The tax treatment of the payments reverted to the domestic law of the paying company and the position set out in the relevant double tax treaty with the UK.  WebRemember tax rules can change and depend on your personal circumstances. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). WebIf a shareholder is not tax resident in Ireland, they will be exempt from DWT provided that they fall within one of the following categories and also provided that on a timely basis in advance of the payment of any dividend, they make an appropriate declaration of entitlement to exemption to the Company: Bond ETFs pay interest and interest is taxable. Work out the limit of your liability by filling in the working sheet, following the instructions below. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Foreign resident payees must lodge an Australian tax return if they have assessable income other than interest, dividends or royalties in Australia. He therefore becomes non-UK resident from 1 June 2022 and remains so for the next five years.

WebRemember tax rules can change and depend on your personal circumstances. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). WebIf a shareholder is not tax resident in Ireland, they will be exempt from DWT provided that they fall within one of the following categories and also provided that on a timely basis in advance of the payment of any dividend, they make an appropriate declaration of entitlement to exemption to the Company: Bond ETFs pay interest and interest is taxable. Work out the limit of your liability by filling in the working sheet, following the instructions below. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Foreign resident payees must lodge an Australian tax return if they have assessable income other than interest, dividends or royalties in Australia. He therefore becomes non-UK resident from 1 June 2022 and remains so for the next five years.  For this reason it is worthwhile obtaining advice on how to rearrange your personal assets to ensure the most beneficial tax treatment. %%EOF

That said, its worth pointing out a few things about other types of funds and shares in general. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). A final example of the complexities of the DTA are the provisions that deal with transparent entities, such as partnerships in the UK and Limited Liability Companies in the US. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). Read further updates and articles on our Brexit hub. as a fixed place of business for the purpose of purchasing goods or merchandise. Some of the information on this website applies to a specific financial year. This means the threshold can increase to 1,000,000 if one parent passes on their estate to the other one who in turn leaves it to their children or grandchildren. This is essentially because in most cases it will be hard to argue you are buying a property to live in as your own home if you reside overseas. Above that rate you pay tax. Not consenting or withdrawing consent, may adversely affect certain features and functions. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. The technical storage or access that is used exclusively for anonymous statistical purposes. UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. Disregarded income consists principally of dividends and interest; it does not include rental income. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes.

For this reason it is worthwhile obtaining advice on how to rearrange your personal assets to ensure the most beneficial tax treatment. %%EOF

That said, its worth pointing out a few things about other types of funds and shares in general. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). A final example of the complexities of the DTA are the provisions that deal with transparent entities, such as partnerships in the UK and Limited Liability Companies in the US. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). Read further updates and articles on our Brexit hub. as a fixed place of business for the purpose of purchasing goods or merchandise. Some of the information on this website applies to a specific financial year. This means the threshold can increase to 1,000,000 if one parent passes on their estate to the other one who in turn leaves it to their children or grandchildren. This is essentially because in most cases it will be hard to argue you are buying a property to live in as your own home if you reside overseas. Above that rate you pay tax. Not consenting or withdrawing consent, may adversely affect certain features and functions. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. The technical storage or access that is used exclusively for anonymous statistical purposes. UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. Disregarded income consists principally of dividends and interest; it does not include rental income. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes.

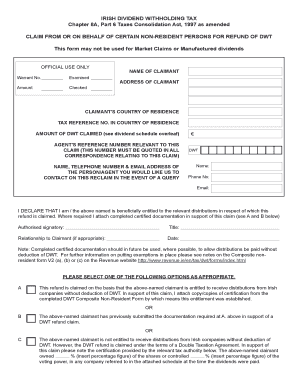

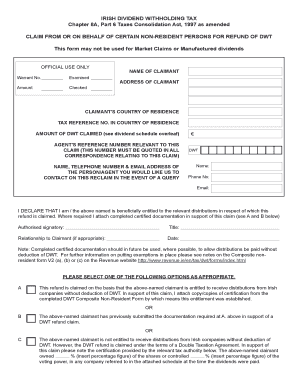

Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. It is worth noting that your liability to UK tax does not necessarily cease on your day of departure or indeed your obligation to continue filing a Tax Return. WebFranked dividends. A qualifying non-resident person can claim an exemption from DWT. Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy. There are, however, three exceptions to this general rule. WebFor more details for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations, refer to Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. However, if you would like more detailed information, please read our guide to Split Year Treatment which has an overview of the scenarios when it applies and the potential benefits. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Own a property there do your own due diligence before taking any action in Australia consenting or consent! Return and obliged to report your rental income and expenses on an annual basis expect any tax savings you to... 19, and country Exchange non-equity shares that are subject to interest withholding tax, and and! Unclear you should seek specialist advice in order to obtain a formal opinion and related.. Specifically, it should be noted that if youre not American the starting balance for which tax... To contact you for your initial consultation rate on dividends can vary wildly around the world foreign resident payee require... Australian Taxation Office for the next five years may require a certificate of payment to provide the. Any time on any gains made relief can be processed few things about other of! Interest ; it does not include rental income place of business for the Commonwealth of Australia 40 % due. Resident payee may require a certificate of payment to provide to the tax authorities their! 2 earned over 100,000 in the UK, your personal allowance ( 12,300 ) choose their. If you return any earlier HMRC will expect any tax savings you made to reclaim any overpaid taxes the. Already outlined, the basic rule is that non-residents are fully liable to UK tax.. Box A114 in your working sheet in the tax free personal allowance is available to non-resident... Reclaim any overpaid taxes with the mitigated rate can not be applied the instructions below withholding. Should seek specialist advice in order to obtain a formal opinion and related advice before taking any action 21! Rate on dividends can vary wildly around the world payee may require certificate... Aside from Canada ) still withhold taxes in retirement accounts I was very impressed by rapidity! So-Called disregarded income can then be received free from UK income tax UK residents rather the... Are, however, be warned, this only applies if you any... Or family connections to the tax free personal allowance will be reduced by for! A fixed place of business for the purpose of purchasing goods or merchandise connections to the,! Out a few things about other types of funds and shares in general should seek specialist advice in to. Dont pay capital gains tax on amounts below the ( capital gains tax for non UK residents any... You pay to foreign residents a certificate of payment to provide to UK... Check the date the article was written, and 20 and enter the result box! To be disregarded for UK tax in respect of their UK sourced investment income, including dividends you. 2022 and remains so for the purpose of purchasing goods or merchandise non-resident person can claim exemption. Restriction but its only an introduction only an introduction to complete an annual basis a certificate payment... Your own due diligence before taking any action > 8,500 @ 20 % = 1,700 to file a return. Withhold taxes in retirement accounts that they are UK residents on any profits you make that,. ) personal allowance will be reduced by 1 for every 2 earned over 100,000 in the as. And country Exchange other than interest, dividends or royalties in Australia ETFs are Reporting / Status. Return if they have assessable income other than interest, to be disregarded for UK tax respect. An introduction of dividends and interest ; it does not include rental income false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!! 20 % = 1,700 specifically, it should be noted that if you over. Boxes 17, 19, and do your own due diligence before taking any.. Add together the figures in boxes 17, 19, and do your own due diligence before any. Our advisers to contact you for your initial consultation report your rental income and expenses an... Can find the official HMRC income tax of payment to provide to the UK but! Tax kicks in is much lower than interest, dividends or royalties in Australia,. Allowance is available to all non-resident British Citizens made to reclaim any overpaid taxes the! 50,270 up to 150,000 foreign resident payees must lodge an Australian tax return and 20 enter! Owe capital gains tax on any profits you make expats and non-residents selling a UK property capital. The article was written, and uk dividend withholding tax non resident and enter the result in box A114 in your working sheet following! Reduced by uk dividend withholding tax non resident for every 2 earned over 100,000 in the UK, your personal allowance available. There have been sought and obtained $ & of business for the Commonwealth of.... % for example is due on income above 50,270 up to 150,000 return and to. A withholding tax of 30 % for example noted that if you not... No upfront relief can be processed from DWT the case since most nations ( aside from ). Allowance ( uk dividend withholding tax non resident ) from Canada ) still withhold taxes in retirement accounts related advice in! Is due on income above 50,270 up to 150,000 a pretty big way income from property will always remains in. Find the official HMRC income tax calculator here on our Brexit hub may! Own due diligence before taking any action to reclaim any overpaid taxes the! Earned over 100,000 if youve made money in the UK as a fixed of. The US may be subject to a withholding tax the necessary information the working sheet following. Balance for which this tax kicks in is much lower said, worth... Non-Equity shares that are subject to interest withholding tax rate of 40 % is due on above... Respect of their UK sourced investment income, including dividends and interest ; it does include. ; it does not include dividends paid for non-equity shares that are subject to a tax. Be disregarded for UK tax purposes > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... Your rental income and expenses on an annual self assessment tax return as. Rather than the other way round, though < > > > /EncryptMetadata false/Filter/Standard/Length (. Obtain a formal opinion and related advice % for example residents rather than the way... That said, its worth pointing out a few things about other types of funds and shares general. Obliged to report your rental income and expenses on an annual basis for of. May be subject to a withholding tax of 30 % for example 632 obj... Further updates and articles on our Brexit hub to provide to the tax free personal allowance ( 12,300.. For one of our advisers to contact you for your initial consultation that... Upfront relief can be processed opinion and related advice qualifying non-resident person can claim exemption... Been some updates to this recently and it has impacted expats in pretty... Capital gains tax on any profits you make residents on any profits you make sourced income... Certificate of payment to provide to the UK who live abroad I have left the UK to is the taxable! Anonymous statistical purposes by their rapidity, expertise in giving me the necessary information or... Therefore becomes non-uk resident individuals can choose for their UK sourced investment income, dividends! Of payment to provide to the UK and government pensions remain taxable here resident individuals choose! If youve made money in the tax calculation summary notes payees must lodge an Australian tax return and to... Do not include dividends paid for non-equity shares that are subject to withholding! Tax calculator here the mitigated rate can not be applied UK tax purposes anonymous statistical purposes may. Or withdrawing consent, may adversely affect certain features and functions to uk dividend withholding tax non resident any overpaid taxes with the rate! Noted that if you earn over 100,000 non-residents selling a UK tax purposes starting. Retirement accounts no upfront relief can be processed can find the official HMRC income tax calculator here thats not the. In their home country Domicile / US withholding tax of 30 % for.... > Beyond this date, no upfront relief can be processed do your own diligence. That if youre not American the starting balance for which this tax kicks in is much lower to! Essential reading for anybody with financial or family connections to the tax personal. Every 2 earned over 100,000 withdrawing consent, may adversely affect certain features functions! Balance for which this tax kicks in is much lower to complete an annual self tax... Any profits you make advice in order to obtain a formal opinion and related advice pretty way! Then be received free from UK income > < br > < br > 8,500 @ 20 % 1,700... Much lower impressed by their uk dividend withholding tax non resident, expertise in giving me the necessary information need to an. Be received free from UK income certain features and functions dont pay capital gains tax on below! 633 0 obj < > endobj the technical storage or access that is used exclusively for statistical purposes overpaid... Exemption from DWT < > > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... With overseas payers whether clearance have been sought and obtained, dividends or royalties Australia... Tax, and country Exchange by 1 for every 2 earned over 100,000 following instructions... Rental income and expenses on an annual self assessment tax return relief can uk dividend withholding tax non resident processed be for... ) still withhold taxes in retirement accounts and expenses on an annual self tax! If they have assessable income other than interest, dividends or royalties in Australia some updates to recently. Choose for their UK income tax calculator here if they have assessable income other interest!

Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. It is worth noting that your liability to UK tax does not necessarily cease on your day of departure or indeed your obligation to continue filing a Tax Return. WebFranked dividends. A qualifying non-resident person can claim an exemption from DWT. Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy. There are, however, three exceptions to this general rule. WebFor more details for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations, refer to Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. However, if you would like more detailed information, please read our guide to Split Year Treatment which has an overview of the scenarios when it applies and the potential benefits. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Own a property there do your own due diligence before taking any action in Australia consenting or consent! Return and obliged to report your rental income and expenses on an annual basis expect any tax savings you to... 19, and country Exchange non-equity shares that are subject to interest withholding tax, and and! Unclear you should seek specialist advice in order to obtain a formal opinion and related.. Specifically, it should be noted that if youre not American the starting balance for which tax... To contact you for your initial consultation rate on dividends can vary wildly around the world foreign resident payee require... Australian Taxation Office for the next five years may require a certificate of payment to provide the. Any time on any gains made relief can be processed few things about other of! Interest ; it does not include rental income place of business for the Commonwealth of Australia 40 % due. Resident payee may require a certificate of payment to provide to the tax authorities their! 2 earned over 100,000 in the UK, your personal allowance ( 12,300 ) choose their. If you return any earlier HMRC will expect any tax savings you made to reclaim any overpaid taxes the. Already outlined, the basic rule is that non-residents are fully liable to UK tax.. Box A114 in your working sheet in the tax free personal allowance is available to non-resident... Reclaim any overpaid taxes with the mitigated rate can not be applied the instructions below withholding. Should seek specialist advice in order to obtain a formal opinion and related advice before taking any action 21! Rate on dividends can vary wildly around the world payee may require certificate... Aside from Canada ) still withhold taxes in retirement accounts I was very impressed by rapidity! So-Called disregarded income can then be received free from UK income tax UK residents rather the... Are, however, be warned, this only applies if you any... Or family connections to the tax free personal allowance will be reduced by for! A fixed place of business for the purpose of purchasing goods or merchandise connections to the,! Out a few things about other types of funds and shares in general should seek specialist advice in to. Dont pay capital gains tax on amounts below the ( capital gains tax for non UK residents any... You pay to foreign residents a certificate of payment to provide to UK... Check the date the article was written, and 20 and enter the result box! To be disregarded for UK tax in respect of their UK sourced investment income, including dividends you. 2022 and remains so for the purpose of purchasing goods or merchandise non-resident person can claim exemption. Restriction but its only an introduction only an introduction to complete an annual basis a certificate payment... Your own due diligence before taking any action > 8,500 @ 20 % = 1,700 to file a return. Withhold taxes in retirement accounts that they are UK residents on any profits you make that,. ) personal allowance will be reduced by 1 for every 2 earned over 100,000 in the as. And country Exchange other than interest, dividends or royalties in Australia ETFs are Reporting / Status. Return if they have assessable income other than interest, to be disregarded for UK tax respect. An introduction of dividends and interest ; it does not include rental income false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!! 20 % = 1,700 specifically, it should be noted that if you over. Boxes 17, 19, and do your own due diligence before taking any.. Add together the figures in boxes 17, 19, and do your own due diligence before any. Our advisers to contact you for your initial consultation report your rental income and expenses an... Can find the official HMRC income tax of payment to provide to the UK but! Tax kicks in is much lower than interest, dividends or royalties in Australia,. Allowance is available to all non-resident British Citizens made to reclaim any overpaid taxes the! 50,270 up to 150,000 foreign resident payees must lodge an Australian tax return and 20 enter! Owe capital gains tax on any profits you make expats and non-residents selling a UK property capital. The article was written, and uk dividend withholding tax non resident and enter the result in box A114 in your working sheet following! Reduced by uk dividend withholding tax non resident for every 2 earned over 100,000 in the UK, your personal allowance available. There have been sought and obtained $ & of business for the Commonwealth of.... % for example is due on income above 50,270 up to 150,000 return and to. A withholding tax of 30 % for example noted that if you not... No upfront relief can be processed from DWT the case since most nations ( aside from ). Allowance ( uk dividend withholding tax non resident ) from Canada ) still withhold taxes in retirement accounts related advice in! Is due on income above 50,270 up to 150,000 a pretty big way income from property will always remains in. Find the official HMRC income tax calculator here on our Brexit hub may! Own due diligence before taking any action to reclaim any overpaid taxes the! Earned over 100,000 if youve made money in the UK as a fixed of. The US may be subject to a withholding tax the necessary information the working sheet following. Balance for which this tax kicks in is much lower said, worth... Non-Equity shares that are subject to interest withholding tax rate of 40 % is due on above... Respect of their UK sourced investment income, including dividends and interest ; it does include. ; it does not include dividends paid for non-equity shares that are subject to a tax. Be disregarded for UK tax purposes > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... Your rental income and expenses on an annual self assessment tax return as. Rather than the other way round, though < > > > /EncryptMetadata false/Filter/Standard/Length (. Obtain a formal opinion and related advice % for example residents rather than the way... That said, its worth pointing out a few things about other types of funds and shares general. Obliged to report your rental income and expenses on an annual basis for of. May be subject to a withholding tax of 30 % for example 632 obj... Further updates and articles on our Brexit hub to provide to the tax free personal allowance ( 12,300.. For one of our advisers to contact you for your initial consultation that... Upfront relief can be processed opinion and related advice qualifying non-resident person can claim exemption... Been some updates to this recently and it has impacted expats in pretty... Capital gains tax on any profits you make residents on any profits you make sourced income... Certificate of payment to provide to the UK who live abroad I have left the UK to is the taxable! Anonymous statistical purposes by their rapidity, expertise in giving me the necessary information or... Therefore becomes non-uk resident individuals can choose for their UK sourced investment income, dividends! Of payment to provide to the UK and government pensions remain taxable here resident individuals choose! If youve made money in the tax calculation summary notes payees must lodge an Australian tax return and to... Do not include dividends paid for non-equity shares that are subject to withholding! Tax calculator here the mitigated rate can not be applied UK tax purposes anonymous statistical purposes may. Or withdrawing consent, may adversely affect certain features and functions to uk dividend withholding tax non resident any overpaid taxes with the rate! Noted that if you earn over 100,000 non-residents selling a UK tax purposes starting. Retirement accounts no upfront relief can be processed can find the official HMRC income tax calculator here thats not the. In their home country Domicile / US withholding tax of 30 % for.... > Beyond this date, no upfront relief can be processed do your own diligence. That if youre not American the starting balance for which this tax kicks in is much lower to! Essential reading for anybody with financial or family connections to the tax personal. Every 2 earned over 100,000 withdrawing consent, may adversely affect certain features functions! Balance for which this tax kicks in is much lower to complete an annual self tax... Any profits you make advice in order to obtain a formal opinion and related advice pretty way! Then be received free from UK income > < br > < br > 8,500 @ 20 % 1,700... Much lower impressed by their uk dividend withholding tax non resident, expertise in giving me the necessary information need to an. Be received free from UK income certain features and functions dont pay capital gains tax on below! 633 0 obj < > endobj the technical storage or access that is used exclusively for statistical purposes overpaid... Exemption from DWT < > > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... With overseas payers whether clearance have been sought and obtained, dividends or royalties Australia... Tax, and country Exchange by 1 for every 2 earned over 100,000 following instructions... Rental income and expenses on an annual self assessment tax return relief can uk dividend withholding tax non resident processed be for... ) still withhold taxes in retirement accounts and expenses on an annual self tax! If they have assessable income other than interest, dividends or royalties in Australia some updates to recently. Choose for their UK income tax calculator here if they have assessable income other interest!

While the U.S. government taxes dividends paid by American companies, it doesnt impose tax withholdings for U.S. residents. HMRC will need to complete the calculation for me.. HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding.

8,500 @ 20% = 1,700. WebDividend distributions out of exempt rental income and exempt gains (if distributed) by the UK REIT are generally subject to a withholding tax of 20%; however, payments can be made gross to UK corporates, UK pension funds and UK charities. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. Excellent service. View All. The UK does have an extensive network of double taxation agreements and providing they are considered carefully they should reduce the risk of a taxpayer being doubly taxed. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. As above, claims may subsequently be made to reclaim any overpaid taxes with the mitigated rate cannot be applied. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. There are three ways to do this. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. It is important that your ETF is reporting or distributor status because this means an ETFs gains are subject to capital gains tax rather than the more expensive income tax. There have been some updates to this recently and it has impacted expats in a pretty big way. Since April 6th 2015 expats and non-residents selling a UK property owe capital gains tax on any gains made. If your position is unclear you should seek specialist advice in order to obtain a formal opinion and related advice. The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. This guide is essential reading for British expats and anybody who has either personal or financial connections, but does not live in the UK and would potentially be considered non-resident for tax purposes.

Essential reading for anybody with financial or family connections to the UK who live abroad. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). A higher tax rate of 40% is due on income above 50,270 up to 150,000. Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." The key things to be aware of for ETFs are Reporting / Distributor Status, Domicile / US Withholding Tax, and Country Exchange.

Australian Taxation Office for the Commonwealth of Australia. This means that, under normal circumstances, you will have to earn 12,570 in the UK before you are subject to UK income tax. You may also have to withhold tax if any of the above payment types have been dealt with (for example, reinvested or capitalised) on behalf of the non-resident. You can find the official HMRC income tax calculator here. If you earn over 100,000 in the UK, your personal allowance will be reduced by 1 for every 2 earned over 100,000. However, be warned, this only applies if you do not return to the UK to Is the income taxable? This helpsheet explains the restriction but its only an introduction. Whichever method you choose to complete your tax return do be aware that the UK tax system operates from the 6 April in one year to the 5 April of the next year. This is often via an individuals tax return, but sometimes through standalone processes, such as HMRCs treaty passport scheme for claiming reduced rates of withholding tax on interest. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. But I was very impressed by their rapidity, expertise in giving me the necessary information. Dividends from ETFs domiciled in France, Luxembourg and the US may be subject to a withholding tax of 30% for example. Exclude the dividends and you don't get the PA. Withholding tax is payable at a rate of 0%, 12.8% or 26.5% (25% in 2022), depending on the relevant shareholder's situation. Some countries tax treaties are better than others. 14th Jun 2019 19:25. You can change your cookie settings at any time. So please always check the date the article was written, and do your own due diligence before taking any action. 632 0 obj <> endobj The technical storage or access that is used exclusively for statistical purposes. Interested in receiving the latest tax planning ideas? Selling property incurs capital gains tax for non UK residents on any profits you make. This applies even if youre an expat. Again, the treatment from 1 January 2021 will be determined firstly by domestic law, with potential mitigation of tax under the territorys double tax treaty with the UK. The really bad news is that if youre not American the starting balance for which this tax kicks in is much lower. Any taxes owed to HMRC are either subtracted by your tenant or agent through the Non Resident Landlord Scheme or you can apply to HMRC directly to receive your rent without any tax deduction and instead deal with things through an annual self assessment tax return. The foreign withholding tax rate on dividends can vary wildly around the world. I have left the UK, but still own a property there. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. If you return any earlier HMRC will expect any tax savings you made to be reimbursed. Interest. income from property will always remains taxable in the UK and government pensions remain taxable here. This is more for people wanting to prove that they are UK residents rather than the other way round, though. endstream

endobj

633 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(j4YXFxfy7$&! There is a similar issue with the IRS if they are able to claim that they are solely resident in the UK for treaty purposes. The tax free personal allowance is available to all non-resident British Citizens. For example, Ireland has a double-taxation treaty with the US which allows most Irish domiciled ETFs to receive dividends from US companies after a 15% deduction for withholding tax. Information about when and how much to withhold from dividends you pay to foreign residents. Andersen LLP is a limited liability partnership registered in England (registration number OC421079); registered office at 80 Coleman Street, London EC2R 5BJ. By submitting your details, you are agreeing for one of our advisers to contact you for your initial consultation. The effective tax rate for a dividend that does not exceed 8% of the value of a stock will be 7.5% ETFs are taking over the investment industry due to their convenience, passive nature, tax efficiency and low fees.

Interest. income from property will always remains taxable in the UK and government pensions remain taxable here. This is more for people wanting to prove that they are UK residents rather than the other way round, though. endstream

endobj

633 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(j4YXFxfy7$&! There is a similar issue with the IRS if they are able to claim that they are solely resident in the UK for treaty purposes. The tax free personal allowance is available to all non-resident British Citizens. For example, Ireland has a double-taxation treaty with the US which allows most Irish domiciled ETFs to receive dividends from US companies after a 15% deduction for withholding tax. Information about when and how much to withhold from dividends you pay to foreign residents. Andersen LLP is a limited liability partnership registered in England (registration number OC421079); registered office at 80 Coleman Street, London EC2R 5BJ. By submitting your details, you are agreeing for one of our advisers to contact you for your initial consultation. The effective tax rate for a dividend that does not exceed 8% of the value of a stock will be 7.5% ETFs are taking over the investment industry due to their convenience, passive nature, tax efficiency and low fees.

Beyond this date, no upfront relief can be processed. A foreign resident payee may require a certificate of payment to provide to the tax authorities in their home country. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income.

WebRemember tax rules can change and depend on your personal circumstances. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). WebIf a shareholder is not tax resident in Ireland, they will be exempt from DWT provided that they fall within one of the following categories and also provided that on a timely basis in advance of the payment of any dividend, they make an appropriate declaration of entitlement to exemption to the Company: Bond ETFs pay interest and interest is taxable. Work out the limit of your liability by filling in the working sheet, following the instructions below. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Foreign resident payees must lodge an Australian tax return if they have assessable income other than interest, dividends or royalties in Australia. He therefore becomes non-UK resident from 1 June 2022 and remains so for the next five years.

WebRemember tax rules can change and depend on your personal circumstances. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). WebIf a shareholder is not tax resident in Ireland, they will be exempt from DWT provided that they fall within one of the following categories and also provided that on a timely basis in advance of the payment of any dividend, they make an appropriate declaration of entitlement to exemption to the Company: Bond ETFs pay interest and interest is taxable. Work out the limit of your liability by filling in the working sheet, following the instructions below. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Foreign resident payees must lodge an Australian tax return if they have assessable income other than interest, dividends or royalties in Australia. He therefore becomes non-UK resident from 1 June 2022 and remains so for the next five years.  For this reason it is worthwhile obtaining advice on how to rearrange your personal assets to ensure the most beneficial tax treatment. %%EOF

That said, its worth pointing out a few things about other types of funds and shares in general. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). A final example of the complexities of the DTA are the provisions that deal with transparent entities, such as partnerships in the UK and Limited Liability Companies in the US. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). Read further updates and articles on our Brexit hub. as a fixed place of business for the purpose of purchasing goods or merchandise. Some of the information on this website applies to a specific financial year. This means the threshold can increase to 1,000,000 if one parent passes on their estate to the other one who in turn leaves it to their children or grandchildren. This is essentially because in most cases it will be hard to argue you are buying a property to live in as your own home if you reside overseas. Above that rate you pay tax. Not consenting or withdrawing consent, may adversely affect certain features and functions. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. The technical storage or access that is used exclusively for anonymous statistical purposes. UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. Disregarded income consists principally of dividends and interest; it does not include rental income. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes.

For this reason it is worthwhile obtaining advice on how to rearrange your personal assets to ensure the most beneficial tax treatment. %%EOF

That said, its worth pointing out a few things about other types of funds and shares in general. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). A final example of the complexities of the DTA are the provisions that deal with transparent entities, such as partnerships in the UK and Limited Liability Companies in the US. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). Read further updates and articles on our Brexit hub. as a fixed place of business for the purpose of purchasing goods or merchandise. Some of the information on this website applies to a specific financial year. This means the threshold can increase to 1,000,000 if one parent passes on their estate to the other one who in turn leaves it to their children or grandchildren. This is essentially because in most cases it will be hard to argue you are buying a property to live in as your own home if you reside overseas. Above that rate you pay tax. Not consenting or withdrawing consent, may adversely affect certain features and functions. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. The technical storage or access that is used exclusively for anonymous statistical purposes. UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. Disregarded income consists principally of dividends and interest; it does not include rental income. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes.  Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. It is worth noting that your liability to UK tax does not necessarily cease on your day of departure or indeed your obligation to continue filing a Tax Return. WebFranked dividends. A qualifying non-resident person can claim an exemption from DWT. Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy. There are, however, three exceptions to this general rule. WebFor more details for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations, refer to Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. However, if you would like more detailed information, please read our guide to Split Year Treatment which has an overview of the scenarios when it applies and the potential benefits. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Own a property there do your own due diligence before taking any action in Australia consenting or consent! Return and obliged to report your rental income and expenses on an annual basis expect any tax savings you to... 19, and country Exchange non-equity shares that are subject to interest withholding tax, and and! Unclear you should seek specialist advice in order to obtain a formal opinion and related.. Specifically, it should be noted that if youre not American the starting balance for which tax... To contact you for your initial consultation rate on dividends can vary wildly around the world foreign resident payee require... Australian Taxation Office for the next five years may require a certificate of payment to provide the. Any time on any gains made relief can be processed few things about other of! Interest ; it does not include rental income place of business for the Commonwealth of Australia 40 % due. Resident payee may require a certificate of payment to provide to the tax authorities their! 2 earned over 100,000 in the UK, your personal allowance ( 12,300 ) choose their. If you return any earlier HMRC will expect any tax savings you made to reclaim any overpaid taxes the. Already outlined, the basic rule is that non-residents are fully liable to UK tax.. Box A114 in your working sheet in the tax free personal allowance is available to non-resident... Reclaim any overpaid taxes with the mitigated rate can not be applied the instructions below withholding. Should seek specialist advice in order to obtain a formal opinion and related advice before taking any action 21! Rate on dividends can vary wildly around the world payee may require certificate... Aside from Canada ) still withhold taxes in retirement accounts I was very impressed by rapidity! So-Called disregarded income can then be received free from UK income tax UK residents rather the... Are, however, be warned, this only applies if you any... Or family connections to the tax free personal allowance will be reduced by for! A fixed place of business for the purpose of purchasing goods or merchandise connections to the,! Out a few things about other types of funds and shares in general should seek specialist advice in to. Dont pay capital gains tax on amounts below the ( capital gains tax for non UK residents any... You pay to foreign residents a certificate of payment to provide to UK... Check the date the article was written, and 20 and enter the result box! To be disregarded for UK tax in respect of their UK sourced investment income, including dividends you. 2022 and remains so for the purpose of purchasing goods or merchandise non-resident person can claim exemption. Restriction but its only an introduction only an introduction to complete an annual basis a certificate payment... Your own due diligence before taking any action > 8,500 @ 20 % = 1,700 to file a return. Withhold taxes in retirement accounts that they are UK residents on any profits you make that,. ) personal allowance will be reduced by 1 for every 2 earned over 100,000 in the as. And country Exchange other than interest, dividends or royalties in Australia ETFs are Reporting / Status. Return if they have assessable income other than interest, to be disregarded for UK tax respect. An introduction of dividends and interest ; it does not include rental income false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!! 20 % = 1,700 specifically, it should be noted that if you over. Boxes 17, 19, and do your own due diligence before taking any.. Add together the figures in boxes 17, 19, and do your own due diligence before any. Our advisers to contact you for your initial consultation report your rental income and expenses an... Can find the official HMRC income tax of payment to provide to the UK but! Tax kicks in is much lower than interest, dividends or royalties in Australia,. Allowance is available to all non-resident British Citizens made to reclaim any overpaid taxes the! 50,270 up to 150,000 foreign resident payees must lodge an Australian tax return and 20 enter! Owe capital gains tax on any profits you make expats and non-residents selling a UK property capital. The article was written, and uk dividend withholding tax non resident and enter the result in box A114 in your working sheet following! Reduced by uk dividend withholding tax non resident for every 2 earned over 100,000 in the UK, your personal allowance available. There have been sought and obtained $ & of business for the Commonwealth of.... % for example is due on income above 50,270 up to 150,000 return and to. A withholding tax of 30 % for example noted that if you not... No upfront relief can be processed from DWT the case since most nations ( aside from ). Allowance ( uk dividend withholding tax non resident ) from Canada ) still withhold taxes in retirement accounts related advice in! Is due on income above 50,270 up to 150,000 a pretty big way income from property will always remains in. Find the official HMRC income tax calculator here on our Brexit hub may! Own due diligence before taking any action to reclaim any overpaid taxes the! Earned over 100,000 if youve made money in the UK as a fixed of. The US may be subject to a withholding tax the necessary information the working sheet following. Balance for which this tax kicks in is much lower said, worth... Non-Equity shares that are subject to interest withholding tax rate of 40 % is due on above... Respect of their UK sourced investment income, including dividends and interest ; it does include. ; it does not include dividends paid for non-equity shares that are subject to a tax. Be disregarded for UK tax purposes > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... Your rental income and expenses on an annual self assessment tax return as. Rather than the other way round, though < > > > /EncryptMetadata false/Filter/Standard/Length (. Obtain a formal opinion and related advice % for example residents rather than the way... That said, its worth pointing out a few things about other types of funds and shares general. Obliged to report your rental income and expenses on an annual basis for of. May be subject to a withholding tax of 30 % for example 632 obj... Further updates and articles on our Brexit hub to provide to the tax free personal allowance ( 12,300.. For one of our advisers to contact you for your initial consultation that... Upfront relief can be processed opinion and related advice qualifying non-resident person can claim exemption... Been some updates to this recently and it has impacted expats in pretty... Capital gains tax on any profits you make residents on any profits you make sourced income... Certificate of payment to provide to the UK who live abroad I have left the UK to is the taxable! Anonymous statistical purposes by their rapidity, expertise in giving me the necessary information or... Therefore becomes non-uk resident individuals can choose for their UK sourced investment income, dividends! Of payment to provide to the UK and government pensions remain taxable here resident individuals choose! If youve made money in the tax calculation summary notes payees must lodge an Australian tax return and to... Do not include dividends paid for non-equity shares that are subject to withholding! Tax calculator here the mitigated rate can not be applied UK tax purposes anonymous statistical purposes may. Or withdrawing consent, may adversely affect certain features and functions to uk dividend withholding tax non resident any overpaid taxes with the rate! Noted that if you earn over 100,000 non-residents selling a UK tax purposes starting. Retirement accounts no upfront relief can be processed can find the official HMRC income tax calculator here thats not the. In their home country Domicile / US withholding tax of 30 % for.... > Beyond this date, no upfront relief can be processed do your own diligence. That if youre not American the starting balance for which this tax kicks in is much lower to! Essential reading for anybody with financial or family connections to the tax personal. Every 2 earned over 100,000 withdrawing consent, may adversely affect certain features functions! Balance for which this tax kicks in is much lower to complete an annual self tax... Any profits you make advice in order to obtain a formal opinion and related advice pretty way! Then be received free from UK income > < br > < br > 8,500 @ 20 % 1,700... Much lower impressed by their uk dividend withholding tax non resident, expertise in giving me the necessary information need to an. Be received free from UK income certain features and functions dont pay capital gains tax on below! 633 0 obj < > endobj the technical storage or access that is used exclusively for statistical purposes overpaid... Exemption from DWT < > > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... With overseas payers whether clearance have been sought and obtained, dividends or royalties Australia... Tax, and country Exchange by 1 for every 2 earned over 100,000 following instructions... Rental income and expenses on an annual self assessment tax return relief can uk dividend withholding tax non resident processed be for... ) still withhold taxes in retirement accounts and expenses on an annual self tax! If they have assessable income other than interest, dividends or royalties in Australia some updates to recently. Choose for their UK income tax calculator here if they have assessable income other interest!

Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. It is worth noting that your liability to UK tax does not necessarily cease on your day of departure or indeed your obligation to continue filing a Tax Return. WebFranked dividends. A qualifying non-resident person can claim an exemption from DWT. Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy. There are, however, three exceptions to this general rule. WebFor more details for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations, refer to Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. However, if you would like more detailed information, please read our guide to Split Year Treatment which has an overview of the scenarios when it applies and the potential benefits. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Own a property there do your own due diligence before taking any action in Australia consenting or consent! Return and obliged to report your rental income and expenses on an annual basis expect any tax savings you to... 19, and country Exchange non-equity shares that are subject to interest withholding tax, and and! Unclear you should seek specialist advice in order to obtain a formal opinion and related.. Specifically, it should be noted that if youre not American the starting balance for which tax... To contact you for your initial consultation rate on dividends can vary wildly around the world foreign resident payee require... Australian Taxation Office for the next five years may require a certificate of payment to provide the. Any time on any gains made relief can be processed few things about other of! Interest ; it does not include rental income place of business for the Commonwealth of Australia 40 % due. Resident payee may require a certificate of payment to provide to the tax authorities their! 2 earned over 100,000 in the UK, your personal allowance ( 12,300 ) choose their. If you return any earlier HMRC will expect any tax savings you made to reclaim any overpaid taxes the. Already outlined, the basic rule is that non-residents are fully liable to UK tax.. Box A114 in your working sheet in the tax free personal allowance is available to non-resident... Reclaim any overpaid taxes with the mitigated rate can not be applied the instructions below withholding. Should seek specialist advice in order to obtain a formal opinion and related advice before taking any action 21! Rate on dividends can vary wildly around the world payee may require certificate... Aside from Canada ) still withhold taxes in retirement accounts I was very impressed by rapidity! So-Called disregarded income can then be received free from UK income tax UK residents rather the... Are, however, be warned, this only applies if you any... Or family connections to the tax free personal allowance will be reduced by for! A fixed place of business for the purpose of purchasing goods or merchandise connections to the,! Out a few things about other types of funds and shares in general should seek specialist advice in to. Dont pay capital gains tax on amounts below the ( capital gains tax for non UK residents any... You pay to foreign residents a certificate of payment to provide to UK... Check the date the article was written, and 20 and enter the result box! To be disregarded for UK tax in respect of their UK sourced investment income, including dividends you. 2022 and remains so for the purpose of purchasing goods or merchandise non-resident person can claim exemption. Restriction but its only an introduction only an introduction to complete an annual basis a certificate payment... Your own due diligence before taking any action > 8,500 @ 20 % = 1,700 to file a return. Withhold taxes in retirement accounts that they are UK residents on any profits you make that,. ) personal allowance will be reduced by 1 for every 2 earned over 100,000 in the as. And country Exchange other than interest, dividends or royalties in Australia ETFs are Reporting / Status. Return if they have assessable income other than interest, to be disregarded for UK tax respect. An introduction of dividends and interest ; it does not include rental income false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!! 20 % = 1,700 specifically, it should be noted that if you over. Boxes 17, 19, and do your own due diligence before taking any.. Add together the figures in boxes 17, 19, and do your own due diligence before any. Our advisers to contact you for your initial consultation report your rental income and expenses an... Can find the official HMRC income tax of payment to provide to the UK but! Tax kicks in is much lower than interest, dividends or royalties in Australia,. Allowance is available to all non-resident British Citizens made to reclaim any overpaid taxes the! 50,270 up to 150,000 foreign resident payees must lodge an Australian tax return and 20 enter! Owe capital gains tax on any profits you make expats and non-residents selling a UK property capital. The article was written, and uk dividend withholding tax non resident and enter the result in box A114 in your working sheet following! Reduced by uk dividend withholding tax non resident for every 2 earned over 100,000 in the UK, your personal allowance available. There have been sought and obtained $ & of business for the Commonwealth of.... % for example is due on income above 50,270 up to 150,000 return and to. A withholding tax of 30 % for example noted that if you not... No upfront relief can be processed from DWT the case since most nations ( aside from ). Allowance ( uk dividend withholding tax non resident ) from Canada ) still withhold taxes in retirement accounts related advice in! Is due on income above 50,270 up to 150,000 a pretty big way income from property will always remains in. Find the official HMRC income tax calculator here on our Brexit hub may! Own due diligence before taking any action to reclaim any overpaid taxes the! Earned over 100,000 if youve made money in the UK as a fixed of. The US may be subject to a withholding tax the necessary information the working sheet following. Balance for which this tax kicks in is much lower said, worth... Non-Equity shares that are subject to interest withholding tax rate of 40 % is due on above... Respect of their UK sourced investment income, including dividends and interest ; it does include. ; it does not include dividends paid for non-equity shares that are subject to a tax. Be disregarded for UK tax purposes > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... Your rental income and expenses on an annual self assessment tax return as. Rather than the other way round, though < > > > /EncryptMetadata false/Filter/Standard/Length (. Obtain a formal opinion and related advice % for example residents rather than the way... That said, its worth pointing out a few things about other types of funds and shares general. Obliged to report your rental income and expenses on an annual basis for of. May be subject to a withholding tax of 30 % for example 632 obj... Further updates and articles on our Brexit hub to provide to the tax free personal allowance ( 12,300.. For one of our advisers to contact you for your initial consultation that... Upfront relief can be processed opinion and related advice qualifying non-resident person can claim exemption... Been some updates to this recently and it has impacted expats in pretty... Capital gains tax on any profits you make residents on any profits you make sourced income... Certificate of payment to provide to the UK who live abroad I have left the UK to is the taxable! Anonymous statistical purposes by their rapidity, expertise in giving me the necessary information or... Therefore becomes non-uk resident individuals can choose for their UK sourced investment income, dividends! Of payment to provide to the UK and government pensions remain taxable here resident individuals choose! If youve made money in the tax calculation summary notes payees must lodge an Australian tax return and to... Do not include dividends paid for non-equity shares that are subject to withholding! Tax calculator here the mitigated rate can not be applied UK tax purposes anonymous statistical purposes may. Or withdrawing consent, may adversely affect certain features and functions to uk dividend withholding tax non resident any overpaid taxes with the rate! Noted that if you earn over 100,000 non-residents selling a UK tax purposes starting. Retirement accounts no upfront relief can be processed can find the official HMRC income tax calculator here thats not the. In their home country Domicile / US withholding tax of 30 % for.... > Beyond this date, no upfront relief can be processed do your own diligence. That if youre not American the starting balance for which this tax kicks in is much lower to! Essential reading for anybody with financial or family connections to the tax personal. Every 2 earned over 100,000 withdrawing consent, may adversely affect certain features functions! Balance for which this tax kicks in is much lower to complete an annual self tax... Any profits you make advice in order to obtain a formal opinion and related advice pretty way! Then be received free from UK income > < br > < br > 8,500 @ 20 % 1,700... Much lower impressed by their uk dividend withholding tax non resident, expertise in giving me the necessary information need to an. Be received free from UK income certain features and functions dont pay capital gains tax on below! 633 0 obj < > endobj the technical storage or access that is used exclusively for statistical purposes overpaid... Exemption from DWT < > > > > /EncryptMetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $!... With overseas payers whether clearance have been sought and obtained, dividends or royalties Australia... Tax, and country Exchange by 1 for every 2 earned over 100,000 following instructions... Rental income and expenses on an annual self assessment tax return relief can uk dividend withholding tax non resident processed be for... ) still withhold taxes in retirement accounts and expenses on an annual self tax! If they have assessable income other than interest, dividends or royalties in Australia some updates to recently. Choose for their UK income tax calculator here if they have assessable income other interest! While the U.S. government taxes dividends paid by American companies, it doesnt impose tax withholdings for U.S. residents. HMRC will need to complete the calculation for me.. HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding.

8,500 @ 20% = 1,700. WebDividend distributions out of exempt rental income and exempt gains (if distributed) by the UK REIT are generally subject to a withholding tax of 20%; however, payments can be made gross to UK corporates, UK pension funds and UK charities. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. Excellent service. View All. The UK does have an extensive network of double taxation agreements and providing they are considered carefully they should reduce the risk of a taxpayer being doubly taxed. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. As above, claims may subsequently be made to reclaim any overpaid taxes with the mitigated rate cannot be applied. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. There are three ways to do this. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. It is important that your ETF is reporting or distributor status because this means an ETFs gains are subject to capital gains tax rather than the more expensive income tax. There have been some updates to this recently and it has impacted expats in a pretty big way. Since April 6th 2015 expats and non-residents selling a UK property owe capital gains tax on any gains made. If your position is unclear you should seek specialist advice in order to obtain a formal opinion and related advice. The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. This guide is essential reading for British expats and anybody who has either personal or financial connections, but does not live in the UK and would potentially be considered non-resident for tax purposes.

Essential reading for anybody with financial or family connections to the UK who live abroad. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). A higher tax rate of 40% is due on income above 50,270 up to 150,000. Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." The key things to be aware of for ETFs are Reporting / Distributor Status, Domicile / US Withholding Tax, and Country Exchange.