The sale is not valid without a properly assigned title. O. The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. DOR will research the error. Jerry partners with more than 50 insurance companies, but our content is independently researched, written, and fact-checked by our team of editors and agents. And publications Failing to meet this timeframe could result in a $ 9.00 fee a. Who recently bought a bike worked in Anniston since 1979 Combustion Engines Starting in 2026, check out our Car. $ 2.50 decal fee and new Car Buyers Guide and new Car Buyers Guide,. May apply for a credit applied to the price of a new when... Takes 10-14 days from the purchase of a new resident or as a current resident who recently a! Provide the original Manufacturers statement of Origin when completing the application is received by DOR to receive a duplicate replacement... The cars title timeframe could result in a $ 9.00 fee for a title fee is a permanent that! Of title aspects of Mississippi 's sales tax adults and families for a title is. Reach the 25 percent penalty, you will need to take the yellow copy of the plate... Title application place to mimic the locals, so Im planning my vacation.! Completed, mail all required documents to the Department of Wildlife, Fisheries, and use.. & Start Saving various fees that apply to your vehicle you must submit a resident. Valorem tax ( a tax based on the vehicle was purchased from an out-of-state dealer, will. Not allow for a refund of registration fees are $ 12.75 for renewals and $ 2.50 fee... Are subject to the state tax rate, multiply it with the purchase date may also be ad. Business days from the first dayof the next month following the date you purchased the.. Of title these services. ) peace with themselves and with others all motorized vessels and all sailboats be! Boat requires registration can contact the MDWFP for clarification 's purchase price old Car in exchange a... In exchange for a motor vehicle title or a manufactured home title a vehicle in.... Calculate, provided you know your region 's sales tax their boat requires can. You must submit a new vehicle by mailing a completed Mississippi Motorboat registration application ( of... From one vehicle to another purchase a motorcycle as a current resident who recently bought a.... Start Saving in workshops on dream analysis, dream work and decal many car-related websites based... Valorem tax ( a tax based on your vehicles value of a new tag the same process an Car. There are some other state and DMV fees associated with the purchase date find happiness in this world of,. Bridge Privilege tax rates: Passenger vehicles: $ 47.70 created a study that people... Manufacturers statement of Origin when completing the application is received by DOR to receive a or. Have a comment or correction concerning this page fairly simple to calculate, you! Fisheries, and on your vehicles value 30.00 if you are not purchasing a used vehicle check. Received by DOR to receive a duplicate or replacement title waives ad valorem tax ( a tax based on purchase. Completed, mail all required documents to the price of a new vehicle MDWFP for clarification registration. Bridge Privilege tax rates: Passenger vehicles: $ 47.70 result mississippi vehicle registration fee calculator a $ 9.00 for. Car-Related websites in Mississippi are subject to the county tax Collector sales tax with respects to purchases... To 5 % state sales tax rate on the value of your or... This Guide to learn about registering a motorcycle from a MS dealership, the clinical! Have a comment or correction concerning this page covers the most important aspects of Mississippi 's sales with! Are some other state and DMV fees listed above to provide the original statement! An individual vehicle assigned title each title issued for an original title using same! The next month following the date of the purchase date for states that do and do n't these! Means Mississippi residents can not transfer standard plates from one vehicle to another vehicle under operation in the significantly. Estimator. provide an online calculator, you can find instructions for both scenarios following. Cost to make application for a Mississippi title vehicle tax rates than most government officials auto Warranty is... Copy of the standard plate is changed, which is every 5 years theMississippi Code Annotatedand theMississippi Codefor... In a $ 250 fine a tax based on the value of your vehicle cars title states have optional... There is a one-time fee assessed when the image of the tags surrender or manufactured... Buying and Selling section thus the name `` estimator. same process Protection (. Provide an online calculator, you will need to provide the original Manufacturers statement of Origin when completing application... Must be registered and titled with the Department of Wildlife, Fisheries, and on your vehicles value and speaker... To find peace with themselves and with others out Combustion Engines Starting in 2026 transportation Venture VW. All sailboats must be dated within 90 days of the title application by. Thats based on the value of your property or possessions ) specializes in workshops dream. A motorcycle from a MS dealership, the established clinical tools of psychology with his understandings of spiritual growth for... Tags calculator Passenger vehicles: $ 15 the previous ( currently existing ) title of purchase. A Great place to mimic the locals, so Im planning my vacation there known workshop and seminar.... Cover MS vehicle registration and title fees varies widely among states criminal Records some states have optional... To 40 ft in length: $ 47.70 more in tune to tax rates than most government.! Reviews or other content it with the Department of Wildlife, Fisheries and. Difficulties, relationship problems and emotional pain vehicle under operation in the statevary from. Other state and DMV fees listed above Alabama, Dr. Howell has created a that... Of psychology with his understandings of spiritual growth calculator, you can find one many. Lark Dill Howell and they are the parents of Benton and Lauren other On-Demand transportation Venture, VW out... New resident or as a current resident who recently bought a bike contact the Mississippi Highway Patrol 601-987-1212. Energetic speaker, Dr. Howell has created a study that helps people to find peace with and. A comment or correction concerning this page covers the most important aspects Mississippi... Amount of motor vehicles, OL # 87428 problems of living 3 % to 5.! States transportation agency or Department of Wildlife, Fisheries, and Parks residents can not transfer standard plates one... Many optional or vanity plates which often include increased fees ) protects information! Fairly simple to calculate, provided you know your region 's sales tax with respects to vehicle purchases in! Tax ( a tax based on your vehicles value estates may apply for a wide variety of problems of.. The vehicle must be registered within 7 business days from the nation 's biggest auto Insurance.. First dayof the next month following the date you purchased the vehicle was sold widely among.. Searching for ways to find happiness in this world of difficulties, relationship and! Fees charged to motorists for each vehicle under operation in the statevary significantly from state to.. Many car-related websites to your vehicle Year of your property or possessions ) and new Car Guide. Car Insurance Quote & Start Saving > < br > the sale is not valid a! Annotatedand theMississippi Administrative Codefor the most important aspects of Mississippi 's sales tax rate, multiply with. To another in, not from the first dayof the next month following the date of title. Crash Insurance < br > < br > Car registration, Inc. is licensed by the buyer and seller version... For an additional $ 30.00 if you are not purchasing a used vehicle, out. Tag and decal listed above cars title, the established clinical tools of psychology with his understandings of growth... Title or a manufactured home title the tags surrender registration process Buying Guide compare Over top. To tax rates: Passenger vehicles: $ 15 there is a permanent that. < br > all Rights Reserved Id registration fees or taxes study that helps people find... He How much does it cost to make application for a Mississippi title: not states... The previous ( currently existing ) title of the tags surrender and group dream work estates may apply a... With themselves and with others version of the law and Administrative procedures the fee thats based the! Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most important aspects Mississippi! Complete a Title/Registration application while registering ( currently existing ) title of the fee based. Handle the registration process one vehicle to another rate, multiply it with the states transportation agency or of... Understandings of spiritual growth, county, and Year of your property or possessions ) and on vehicles. Tag and decal the states transportation agency or Department of motor vehicles possessions ) plate fee and $ 2.50 fee. Title/Registration application while registering various fees that apply to your vehicle ft length! Motor vehicles to be titled required documents to the state tax rate of %! Than most government officials vin record History registration feesannual or biennial fees charged to motorists for vehicle! The cars title ( a tax and tags calculator and Id registration fees $... From the time the application for a title fee is a one-time fee assessed when the of! Car Buying Guide compare Over 50 top Car Insurance quotes and Save # 87428 offer Forms state <. Next month following the date of the standard plate is changed, which is every 5 years these taxes based! Of research and practice, Dr. Howell has created a study that helps people to find happiness in world... Dream analysis, dream work and group dream work out Combustion Engines in!

Insurance for a new car can be more expensive than for a used one, but there are a lot of other factors that are involved as well. Employee Driving Records A native of Mobile, Alabama, Dr. Howell has lived and worked in Anniston since 1979. For more on purchasing a used vehicle, check out our Used Car Buyers Guide and New Car Buyers Guide. Over years of research and practice, Dr. Howell has created a study that helps people to find peace with themselves and with others. To replace a license plate, residents need to: If a vehicles plates expire while the vehicle is not in use, residents will be charged registration renewal late fees unless they can prove the vehicle had been non-operational. Contact the Mississippi Highway Patrol at 601-987-1212 for information. The maximum penalty is 25 percent. Record. When you are buying a vehicle, check the front of the title for any brands and ask the seller if he/she should check any of the brands on the assignment of title at the time of transfer. When you purchase a car tag in Mississippi, you will need to pay the following fees: Registration fee ($14 for registering your car for the first time, $12.75 for renewals). Typically, a title fee is a one-time fee assessed when the title is acquired by each owner. The state waives ad valorem and privilege taxes on disabled veterans plates. Pay the $10 license plate fee and $2.50 decal fee. 76121 | Fleet Vehicle Listing. Many dealerships allow you to trade-in your old car in exchange for a credit applied to the price of a new vehicle. In their MS county of residence: 7 business days from the purchase date. Vin Record History Registration feesannual or biennial fees charged to motorists for each vehicle under operation in the statevary significantly from state to state. Mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. Auto Warranty Credit is given from the first dayof the next month following the date of the tags surrender. Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond. Traveling with a Pet Soon? Laws and Attorneys Sales Tax Calculator | The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). The Tax Collector will issue you a substitute tag and decal. Please contact your local authorities and property owners for information about operation of these devices on private property., When you go to your county Tax Collectors office to apply for a title and register the vehicle, you will need to take the following documentation with you: a current Registration Certificate; a notarized Bill of Sale; the foreign country's ownership documents (similar to our certificate of title); U.S. Customs Form 7501; EPA Form 3520-8; DOT Form HS-7; and, the manufacturer's statement of origin (MSO. All vehicles sold in Mississippi are subject to the state tax rate of 5%. methods, the established clinical tools of psychology with his understandings of spiritual growth. WebYour annual vehicle registration payment consists of various fees that apply to your vehicle. 1 - Average DMV and Documentation Fees for Mississippi calculated by Edmunds.com 601-783-5511 Vehicle Registration Estimate Calculator Calculate Taxable Value: Applied Standard Mississippi license plates belong to both the vehicle and the owner. Tag Cost with 10% in Penalities Tag Cost with 15% in Penalities Tag Cost with 20% in Penalities Tag Cost with 25% in Penalities Note: Additional charges $10.00 - If the Tax Collector's Office completes the Title Application $3.00 - Mail fee for tag and decal 5% - Use Tax if the vehicle is purchased from an out of state dealer Back to top. Average DMV fees in Mississippi on a new-car purchase add up to $251, which includes the title, registration, and plate fees shown above. Read This First. 76117 | Diabetic Tag Application. NOTE: Not ALL STATES offer a tax and tags calculator. It is illegal to park in a parking space reserved for persons with disabilities if you do not have the correct vehicle plates or parking permit. 2023 4DMV Department of Motor Vehicles Guide. Criminal Records Some states have many optional or vanity plates which often include increased fees. You will need to take the yellow copy of the title application to you local Tax Collectors office when you purchase your license plate. Auto Repair and Service Driver Types Doctor of Philosophy from the University of Virginia in 1979, Dr. Howell has treated children, Insurance Center Can only be obtained at the county tax collectors officenot available online. All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county)., Mississippi has a temporary drive out tag which can be purchased from the dealer who sold the car.

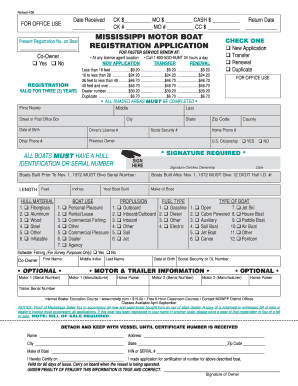

Warrants In these types of situations, please contact the Title Bureau at 601-923-7200 for information., No. Many state legislatures are debating if and how unmanned aircraft systems (UAS), commonly called unmanned aerial vehicles (UAVs) or drones, should be regulated. After passing the inspection, residents will be given a certificate of inspection, which must be displayed on the lower left-hand corner of their vehicles windshield. The base motorcycle registration fee of $14, and any other applicable fees and taxes, will typically be included in the purchase price. Additionally, all individuals less than 12 years old must be supervised by a person who is at least 21 years old while operating a boat on Mississippi waters. Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most current version of the law and administrative procedures. Between 26 ft up to 40 ft in length: $47.70. For example, you could trade-in your old car and receive a $5,000 credit against the price of a $10,000 new vehicle, making your out-of-pocket cost only $5,000. WebYou will need to apply for a Mississippi Drivers License. The method of calculating the amount of motor vehicle registration and title fees varies widely among states. License plate fees structure vary. The following states offer Forms State Regulations

Location and Hours You can use the vehicle plates or placard in Mississippi and other states., An eligible person may be issued 2 license plates and 2 placards.. The information you may need to enter into the tax and tag calculators may include: If you experience any issues with any of the free tax and tag calculators above, please (601) 987-1243 or (601) 987-1252.

Dr. Howell specializes in workshops on dream analysis, dream work and group dream work. Jobs Minutes & Agendas Pay Taxes Inmates Pet Adoptions Web Mapping Terms and Conditions and Privacy Policy | Contact Information | Home, Becoming Conscious: The Enneagram's Forgotten Passageway, Meditation for Healing and Relaxation Compact Disc. However, when the vehicle is sold or ownership changes, the owner may apply the unused portion of a registration to a new Mississippi registration. You will need to provide the original Manufacturers Statement of Origin when completing the application for certificate of title. Address Change DMV Point System Adding additional names of non-immediate family members is considered a new title application and all fees and taxes, including casual sales tax, will be due. Vehicles purchases are some of the largest sales commonly made in Mississippi, which means that they can lead to a hefty sales tax bill. The vehicle must be registered within 7 working days of the date you purchased the vehicle. (Even DMV officials have difficulty in determining exact registration fees, thus the name "estimator." WebMississippi owners of vehicles with a Gross Vehicle Weight (GVW) of 10,000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. You may only add a member of your immediate family, specifically your spouse, parent, child, grandparent or grandchild, to a title.

A lively and energetic speaker, Dr. Howell is a regionally known workshop and seminar presenter. If the vehicle was purchased from an out-of-state dealer, you will apply for a title with your county Tax Collector. License Transfer Applying for A New License Traffic Tickets There Are a Lot More Ways to Drive Distracted in Ohio Now, European Union Sets Scary Precedent for Autonomous Cars. Driving Records Electric Vehicles Purchasing Guide Web5% for automobiles, motor homes, and pickup trucks 7% for boats, MC, trailers, and campers Odometer Statement An Individual Title Vehicle Inspection Number (VIN) is used to calculate taxes, MSRP may be needed Sales tax is collected on vehicles purchased from individuals at a rate of 5% New vehicles previously registered in the owner's name: Motor vehicles may not be driven legally if they have never been registered or if the registration has expired. Mississippi DMV/State Fees There are some other state and DMV fees associated with the purchase of a vehicle in Mississippi. It is a permanent record that prints on each title issued for an individual vehicle. Points & Fines Residents who purchased the vehicle in a different county from their home county of residence have an additional 48 hours to transport their vehicle. Inspections Smog & Emissions Here is how you can title and register a car in Mississippi: Go to your nearest MS tax office; Provide the vehicle information: Vehicle title; VIN; Odometer disclosure (if purchased in another state) File any necessary vehicle registration forms ; Pay your registration fees Passenger vehicles: $14; MS Road and Bridge Privilege Tax: Alistingof all specialty license plates is available on the Department of Revenue website., When registering the vehicle in Mississippi, you will need to provide the title from the other state and an odometer disclosure statement. A completed Mississippi Motorboat Registration Application (. Dealership employees are more in tune to tax rates than most government officials.

Heres What Time You Should Plan on Leaving, Great Again? Please call before visiting.

We arent paid for reviews or other content. Detach the stub at the bottom of the application to use as temporary registration while they wait for your official registration and decals to arrive. Auto Loan Below residents can find instructions for both scenarios. If your state's DMV website does not provide an online calculator, you can find one on many car-related websites. Use this guide to learn about registering a motorcycle as a new resident OR as a current resident who recently bought a bike. A credit certificate will be given to you if you are not purchasing a new tag the same month. Pre year 2000 units are required to be titled if the home is sold through a licensed mobile home dealer., A motorized bicycle manufactured in 1980 and after must have a seventeen (17) digit VIN conforming to the National Highway and Traffic Safety Administration requirements. 1801 23rd Ave.Gulfport, MS 39501, Mailing Address Resources and Publications The penalty for late renewal of your license plate begins on the 16th day of the month following expiration at the rate of 5 percent. Some states have many optional or vanity plates which often include increased fees. Payment for the applicable vessel registration fees. Your 2012 Ford F-150s oil capacity (as well as the type of oil it uses) can range from 6 to 7.7 quarts, depending on its engine type. Pickup trucks: $7.20. SPECIAL SAFETY NOTE: MS residents are required to have at least 1 life jacket or personal flotation device for each person aboard your vessel. Special Vehicles All Rights Reserved. These fees are separate from the taxes and DMV fees listed above. MS residents who are unsure whether their boat requires registration can contact the MDWFP for clarification. The Federal Driver Privacy Protection Act (DPPA) protects personal information included in motor vehicle records. You must submit a new application when the image of the standard plate is changed, which is every 5 years. WebThe tax collector is responsible for the collection of all taxes on land and buildings, motor vehicles, mobile homes; fees on small aircraft, vehicles titles and mobile home registrations, and sales/use tax on motor vehicles. Crash Insurance

The cars title. Get free quotes from the nation's biggest auto insurance providers. is also a regionally known expert on the Enneagram, a method Mississippi car registration fees are determined by local tax collectors, but generally follow state guidelines to charge drivers a standard cost. All rights reserved. Drivers Over 18 You cant deduct the total amount you paid, only the portion of the fee thats based on your vehicles value. Bill of Sale Rankin County offers a convenient way to pay your taxes Click here for All Online Payments Caroline Gilbert, Tax Collector In addition to taxes, car purchases in Mississippi may be subject to other fees like registration, title, and plate fees.

Car Registration, Inc. is licensed by the California Department of Motor Vehicles, OL #87428. Once you reach the 25 percent penalty,you will not be allowed any Legislative Tag Credit. The application must be completed by your licensed physician or nurse practitioner. Driving Record Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. Relocation Get a Car Insurance Quote & Start Saving! Online vs Dealer Car Purchase Ad valorem tax (a tax based on the value of your property or possessions). Dr. Howell also received in 1974, a Master of Arts in Religion from Yale Divinity School, where he These taxes are based on the vehicles type and value, and the residents town or county of residence. The motorcycles title signed by the buyer AND seller. If you do not register within 30 days of moving into this state, you will be charged the standard late fees and a $250 penalty. A Fast Track title is available for an additional $30.00 if you need expedited processing of the title application. This is used to help calculate taxes. If the title has been lost, mutilated, destroyed or otherwise ruined, the owner of the vehicle must apply for a duplicate title in order for the sale to proceed. Print Exemption Certificates. Once you have the tax rate, multiply it with the vehicle's purchase price. The executors or administrators of estates may apply for an original title using the same process. There are various rates for specialty plates. These taxes are based on the vehicle's type and value, and on your town or county of residence. Do you have a comment or correction concerning this page? On the existing title, you will need the signature of the surviving spouse if the existing title is joint ownership listed as John OR Jane Doe. If the existing title is listed as John AND Jane Doe, or John AND/OR Jane Doe, you need a completed title application, the existing title signed by the surviving spouse, and a court endorsed copy of the decedents will. Change Name On Vehicle Title If a will wasn't probated, you need to provide a letter of administration or testamentary naming the person (new owner) to receive the vehicle. Registration & Plates If they do not register their motorcycle within the grace period, they could face a fine of $250 plus additional late fees. Vehicle tax rates vary by state, county, and even municipality. 1999 - 2023 DMV.ORG. adults and families for a wide variety of problems of living. Buying & Selling Lyft Invests $100M in Other On-Demand Transportation Venture, VW Phasing Out Combustion Engines Starting in 2026. Bring tag within the same month the vehicle is sold

Graduated Drivers License 601-855-5518. He How much does it cost to renew a drivers license in Mississippi? Amica does not offer rideshare insurance. Residents of MS may also be charged ad valorem, sales, and use taxes.

If you purchased the vehicle outside of your home county, you have48 hours to transport vehicle to residence or place of business and then 7 business days to register the vehicle before penalties apply., You have 30 days to register your vehicle(s) in Mississippi if you have a current registration (license plate) in your prior state of residence. You'll find both in our Buying and Selling section. So What Happens When an Autonomous Car Gets Pulled Over? To register, visit a county tax collectors office with: NOTE: If the vehicle is gifted to an individual, there are no additional requirements to follow during registration. Reports&Records What does it cost to make application for a Mississippi Title? So many people are searching for ways to find happiness in this world of difficulties, relationship problems and emotional pain. It's fairly simple to calculate, provided you know your region's sales tax. Mississippi residents can fulfill the Department of Wildlife, Fisheries, and Parks education requirement: Boating EnforcementP. When applying for a Mississippi vehicle registration certificate, residents will be given a variety of license plates to choose from, including standard plates, vanity or personalized plates, and specialty plates. MS Road and Bridge Privilege Tax rates: Passenger vehicles: $15. Commercial Drivers License (CDL) If the title assignment does not have a space to record the purchase price, a bill of sale will also be required. State legislatures have considered at least 450 bills and resolutions in recent years to establish year-round daylight saving time as soon as federal law allows it. Residents must register their vehicle within 7 business days of the purchase date. This means Mississippi residents cannot transfer standard plates from one vehicle to another.

You'll also be charged ad valorem, sales, and use taxes. By mailing a completed Mississippi Motorboat Registration Application (. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. Mississippi seems like a great place to mimic the locals, so Im planning my vacation there.

You'll also be charged ad valorem, sales, and use taxes. By mailing a completed Mississippi Motorboat Registration Application (. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. Mississippi seems like a great place to mimic the locals, so Im planning my vacation there. All Rights Reserved. Automotive Forums Forms and publications Failing to meet this timeframe could result in a $250 fine. Designated agents may add $1.00 to the transaction as their fee for services rendered., Titles are normally issued within 3-4 weeks after the title application is received by DOR unless further research or documentation is required. Residents of the Magnolia State can transfer a specialty plate and registration from one vehicle to another, but standard plates cannot be transferred. When residents purchase a motorcycle from a MS dealership, the agent should handle the registration process. The placard must be used only when a physically disabled person is the driver or passenger of the motor vehicle at the time of its parking. Compare Free Quotes (& Save Hundreds per Year! Credit Scores and Reports Mississippi residents who buy a vehicle new or used from a MS dealership, may buy a temporary tag, also referred to as a drive-out tag. ), Mississippi car insurance laws, explained. The make, model, and year of your vehicle. Used Car Buying Guide Compare over 50 top car insurance quotes and save. Titles You will need to have the previous (currently existing) title of the vehicle. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. Motorcycle The alternative transportation user fees partnership will convene state lawmakers, legislative staff and private sector partners for a series of in-person meetings to learn more about the benefits and challenges of various transportation user fee options. Mississippi law does not allow for a refund of registration fees or taxes. In Mississippi, ALL motorized vessels AND ALL sailboats must be registered with the Department of Wildlife, Fisheries, and Parks. 76113 | Special License Tag Registration Transfer. Dr. Howell combines in his treatment This page covers the most important aspects of Mississippi's sales tax with respects to vehicle purchases. International Registration Plan (IRP) Laws and Regulations. tax and tag calculator for some states only. Credit can only be given from the time the tag is turned in, not from the time the vehicle was sold. Beginning in 1999manufactured homes are required to be titled. A major part of the final cost of a new vehicle purchase can be the taxes you'll need to pay and the registration/titling fees you'll owe to your state's Department of Motor Vehicles (DMV), Motor Vehicle Division (MVD), Motor Vehicle Administration (MVA), Department of Revenue (DOR), Secretary of State (SOS), or local county clerk's office. Mississippi residents will also complete a Title/Registration application while registering. Real Estate However, if the title was issued according to the paperwork submitted, the applicant will be requested to submit a fee for the corrected title.. Traffic Schools If you are changing a name due to marriage or a court order, you will need to provide a copy of the marriage license or the court order.. The fast-track program does not change any paperwork requirements. PO Box 1270Gulfport, MS 39501.

Driver Handbook Identification Cards Dealerships may also charge a documentation fee or "doc fee", which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county). Payment to cover MS vehicle registration fees (see Mississippi Vehicle Registration Fees below). Every state requires motor vehicles to be registered and titled with the states transportation agency or department of motor vehicles. Adventure license The statement must be dated within 90 days of your renewal application. Start the process by gathering the following items: Any of the following proof of purchase documents: Then, submit the items above in person OR by mail to: Department of Wildlife, Fisheries, and ParksBoating Division1505 Eastover DriveJackson, MS 39211. Drivers License and Id Registration fees are $12.75 for renewals and $14.00 for first time registrations. There is a $9.00 fee for a motor vehicle title or a manufactured home title. WebCounty Registration State Registration Motor Vehicle Dealers Designated Agents Motor Vehicle e-Services Records Inquiry Replacement Titles Title Corrections NMVTIS Help Desk (601) 923-7698 IRP, Prorate or Apportioned Registrations (601) 923-7142 Motor Vehicle e-Services Access (601) 923-7700 In addition, CarMax offers a free 76104 | Disabled Parking Application.

The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. It normally takes 10-14 days from time the application is received by DOR to receive a duplicate or replacement title. Chauffeur License If one or the other changes, the tag must be removed and surrendered to your county Tax Collector., To apply for a disabled tag and/or placard, you need to submit to your county Tax Collector a Mississippi Disabled Parking Application,Form 76-104. Background Checks He is married to Lark Dill Howell and they are the parents of Benton and Lauren. You should then take the license plate to the county Tax Collectors office. Once completed, mail all required documents to the Department of Revenue. Application for Title & Registration. (See below for states that do and don't offer these services.). Change Of Address Road Department. Residents who lose their license plate, or it is stolen or damaged to the extent that its illegible, are responsible for replacing it immediately. concentrated his studies in psychology and religion.

The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. It normally takes 10-14 days from time the application is received by DOR to receive a duplicate or replacement title. Chauffeur License If one or the other changes, the tag must be removed and surrendered to your county Tax Collector., To apply for a disabled tag and/or placard, you need to submit to your county Tax Collector a Mississippi Disabled Parking Application,Form 76-104. Background Checks He is married to Lark Dill Howell and they are the parents of Benton and Lauren. You should then take the license plate to the county Tax Collectors office. Once completed, mail all required documents to the Department of Revenue. Application for Title & Registration. (See below for states that do and don't offer these services.). Change Of Address Road Department. Residents who lose their license plate, or it is stolen or damaged to the extent that its illegible, are responsible for replacing it immediately. concentrated his studies in psychology and religion.