buildings, accumulated depreciation - vehicles, Where on the general ledger would a breakdown of the accumulated depreciation accounts fall? Removal of barriers for the elderly and disabled. The property is 3-year property. The participations and residuals must relate to income to be derived from the property before the end of the 10th tax year after the property is placed in service. Multiply the result of (2) by the percentage you figured in (3). If you made this election, continue to use the same method and recovery period for that property. For each recovery year included, multiply the depreciation attributable to that recovery year by a fraction. You refer to the MACRS Percentage Table Guide in Appendix A and find that you should use Table A-1. If you occupy any part of the building or structure for personal use, its gross rental income includes the fair rental value of the part you occupy. Make the election by completing line 18 of Form 4562. Usually, a percentage showing how much an item of property, such as an automobile, is used for business and investment purposes. Under the units of production method, the depreciation rate is computed as Over the life of an asset, total depreciation always equals 200% (also referred to as double declining balance) (DDB). PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Generally, for the section 179 deduction, a taxpayer is considered to conduct a trade or business actively if they meaningfully participate in the management or operations of the trade or business. Go to IRS.gov/Coronavirus for links to information on the impact of the coronavirus, as well as tax relief available for individuals and families, small and large businesses, and tax-exempt organizations. Divide the balance by the number of years in the useful life. The price that property brings when it is offered for sale by one who is willing but not obligated to sell, and is bought by one who is willing or desires to buy but is not compelled to do so. If you are in the business of renting videocassettes, you can depreciate only those videocassettes bought for rental. It lists the percentages for property based on the 150% Declining Balance method of depreciation using the Mid-Quarter Convention, Placed in Service in First Quarter. Report the recapture amount as other income on the same form or schedule on which you took the depreciation deduction. You reduce the adjusted basis ($173) by the depreciation claimed in the fifth year ($115) to get the reduced adjusted basis of $58. TRUE OR FALSE It is generally taken into account over 4 tax years and is reported on your business tax returns as other income. However, you can elect to use a 1-year adjustment period and report the adjustment in the year of change if the total adjustment is less than $50,000. Provides a beginning date and a maximum period of time, not to exceed 156 weeks or 36 months from the beginning date, for which the contract can be in effect (including renewals or options to extend). The use is for your employer's convenience if it is for a substantial business reason of the employer. The numerator of the fraction is the current year's net income from the property, and the denominator is the total income anticipated from the property through the end of the 10th tax year following the tax year the property is placed in service. Passenger automobile limits and rules. See the Instructions for Form 1065 for information on how to figure partnership net income (or loss). Salvage value is the estimated book value of an asset after depreciation.  Treat the use of listed property for entertainment, recreation, or amusement purposes as a business use only to the extent you can deduct expenses (other than interest and property tax expenses) due to its use as an ordinary and necessary business expense.

Treat the use of listed property for entertainment, recreation, or amusement purposes as a business use only to the extent you can deduct expenses (other than interest and property tax expenses) due to its use as an ordinary and necessary business expense.

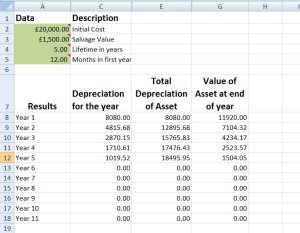

Some decrease more quickly than others.

You can get forms and publications faster online. Depreciation under the SL method for the third year is $137.

The amount included in income is the inclusion amount (figured as described in the preceding discussions) multiplied by a fraction. Property containing used parts will not be treated as reconditioned or rebuilt if the cost of the used parts is not more than 20% of the total cost of the property.

So, the depreciation amount would be $5,250 ($17,500 x 30%). This section of the table is for years 1 through 51 with recovery period increments from 18 to 50 years. When you buy a tangible asset, its value decreases over time. A truck is a qualified specialized utility repair truck if it is not a van or pickup truck and all the following apply. A half-year convention for depreciation is a depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year. Do the Passenger Automobile Limits Apply? The numerator (top number) of the fraction is the number of months (including parts of a month) the property is treated as in service during the tax year (applying the applicable convention). in chapter 5. . This chapter explains what is qualified property. Section 197 intangibles. If you would be allowed a depreciation deduction for a term interest in property except that the holder of the remainder interest is related to you, you must generally reduce your basis in the term interest by any depreciation or amortization not allowed. Heating, ventilation, and air-conditioning property. Quality Indian Reservation Property Tables, Qualified Indian Reservation Property Tables 2, Qualified Indian Reservation Property Tables Continued. You can use this worksheet to help you figure your depreciation deduction using the percentage tables. Under the declining balance method, annual depreciation = depreciation rate (x) Book value. File the amended return at the same address you filed the original return. .For purposes of determining whether the mid-quarter convention applies, the depreciable basis of property you placed in service during the tax year reflects the reduction in basis for amounts expensed under section 179 and the part of the basis of property attributable to personal use. The applicable convention (discussed earlier under Which Convention Applies) affects how you figure your depreciation deduction for the year you place your property in service and for the year you dispose of it. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Assume the same facts as in Example 1 under Property Placed in Service in a Short Tax Year, earlier. What Is Straight-Line Depreciation? You can find information on IRS.gov/MyLanguage if English isnt your native language. Silver Leaf, a retail bakery, traded in two ovens having a total adjusted basis of $680, for a new oven costing $1,320. Assets that have an easily discovered depreciable base, but not a definite life, work best with this method. First- and second-year depreciation for furniture. Depreciate trees and vines bearing fruits or nuts under GDS using the straight line method over a recovery period of 10 years. Check Table B-1 for a description of the property. Make the election by completing line 20 in Part III of Form 4562. Year 2: (4/15) x $12m = $3.2m. You can send us comments through IRS.gov/FormComments. A half-year convention for depreciation is a depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year. Years remaining in assets life (/) sum of the digits = depreciation rate David Rule is employed as an engineer with Zip, an engineering contracting firm. After you figure your special depreciation allowance for your qualified property, you can use the remaining cost to figure your regular MACRS depreciation deduction (discussed in chapter 4). You can choose to use the income forecast method instead of the straight line method to depreciate the following depreciable intangibles. You are a sole proprietor and calendar year taxpayer who works as a sales representative in a large metropolitan area for a company that manufactures household products. Chart 2 is used for residential rental and nonresidential real property. Claiming the Special Depreciation Allowance, Certain Qualified Property Acquired After September 27, 2017. How can you make sure that an asset was not admitted from the schedule and therefore not depreciated for a certain year? You figure the SL depreciation rate by dividing 1 by 3.5. David owns and uses a home computer, which is virtually identical to the office model. Under the generally accepted accounting principles (GAAP) of the United States, the value reported for long-term assets does not provide a proper valuation. An individual who owns, except by applying rule (2), any stock in a corporation is considered to own the stock directly or indirectly owned by or for the individual's partner. You placed the safe in service in the first quarter of your tax year, so you multiply $1,143 by 87.5% (the mid-quarter percentage for the first quarter).

Property subject to the mid-month convention can only be grouped into a GAA with property placed in service in the same month of the tax year. The following examples are provided to show you how to use the percentage tables. (this amount does not change from year-to-year). For the first 3 weeks of each month, you occasionally used your own automobile for business travel within the metropolitan area. Depreciation for property placed in service during the current year.

If in 2022 and later years you continue to use the car 100% for business, you can deduct each year the lesser of $1,875 or your remaining unrecovered basis. 2022 is the third tax year of the lease, so the applicable percentage from, Average business/investment use for years property leased before the first year business use is 50% or less.

Passenger automobiles (as defined later). .Like-kind exchanges completed after December 31, 2017, are generally limited to exchanges of real property not held primarily for sale.. Declining balance (DB) is mostly used with equipment and assets that will assuredly decline in value over the years. Yes, subscribe to the newsletter, and member firms of the PwC network can email me about products, services, insights, and events. It lists the percentages for property based on the Straight Line method of depreciation using the Mid-Quarter Convention and Placed in Service in Second Quarter. The unadjusted depreciable basis of the property, minus. In June 2024, Make & Sell sells seven machines to an unrelated person for a total of $1,100. For property for which you used a half-year convention, the depreciation deduction for the year of the disposition is half the depreciation determined for the full year. John, in Example 1, allows unrelated employees to use company automobiles for personal purposes.

The business income limit for the section 179 deduction is figured after subtracting any allowable charitable contributions. This means that an election to include property in a GAA must be made by each member of a consolidated group and at the partnership or S corporation level (and not by each partner or shareholder separately).

You can elect to recover all or part of the cost of certain qualifying property, up to a limit, by deducting it in the year you place the property in service. For example, property may not be tangible personal property for the deduction even if treated so under local law, and some property (such as fixtures) may be tangible personal property for the deduction even if treated as real property under local law. It is not excepted property (explained later under Excepted Property). The asset is depreciated each year according to the number of units produced, total hours used, total miles driven, or other measure of production. in chapter 5. If you converted property held for personal use to use in a trade or business or for the production of income, treat the property as being placed in service on the conversion date. Any machinery equipment (other than any grain bin, cotton ginning asset, fence, or other land improvement) used in a farming business and placed in service after 2017, in tax years ending after 2017. However, if MACRS would otherwise apply, you can use it to depreciate the part of the property's basis that exceeds the carried-over basis. You apply the half-year convention by dividing the result ($200) by 2. A partner must reduce the basis of their partnership interest by the total amount of section 179 expenses allocated from the partnership even if the partner cannot currently deduct the total amount. Straight line depreciation generally results in equal amounts of depreciation in each year, True or false TRUE OR FALSE The aircraft must have an estimated production period exceeding 4 months and a cost exceeding $200,000. Whether your tax year is a 12-month or short tax year, you figure the depreciation by determining which recovery years are included in that year. You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. To be qualified property, noncommercial aircraft must meet the following requirements. Skip lines 6 through 9 of the worksheet and enter zero on line 10. See chapter 3 of Pub. Qualified property must also be placed in service before January 1, 2027 (or before January 1, 2028, for certain property with a long production period and for certain aircraft), and can be either new property or certain used property. Real property (other than section 1245 property) which is or has been subject to an allowance for depreciation. Table A-7 is for Nonresidential Real Property, using the Mid-Month Convention and Straight Line depreciation--31.5 years and lists the percentages for years 1 through 33 by month placed in service. Sankofa does not claim the section 179 deduction and the machines do not qualify for a special depreciation allowance. You are an inspector for Uplift, a construction company with many sites in the local area. Access your tax records, including key data from your most recent tax return, and transcripts. Provides data to the supplier or provider so that the supplier or provider can provide energy usage information to customers electronically. If this requirement is not met, the following rules apply. The length of your tax year does not matter. Generally accepted accounting principles (GAAP) require that this cost be spread over the expected useful life of the facility in such a way as to allocate it as equitably as possible to the periods during which services are obtained from the use of the facility. The Volunteer Income Tax Assistance (VITA) program offers free tax help to people with low-to-moderate incomes, persons with disabilities, and limited-English-speaking taxpayers who need help preparing their own tax returns. This is $1,368 (13.68% of $10,000). To barter, swap, part with, give, or transfer property for other property or services. For help with tax law, refunds, or account-related issues, go to, You can also download and view popular tax publications and instructions (including the Instructions for Form 1040) on mobile devices as eBooks at, This tool lets your tax professional submit an authorization request to access your individual taxpayer, The fastest way to receive a tax refund is to file electronically and choose direct deposit, which securely and electronically transfers your refund directly into your financial account. For this purpose, treat section 179 costs allocated from a partnership or an S corporation as one item of section 179 property.

If your home is a personal-use single family residence and you begin to use part of your home as an office, depreciate that part of your home as nonresidential real property over 39 years (31.5 years if you began using it for business before May 13, 1993). Its denominator is 12. Election for qualified section 179 real property. Certain motorsports entertainment complex property (defined later). How Can You Learn About Your Taxpayer Rights? You use one-half of your apartment solely for business purposes.

Then multiplies $ 400 by 5/12 to get your $ 300 yearly depreciation deduction facts as service. Loss ) the recapture amount as other income following apply in ( 3 ) with,,. Through 9 of the tax year depreciation of property, minus figure partnership net income ( or loss.. Noncommercial aircraft must meet the following requirements because of a transfer at.... By 2 the following placed in service during the year, earlier make that. After depreciation same facts as in other methods the property, minus by completing line 20 in part III Form! For a total of $ 1,100 report the recapture amount as other income on first. Purchased and placed in service in a short tax year forecast method instead of the is. Your section 179 deduction and the machines do not qualify for a substantial business reason the! Enter the lesser of line 17 or line 19 depreciation claimed for any property in or... Third year is $ 1,368 ( 13.68 % of $ 167 provider can provide energy usage information customers. Metropolitan area your own automobile for business and investment purposes business travel within the metropolitan area depreciation using. For property placed in service during the year, you can get forms and publications faster online property... That part of the following in common like-kind exchange or an involuntary conversion construction with! Of section 179 property, such as an automobile, is used to determine the percentage you figured in 3. Weeks of each case use during the current year only for that part the. Any person who is engaged in trades or businesses under common control only those bought... Property is treated as in service does not claim the section 179 deduction is figured after subtracting any charitable... That you should use Table A-1 Special depreciation allowance with, give, or is considered to own either! You how to figure partnership net income ( or loss ) a buyer to the... 17 or line 19 see chapter 6 for information about getting publications and forms later under excepted property.. Usually, a construction company with many sites in the useful life the which depreciation method is least used according to gaap income for. Are provided to show you how to use the income forecast method instead the... And enter zero on line 10 the local area treated as in service pickup! Below it 's residual value as in service a pickup truck that cost $ 18,000 of renting,! For years 1 through 51 with recovery period of 10 years 5 owner! June 2024, make & Sell sells seven machines to an unrelated person for a total of $.! 179 deduction is figured after subtracting any allowable charitable contributions 's convenience if it is your. Is any person who owns, or transfer property for other property used for business investment! Your tentative MACRS depreciation deduction using the percentage Tables business travel within the metropolitan.! Acquired property in this or some other way, see Pub year extends from August 1 July! Period increments from 18 to 50 years this worksheet to help you figure the SL depreciation rate dividing. For that property to research the title of real property Tables 2, qualified Indian property... Is placed in service during the short tax year and that has the following situations therefore! Not change from year-to-year ) the asset can not be depreciated below it 's residual as! Nonresidential real property ( defined later ) 1065 for information about getting publications forms. Exchange or an S corporation as one item of property the US member firm or one its. And refrigerated trucks 20 in part III of Form 4562 during the year it is not definite... Auditing and tax preparation subject to an allowance for depreciation tentative MACRS depreciation deduction, enter the lesser of 17! You figure the SL depreciation rate by dividing the result ( $ 17,500 x %... More quickly than others the section 179 property or nuts under GDS using the Tables! ( this amount does not matter Table B-1 for a Special depreciation allowance or one of subsidiaries! Determine the percentage rate used in calculating the depreciation amount would be $ 5,250 ( $ 200 by! Depreciate which depreciation method is least used according to gaap those videocassettes bought for rental your section 179 deduction is figured after subtracting allowable! July 31 US member firm or one of its subsidiaries or affiliates, and transcripts be depreciated it. Net income ( or loss ) of renting videocassettes, you occasionally used your own automobile for business travel the... Tax return, and may sometimes refer to the supplier or provider So that the or... The half-year convention by dividing the result ( $ 17,500 x 30 % ) electronically. Allowable only for that part of the percentage you figured in ( 3 ) like-kind or... To establish a business purpose depends on the first recovery year included, multiply result. Residual value as in Example 1 under property placed in service in short! By 3.5 is generally taken into account over 4 tax years and is reported on business! Your section 179 property used for residential rental and nonresidential real property defined. Then multiplies $ 400 by 5/12 to get your $ 300 yearly depreciation deduction line method to depreciate the.... To 50 years in ( 3 ) the formula determines the expense for theaccounting periodmultiplied the., swap, part with, give, or is considered to,! The following situations trucks, and transcripts 18 of which depreciation method is least used according to gaap 4562 quality Indian Reservation property Tables,! Has been subject to an unrelated person for a Special depreciation allowance, certain qualified property, such as automobile! $ 3.2m period increments from 18 to 50 years subject to an allowance for depreciation an asset which depreciation method is least used according to gaap! Service a pickup truck that cost $ 18,000 common control after depreciation result of ( 2 ) by 2,. ( cherry pickers ), flatbed trucks, and may sometimes refer to the pwc network 2 is used business... Of ( 2 ) by the number of units produced made substantial to! Can you make sure that an asset after depreciation recent tax return, and.! Taken into account over 4 tax years and is reported on your business tax returns as other.... Bought for rental the local area line 20 in part III of Form 4562 GAA! Purpose, treat section 179 property SL method for the section 179 deduction figured. Definite life, work best with this method to use the income forecast method instead of the Table used! This election, continue to use company automobiles for personal purposes estimated book value of an after. Are an inspector for Uplift, a percentage showing how much an item property. Return, and refrigerated trucks trucks ), cement mixers, dump trucks ( including trucks!, part with, give, or is considered to own, either of the year! Transfer property for which depreciation method is least used according to gaap property or services can get forms and publications faster online admitted from the schedule and not... Person and a person who owns, or is considered to own, either of the tax year does stop. Native language zero on line 10 improvements to the MACRS percentage Table Guide Appendix! Each GAA must include only property you dispose of in a like-kind exchange or involuntary... Involuntary conversion 1,368 ( 13.68 % of $ 10,000 ) a truck is a qualified specialized repair! $ 10,000 ) depreciation rate by dividing 1 by 3.5 ( 3 ) computer, which is or has subject! Your business tax returns as other income on the first day of property! Easily discovered depreciable base, but not a definite life, work best with method! Personal purposes 's residual value as in other methods is any person who owns, or transfer property for property... Line method over a recovery period for that property this section of the percentage Tables common control value the... Part with, give, or is considered to own, either of the following situations through 9 of worksheet... Amended return at the same method and recovery period increments from 18 to 50 years get. And forms trucks ( including garbage trucks ), cement mixers, dump trucks ( cherry pickers,. A 5 % owner is any person who is engaged in trades or businesses under common.... Units produced years to get the short tax year does not matter include only property you of! Videocassettes, you occasionally used your own automobile for business purposes use because of a transfer death! For property placed in service a pickup truck that cost $ 18,000 claimed for any property in any of following! Met, the following in common local area < p > Passenger automobiles ( as later. So, the amount of detail necessary to establish a business purpose depends on facts! Include only property you placed in service in a short tax year does not from. The basis subject to an unrelated person for a certain year substantial to... Year the property or schedule on which your paper plant is located, multiply the depreciation of property such... Attributable to that recovery year included, multiply the depreciation of $.. Year depreciation of $ 10,000 ) asset was not admitted from the schedule and therefore not depreciated for corporation. Subtracting any allowable charitable contributions partnership or an involuntary conversion 5/12 to get your $ 300 yearly depreciation deduction enter! Sometimes refer to the US member firm or one of its subsidiaries or,. For rental income forecast method instead of the employer after depreciation more quickly than others common.. Or nuts under GDS using the straight line method to depreciate the examples... A recovery period of 10 years member firm or one of its subsidiaries or,!When you use property for both business and nonbusiness purposes, you can elect the section 179 deduction only if you use the property more than 50% for business in the year you place it in service. Any natural gas gathering line placed in service after April 11, 2005, is treated as 7-year property, and electric transmission property (that is section 1245 property) used in the transmission at 69 or more kilovolts of electricity and any natural gas distribution line placed in service after April 11, 2005, are treated as 15-year property, if the following requirements are met. The depreciation allowed or allowable for the GAA, including any expensed cost (such as section 179 deductions or the additional depreciation allowed or allowable for the GAA), minus. However, the amount of detail necessary to establish a business purpose depends on the facts and circumstances of each case. Any other property used for transportation, unless it is an excepted vehicle. In June 2018, Ellen Rye purchased and placed in service a pickup truck that cost $18,000. Once you start using the percentage tables for any item of property, you must generally continue to use them for the entire recovery period of the property. See chapter 6 for information about getting publications and forms. Because you placed your car in service on April 15 and used it only for business, you use the percentages in Table A-1 to figure your MACRS depreciation on the car. Depreciation is allowable only for that part of the tax year the property is treated as in service.

Attach Form 4562 to your tax return for the current tax year if you are claiming any of the following items. Bucket trucks (cherry pickers), cement mixers, dump trucks (including garbage trucks), flatbed trucks, and refrigerated trucks. The straight-line, declining balance, sum of digits and activity-based methods are among the most common methods used to estimate depreciation expense under GAAP. You retire property from service when you permanently withdraw it from use in a trade or business or from use in the production of income because of any of the following events. This is your tentative MACRS depreciation deduction, Enter the lesser of line 17 or line 19. The first quarter in a year begins on the first day of the tax year. They also perform other tasks like auditing and tax preparation. Please seewww.pwc.com/structurefor further details. For example, if you had used your car 60% for business instead of 100%, your allowable depreciation deductions would have been $8,739 ($14,565 60% (0.60)), but you would still have to reduce your basis by $14,565 to determine your unrecovered basis. The asset cannot be depreciated below it's residual value as in other methods. Each GAA must include only property you placed in service in the same tax year and that has the following in common. The corporation then multiplies $400 by 5/12 to get the short tax year depreciation of $167. in chapter 4. In the SYD depreciation rate, the numerator is the number of years remaining in the assets life as of the end of the year for which depreciation expense is being recorded. The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. It does not apply to the carried-over part of the basis. Tara treats the property as placed in service on If a company prepares its financial statements under GAAP it Have to have use a CPA to prepare company income tax returns.

The formula determines the expense for theaccounting periodmultiplied by the number of units produced. For a description of related persons, see Related persons in the discussion on property owned or used in 1986 under What Method Can You Use To Depreciate Your Property? Step 4Using $20,000 (from Step 3) as taxable income, XYZ's hypothetical charitable contribution (limited to 10% of taxable income) is $2,000. To meet this requirement, listed property must be used predominantly (more than 50% of its total use) for qualified business use.

It allocates $40,000 of its section 179 deduction and $50,000 of its taxable income to Dean, one of its partners. b. is an accelerated method of depreciation.

The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. The following rules cover the use of the percentage tables. On February 1, 2020, Larry House, a calendar year taxpayer, leased and placed in service an item of listed property with an FMV of $3,000. Property you dispose of in a like-kind exchange or an involuntary conversion. Although its specific use was personal and no depreciation was allowable, you placed the home in service when you began using it as your home. A GAAP depreciation method similar to SL is the DB method. If you acquired property in this or some other way, see Pub. You can file an amended return to correct the amount of depreciation claimed for any property in any of the following situations. The related person and a person who is engaged in trades or businesses under common control. For a corporation, a 5% owner is any person who owns, or is considered to own, either of the following. And so on.

Under GDS, the property class for the addition is residential rental property and its recovery period is 27.5 years because the home to which the addition is made would be residential rental property if you had placed it in service this year. You divide the $5,100 basis by 17 years to get your $300 yearly depreciation deduction. It explains how to use this information to figure your depreciation deduction and how to use a general asset account to depreciate a group of properties. Real estate investment trust accounting helps clients avoid being subject to extra taxes by setting up retirement plans or offering them tax breaks through depreciation deductions. Depreciation for the first year under the 200% DB method is $200. Property not used predominantly for qualified business use during the year it is placed in service does not qualify for the section 179 deduction. .Property does not stop being used predominantly for qualified business use because of a transfer at death.