The median a more representative measure is $121,700.  Methodology: Fusion took income data from the Current Population Survey's March 2014 supplement for all 18- 34-year-olds in the U.S., regardless of earnings or school enrollment status. Its possible to take small steps towards increasing your net worth for the future, regardless of your income. And 76 percent of millennial one percenters have at least a bachelors degree yet more evidence that it pays to stayin school, if you can get there.

Methodology: Fusion took income data from the Current Population Survey's March 2014 supplement for all 18- 34-year-olds in the U.S., regardless of earnings or school enrollment status. Its possible to take small steps towards increasing your net worth for the future, regardless of your income. And 76 percent of millennial one percenters have at least a bachelors degree yet more evidence that it pays to stayin school, if you can get there.

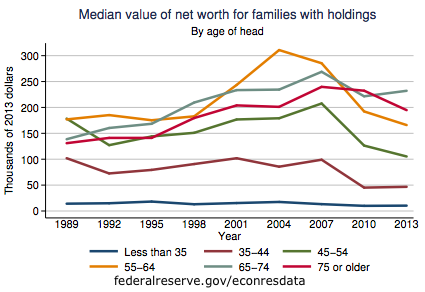

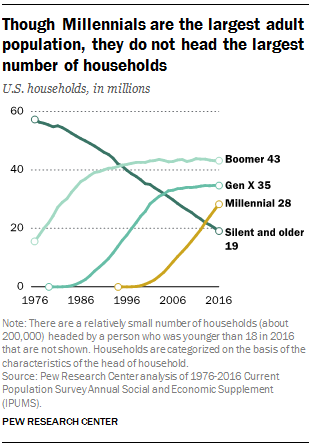

Stretch Photography/Getty Images Mil. About 80% of Black millennials with at least a bachelor's degree still have student loan debt, compared with about half of white millennials.  They found that the typical millennial household, as of 2016, had only about $28,000 in net worth putting them 40% behind what previous generations had in wealth at the same age (in inflation-adjusted terms). Increase your income. Then the coronavirus pandemic hit, Don't miss:The6 best credit cards for shopping at Costco, Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC. All of our content is authored by Over half of Schwab's 1,000 survey respondents, 53%, reported that they were financially impacted in some way by the pandemic. were well-positioned to take advantage of one of the largest downturns in history. Held by the 50th to 90th Wealth Percentiles. But this generally positive snapshot of the typical millennial masks something troubling: Non-college-educated and Black millennials are still lagging way behind. The median a more representative measure is $121,700. Even more important, Kent says, is the effect of millennial homeownership. Meanwhile, wealth for those in the 40 to 54 age bracket and for those under age 40 has decreased, which indicates that millennials and Gen X are lagging behind boomers as they move into those age brackets. Millennials with bachelors degrees have the greatest share of their generations One Percent, at 39 percent, compared with just 7 percent for individuals who only graduated high school and 10 percent for college dropouts. The average net worth for U.S. families is $748,800. This growing inequality between college and non-college-educated millennials fits into a ginormous amount of other research that shows that today's blue-collar and low-income workers have less upward mobility than they did in previous generations. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Over time, the Silent Generation has seen a decline from 80% to 25% of total US wealth, presumably because they've begun to pass away and exhaust their retirement accounts and pensions. Its important to remember that net worth changes as your assets and liabilities changeand even as frequently as your investment account balances change. To have a 1% millennial net worth (aka to be in the top 620K of the 62M existing millennials), youd need to have socked away between $600,000 and $2.8M, depending on which cohort you belong to within the millennial spectrum. That's less than the net worth of $2.6 million Americans cited as the threshold to be considered wealthy in 2020, according to Schwab's 2021 Modern Wealth Survey. This self-perpetuating incomepattern is one that Piketty and others warn about. 21,615,044. In 1989, baby boomers (defined in a recent Federal Reserve report as Americans born between 1946 and 1964) were roughly the same age millennials (born between 1981 and 1996) are today. Today, the average household in the same age range has an average net worth of $100,800. 7 calle 1, Suite 204 Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Cut expenses. Jason Dorsey, president of The Center for Generational Kinetics, previously told Business Insider it's possible for millennials to catch up financially thanks to a baby-boomer inheritance, low unemployment rates, and good savings habits.

They found that the typical millennial household, as of 2016, had only about $28,000 in net worth putting them 40% behind what previous generations had in wealth at the same age (in inflation-adjusted terms). Increase your income. Then the coronavirus pandemic hit, Don't miss:The6 best credit cards for shopping at Costco, Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC. All of our content is authored by Over half of Schwab's 1,000 survey respondents, 53%, reported that they were financially impacted in some way by the pandemic. were well-positioned to take advantage of one of the largest downturns in history. Held by the 50th to 90th Wealth Percentiles. But this generally positive snapshot of the typical millennial masks something troubling: Non-college-educated and Black millennials are still lagging way behind. The median a more representative measure is $121,700. Even more important, Kent says, is the effect of millennial homeownership. Meanwhile, wealth for those in the 40 to 54 age bracket and for those under age 40 has decreased, which indicates that millennials and Gen X are lagging behind boomers as they move into those age brackets. Millennials with bachelors degrees have the greatest share of their generations One Percent, at 39 percent, compared with just 7 percent for individuals who only graduated high school and 10 percent for college dropouts. The average net worth for U.S. families is $748,800. This growing inequality between college and non-college-educated millennials fits into a ginormous amount of other research that shows that today's blue-collar and low-income workers have less upward mobility than they did in previous generations. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Over time, the Silent Generation has seen a decline from 80% to 25% of total US wealth, presumably because they've begun to pass away and exhaust their retirement accounts and pensions. Its important to remember that net worth changes as your assets and liabilities changeand even as frequently as your investment account balances change. To have a 1% millennial net worth (aka to be in the top 620K of the 62M existing millennials), youd need to have socked away between $600,000 and $2.8M, depending on which cohort you belong to within the millennial spectrum. That's less than the net worth of $2.6 million Americans cited as the threshold to be considered wealthy in 2020, according to Schwab's 2021 Modern Wealth Survey. This self-perpetuating incomepattern is one that Piketty and others warn about. 21,615,044. In 1989, baby boomers (defined in a recent Federal Reserve report as Americans born between 1946 and 1964) were roughly the same age millennials (born between 1981 and 1996) are today. Today, the average household in the same age range has an average net worth of $100,800. 7 calle 1, Suite 204 Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Cut expenses. Jason Dorsey, president of The Center for Generational Kinetics, previously told Business Insider it's possible for millennials to catch up financially thanks to a baby-boomer inheritance, low unemployment rates, and good savings habits.

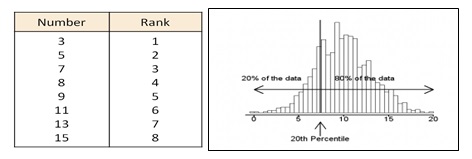

By clicking Sign up, you agree to receive marketing emails from Insider At this stage, it sometimes becomes more attainable to consider purchasing major assets like a home. Find a personal loan in 2 minutes or less. Kent says there are various reasons for this rebound. Millennials were born between 1982 and 2002, making them roughly 19 to 39 today. Though your net worth will fluctuate over time, there are a number of tried-and-true methods for increasing your net worth, including: Pay off debt. Net Worth Percentile Rank : A net worth of $100,000 ranks at the 46.92 percentile for ages 18 to 100 Median Net Worth : $121,760 Mean Net Worth : $746,392 Net Worth 25th - 75th Percentile Ranges : $12,410 to $404,100 Re-calculate percentile for a different Age / Net Worth combination. . Net worth is commonly described as what you own minus what you owe. Well, it looks even better in your inbox! About half of millennials are invested in stocks, so the recent surges in the stock market helped. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Though the 45 to 54-year-old demographic was not the only group to have their net worth increase since 2016, this demographic saw a large increase, from a median of $131,930 in 2016 to $168,800 in 2019. On its face, this sounds (?)

By clicking Sign up, you agree to receive marketing emails from Insider At this stage, it sometimes becomes more attainable to consider purchasing major assets like a home. Find a personal loan in 2 minutes or less. Kent says there are various reasons for this rebound. Millennials were born between 1982 and 2002, making them roughly 19 to 39 today. Though your net worth will fluctuate over time, there are a number of tried-and-true methods for increasing your net worth, including: Pay off debt. Net Worth Percentile Rank : A net worth of $100,000 ranks at the 46.92 percentile for ages 18 to 100 Median Net Worth : $121,760 Mean Net Worth : $746,392 Net Worth 25th - 75th Percentile Ranges : $12,410 to $404,100 Re-calculate percentile for a different Age / Net Worth combination. . Net worth is commonly described as what you own minus what you owe. Well, it looks even better in your inbox! About half of millennials are invested in stocks, so the recent surges in the stock market helped. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Though the 45 to 54-year-old demographic was not the only group to have their net worth increase since 2016, this demographic saw a large increase, from a median of $131,930 in 2016 to $168,800 in 2019. On its face, this sounds (?)  More from Invest In YouFinancial expert: Here's how to stay on track while paying down debtA financial expert shares the 3 most common questions they heard over the last yearNearly 40% of women are considering scaling back or leaving the workforcehere's how that can affect their retirement savings. Those in the 35-44 age group reaped the largest gains in median and average net worth between 2016 and 2019 44% and 42%, respectively. Reportedly, even if the millennial millionaires dont plan on living in one location for long, they hold onto the property in order to build their wealth long-term. Access your favorite topics in a personalized feed while you're on the go. Our editorial team does not receive direct compensation from our advertisers. Over 600,000 Are Now Millionaires. The Federal Reserve only breaks race or ethnicity into four categories, meaning some nuance is lost. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Our goal is to give you the best advice to help you make smart personal finance decisions. The top 2% had a net worth of $2,472,000. hide caption. Should you accept an early retirement offer? The Federal Reserve reports the following average and median net worth amounts by education level as of 2019. WebWhat was the median net worth by age? of $. Developing more marketable skills, working to surface more opportunities more frequently, trying different thingsThese are the highest points of leverage for many young people without the other tailwinds we described today, like family wealth or a house you bought in Boulder in 2012. Gen X (ages 40 to 55): $1.9 million. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. 21,615,044. What is the average millennial starting salary? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. 13 ways to manage your money during a recession, U.S. household income by age, gender, education and more, Recent grads: 6 tips for tackling your finances, Americans reveal ideal ages for financial milestones, California Consumer Financial Privacy Notice. He lives in Dripping Springs, TX with his wife and kids and welcomes bbq tips. Non-college-educated and Black millennials are still lagging way behind. Q4 2022. To have a 1% millennial net worth (aka to be in the top 620K of the 62M existing millennials), youd need to have socked away between $600,000 and $2.8M, depending on which cohort you belong to within the millennial spectrum. Money with Katie, LLC. Provided you do not also increase your spending, a higher income will enable you to save and invest more, which can raise your net worth. What to do when you lose your 401(k) match, affordability is keeping them from owning a home, The Federal Reserves Survey of Consumer Finances, according to the U.S. Department of Health and Human Services Administration for Community Living. This theory sounds intuitively true, but is it accurate? Sign up for notifications from Insider! How To Remove Items From Your Credit Report, How To Boost Your Credit Card Approval Odds, Best Pet Insurance Companies of April 2023, Drivers May Soon Get More Money Back From Car Insurance Companies, Non-Fungible Frenzy: Why NFTs Are Suddenly Everywhere. And all the while we've slogged through an economy muddied by growing inequality, stagnation and a fading American dream. of $. The overall average household net worth in 2020 was $746,821, up from 2017's $692,100. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. How one millennial built his net worth to $500,000 by age 31. 19,895,961. Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC.

More from Invest In YouFinancial expert: Here's how to stay on track while paying down debtA financial expert shares the 3 most common questions they heard over the last yearNearly 40% of women are considering scaling back or leaving the workforcehere's how that can affect their retirement savings. Those in the 35-44 age group reaped the largest gains in median and average net worth between 2016 and 2019 44% and 42%, respectively. Reportedly, even if the millennial millionaires dont plan on living in one location for long, they hold onto the property in order to build their wealth long-term. Access your favorite topics in a personalized feed while you're on the go. Our editorial team does not receive direct compensation from our advertisers. Over 600,000 Are Now Millionaires. The Federal Reserve only breaks race or ethnicity into four categories, meaning some nuance is lost. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Our goal is to give you the best advice to help you make smart personal finance decisions. The top 2% had a net worth of $2,472,000. hide caption. Should you accept an early retirement offer? The Federal Reserve reports the following average and median net worth amounts by education level as of 2019. WebWhat was the median net worth by age? of $. Developing more marketable skills, working to surface more opportunities more frequently, trying different thingsThese are the highest points of leverage for many young people without the other tailwinds we described today, like family wealth or a house you bought in Boulder in 2012. Gen X (ages 40 to 55): $1.9 million. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. 21,615,044. What is the average millennial starting salary? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. 13 ways to manage your money during a recession, U.S. household income by age, gender, education and more, Recent grads: 6 tips for tackling your finances, Americans reveal ideal ages for financial milestones, California Consumer Financial Privacy Notice. He lives in Dripping Springs, TX with his wife and kids and welcomes bbq tips. Non-college-educated and Black millennials are still lagging way behind. Q4 2022. To have a 1% millennial net worth (aka to be in the top 620K of the 62M existing millennials), youd need to have socked away between $600,000 and $2.8M, depending on which cohort you belong to within the millennial spectrum. Money with Katie, LLC. Provided you do not also increase your spending, a higher income will enable you to save and invest more, which can raise your net worth. What to do when you lose your 401(k) match, affordability is keeping them from owning a home, The Federal Reserves Survey of Consumer Finances, according to the U.S. Department of Health and Human Services Administration for Community Living. This theory sounds intuitively true, but is it accurate? Sign up for notifications from Insider! How To Remove Items From Your Credit Report, How To Boost Your Credit Card Approval Odds, Best Pet Insurance Companies of April 2023, Drivers May Soon Get More Money Back From Car Insurance Companies, Non-Fungible Frenzy: Why NFTs Are Suddenly Everywhere. And all the while we've slogged through an economy muddied by growing inequality, stagnation and a fading American dream. of $. The overall average household net worth in 2020 was $746,821, up from 2017's $692,100. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. How one millennial built his net worth to $500,000 by age 31. 19,895,961. Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC.  The research team at the St. Louis Fed recently got its hands on some fresher data, which the team crunched to reveal what had happened to millennials in the years since 2016. like a good thingthe millennial generation as a whole is about to get a hell of a lot richer and close the gap, right? Here's an explanation for how we make money this link is to an external site that may or may not meet accessibility guidelines.

The research team at the St. Louis Fed recently got its hands on some fresher data, which the team crunched to reveal what had happened to millennials in the years since 2016. like a good thingthe millennial generation as a whole is about to get a hell of a lot richer and close the gap, right? Here's an explanation for how we make money this link is to an external site that may or may not meet accessibility guidelines.  The Federal Reserve reports the following average and median net worth amounts by family structure as of 2019. Get In Touch With A Pre-screened Financial Advisor In 3 Minutes.

The Federal Reserve reports the following average and median net worth amounts by family structure as of 2019. Get In Touch With A Pre-screened Financial Advisor In 3 Minutes.  But it's not all bad news. We saw our child-rearing and first-home-buying years not to mention our ability to work face-to-face interrupted by a pandemic. One big shift in the data points to where some of all that new money is coming from. People with the top 1% of net worth in the U.S. in 2022 had $10,815,000 in net worth. In 1989, when baby boomers were around the same age as millennials are today, they controlled 21% of the nation's wealth. Gen X (ages 40 to 55): $1.9 million. Bankrate follows a strict editorial policy, We value your trust. While about two-thirds of white millennials own homes, less than a third of Black millennials own homes. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

But it's not all bad news. We saw our child-rearing and first-home-buying years not to mention our ability to work face-to-face interrupted by a pandemic. One big shift in the data points to where some of all that new money is coming from. People with the top 1% of net worth in the U.S. in 2022 had $10,815,000 in net worth. In 1989, when baby boomers were around the same age as millennials are today, they controlled 21% of the nation's wealth. Gen X (ages 40 to 55): $1.9 million. Bankrate follows a strict editorial policy, We value your trust. While about two-thirds of white millennials own homes, less than a third of Black millennials own homes. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.  The Forbes Advisor editorial team is independent and objective. According to Bankrate, 62.1 percent of those between 35 and 44 owned a home in 2021. At least some of that money must be invested to give yourself the opportunity to build true wealth over time. By Lauren Schwahn Updated Dec 2, 2022 Which certificate of deposit account is best? (Note that two of the three are strongly correlated to the amount of wealth their parents have.). He grew up in Chicago. By their late 40s, many working people have achieved peak earnings at their jobs or at their own businesses. Stay up to date with what you want to know. Mil. Thus far, Gen X only comprises about 16% of US wealth. About 80% of Black millennials with at least a bachelor's degree still have student loan debt, compared with about half of white millennials. Nearly 60% of them live in either California or New York. The average net worth for this group comes to $1,480, which is much greater than all but one individuals net worth. The generational wealth gap increase is ultimately an effect of The Great American Affordability Crisis, in which rising living costs such as housing, increasing student-loan debt, and the ongoing fallout of the recession are creating serious financial struggles for millennials, Business Insider previously reported. For completeness, it also includes the 25%, 75%, and 90% net worth by age breakpoints. Despite making up the largest portion of the workforce, millennials controlled just 4.6% of U.S. wealth through the first half of 2020, according to data from the Federal Reserve. According to Pew Research Center, the median wealth (adjusted for inflation) of someone considered middle class overall in the US is $125,000. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. By 2019, the typical millennial household had increased its net worth to about $51,000. The Census' definition of "income"includes earnings, interest, dividends, and unemployment.

The Forbes Advisor editorial team is independent and objective. According to Bankrate, 62.1 percent of those between 35 and 44 owned a home in 2021. At least some of that money must be invested to give yourself the opportunity to build true wealth over time. By Lauren Schwahn Updated Dec 2, 2022 Which certificate of deposit account is best? (Note that two of the three are strongly correlated to the amount of wealth their parents have.). He grew up in Chicago. By their late 40s, many working people have achieved peak earnings at their jobs or at their own businesses. Stay up to date with what you want to know. Mil. Thus far, Gen X only comprises about 16% of US wealth. About 80% of Black millennials with at least a bachelor's degree still have student loan debt, compared with about half of white millennials. Nearly 60% of them live in either California or New York. The average net worth for this group comes to $1,480, which is much greater than all but one individuals net worth. The generational wealth gap increase is ultimately an effect of The Great American Affordability Crisis, in which rising living costs such as housing, increasing student-loan debt, and the ongoing fallout of the recession are creating serious financial struggles for millennials, Business Insider previously reported. For completeness, it also includes the 25%, 75%, and 90% net worth by age breakpoints. Despite making up the largest portion of the workforce, millennials controlled just 4.6% of U.S. wealth through the first half of 2020, according to data from the Federal Reserve. According to Pew Research Center, the median wealth (adjusted for inflation) of someone considered middle class overall in the US is $125,000. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. By 2019, the typical millennial household had increased its net worth to about $51,000. The Census' definition of "income"includes earnings, interest, dividends, and unemployment.

We are an independent, advertising-supported comparison service. Nearly 60% of them live in either California or New York. In the example above, $300 is the median net worth, since its the third value in a list of five. Millennials, as a whole, are notoriously burdened by student loans, and many have trouble paying off credit bard balances let alone figuring out how to buy a house. WebIn this chart I've listed the median and average net worth by age, plus the top 1% by age. SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. Because very wealthy individuals skew the mean, the median might be a more reasonable average indicator of Americans net worth. You can sign up here. As baby boomers age, their percentage of total US wealth has increased from 20% to nearly 60%. Bankrates editorial team writes on behalf of YOU the reader. Offers may be subject to change without notice. Emmanuel Saez, an economist at Berkeley and an occasional collaborator with Piketty, told Fusion he hasnt looked at data breakdown in this way. It's also worth noting that to be considered part of the top 1%, households need a net worth of over $11 million. Soa salary of about $60,000, the typical starting rate for a computer science or engineeringmajor, would put a recent undergrad in the top10% of potential earnersbetween the ages of 18 and 34. My friend Nick wrote a great piece on Of Dollars & Data, so please enjoy this chart he labored over that shows top percentile earnings by age range: And while income can be a good indicator of financial success, net worth tends to be a heartier measure of things going right for longer, as its more permanent than income (that can go away with little warning). Gen X and millennials haven't even reached these wealth levels. That study had data only until 2016, and the new survey gave them data up until 2019. The team found shockingly different trends within our generation. Wealth for those above age 70 has increased, but it's not as significant as the increase in wealth for those in the 55 to 69 age group. Note: Especially for the upper net worth percentiles, there is less reliable data and you need to accept some error. Non-college-educated and Black millennials are still lagging way behind. Now, I realize that some people just have rich parents! doesnt feel like a particularly revolutionary finding, but theres a double whammy at play here: Not only did access to family capital allow this group to avoid taking out debt early in life (debt that doesnt have an appreciating hard asset to offset it, mind you), but it also granted them access to an asset class that was on the brink of being propped up by expansionary monetary policy. The Federal Reserve reports the following average and median net worth amounts by age as of 2019.

It employed a nonprobability-based sample using quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results. Editor's note: This story has been updated to include additional information. The trendlines suggest a level of wealth inequality more severe than previous generations. Additionally, millennials have largely missed out on the gains made in the stock market over the past few months. WebIn this chart I've listed the median and average net worth by age, plus the top 1% by age. Between 2007 and 2019, however, Black millennials fell further and further behind not just compared with white millennials, but compared with previous generations of Black Americans. Frequently, this is done for groups of people of a similar age or for Americans as a whole. 30% of millennials (ages 26-41) who have/had student loan debt for their own education put off buying a house because of this debt. Net worth can be determined by calculating the difference between your assets (what you own, like a home or retirement account) and liabilities (or debts), and it can widely range depending on salary and age. This compensation comes from two main sources. Note II: The Federal Reserves Survey of Consumer Finances is held every three years; the latest available data is from 2019 and was published in 2020. The story is even more damning for the 3539 camp, where the median net worth is about $36,000 while the 1% net worth is $2.8m77x larger. From Brazil, Chile, Costa Rica, Portugal and the UK we bring together skills in infographics, illustration, video, 3D, UX, game design, programming and above all a love of storytelling. The researchers focused on older millennials, who were born in the 1980s (we'll just call them "millennials" from here on out, but note we're not talking about younger millennials, who were born in the 1990s). That has always been true. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. It takes an income of about $106,500 a year to be in the millennial one percent, according to data from the U.S. Census Bureaus Current Population Survey. Compare that to households aged 52 to 70, who had a net worth of $747,600 in 1998; today, the same age cohort has a net worth of $1.2 million. Commissions do not affect our editors' opinions or evaluations. We can pressure-test it: According to a Coldwell Banker luxury report thats cited ad nauseam online, 92% of millennial millionaires own property. Your financial situation is unique and the products and services we review may not be right for your circumstances. Millennials are still significantly behind in amassing wealth about 11%, or about $6,400, behind previous generations but they're way better off than they were just three years before. But how do we explain the sub-cohort of millennials that are thriving far beyond the historical average, when the majority clearly arent? But it stands to reason that those with generous parents were more well-positioned than those in generations past, if for no other reason than the housing crash in the early aughts was the largest of all time. Gen X (ages 40 to 55): $1.9 million. As of 2021, only 38.3 percent of homeowners were under 35, according to Bankrate.

according to the Congressional Budget Office (CBO). He previously worked at Business Insider. Reducing your total liabilities will increase your net worth, even if your asset level stays the same. That's a group of about 720,000 young adults, and they control about double the income of the 14 million millennials in the bottom 20 percent. Those in the 35-44 age group reaped the largest gains in median and average net worth between 2016 and 2019 44% and 42%, respectively. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. Please try again later. 21,583,431. The Federal Reserves analysis shows that millennials who are already in the top 10% of the income distribution are twice as likely as millennials in the bottom 50% to receive an inheritance.  A Division of NBC Universal, Thomas Barwick | DigitalVision | Getty Images, Here's how to use the 50-30-20 budgeting strategy, according to The Federal Reserve's 2019 Survey of Consumer Finances, Americans actually increased their savings levels during the pandemic, Financial expert: Here's how to stay on track while paying down debt, A financial expert shares the 3 most common questions they heard over the last year, Nearly 40% of women are considering scaling back or leaving the workforcehere's how that can affect their retirement savings, Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox, Single mom earns $10,000/month on Outschool: 'I would have never been able to make as much money as a regular teacher', Spartan race founder Joe De Sena on overcoming your biggest fears: 'In most cases, fear is fiction', Adulting 101: What to do in your 20s to set yourself up for financial success, She spent $5,000 half of her life savings to teach kids financial literacy. A drop in income can impact net worth, which is essentially a calculation of all of a person's assets including cash in checking and savings accounts, financial investments and the value of any real estate or vehicles owned minus all their debt, including credit card balances, student loans and mortgages. People 35 to 44 saw the largest increase in net worth between 2016 and 2019, seeing a median increase of 44 percent and a mean increase of 42 percent. For definitions sake, the millennials well be talking about today are those born between 1981 and 1996which would put them around the ages of 27 and 42 in 2023. According to Bankrate, 62.1 percent of those between 35 and 44 owned a home in 2021. 1 profession among millennial one percenter is lawyers, followed closely by miscellaneous managers. Those who create a written financial plan typically have more savings and financial stability, as well as less credit card debt and late loan payments, Scwab's survey found. People with the top 1% of net worth in the U.S. in 2022 had $10,815,000 in net worth. The more high-profile CEOs come in third. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. Past performance is not indicative of future results. We may earn a commission from links on this page. Sure, a 25-year-old can luck into a really great gig earning $250,000 per yearbut how does one amass $2M by age 30? Most Americans say that to be considered "wealthy" in the U.S. in 2021, you need to have a net worth of nearly $2 million $1.9 million to be exact. 24% of working U.S. adults who contributed the same or less to their retirement savings in 2022 compared to 2021 said stagnant or reduced income held them back from saving more. Opinions expressed on this site are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. 2023 Bankrate, LLC. Others have fallen further behind. Real estates all about timing, and millennials were between the ages of 15 and 30 in 2011 when the real estate market bottomed. jonathan michael schmidt; potato shortage uk 1970s Without being too morbid about it, as that generation passes on (though hopefully not too quickly), they are leaving their incredible wealth to their millennial progeny, many of whom are already doing pretty well for one reason or another. Millennials are an interesting generation, because we usually discuss our avocado-toast-eating brethren as an economic monolith. But boomers held 21% of America's total net worth in 1989 seven times millennials' paltry 3% share in 2019, wrote Alex Tabarrok in the blog Marginal Revolution. That means the wealth gap between older households and younger households has nearly doubled in the past 20 years, climbing from seven to twelve times the net worth. The study (all values are adjusted for inflation) found that in 1998, the average household aged 20 to 35 had a net worth of $103,400. Baby boomers (ages 56 to 74): $2.5 million.

A Division of NBC Universal, Thomas Barwick | DigitalVision | Getty Images, Here's how to use the 50-30-20 budgeting strategy, according to The Federal Reserve's 2019 Survey of Consumer Finances, Americans actually increased their savings levels during the pandemic, Financial expert: Here's how to stay on track while paying down debt, A financial expert shares the 3 most common questions they heard over the last year, Nearly 40% of women are considering scaling back or leaving the workforcehere's how that can affect their retirement savings, Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox, Single mom earns $10,000/month on Outschool: 'I would have never been able to make as much money as a regular teacher', Spartan race founder Joe De Sena on overcoming your biggest fears: 'In most cases, fear is fiction', Adulting 101: What to do in your 20s to set yourself up for financial success, She spent $5,000 half of her life savings to teach kids financial literacy. A drop in income can impact net worth, which is essentially a calculation of all of a person's assets including cash in checking and savings accounts, financial investments and the value of any real estate or vehicles owned minus all their debt, including credit card balances, student loans and mortgages. People 35 to 44 saw the largest increase in net worth between 2016 and 2019, seeing a median increase of 44 percent and a mean increase of 42 percent. For definitions sake, the millennials well be talking about today are those born between 1981 and 1996which would put them around the ages of 27 and 42 in 2023. According to Bankrate, 62.1 percent of those between 35 and 44 owned a home in 2021. 1 profession among millennial one percenter is lawyers, followed closely by miscellaneous managers. Those who create a written financial plan typically have more savings and financial stability, as well as less credit card debt and late loan payments, Scwab's survey found. People with the top 1% of net worth in the U.S. in 2022 had $10,815,000 in net worth. The more high-profile CEOs come in third. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. Past performance is not indicative of future results. We may earn a commission from links on this page. Sure, a 25-year-old can luck into a really great gig earning $250,000 per yearbut how does one amass $2M by age 30? Most Americans say that to be considered "wealthy" in the U.S. in 2021, you need to have a net worth of nearly $2 million $1.9 million to be exact. 24% of working U.S. adults who contributed the same or less to their retirement savings in 2022 compared to 2021 said stagnant or reduced income held them back from saving more. Opinions expressed on this site are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. 2023 Bankrate, LLC. Others have fallen further behind. Real estates all about timing, and millennials were between the ages of 15 and 30 in 2011 when the real estate market bottomed. jonathan michael schmidt; potato shortage uk 1970s Without being too morbid about it, as that generation passes on (though hopefully not too quickly), they are leaving their incredible wealth to their millennial progeny, many of whom are already doing pretty well for one reason or another. Millennials are an interesting generation, because we usually discuss our avocado-toast-eating brethren as an economic monolith. But boomers held 21% of America's total net worth in 1989 seven times millennials' paltry 3% share in 2019, wrote Alex Tabarrok in the blog Marginal Revolution. That means the wealth gap between older households and younger households has nearly doubled in the past 20 years, climbing from seven to twelve times the net worth. The study (all values are adjusted for inflation) found that in 1998, the average household aged 20 to 35 had a net worth of $103,400. Baby boomers (ages 56 to 74): $2.5 million.

Katie Gatti Tassin is the voice and face behind Money with Katie. And because real estate is an asset class that primarily uses leverage to generate returns, this groups parents wouldnt have to be the yacht-owning, company-leading, Rockefeller typesa single, large cash infusion from a decently well-to-do family member at the right time can spark a mushrooming real estate portfolio, if you know what youre doing. It becomes a funnel that pushes [their children] to a really high net worth much earlier in life than people who didn't have any of those advantages.So it stands to reason that millennials whose parents foot the bill for college (and maybe even gifted them the down payment for their first home, or provided an interest-free loan) are in a radically different position today than those who did not have this leg up. The Boomers, baby! For more information, read, Tax Scammers Are Getting Sneakier. Lets dig in. Baby boomers, meanwhile, own over 55%. this post may contain references to products from our partners. But quite a few millennials are doing just fine financially.

Katie Gatti Tassin is the voice and face behind Money with Katie. And because real estate is an asset class that primarily uses leverage to generate returns, this groups parents wouldnt have to be the yacht-owning, company-leading, Rockefeller typesa single, large cash infusion from a decently well-to-do family member at the right time can spark a mushrooming real estate portfolio, if you know what youre doing. It becomes a funnel that pushes [their children] to a really high net worth much earlier in life than people who didn't have any of those advantages.So it stands to reason that millennials whose parents foot the bill for college (and maybe even gifted them the down payment for their first home, or provided an interest-free loan) are in a radically different position today than those who did not have this leg up. The Boomers, baby! For more information, read, Tax Scammers Are Getting Sneakier. Lets dig in. Baby boomers, meanwhile, own over 55%. this post may contain references to products from our partners. But quite a few millennials are doing just fine financially.  "We have spent so much of the last year focusing on getting through today, but we're now seeing an opportunity to look ahead and plan for tomorrow," Williams says.

"We have spent so much of the last year focusing on getting through today, but we're now seeing an opportunity to look ahead and plan for tomorrow," Williams says.