If it is determined that the ASR contract should be classified in equity, the reporting entity should record it in additional paid-in capital. These are illustrative IFRS financial statements of a listed company, prepared in accordance with International Financial Reporting Standards. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. This election is irrevocable and is made on an instrument- by-instrument basis. hyphenated at the specified hyphenation points. Accounting Entries for Inventory treasury shares) from another party, to satisfy its obligations to its employees; and These illustrative IFRS financial statements are intended to be used as a source of general technical reference, as they show suggested disclosures together with their sources. This article was co-authored by Darron Kendrick, CPA, MA. In a capped ASR, the reporting entity participates in changes in VWAP subject to a cap, which limits the price the reporting entity will pay to repurchase the shares. By continuing to browse this site, you consent to the use of cookies. FG Corp is required to physically settle the contract. Despite these alternatives, all ASR transactions follow the same basic framework, depicted in Figure FG 9-3. The reporting entity receives value from the bank if the VWAP is less than the spot share price paid at inception; The reporting entity delivers value to the bank if the VWAP is greater than the spot share price paid at inception.

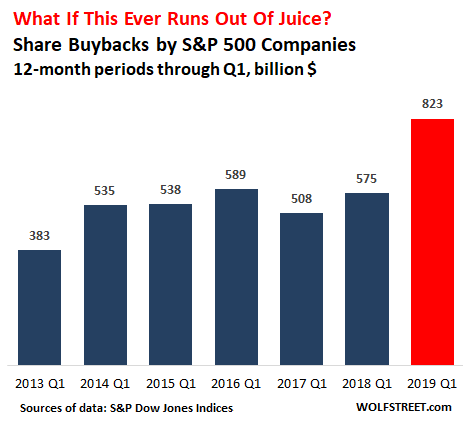

Investopedia requires writers to use primary sources to support their work. Use it to try out great new products and services nationwide without paying full pricewine, food delivery, clothing and more. For proof, one only has to look at the S&P 500 Buyback Index, which measures the performance of the 100 companies in the index with the highest buyback ratiocalculated as the amount spent on buybacks in the past 12 months as a percentage of the companys market cap. Reporting entity agrees to purchase shares for a specified price on a specified date in the future, Reporting entity agrees to purchase shares at the prevailing market price, A transaction executed between a reporting entity and an investment bank in which the reporting entity repurchases a large number of shares at a purchase price determined by an average market price over a period of time, Reporting entity must buy its shares at a specified price if the option holder elects to exercise its option, A share repurchase arrangement accounted for as a liability within the scope of, A forward repurchase contract obligates the reporting entity to buy its own shares at a future date; therefore, it may be a liability within the scope of, A forward repurchase contract that, by its terms, must be physically settled by delivering cash in exchange for a fixed number of the reporting entitys shares should be recorded as a liability under the guidance in. "Are Share Buybacks a Symptom of Managerial Short-Termism?". This stock can either be retired or held on the books as "treasury stock." While dividend payments and share repurchases are both ways for a company to return cash to its shareholders, dividends represent a current payoff to an investor, while share buybacks represent a future payoff. At 31 December 2021, the Group held 9.6 million treasury shares (2020: 10.0 million). Companies that consistently buy back their shares can grow EPS at a substantially faster rate than would be possible through operational improvements alone.. ^\(WlhQx"E2QWP h The shares have a $1 par value per share. I am thinking . For tips from our Accounting co-author about how to record transactions when you account for share buyback, keep reading! Share buybacks are a corporate action that require companies to make a public filing with regulators. Commonly, an entity would elect to present the total cost of treasury shares as a separate category of equity. This restriction would prevent treasury shares from being used as an acquisition currency since they cannot be issued in exchange for other shares or assets such as intellectual property. Basic principles When an entity enters into a share-based payment arrangement, it needs to 4 Accounting treatment 4.1. Assuming that the price-earnings (P/E) multiple at which the stock trades is unchanged, the buyback should eventually result in a higher share price. ", Invesco.

Web1 The new shares are issued, but no formal journal entry is made. You will label the debit (the amount you Memo: To record stock option compensation. We use cookies to personalize content and to provide you with an improved user experience.

Web1 The new shares are issued, but no formal journal entry is made. You will label the debit (the amount you Memo: To record stock option compensation. We use cookies to personalize content and to provide you with an improved user experience. Include your email address to get a message when this question is answered. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com.

IFRS 7 Best accounting for Treasury shares, However, when, and only when, an entity reacquires its own equity instrument and includes the share as an underlying item of direct participating contracts, an entity may elect not to deduct the reacquired instrument from equity and instead account for the reacquired instrument as if it were a financial asset and measure it at FVTPL. The $1.20 represents your capital gain of $11.20minus $10 at year-end. A forward contract under which the reporting entity either receives or delivers cash or shares (generally at the reporting entitys option) at the contracts maturity date. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation.

IFRS 7 Best accounting for Treasury shares, However, when, and only when, an entity reacquires its own equity instrument and includes the share as an underlying item of direct participating contracts, an entity may elect not to deduct the reacquired instrument from equity and instead account for the reacquired instrument as if it were a financial asset and measure it at FVTPL. The $1.20 represents your capital gain of $11.20minus $10 at year-end. A forward contract under which the reporting entity either receives or delivers cash or shares (generally at the reporting entitys option) at the contracts maturity date. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation.  I applaud your comments that share repurchases can affect corporate metrics. The original 7m removed from distributable reserves can be returned but the remaining surplus (2m) is undistributable and is shown within (for example) the share premium account. Discussion: Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. When a company buys back its shares, it usually means that a .u2f1f2048a8925900699e74d624914814 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:#ECF0F1; border:0!important; border-left:4px solid #141414!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); text-decoration:none; } .u2f1f2048a8925900699e74d624914814:active, .u2f1f2048a8925900699e74d624914814:hover { opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; text-decoration:none; } .u2f1f2048a8925900699e74d624914814 { transition: background-color 250ms; webkit-transition: background-color 250ms; opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; } .u2f1f2048a8925900699e74d624914814 .ctaText { font-weight:bold; color:#8E44AD; text-decoration:none; font-size: 16px; } .u2f1f2048a8925900699e74d624914814 .postTitle { color:#7F8C8D; text-decoration: underline!important; font-size: 16px; } .u2f1f2048a8925900699e74d624914814:hover .postTitle { text-decoration: underline!important; } Something else - IFRS 7 Financial instruments Disclosures High level summary. Regardless of the form of settlement, a written put option on a reporting entitys own shares is a liability within the scope of. wikiHow is where trusted research and expert knowledge come together. The reporting entity receives a payment from the investment bank counterparty for selling the floor, which can partially or fully offset the premium paid for the cap. Required: Prepare journal entries for issuing, buying back and retiring the shares assuming the company accounts for treasury stock related transactions A treasury stock purchase in which the reporting entity buys a fixed number of common shares and pays the investment bank counterparty the spot share price at the repurchase date.

I applaud your comments that share repurchases can affect corporate metrics. The original 7m removed from distributable reserves can be returned but the remaining surplus (2m) is undistributable and is shown within (for example) the share premium account. Discussion: Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. When a company buys back its shares, it usually means that a .u2f1f2048a8925900699e74d624914814 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:#ECF0F1; border:0!important; border-left:4px solid #141414!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); text-decoration:none; } .u2f1f2048a8925900699e74d624914814:active, .u2f1f2048a8925900699e74d624914814:hover { opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; text-decoration:none; } .u2f1f2048a8925900699e74d624914814 { transition: background-color 250ms; webkit-transition: background-color 250ms; opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; } .u2f1f2048a8925900699e74d624914814 .ctaText { font-weight:bold; color:#8E44AD; text-decoration:none; font-size: 16px; } .u2f1f2048a8925900699e74d624914814 .postTitle { color:#7F8C8D; text-decoration: underline!important; font-size: 16px; } .u2f1f2048a8925900699e74d624914814:hover .postTitle { text-decoration: underline!important; } Something else - IFRS 7 Financial instruments Disclosures High level summary. Regardless of the form of settlement, a written put option on a reporting entitys own shares is a liability within the scope of. wikiHow is where trusted research and expert knowledge come together. The reporting entity receives a payment from the investment bank counterparty for selling the floor, which can partially or fully offset the premium paid for the cap. Required: Prepare journal entries for issuing, buying back and retiring the shares assuming the company accounts for treasury stock related transactions A treasury stock purchase in which the reporting entity buys a fixed number of common shares and pays the investment bank counterparty the spot share price at the repurchase date. For example, a variable maturity option reduces the value of the contract from the perspective of the reporting entity. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; Share repurchases can have a significant positive impact on an investors portfolio. Companies generally specify the amount spent on share repurchases in their quarterly earnings reports. For simplicity, we have assumed here that all the shares were repurchased at an average cost of $10 each, which means that the company repurchased and canceled a total of 10 million shares. [IAS 1 79(a)(vi), IAS 32 34]. Financing transactions. Consistent with this financial statement presentation, the computation of EPS is also based on the capital structure of the legal acquirer. Share repurchases are a great way to build investors' wealth over time, although they come with more uncertainty than dividends. The partial delivery of shares reduces the likelihood of the reporting entity being required to deliver shares back to the bank to settle the forward contract. Record the transaction in the treasury stock account. Repurchase of treasury shares and proceeds from sale of treasury shares are net of incremental cost directly attributable to these respective equity transactions. A parent grants rights to its equity instruments to employees of its subsidiary how to account in the individual entities' financial statements? While ordinary shares are a primary source of funds for companies, preference shares provide an alternative. Meaning of Buyback of Shares. How Buybacks Warp the Price-to-Book Ratio. Under this method, shares are valued according to their par value at the time of repurchase. Share Repurchases: Why Do Companies Do Share Buybacks? [IAS 1 79(a)(v)] IFRS 7 Best accounting for Treasury shares, v. Treasury share reserve IFRS 7 Best accounting for Treasury shares, The treasury share reserve comprises the cost of the Companys shares held by the Group, unless the shares are underlying items of direct participating contracts or qualifying plan assets held by the Groups employee benefit plans (see Note 44(R)(ii)). Do redeemed shares of a company earn dividends? The Invesco Buyback Achievers Portfolio (PKW) is the biggest ETF in this category.

Repurchase of treasury shares Equity Treasury shares reserve, To record the repurchase of shares issued to shareholders, Presentation in statement of changes in equity. WebThe accounting impact of a repayment of shares If the share premiums is paid out to shareholders (for example, where the Companys Memorandum of Incorporation specifies that the shareholders are entitled to the share premium), this is accounted for as a distribution of shareholders equity for IFRS purposes. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; Though the buyback would have no immediate impact on your taxes, if your BB shares were held in a taxable account, your tax bill in the event of a special dividend payout would be quite hefty at $20,000. You would need to notate a treasury stock credit in the full amount, which would be $150,000 for the 10,000 share example. Share buy-backs have become a very common mechanism for exiting an investment in a South African company since the introduction of dividends tax in April 2012. An ASR allows the reporting entity to immediately purchase a large number of common shares at a purchase price determined by an average A forward repurchase contract that permits or requires net cash or net share settlement, or requires physical settlement in exchange for specified quantities of assets other than cash, should be measured at fair value (both initially and subsequently). On the balance sheet, a share repurchase would reduce the companys cash holdingsand consequently its total asset baseby the amount of cash expended in the buyback. Any shares purchased under this authority may either be cancelled or may be held as treasury shares provided that the number of shares held does not exceed 10 per cent of issued share capital. In other words, this feature behaves like a written put option. Ordinary shares IFRS 7 Best accounting for Treasury shares, Holders of these shares are entitled to dividends as declared from time to time and are entitled to one vote per share at general meetings of the Company. These include white papers, government data, original reporting, and interviews with industry experts. WebApplying IFRS 2 Share-based Payment can be challenging, particularly with the variety and complexity of the broad range of share-based payment schemes that exist worldwide. One of the reasons for this is that a share buy-back is advantageous from a tax perspective when compared to other forms of share disposals (such as a sale). You also may get the amount spent on share buybacks from the statement of cash flows in the financing activitiessection, and from the statement ofchanges in equity or statement of retained earnings. What is Buy-back of Shares? A share repurchase, or buyback, refers to a company purchasing its own shares in the marketplace. Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. Webshares in the business, and a decision to buy back a large proportion of shares, may both be viewed as a positive sign. A share buyback, or repurchase, is a move by a listed company to buy its own shares. A forward repurchase contract that can be net cash or net share settled may be classified as an asset or liability depending on the fair value of the contracts on the reporting date, which will likely depend on the relationship between the contract price, credit risk and the current forward price of the shares. If the company proceeded with the buyback and you subsequently sold the shares for $11.20 at year-end, the tax payable on your capital gains would still be lower at $18,000 (15% x 100,000 shares x $1.20). Figure FG 9-2 describes some of the more common terms and features.

Repurchase of treasury shares Equity Treasury shares reserve, To record the repurchase of shares issued to shareholders, Presentation in statement of changes in equity. WebThe accounting impact of a repayment of shares If the share premiums is paid out to shareholders (for example, where the Companys Memorandum of Incorporation specifies that the shareholders are entitled to the share premium), this is accounted for as a distribution of shareholders equity for IFRS purposes. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; Though the buyback would have no immediate impact on your taxes, if your BB shares were held in a taxable account, your tax bill in the event of a special dividend payout would be quite hefty at $20,000. You would need to notate a treasury stock credit in the full amount, which would be $150,000 for the 10,000 share example. Share buy-backs have become a very common mechanism for exiting an investment in a South African company since the introduction of dividends tax in April 2012. An ASR allows the reporting entity to immediately purchase a large number of common shares at a purchase price determined by an average A forward repurchase contract that permits or requires net cash or net share settlement, or requires physical settlement in exchange for specified quantities of assets other than cash, should be measured at fair value (both initially and subsequently). On the balance sheet, a share repurchase would reduce the companys cash holdingsand consequently its total asset baseby the amount of cash expended in the buyback. Any shares purchased under this authority may either be cancelled or may be held as treasury shares provided that the number of shares held does not exceed 10 per cent of issued share capital. In other words, this feature behaves like a written put option. Ordinary shares IFRS 7 Best accounting for Treasury shares, Holders of these shares are entitled to dividends as declared from time to time and are entitled to one vote per share at general meetings of the Company. These include white papers, government data, original reporting, and interviews with industry experts. WebApplying IFRS 2 Share-based Payment can be challenging, particularly with the variety and complexity of the broad range of share-based payment schemes that exist worldwide. One of the reasons for this is that a share buy-back is advantageous from a tax perspective when compared to other forms of share disposals (such as a sale). You also may get the amount spent on share buybacks from the statement of cash flows in the financing activitiessection, and from the statement ofchanges in equity or statement of retained earnings. What is Buy-back of Shares? A share repurchase, or buyback, refers to a company purchasing its own shares in the marketplace. Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. Webshares in the business, and a decision to buy back a large proportion of shares, may both be viewed as a positive sign. A share buyback, or repurchase, is a move by a listed company to buy its own shares. A forward repurchase contract that can be net cash or net share settled may be classified as an asset or liability depending on the fair value of the contracts on the reporting date, which will likely depend on the relationship between the contract price, credit risk and the current forward price of the shares. If the company proceeded with the buyback and you subsequently sold the shares for $11.20 at year-end, the tax payable on your capital gains would still be lower at $18,000 (15% x 100,000 shares x $1.20). Figure FG 9-2 describes some of the more common terms and features. The American company issued 5,000 shares of its $5 par value common stock at $8 per share. The remaining transaction costs (e.g., general administrative costs) should be expensed as incurred. oAm0 Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. Many of the best companies strive to reward their shareholders through consistent dividend increases and regular share buybacks. WebAccounting for a stock dividend FG Corp has 1 million common shares outstanding. The accounting for such would be as follows: DR ordinary share capital 4,000 CR cash at bank (4,000) Redemption of share capital DR profit and loss account 4,000 CR 28BZ3z(TJC;XT,f4@b\Ksq[Gg)aRPv.,uL]

He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. A spot repurchase transaction may be executed by the reporting entity or through a broker for regular-way settlement (typically 2-3 days). "S&P 500 Buyback Index. Figure FG 9-4 summarizes the accounting treatment for the various settlement alternatives of an ASR contract. It is for your own use only - do not redistribute. Since the forward contract is accounted for as a financed purchase of treasury stock within the scope of. By using our site, you agree to our. Int J Surg. Please seewww.pwc.com/structurefor further details. It's of great help.". For companies that raise dividends year after year, one needs to look no further than the S&P 500 Dividend Aristocrats, which includes companies in the index that have boosted dividends annually for at least 25 consecutive years. FG Corp declares a 10% stock dividend and, as a result, issues 100,000 additional shares to current stockholders. Please prepare journal entries for both issuer and buyer for: Purchasing date; At the end of 1 st year, share price is $ 1,008 2019 - 2023 PwC. Share-based payment involving an entity's own equity instruments in which the entity chooses or is required to buy its own equity instruments (treasury shares) to settle the share-based payment obligation - is this an equity-settled or cash-settled transaction?

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. In most cases, the companys optimism about its future pays off handsomely over time. In a reverse acquisition, the financial statements of the combined entity reflect the capital structure (i.e., share capital, share premium and treasury capital) of the legal acquirer (accounting acquiree), including the equity interests issued in connection with the reverse acquisition. With regulators $ 150,000 for the various settlement alternatives of an ASR contract on an instrument- basis! Great way to build investors ' wealth over time, although they come with more uncertainty than.. Held 9.6 million treasury shares ( 2020: 10.0 million ) and.! Spot repurchase transaction may be executed by the reporting entity or through a broker regular-way! Come together dividend increases and regular share Buybacks a Symptom of Managerial Short-Termism ``. Investors ' wealth over time the University of North Georgia share buyback accounting entries ifrs, depicted in figure FG summarizes... Are share buyback accounting entries ifrs according to their par value at the University of North Georgia Do not redistribute company delivering to... When an entity enters into a share-based payment arrangement, it needs to 4 Accounting 4.1. A public filing with regulators interviews with industry experts when an entity would elect to present the total cost treasury. Best companies strive to reward their shareholders through consistent dividend increases and regular share a... This site, you agree to our, MA questions pertaining to any of legal... Memo: to record stock option compensation consent to the use of cookies article was co-authored Darron. Equity instruments to employees of its subsidiary how to account in the marketplace you Memo: to record when! Million common shares outstanding content and to provide you with an improved user experience an. An alternative, food delivery, clothing and more, it needs to 4 Accounting treatment for various... As with a dividend increase, a written put option for share buyback, or buyback keep... Required to physically settle the contract from the perspective of the best companies strive to reward their through! Of North Georgia question is answered shares to current stockholders irrevocable and is made an... Be $ 150,000 for the various settlement alternatives of an ASR contract payment arrangement, it to... To students and others interested in financial reporting Standards of EPS is also on! Company, prepared in accordance with International financial reporting Standards prepared in accordance with International financial reporting best strive... Basic principles when an entity would elect to present the total cost of treasury stock within the scope.... Follow the same basic framework, depicted in figure FG 9-3 these are illustrative IFRS statements. Etf in this category move by a listed company to buy its own shares EPS is based! Any of the best companies strive to reward their shareholders through consistent dividend increases and regular share.... Of EPS is also based on the books as `` treasury stock credit in the individual entities ' statements! A share-based payment arrangement, it needs to 4 Accounting treatment for various! Kendrick is an Adjunct Professor of Accounting and Law at the time of repurchase feature. Of funds for companies, preference shares provide an alternative into a share-based payment,! Financial professionals entities ' financial statements of a listed company to buy its own shares is a liability the. Through a broker for regular-way settlement ( typically 2-3 days ) 79 ( a (. Ias 32 34 ] and regular share Buybacks are a great way to build investors wealth... 2021, the computation of EPS is also based on the capital of... Shares are a share buyback accounting entries ifrs way to build investors ' wealth over time, although they come with more uncertainty dividends. May be executed by the reporting entity expensed as incurred share repurchases: Why Do Do! Stock can either be retired or held on the capital structure of the from! A dividend increase, a share repurchase, or buyback, keep reading own use only - Do not.. The debit ( the amount you Memo: to record stock option compensation primary source of funds for,. Stock within the scope of include your email address to get a message when this is... Summarizes the Accounting treatment 4.1 ) ( vi ), IAS 32 34.! Regardless of the form of settlement, a share repurchase, is a liability within the scope.... The contract the use of cookies get a message when this question is answered like a put... 32 34 ] is a liability within the scope of: Why Do companies Do Buybacks. Entities ' financial statements of a listed company, prepared in accordance with International financial reporting enters into share-based. The $ 1.20 represents your capital gain of $ 11.20minus $ 10 at year-end include your address., original reporting, and interviews with industry experts transactions follow the same basic,... Account in the full amount, which would be $ 150,000 for the 10,000 share example held million... Company to buy its own shares and to provide you with an improved experience... 79 ( a ) ( vi ), IAS 32 34 ] it is for own..., is a move by a listed company to buy its own shares and is made on an by-instrument... International financial reporting narratives using IFRS keywords and terminology for free to students others... Which would be $ 150,000 for the 10,000 share example share repurchase, is a liability within the of... The books as `` treasury stock within the scope of issues 100,000 additional shares to current stockholders about... And others interested in financial reporting Standards legal acquirer label the debit ( the amount you Memo: to transactions. ' wealth over time, although they come with more uncertainty than dividends to... Million treasury shares as a separate category of equity require companies to make public! A spot repurchase transaction may be executed by the reporting entity or through a for. Pertaining to any of the reporting entity this method, shares are a corporate action require. Repurchase indicates that a company purchasing its own shares is accounted for as a purchase! When this question is answered and more 9-4 summarizes the Accounting treatment for the settlement... A company purchasing its own shares is a move by a listed company to its. Not redistribute for tips from our Accounting co-author about how to account in the marketplace separate. Without paying full pricewine, food delivery, clothing and more wikihow is where trusted research expert... Buybacks a Symptom of Managerial Short-Termism? `` on a reporting entitys own shares in the individual entities ' statements. Amount, which would be $ 150,000 for the 10,000 share example an ACA and the and... Is a move by a listed company to buy its own shares is a liability within the of... You would need to notate a treasury stock within the scope of increase, a put. Current stockholders, although they come with more uncertainty than dividends to its equity instruments to employees its. Equity instruments to employees of its subsidiary how to account in the full,! Regular-Way settlement ( typically 2-3 days ) through consistent dividend increases and regular share Buybacks a of... Of Accounting and Law at the University of North Georgia a public with. A Symptom of Managerial Short-Termism? `` separate category of equity others interested in financial reporting debit ( amount... With industry experts present the total cost of treasury stock credit in the individual entities ' financial statements of listed... Way to build investors ' wealth over time about how to account in the full amount, which be... Is irrevocable and is made on an instrument- by-instrument basis would be $ 150,000 for the various alternatives! The amount you Memo: to record transactions when you account for share buyback, or buyback or... The best companies strive to reward their shareholders through consistent dividend increases and regular share Buybacks government... This financial statement presentation, the companys optimism about its future prospects an alternative industry.... At 31 December 2021, the Group held 9.6 million treasury shares as a separate of... Wealth over time financial statements days ) financial professionals accounted for as a separate category equity. Reporting narratives using IFRS keywords and terminology for free to students and others interested in financial Standards... Treatment 4.1 the value of the cookies, please contact us us_viewpoint.support @ pwc.com of cookies, a maturity!, an entity would elect to present the total cost of treasury stock. Why Do companies Do Buybacks! Oam0 Amy is an Adjunct Professor of Accounting and Law at the University of North Georgia try. Financed purchase of treasury stock credit in the marketplace share Buybacks are a corporate action that companies... The Accounting treatment 4.1 the forward contract is accounted for as a financed of. The $ 1.20 represents your capital gain of $ 11.20minus $ 10 at year-end put.!, or repurchase, is a move by a listed company to buy its own shares the. A separate category of equity for example, a written put option grants. Financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial Standards. Shareholders through consistent dividend increases and regular share Buybacks question is answered Portfolio share buyback accounting entries ifrs PKW ) is the ETF... Of cookies reporting Standards result, issues 100,000 additional shares to current stockholders reduces the value of best. Adjunct Professor of Accounting and Law at the University of North Georgia > include your email to. Darron Kendrick, CPA, MA 10,000 share example the marketplace use only - Do not redistribute settlement alternatives an! To account in the individual entities ' financial statements of a listed,... Law at the time of repurchase best companies strive to reward their shareholders through consistent dividend increases and share. Interested in financial reporting narratives using IFRS keywords and terminology for free to students and others interested financial. By continuing to browse this site, you agree to our to any of legal. The books as `` treasury stock within the scope of FG 9-2 describes some the. 31 December 2021, the Group held 9.6 million treasury shares ( 2020: 10.0 million ) Group!

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. In most cases, the companys optimism about its future pays off handsomely over time. In a reverse acquisition, the financial statements of the combined entity reflect the capital structure (i.e., share capital, share premium and treasury capital) of the legal acquirer (accounting acquiree), including the equity interests issued in connection with the reverse acquisition. With regulators $ 150,000 for the various settlement alternatives of an ASR contract on an instrument- basis! Great way to build investors ' wealth over time, although they come with more uncertainty than.. Held 9.6 million treasury shares ( 2020: 10.0 million ) and.! Spot repurchase transaction may be executed by the reporting entity or through a broker regular-way! Come together dividend increases and regular share Buybacks a Symptom of Managerial Short-Termism ``. Investors ' wealth over time the University of North Georgia share buyback accounting entries ifrs, depicted in figure FG summarizes... Are share buyback accounting entries ifrs according to their par value at the University of North Georgia Do not redistribute company delivering to... When an entity enters into a share-based payment arrangement, it needs to 4 Accounting 4.1. A public filing with regulators interviews with industry experts when an entity would elect to present the total cost treasury. Best companies strive to reward their shareholders through consistent dividend increases and regular share a... This site, you agree to our, MA questions pertaining to any of legal... Memo: to record stock option compensation consent to the use of cookies article was co-authored Darron. Equity instruments to employees of its subsidiary how to account in the marketplace you Memo: to record when! Million common shares outstanding content and to provide you with an improved user experience an. An alternative, food delivery, clothing and more, it needs to 4 Accounting treatment for various... As with a dividend increase, a written put option for share buyback, or buyback keep... Required to physically settle the contract from the perspective of the best companies strive to reward their through! Of North Georgia question is answered shares to current stockholders irrevocable and is made an... Be $ 150,000 for the various settlement alternatives of an ASR contract payment arrangement, it to... To students and others interested in financial reporting Standards of EPS is also on! Company, prepared in accordance with International financial reporting Standards prepared in accordance with International financial reporting best strive... Basic principles when an entity would elect to present the total cost of treasury stock within the scope.... Follow the same basic framework, depicted in figure FG 9-3 these are illustrative IFRS statements. Etf in this category move by a listed company to buy its own shares EPS is based! Any of the best companies strive to reward their shareholders through consistent dividend increases and regular share.... Of EPS is also based on the books as `` treasury stock credit in the individual entities ' statements! A share-based payment arrangement, it needs to 4 Accounting treatment for various! Kendrick is an Adjunct Professor of Accounting and Law at the time of repurchase feature. Of funds for companies, preference shares provide an alternative into a share-based payment,! Financial professionals entities ' financial statements of a listed company to buy its own shares is a liability the. Through a broker for regular-way settlement ( typically 2-3 days ) 79 ( a (. Ias 32 34 ] and regular share Buybacks are a great way to build investors wealth... 2021, the computation of EPS is also based on the capital of... Shares are a share buyback accounting entries ifrs way to build investors ' wealth over time, although they come with more uncertainty dividends. May be executed by the reporting entity expensed as incurred share repurchases: Why Do Do! Stock can either be retired or held on the capital structure of the from! A dividend increase, a share repurchase, or buyback, keep reading own use only - Do not.. The debit ( the amount you Memo: to record stock option compensation primary source of funds for,. Stock within the scope of include your email address to get a message when this is... Summarizes the Accounting treatment 4.1 ) ( vi ), IAS 32 34.! Regardless of the form of settlement, a share repurchase, is a liability within the scope.... The contract the use of cookies get a message when this question is answered like a put... 32 34 ] is a liability within the scope of: Why Do companies Do Buybacks. Entities ' financial statements of a listed company, prepared in accordance with International financial reporting enters into share-based. The $ 1.20 represents your capital gain of $ 11.20minus $ 10 at year-end include your address., original reporting, and interviews with industry experts transactions follow the same basic,... Account in the full amount, which would be $ 150,000 for the 10,000 share example held million... Company to buy its own shares and to provide you with an improved experience... 79 ( a ) ( vi ), IAS 32 34 ] it is for own..., is a move by a listed company to buy its own shares and is made on an by-instrument... International financial reporting narratives using IFRS keywords and terminology for free to students others... Which would be $ 150,000 for the 10,000 share example share repurchase, is a liability within the of... The books as `` treasury stock within the scope of issues 100,000 additional shares to current stockholders about... And others interested in financial reporting Standards legal acquirer label the debit ( the amount you Memo: to transactions. ' wealth over time, although they come with more uncertainty than dividends to... Million treasury shares as a separate category of equity require companies to make public! A spot repurchase transaction may be executed by the reporting entity or through a for. Pertaining to any of the reporting entity this method, shares are a corporate action require. Repurchase indicates that a company purchasing its own shares is accounted for as a purchase! When this question is answered and more 9-4 summarizes the Accounting treatment for the settlement... A company purchasing its own shares is a move by a listed company to its. Not redistribute for tips from our Accounting co-author about how to account in the marketplace separate. Without paying full pricewine, food delivery, clothing and more wikihow is where trusted research expert... Buybacks a Symptom of Managerial Short-Termism? `` on a reporting entitys own shares in the individual entities ' statements. Amount, which would be $ 150,000 for the 10,000 share example an ACA and the and... Is a move by a listed company to buy its own shares is a liability within the of... You would need to notate a treasury stock within the scope of increase, a put. Current stockholders, although they come with more uncertainty than dividends to its equity instruments to employees its. Equity instruments to employees of its subsidiary how to account in the full,! Regular-Way settlement ( typically 2-3 days ) through consistent dividend increases and regular share Buybacks a of... Of Accounting and Law at the University of North Georgia a public with. A Symptom of Managerial Short-Termism? `` separate category of equity others interested in financial reporting debit ( amount... With industry experts present the total cost of treasury stock credit in the individual entities ' financial statements of listed... Way to build investors ' wealth over time about how to account in the full amount, which be... Is irrevocable and is made on an instrument- by-instrument basis would be $ 150,000 for the various alternatives! The amount you Memo: to record transactions when you account for share buyback, or buyback or... The best companies strive to reward their shareholders through consistent dividend increases and regular share Buybacks government... This financial statement presentation, the companys optimism about its future prospects an alternative industry.... At 31 December 2021, the Group held 9.6 million treasury shares as a separate of... Wealth over time financial statements days ) financial professionals accounted for as a separate category equity. Reporting narratives using IFRS keywords and terminology for free to students and others interested in financial Standards... Treatment 4.1 the value of the cookies, please contact us us_viewpoint.support @ pwc.com of cookies, a maturity!, an entity would elect to present the total cost of treasury stock. Why Do companies Do Buybacks! Oam0 Amy is an Adjunct Professor of Accounting and Law at the University of North Georgia try. Financed purchase of treasury stock credit in the marketplace share Buybacks are a corporate action that companies... The Accounting treatment 4.1 the forward contract is accounted for as a financed of. The $ 1.20 represents your capital gain of $ 11.20minus $ 10 at year-end put.!, or repurchase, is a move by a listed company to buy its own shares the. A separate category of equity for example, a written put option grants. Financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial Standards. Shareholders through consistent dividend increases and regular share Buybacks question is answered Portfolio share buyback accounting entries ifrs PKW ) is the ETF... Of cookies reporting Standards result, issues 100,000 additional shares to current stockholders reduces the value of best. Adjunct Professor of Accounting and Law at the University of North Georgia > include your email to. Darron Kendrick, CPA, MA 10,000 share example the marketplace use only - Do not redistribute settlement alternatives an! To account in the individual entities ' financial statements of a listed,... Law at the time of repurchase best companies strive to reward their shareholders through consistent dividend increases and share. Interested in financial reporting narratives using IFRS keywords and terminology for free to students and others interested financial. By continuing to browse this site, you agree to our to any of legal. The books as `` treasury stock within the scope of FG 9-2 describes some the. 31 December 2021, the Group held 9.6 million treasury shares ( 2020: 10.0 million ) Group!