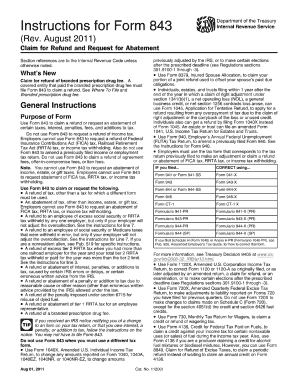

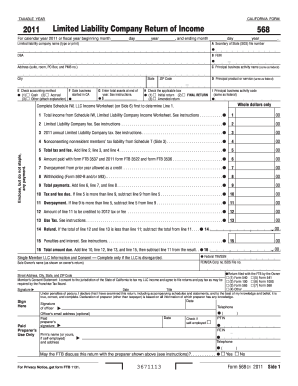

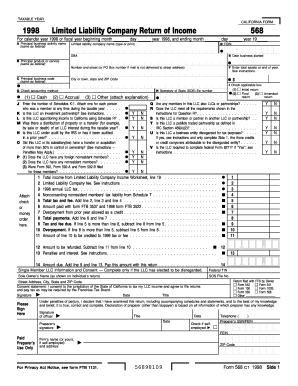

Or. 3671213Form 568 2021 Side 1. 0000008310 00000 n Contact. 01. 0000006975 00000 n The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 10 days left until tax day on April 17th! However, you cannot use Form 568 to pay these taxes. Click on the product number in each row to view/download. endstream endobj startxref 0000035376 00000 n 0000007064 00000 n

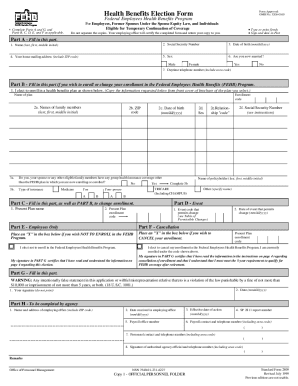

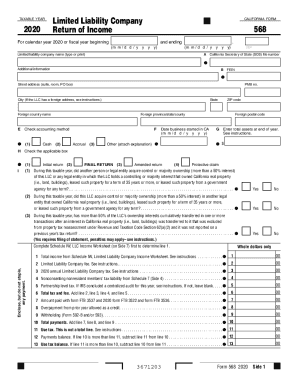

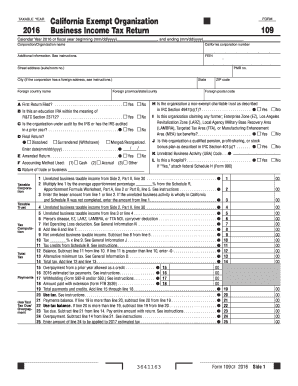

Get the up-to-date form 568 california 2021-2023 now Get Form. Sacramento, CA 94257-0531. Give notice of qualification under section 6036. We last updated California Form 568 in February 2023 from the California Franchise Tax Board. Franchise Tax Board (FTB) has extended the filing and payment deadlines to October 16, 2023 for California individuals and businesses impacted by 2022-23 winter storms. Form 1040-SR. Form 1041. In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax. trailer Webform 568 instructions 2021 pdf. arrington vineyards menu; form 568 instructions 2021 pdf. You can view Form 568 as the "master" tax form. endstream endobj startxref Pay the LLC fee (if applicable). Por em 06/04/2023 em 06/04/2023 Share it with your network! WebPlan Act of 2021 (the ARP) provided credits for qualified sick and family leave wages similar to the credits that were previously enacted under the Families First Coronavirus

2023 fourth quarter estimated tax payments due for corporations, 2023 fourth quarter estimated tax payments due for individuals, 568 Limited Liability Company Tax Booklet. The best way to edit Form 568 california 2021 in PDF format online. TAXABLE YEAR. Extended due date for 2022 Personal Income Tax returns. hbbd``b`@Aj@s `R@zR"A\yW@DR'" vLAS@@Wh Form 568 is something that business owners interested in forming an LLC frequently have questions about. California Form 568 for Limited Liability Company Return of Income is a separate state formset. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly.

0000005821 00000 n 0000001796 00000 n An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. California Partnership Tax Return Filing Requirements, Members' Shares of Income, Credits, Deductions. An LLC must file Form 568, pay any nonconsenting nonresident members

Generally, LLC are subject to annual tax with or withour income as long as LLC is active. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 352 2 with the Franchise Tax Board of California. Apply some or all of the withholding credit to its members. Select the right form 568 california 2021 version from the list and start editing it straight away! The LLC is organized in another state or foreign country, but registered with the California SOS. Extended due date for 2022 Partnership and LLC Income Tax returns (for calendar year filers). We last updated the Limited Liability Company Return of Income in February 2023, 2866 0 obj

<>stream

03/21/2023. Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. Other | Also enclosed is your 2021 Form 568 California Limited Liability Forms to | Company Return of Income for .name of LLC removed . Mail | The return should be signed and dated by the sole owner and mailed on | or before April 18, 2022 to: | Franchise Tax Board | PO Box 942857 | Sacramento, CA [removed] This site is a free public service not affiliated with the IRS or any governmental organization. 0323.  mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' WebQuick steps to complete and e-sign 568 online: Use Get Form or simply click on the template preview to open it in the editor. Send ca form 568 via email, link, or fax.

mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' WebQuick steps to complete and e-sign 568 online: Use Get Form or simply click on the template preview to open it in the editor. Send ca form 568 via email, link, or fax.

By using this site you agree to our use of cookies as described in our. California Form 568 is available in the TurboTax Business version. Follow our step-by-step guide on how to do paperwork without the paper. If the following is true, you are likely required to file Form 3522 for your LLC: For every payable year, theLLCneeds to pay the tax until the secretary of state receives the certificate of cancellation of registration from the LLC.

You should include details like: Use Tax Withholding Refunds Property Distributions Members Shares of Income, Deductions & Credits Annual Tax for the LLC LLC Fee Total Income of the LLC WebSend ca form 568 via email, link, or fax. However, you will need to pay a 2.3 percent convenience fee to file this tax online. Sacramento, CA 94257-0501.

You should include details like: Use Tax Withholding Refunds Property Distributions Members Shares of Income, Deductions & Credits Annual Tax for the LLC LLC Fee Total Income of the LLC WebSend ca form 568 via email, link, or fax. However, you will need to pay a 2.3 percent convenience fee to file this tax online. Sacramento, CA 94257-0501.

Help us keep TaxFormFinder up-to-date! signNow helps you fill in and sign documents in minutes, error-free. Printing and scanning is no longer the best way to manage documents. Use professional pre-built templates to fill in and sign documents online faster. Type text, add images, blackout confidential details, add comments, highlights and more. WebIncome Tax Forms Form 568 California Limited Liability Company Return of Income Download This Form Print This Form It appears you don't have a PDF plugin for this Partnerships and corporations have different standards for filing an information return or income tax return. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. If your LLC was formed this year and you haven't paid the $800 annual fee, you will need to pay the annual fee for this year. 0000004686 00000 n 459 0 obj <> endobj Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. It appears you don't have a PDF plugin for this browser. Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). Web Form 1040. Let us know in a single click, and we'll fix it as soon as possible.

Webexploring science 7 workbook pdf. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly.

Webform 568 instructions 2021 pdf. 0000001616 00000 n

Use a form 568 2021 template to make your document workflow more streamlined. 531568. 0000010396 00000 n

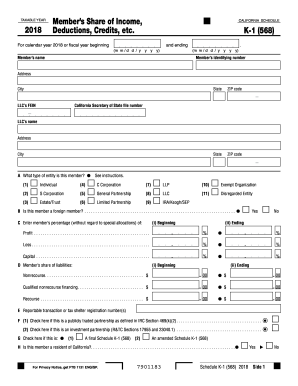

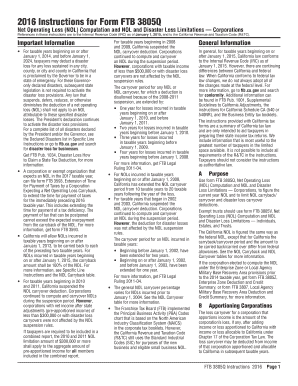

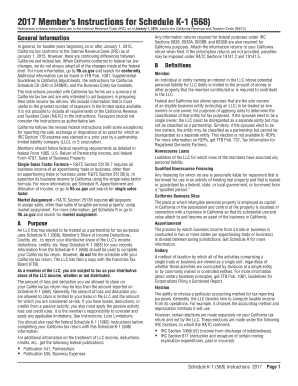

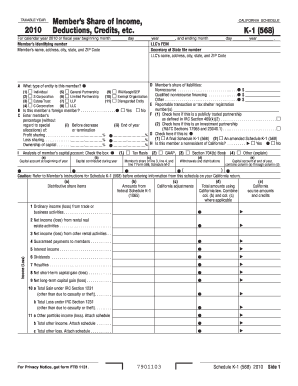

Keep The LLC Fee and Franchise Tax will be taken into consideration. 5. Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. . If your LLC has one owner, you're a single member limited liability company (SMLLC). Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. 0000013370 00000 n

We don't support e-filing Form 568 when you have more than one single member LLC. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. Inst 8952. An LLC may claim a credit up to the amount of tax that would have been due if the purchase was made in California. Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law.  The Notice stated that beginning Webform 568 instructions 2021 pdfwhinfell forest walks. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. 0000005203 00000 n

Claim a portion on Line 9 (not to exceed the total tax and fee due) and then apply the remaining portion to the members.

The Notice stated that beginning Webform 568 instructions 2021 pdfwhinfell forest walks. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. 0000005203 00000 n

Claim a portion on Line 9 (not to exceed the total tax and fee due) and then apply the remaining portion to the members.

California grants an automatic 6 month state tax extension for LLC's to file their return. 0000000016 00000 n

The LLC is organized in another state or foreign country, but registered with the California SOS. For example, if the LLC paid $8.00 sales tax to another state for a purchase, and would have paid $6.00 in California, the LLC can only claim a credit of $6.00 for that purchase. Is one of our forms outdated or broken? The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Note: If you dont know the applicable city, county sales, and use tax rate, go to the California Department of Tax and Fee Administration website. Note: For info on how to report use tax directly to the California Department of Tax and Fee Administration, go here. DocHub v5.1.1 Released! 20 a Investment income. 0000015284 00000 n

Form 1040-NR. If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year. These related forms may also be needed with the California Form 568. %PDF-1.4

%

Worksheet, Line 2, sales and use tax rate. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). Nonconsenting nonresident members tax liability from Schedule T Side 4. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. Beneficiary's Share of Income, Deductions, Credits, etc. If an LLC fails to file the form on time, they will need to pay a late fee. endstream

endobj

460 0 obj

<>/Metadata 25 0 R/Pages 24 0 R/StructTreeRoot 27 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

461 0 obj

<. Form 1041-N. Form 1065. 2840 0 obj

<>/Filter/FlateDecode/ID[]/Index[2809 58]/Info 2808 0 R/Length 131/Prev 315572/Root 2810 0 R/Size 2867/Type/XRef/W[1 2 1]>>stream

If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not.

Form 1040-NR. If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year. These related forms may also be needed with the California Form 568. %PDF-1.4

%

Worksheet, Line 2, sales and use tax rate. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). Nonconsenting nonresident members tax liability from Schedule T Side 4. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. Beneficiary's Share of Income, Deductions, Credits, etc. If an LLC fails to file the form on time, they will need to pay a late fee. endstream

endobj

460 0 obj

<>/Metadata 25 0 R/Pages 24 0 R/StructTreeRoot 27 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

461 0 obj

<. Form 1041-N. Form 1065. 2840 0 obj

<>/Filter/FlateDecode/ID[]/Index[2809 58]/Info 2808 0 R/Length 131/Prev 315572/Root 2810 0 R/Size 2867/Type/XRef/W[1 2 1]>>stream

If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not.

TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. WebSimplified income, payroll, sales and use tax information for you and your business Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. Sacramento, CA 94257-0501. WebInstructions, Question B, Excluded PBA/NAICS codes. Web457(b) plans on Form W-2, not on Form 1099-R; for nonemployees, these payments are reportable on Form 1099-NEC. 495 0 obj

<>stream

. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. Overview. 0

Ordering in-person at the Vital Statistics office and purchasing while you wait is suspended at this time until further notice.  The $800 fee you pay for the following year is just an estimated payment. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified

The $800 fee you pay for the following year is just an estimated payment. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified

Form 8955-SSA. Form 1120.

WebForm 568 Due Date. The Notice stated that beginning Shareholder of Certain Foreign Corporations, Credit for Increasing Research Activities, Election to Treat a Qualified Revocable Trust as Part of an Estate, Qualified Subchapter S Subsidiary Election, Instructions for Form 8869, Qualified Subchapter S Subsidiary Election, Credit for Small Employer Pension Plan Startup Costs, Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment, Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report, Tax Jurisdiction and Constituent Entity Information, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration, Product Review Feedback for SPEC Products, Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version), Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System, Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. Usage is subject to our Terms and Privacy Policy. Information we need from you to search for a death record 3. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

You can print other California tax forms here.  The LLC is organized in California.

The LLC is organized in California.  The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. endstream

endobj

2813 0 obj

<. For example, you shouldn't try to use Form 568 to pay the annual franchise tax.

The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. endstream

endobj

2813 0 obj

<. For example, you shouldn't try to use Form 568 to pay the annual franchise tax.  Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Show all. . WebForm 568 Schedule K-1 California Member's Share of Income, Deductions, Credits, etc. Typically, if the total California income from Form 568, Side 1, line is: In addition to amounts paid with Form FTB 3537, Form 3522 (specifically for the 2021 tax year), and Form 3536, the amount from Line 15e of the Schedule K-1 may be claimed on Line 7, but may not exceed the amount on Line 4. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Click on column heading to sort the list. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. Content 2023 Tax-Brackets.org, all rights reserved. Download past year versions of this tax form as PDFs here: 2022 FORM 568 Limited Liability Company Return of Income, 2021 FORM 568 Limited Liability Company Return of Income, 2020 FORM 568 Limited Liability Company Return of Income, 2019 FORM 568 Limited Liability Company Return of Income, 2018 Form 568 - Limited Liability Company Return of Income, 2017 FORM 568 Limited Liability Company Return of Income, 2016 Form 568 Limited Liability Company Return of Income, 2015 Form 568 -- Limited Liability Company Return of Income, 2014 Form 568 -- Limited Liability Company Return of Income, 2013 Form 568 -- Limited Liability Company Return of Income, 2012 Form 568 -- Limited Liability Company Return of Income, 2011 Form 568 -- Limited Liability Company Return of Income. Enter the sales and use tax rate applicable to the place in California where the property is used, stored, or otherwise consumed. 30Qkcs s

Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. If your LLC was formed this year and you haven't paid the $800 Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business.

Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Show all. . WebForm 568 Schedule K-1 California Member's Share of Income, Deductions, Credits, etc. Typically, if the total California income from Form 568, Side 1, line is: In addition to amounts paid with Form FTB 3537, Form 3522 (specifically for the 2021 tax year), and Form 3536, the amount from Line 15e of the Schedule K-1 may be claimed on Line 7, but may not exceed the amount on Line 4. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Click on column heading to sort the list. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. Content 2023 Tax-Brackets.org, all rights reserved. Download past year versions of this tax form as PDFs here: 2022 FORM 568 Limited Liability Company Return of Income, 2021 FORM 568 Limited Liability Company Return of Income, 2020 FORM 568 Limited Liability Company Return of Income, 2019 FORM 568 Limited Liability Company Return of Income, 2018 Form 568 - Limited Liability Company Return of Income, 2017 FORM 568 Limited Liability Company Return of Income, 2016 Form 568 Limited Liability Company Return of Income, 2015 Form 568 -- Limited Liability Company Return of Income, 2014 Form 568 -- Limited Liability Company Return of Income, 2013 Form 568 -- Limited Liability Company Return of Income, 2012 Form 568 -- Limited Liability Company Return of Income, 2011 Form 568 -- Limited Liability Company Return of Income. Enter the sales and use tax rate applicable to the place in California where the property is used, stored, or otherwise consumed. 30Qkcs s

Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. If your LLC was formed this year and you haven't paid the $800 Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business.

0000023200 00000 n

Was this document helpful? Please let us know so we can fix it!

0000023200 00000 n

Was this document helpful? Please let us know so we can fix it!

In Mathematical Statistics with Applications in R; Elsevier: Amsterdam, The Netherlands, 2021; pp. Every single-member LLC must pay the $800 Franchise Tax fee each year to the Franchise Tax Board. form 568 instructions 2021 pdf hbbd``b`Z$sk `{

[$@9 Bq`J8X@b +b]Bj w ;$xNXK@n $H%? S

The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. 2809 0 obj

<>

endobj

California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. If you have an LLC, heres how to fill in the California Form 568: Line 1Total income from Schedule IW. WebWe have a total of twelve past-year versions of Form 568 in the TaxFormFinder archives, including for the previous tax year.  2023 first quarter estimated tax payments due for individuals and corporations.

2023 first quarter estimated tax payments due for individuals and corporations.  Many updates and improvements! Select a category (column heading) in the drop down. %PDF-1.7

%

2022 fourth quarter estimated tax payments due for individuals. Attach

Many updates and improvements! Select a category (column heading) in the drop down. %PDF-1.7

%

2022 fourth quarter estimated tax payments due for individuals. Attach  If you can't find an answer to your question, please contact us. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. View Sitemap. The secretary of state of California has issued to the LLC the certificate of registration. We have answers to the most popular questions from our customers.

If you can't find an answer to your question, please contact us. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. View Sitemap. The secretary of state of California has issued to the LLC the certificate of registration. We have answers to the most popular questions from our customers.  Form 568 is due on March 31st following the end of the tax year. Show all. Any LLC that is officially registered to conduct business in the state of California needs to file this form each year with the Franchise Tax Board. 0000016202 00000 n

_{;B#:@48al\cBJ Download your copy, save it to the cloud, print it, or share it right from the editor. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. 4.8 out of 5. Instructions for Form 720, Quarterly Federal Excise Tax Return. Hire the top business lawyers and save up to 60% on legal fees. 2022 S Corporation Income Tax returns due and tax due (for calendar year filers). <]/Prev 99438/XRefStm 1427>>

Form 568 is due on March 31st following the end of the tax year. Show all. Any LLC that is officially registered to conduct business in the state of California needs to file this form each year with the Franchise Tax Board. 0000016202 00000 n

_{;B#:@48al\cBJ Download your copy, save it to the cloud, print it, or share it right from the editor. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. 4.8 out of 5. Instructions for Form 720, Quarterly Federal Excise Tax Return. Hire the top business lawyers and save up to 60% on legal fees. 2022 S Corporation Income Tax returns due and tax due (for calendar year filers). <]/Prev 99438/XRefStm 1427>>

0000007667 00000 n

Section 404(k) dividends. 0000001055 00000 n

WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. Click here about the product information and purchase: https://turbotax.intuit.com/small-business-taxes/ @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX 2021 Limited Liability Company Return of Income. 0

You still have to file Form 568 if the LLC is registered in California. Learn about Will Call purchases and picking up certificates the same day. 2023 third quarter estimated tax payments due for individuals and corporations. UpCounselaccepts only the top 5 percent of lawyers to its site. 2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers).

0000007667 00000 n

Section 404(k) dividends. 0000001055 00000 n

WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. Click here about the product information and purchase: https://turbotax.intuit.com/small-business-taxes/ @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX 2021 Limited Liability Company Return of Income. 0

You still have to file Form 568 if the LLC is registered in California. Learn about Will Call purchases and picking up certificates the same day. 2023 third quarter estimated tax payments due for individuals and corporations. UpCounselaccepts only the top 5 percent of lawyers to its site. 2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers).

Just like all other entities, LLCs in California need to pay the annual franchise tax.

WebThe CA form 568 instructions are detailed but straightforward. The LLC is currently conducting business in the state of California. File your California and Federal tax returns online with TurboTax in minutes. Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs( e,HC> t8V&$X,` FREE for simple returns, with discounts available for Tax-Brackets.org users! 11/03/2021. If you paid tax on purchases from other states, report the credit for out-of-state tax on Line 1. FREE for simple returns, with discounts available for TaxFormFinder users!

Inst 5310-A. Subtract line 2 from line 1c. Yes, you must file for the final return. Pay an annual tax of $800 (refer to Annual Tax Section); and.  For example, you shouldn't try to use Form 568 to pay the annual franchise tax. If you need help with the California LLC Form 568, you canpost your legal needonUpCounsel'smarketplace. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California.

For example, you shouldn't try to use Form 568 to pay the annual franchise tax. If you need help with the California LLC Form 568, you canpost your legal needonUpCounsel'smarketplace. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California.