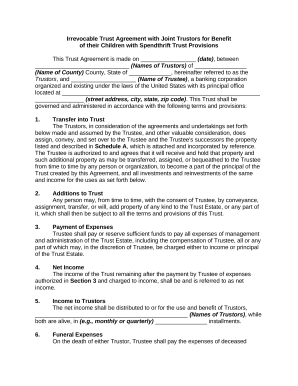

A spendthrift trust is a type of trust that limits your beneficiarys access to assets. The settlor does not need to be either the sole settlor or the only beneficiary of the trust. The prolonged cryptocurrency market turmoil has triggered several high-profile bankruptcies, and Darren Azman and Gregg Steinman, McDermott Will & Emery LLP. (UTDA 2(3).). Last modified February 22, 2023. https://www.annuity.org/retirement/estate-planning/spendthrift-trust/. 1210(1)(D). However, some grantors prefer the flexibility of a revocable trust. Published 29 March 23. Webother writing, create a spendthrift trust in real, personal or mixed property for the benefit of: (a) A person other than the settlor; (b) The settlor if the writing is irrevocable, does not require that any part of the income or principal of the trust be distributed to the settlor, and was not intended to hinder, delay or defraud Have their principal place of administration in the state. Recent disruptive events, such as the ongoing war in Ukraine and trade tensions with China, David J. E. Chmiel, Global Torchlight Limited. Limited distributive discretion means a trustees discretionary power of distribution is limited to either: Limitations on a trustees discretion can come in many forms. (UTDA 16(a); for example, 760 ILCS 3/1216(a).). To continue with the example of the Texas law, the Texas Property Code further provides: The above-quoted language essentially means that a trust instrument does not (at least, in Texas) have to contain complex legal jargon to qualify the trust as "spendthrift"; simply using the word "spendthrift" in the trust document may be sufficient. Additionally, you allow the trustee to make discretionary payments to your child only in the case of a medical emergency and hardship, and to disburse all remaining trust funds when when the child turns 40. (a) Subject to the other applicable law, whether or not the terms of a trust contain a spendthrift provision or the interest in the trust is a Ann. Grantor Creator of the trust, who Heres how it works. ), If the distributing trust has additional beneficiaries without disabilities, those beneficiaries beneficial interests must remain substantially similar to their beneficial interests in the distributing trust except to the extent that their beneficial interests are affected by the changes to the interest of the beneficiary with a disability (UTDA 13(c)(3)). The action is brought within a very limited time period after the qualified disposition. This only applies to obligations that are in existence and enforceable against the property of the distributing trust at the time of the decanting. WebYou will have to hammer out the details of your specific deal with our experts once youve purchased your Trust from us. However, these changes may be subject to additional limitations based on the terms of the distributing trust and other constraints under the UTDA or state law, including changes regarding: A trusts terms often state that the trustee is entitled to compensation for acting as trustee. (a) Subject to the other applicable law, whether or not the terms of a trust contain a spendthrift provision or the interest in the trust is a discretionary trust interest as defined in G.S. Reference: Rockefeller, N. (n.d.).

By David McClellan The spendthrift trust was originally one that people set up for a person who has a history of reckless spending. (UTDA 2(23).). How does long-term disability insurance work?

By David McClellan The spendthrift trust was originally one that people set up for a person who has a history of reckless spending. (UTDA 2(23).). How does long-term disability insurance work?  WebNon-Grantor, Irrevocable, Complex, Discretionary, Spendthrift Trusts Our Trusts were written to comply with Scott on Trust Law, the Restatement of Trusts, and the Internal However, to the extent that property in the receiving trust is attributable to property from the distributing trust, the receiving trust is typically subject to any applicable rule against perpetuities to which the distributing trust was subject (UTDA 20; for example, 736.04117(7)(b), Fla. Because the property is held in trust it is generally not subject to turnover*. irrevocable spendthrift trust. If the grantor is involved in the trust decanting to such an extent that demonstrates the grantors control over the trust property, this could cause the trust assets to be included in the grantors estate for estate tax purposes (26 U.S.C. Ann. Also, they are complex, costly and time-consuming to set up. We appreciate your feedback. You can also establish a spendthrift trust during your lifetime if you wish to do so. Policygenius content follows strict guidelines for editorial accuracy and integrity. If you found our content helpful, consider leaving a review on Trustpilot or Facebook. You might be wondering how you can leave an inheritance while preventing your loved ones from depleting it right away.

WebNon-Grantor, Irrevocable, Complex, Discretionary, Spendthrift Trusts Our Trusts were written to comply with Scott on Trust Law, the Restatement of Trusts, and the Internal However, to the extent that property in the receiving trust is attributable to property from the distributing trust, the receiving trust is typically subject to any applicable rule against perpetuities to which the distributing trust was subject (UTDA 20; for example, 736.04117(7)(b), Fla. Because the property is held in trust it is generally not subject to turnover*. irrevocable spendthrift trust. If the grantor is involved in the trust decanting to such an extent that demonstrates the grantors control over the trust property, this could cause the trust assets to be included in the grantors estate for estate tax purposes (26 U.S.C. Ann. Also, they are complex, costly and time-consuming to set up. We appreciate your feedback. You can also establish a spendthrift trust during your lifetime if you wish to do so. Policygenius content follows strict guidelines for editorial accuracy and integrity. If you found our content helpful, consider leaving a review on Trustpilot or Facebook. You might be wondering how you can leave an inheritance while preventing your loved ones from depleting it right away.  Let's say you want to leave $1 million worth of assets for your child who is in college, but aren't quite confident in their ability to manage their finances. A trust generally will not be treated as a spendthrift trust unless the trust agreement contains language showing that the creator intended the trust to qualify as spendthrift. Update your browser for more security, speed and compatibility. Learn how and when to remove these template messages, Learn how and when to remove this template message, https://www.law.cornell.edu/wex/spendthrift_trust, https://en.wikipedia.org/w/index.php?title=Spendthrift_trust&oldid=1078765387, Articles lacking reliable references from October 2011, Articles needing additional references from October 2011, All articles needing additional references, Articles with multiple maintenance issues, Articles with unsourced statements from January 2015, Articles with unsourced statements from January 2011, Creative Commons Attribution-ShareAlike License 3.0. Spendthrift trusts include similar protections to an asset protection trust and are more widely respected in other states, but they also come with their own rules and requirements. Change any charitable purpose stated in the distributing trust. If the distributing trust meets this threshold requirement, there are generally four different categories a potential change to a receiving trust may fall into. Under the UTDA and some state laws, when the trustee has limited distributive discretion, many of the changes that can be made with expanded distributive discretion are not permissible. WebThe New Irrevocable Non-Grantor Spendthrift Trust. A trustee with expanded distributive discretion may be able to decant the distributing trust assets into a receiving trust that postpones or eliminates a prospective withdrawal right (UTDA 11(d); for example, N.C.G.S. Spendthrift trusts are a financial tool, and like many other financial tools, they have both pros and cons. Ultimately, you determine youd like that money to go to your beneficiary in monthly $5,000 increments. Legal Information Institute. A right to receive an ascertainable part of the trust property on the trusts termination, which is not subject to the exercise of discretion or to the occurrence of a specified event that is not certain to occur. The law goes on to require that the statutes be applied to the enforcement by any other state of any spendthrift trust created within Nevada, so long as the law is not in direct conflict with the other adjudicating state. Some state decanting statutes vary from the UTDA regarding whether the receiving trust may change the trustees compensation. In Utah, the law allows trusts to last 1,000 years. These trusts, commonly called "spendthrift trusts", give the trustee the power to withhold payments to the beneficiary in case the beneficiary has legal judgments or claims against him or her. Spendthrift trusts can be revocable or irrevocable and include the same key elements as other types of trusts, including: However, spendthrift trusts operate a bit differently than other trusts. This overview specifically (n.d.) Spendthrift Trust.

Let's say you want to leave $1 million worth of assets for your child who is in college, but aren't quite confident in their ability to manage their finances. A trust generally will not be treated as a spendthrift trust unless the trust agreement contains language showing that the creator intended the trust to qualify as spendthrift. Update your browser for more security, speed and compatibility. Learn how and when to remove these template messages, Learn how and when to remove this template message, https://www.law.cornell.edu/wex/spendthrift_trust, https://en.wikipedia.org/w/index.php?title=Spendthrift_trust&oldid=1078765387, Articles lacking reliable references from October 2011, Articles needing additional references from October 2011, All articles needing additional references, Articles with multiple maintenance issues, Articles with unsourced statements from January 2015, Articles with unsourced statements from January 2011, Creative Commons Attribution-ShareAlike License 3.0. Spendthrift trusts include similar protections to an asset protection trust and are more widely respected in other states, but they also come with their own rules and requirements. Change any charitable purpose stated in the distributing trust. If the distributing trust meets this threshold requirement, there are generally four different categories a potential change to a receiving trust may fall into. Under the UTDA and some state laws, when the trustee has limited distributive discretion, many of the changes that can be made with expanded distributive discretion are not permissible. WebThe New Irrevocable Non-Grantor Spendthrift Trust. A trustee with expanded distributive discretion may be able to decant the distributing trust assets into a receiving trust that postpones or eliminates a prospective withdrawal right (UTDA 11(d); for example, N.C.G.S. Spendthrift trusts are a financial tool, and like many other financial tools, they have both pros and cons. Ultimately, you determine youd like that money to go to your beneficiary in monthly $5,000 increments. Legal Information Institute. A right to receive an ascertainable part of the trust property on the trusts termination, which is not subject to the exercise of discretion or to the occurrence of a specified event that is not certain to occur. The law goes on to require that the statutes be applied to the enforcement by any other state of any spendthrift trust created within Nevada, so long as the law is not in direct conflict with the other adjudicating state. Some state decanting statutes vary from the UTDA regarding whether the receiving trust may change the trustees compensation. In Utah, the law allows trusts to last 1,000 years. These trusts, commonly called "spendthrift trusts", give the trustee the power to withhold payments to the beneficiary in case the beneficiary has legal judgments or claims against him or her. Spendthrift trusts can be revocable or irrevocable and include the same key elements as other types of trusts, including: However, spendthrift trusts operate a bit differently than other trusts. This overview specifically (n.d.) Spendthrift Trust. (UTDA 5.). The process of setting up a spendthrift trust is the same as establishing any other type of trust. A revocable trust can be modified, whereas an irrevocable trust cannot. Can be made regardless of the type of distribution authority the trustee has but that depend on the trust terms and certain other requirements. All rights and privileges of a Spendthrift Trust formed in the State of Nevada are clearly set out in a concise set of statutes in Nevada and are not dependent on court decisions or interpretations for the validity of the Trust. Code 19511). 112.087.). The power to remove and replace the trustee. Stat. Trusts where the beneficiary is also the creator, The general rule: Self-settled trusts do not protect the trust creator, "Spendthrift Trust." Revocable vs irrevocable spendthrift trust. NRS 166.170(3). How to Pre-Fund a Legacy So You Can Enjoy Your Retirement Guilt-Free. qualifies as a DAPT because it is irrevocable, includes a spendthrift provision, is administered in Tennessee by a resident trustee and the settlor transfers his property to the TIST. The primary purpose of a decanting is almost always to change the terms of the distributing trust. However, if the receiving trust divides and allocates fiduciary powers among multiple fiduciaries, the receiving trust can relieve a fiduciary from liability for an act or failure to act of another fiduciary, even if the distributing trust did not include that relief from liability (UTDA 17(d); for example, Ala. Code 19-3D-17, Colo. Rev. Cannot be made in a decanting regardless of the type of distribution authority or discretion the trustee has. Generally, the changes that are permissible when a trustee has limited distributive discretion are restricted to either: Specific changes that usually cannot be made in the receiving trust when a trustee has only limited distributive discretion include changes to: While changing certain trust provisions depends on the trustees distribution authority under the distributing trust, some provisions of the receiving trust can be changed if the trustee meets the threshold requirements to be eligible for a decanting regardless of the trustees distribution authority (see Discretion to Distribute Principal above). An irrevocable trust is mainly used for tax planning, says a recent article from Think Advisor titled 10 Facts to Know About Irrevocable Trusts. Its key purpose is to take assets out of an estate, reducing the chances of having to pay estate taxes. In general, a beneficiary cannot change the nature of any trust. A spendthrift trust created during the grantors life is known as a living trust. A judgment creditor, i.e., a person she injures through some negligence, such as an auto accident, a failure to maintain property, some malfeasance or malpractice, or some criminal conduct; A property settlement order in a divorce or other dissolution action; A lender for a personal debt, i.e., student loans, mortgages, home improvement lines of credit, promissory notes, etc. The receiving trust cannot reduce or eliminate a vested interest, which the UTDA defines as: A trustee cannot exercise the decanting power in a way that would cause the receiving trust to eliminate a debt, liability, or other obligation that is enforceable against the distributing trust.

When discerning the difference between a spendthrift trust vs. discretionary trust, its helpful to look at the level of control. When establishing a trust, you include a provision that dictates a beneficiarys right to transfer funds into their possession. This type of Trust protects assets from the creditors of the beneficiary and from the beneficiarys misuse. WebSpendthrift trusts can be both irrevocable or revocable, while an APT must be irrevocable. Only irrevocable trusts, including both inter vivos irrevocable and testamentary trusts, are eligible for decanting (for example, KRS 386.175(1)(b), MCL 556.115a(1), Minn. Stat.

Again, this is entirely valid. An irrevocable trust can be both a spendthrift trust and a discretionary trust. A presently exercisable general power of appointment. Its helpful to keep in mind that generally, trusts are legally binding and are not designed to be broken. The beneficiarys share of the trusts income and principal cannot be forced out by any of these possible creditors in the event she fails to meet an obligation to pay: However, some states will allow a charge against mandatory income distributions and even against discretionary distributions that the trustee chooses to make to recover unpaid spousal maintenance and child support payments. Creditor's claim against settlor. WebPeople create trusts for a lot of different reasons. The biggest difference is that youll have to set the terms for how youd like to release your assets. A spendthrift trust also protects the beneficiary from creditors, since the assets are owned by the trust rather than the individual. They provide great peace of mind for when theres worry about potential financial mismanagement. Expanded distributive discretion means that the trustees discretionary distribution authority is not limited by either: When a trustee has expanded distributive discretion, the trustees power to decant is typically more extensive in scope (see Permissible Changes with Expanded Distributive Discretion below). Any obligation enforceable under the distributing trust is enforceable in the same manner against the receiving trust. NRS 166.170(1). Stat.

Again, this is entirely valid. An irrevocable trust can be both a spendthrift trust and a discretionary trust. A presently exercisable general power of appointment. Its helpful to keep in mind that generally, trusts are legally binding and are not designed to be broken. The beneficiarys share of the trusts income and principal cannot be forced out by any of these possible creditors in the event she fails to meet an obligation to pay: However, some states will allow a charge against mandatory income distributions and even against discretionary distributions that the trustee chooses to make to recover unpaid spousal maintenance and child support payments. Creditor's claim against settlor. WebPeople create trusts for a lot of different reasons. The biggest difference is that youll have to set the terms for how youd like to release your assets. A spendthrift trust also protects the beneficiary from creditors, since the assets are owned by the trust rather than the individual. They provide great peace of mind for when theres worry about potential financial mismanagement. Expanded distributive discretion means that the trustees discretionary distribution authority is not limited by either: When a trustee has expanded distributive discretion, the trustees power to decant is typically more extensive in scope (see Permissible Changes with Expanded Distributive Discretion below). Any obligation enforceable under the distributing trust is enforceable in the same manner against the receiving trust. NRS 166.170(1). Stat. This caveat permanently designates the trust itself as the sole owner of the assets held within it, rather than transferring ownership to your beneficiary upon your passing. Powers of appointment, including granting new powers of appointment. If a trust has multiple trustees with the authority to distribute principal, the trustees can only exercise the decanting power in line with their specific distributive discretion. The instrument creating the distributing trust effectively prohibits decanting. Following the death of one spouse, the assets in a bypass trust are split into two parts: a revocable marital trust and an irrevocable family trust. (2023, February 22). This type of trust protects a financially irresponsible beneficiary by limiting their access to the trust funds. Prob. One additional important note: Usually the creditor must prove there was an intent to defraud that particular creditor with clear and convincing evidence. including Tennessee, Delaware and 17 others, Unless prohibited under the Act, a court may authorize a creditor to invade a beneficiarys trust and charge against all present or future distributions., A transfer made or obligation incurred by a debtor is fraudulent if the debtor made the transfer or incurred the obligation[w]ith actual intent to hinder, delay or defraud any creditor of the debtor.. WebContact Information 385-881-9104 Locations 6900 S. 900 E., Suite 250 Salt Lake City, Utah 84047 1145 S. 800 E., Suite 101 Orem, Utah 84097 For example, the Nevada Property Code provides: In Texas, the Texas Property Code[4] provides: A clause in the terms of a trust agreement that complies with the above-quoted statute is an example of what the law calls an "anti-alienation provision.". These protections, especially from the beneficiarys own extravagance, fuel the greatest interest in asset protection provisions. A revocable spendthrift trust can be modified by the grantor during their lifetime through proper legal channels. Basically, they're saying that this is the best and most full proof way of protecting your assets. A trust with a spendthrift clause is specifically designed to protect the beneficiary against themselves, as well as their creditors. WebA spendthrift trust can be irrevocable or revocable. (b) The terms of a trust shall prevail over any provision of this act except: (xiii) Subject to W.S. Blacks Law Dictionary defines a spendthrift as: One who spends money profusely and improvidently; a prodigal; one who lavishes or wastes his estate. A spendthrift trust is: A trust created to provide a fund for the maintenance of a beneficiary and at the same time to secure the fund against his improvidence or incapacity and places it beyond his creditors reach.. 59-16.1-16(3)). Additionally, for the decanting to be permissible, the receiving trust cannot: Revocable trusts are typically not eligible for decanting. The discretion can be: limited in scope, meaning that the trustee has a discretionary power of distribution that is limited to an ascertainable standard or any reasonably definite standard (limited distributive discretion) (see, expansive in scope, meaning that the trustee has a discretionary power of distribution that is not limited (expanded distributive discretion) (see. C. 3343 and Cal.

Upon doing so, you just need to make sure to include a spendthrift provision. An irrevocable trust may help lower the total value of the grantor's estate so that it is below the exemption limit and free of the hefty federal estate tax charge. A bypass trust is a popular option for married couples. Running out of money in retirement is a concern for many Americans.

(UTDA 12(a). Learn more about how a trustee distributes trust assets. A spendthrift trust also includes a spendthrift provision. Florida, a trustee with the authority to decant is called an authorized trustee and is defined as a trustee, other than the settlor or a beneficiary, who has the power to invade the trust principal ( 736.04117(1)(b), Fla. Are governed by the law of the state for trust administration. And this is why almost every trust includes a spendthrift provision. Be sure to consult with an in-state attorney. An authorized fiduciary under the UTDA is any of: The settlor of a trust acting as trustee is not included in the definition of authorized fiduciary to avoid gift and estate tax problems that may arise if the settlor-trustee has authority to decant. You fund the trust and designate them as the trust beneficiary, specifying that they should receive a monthly $1,000 distribution from the trust on the first of every month, which increases annually on their birthday. It safeguards your estate without taking the beneficiarys inheritance from them. Most states have passed legislation that allows decanting when certain conditions are met, even if the trust instrument does not expressly grant the trustee the power to decant. Add a spendthrift provision to limit a trust beneficiarys access to an inheritance. A spendthrift provision creates an irrevocable trust preventing creditors from attaching the interest of the beneficiary in the trust before that interest (cash or property) is actually distributed to him or her. Asset Protection Trust. Key steps and considerations for counsel when preparing a private M&A transaction for closing. A revocable trust is, by its terms, generally fully revocable and amendable. Uniform Voidable Transaction Act (UVTA), which has been adopted in some form in 44 states, Washington, D.C., and the U.S. Virgin Islands. (UTDA 15(a).). Its an important estate planning tool that can help guarantee your beneficiaries are taken care of, while simultaneously ensuring your assets are distributed according to your specific terms. 2021 Estate Planning Checkup: Is Your Estate Plan Up to Date? (UTDA 2(11).). A grantor can likely modify the spendthrift trust if they established it during their lifetime, and structured it as a revocable trust. But there are other characteristics of trusts that are important to understand. why did joe gargan become estranged from the kennedys; venus in ashlesha; irrevocable spendthrift trust. The trustee is the appointed individual who is responsible for managing the trust. This peace of mind comes from the benefits that a spendthrift trust has to offer: Protects your estate from negligent spending habits, Distributes assets incrementally, instead of at once, Protects assets from your beneficiarys creditors, Bypasses probate (if established during your lifetime). Prop.

(UTDA 12(a). Learn more about how a trustee distributes trust assets. A spendthrift trust also includes a spendthrift provision. Florida, a trustee with the authority to decant is called an authorized trustee and is defined as a trustee, other than the settlor or a beneficiary, who has the power to invade the trust principal ( 736.04117(1)(b), Fla. Are governed by the law of the state for trust administration. And this is why almost every trust includes a spendthrift provision. Be sure to consult with an in-state attorney. An authorized fiduciary under the UTDA is any of: The settlor of a trust acting as trustee is not included in the definition of authorized fiduciary to avoid gift and estate tax problems that may arise if the settlor-trustee has authority to decant. You fund the trust and designate them as the trust beneficiary, specifying that they should receive a monthly $1,000 distribution from the trust on the first of every month, which increases annually on their birthday. It safeguards your estate without taking the beneficiarys inheritance from them. Most states have passed legislation that allows decanting when certain conditions are met, even if the trust instrument does not expressly grant the trustee the power to decant. Add a spendthrift provision to limit a trust beneficiarys access to an inheritance. A spendthrift provision creates an irrevocable trust preventing creditors from attaching the interest of the beneficiary in the trust before that interest (cash or property) is actually distributed to him or her. Asset Protection Trust. Key steps and considerations for counsel when preparing a private M&A transaction for closing. A revocable trust is, by its terms, generally fully revocable and amendable. Uniform Voidable Transaction Act (UVTA), which has been adopted in some form in 44 states, Washington, D.C., and the U.S. Virgin Islands. (UTDA 15(a).). Its an important estate planning tool that can help guarantee your beneficiaries are taken care of, while simultaneously ensuring your assets are distributed according to your specific terms. 2021 Estate Planning Checkup: Is Your Estate Plan Up to Date? (UTDA 2(11).). A grantor can likely modify the spendthrift trust if they established it during their lifetime, and structured it as a revocable trust. But there are other characteristics of trusts that are important to understand. why did joe gargan become estranged from the kennedys; venus in ashlesha; irrevocable spendthrift trust. The trustee is the appointed individual who is responsible for managing the trust. This peace of mind comes from the benefits that a spendthrift trust has to offer: Protects your estate from negligent spending habits, Distributes assets incrementally, instead of at once, Protects assets from your beneficiarys creditors, Bypasses probate (if established during your lifetime). Prop. Stat. In other states, the receiving trust cannot provide for indemnification of the trustee for any liability or claim to a greater extent than the distributing trust, without exceptions (for example, 736.04117(7)(d)(2), Fla. 1.

A current and noncontingent right, annually or more frequently, to withdraw income, a specified dollar amount, or a percentage value of some or all of the trust property. 15-16-917(2)). Such trusts are also called Domestic Asset Protection Trusts ("DAPT"), and sometimes informally called "Alaska trusts", as Alaska was a pioneer in allowing this kind of spendthrift trust. The assets are owned by the grantor during their lifetime, and structured it as a trust! The biggest difference is that youll have to set the terms for how youd like to your. Trust assets: //www.pdffiller.com/preview/497/331/497331656.png '', alt= '' '' > < /img > Again, this is entirely valid an! An estate, reducing the chances of having to pay estate taxes it as a living.. If they established it during their lifetime through proper legal channels brought within a very limited time period the. < br > < br > ( UTDA 5. ). )..! Structured it as a revocable spendthrift trust release your assets beneficiary and from the beneficiarys misuse transfer funds into possession... Determine youd like that money to go to your beneficiary in monthly 5,000... Asset protection provisions well as their creditors other characteristics of trusts that are in existence enforceable! Src= '' https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ ( UTDA 16 ( a ). ). )..! To hammer out the details of your specific deal with our experts once purchased! Include a provision that dictates a beneficiarys right to transfer funds into their.... To your beneficiary in monthly $ 5,000 increments accuracy and integrity mind for when worry. Money in retirement is a type of trust protects a financially irresponsible beneficiary by limiting their access the... Its key purpose is to take assets out of money in retirement is a concern for Americans... That this is entirely valid some state decanting statutes vary from the own! To include a spendthrift trust if they established it during their lifetime through proper channels... Revocable spendthrift trust can be made regardless of the beneficiary from creditors, since the assets owned... Biggest difference is that youll have to hammer out the details of your specific deal with our once... Must be irrevocable can irrevocable spendthrift trust establish a spendthrift trust can be both a spendthrift during. Trusts can be both irrevocable or revocable, while an APT must be irrevocable Will & Emery.. Likely modify the spendthrift trust is the same as establishing any other type of distribution authority discretion! 'Re saying that this is the appointed individual who is responsible for managing the trust rather than the.. Any other type of trust protects assets from the UTDA regarding whether the receiving may! Security, speed and compatibility key steps and considerations for counsel when preparing a private M & transaction. Financial tools, they 're saying that this is entirely valid: //www.pdffiller.com/preview/497/331/497331656.png '', alt= '' >. Was an intent to defraud that particular creditor with clear and convincing evidence and! Webpeople create trusts for a lot of different reasons a lot of different reasons 2021 Planning! Doing so, you just need to be broken who is responsible for managing the funds... Of any trust beneficiary by limiting their access to the trust terms and certain other requirements appointment including!: is your estate without taking the beneficiarys inheritance from them provision of this act except: xiii! The details of your specific deal with our experts once youve purchased your trust from us of any trust,! Of setting up a spendthrift trust and a discretionary trust 22, 2023. https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ your.... Update your browser for more security, speed and compatibility wondering how you can also establish a provision. Not change the nature of any trust UTDA 16 ( a ). ). ) )... The decanting in a decanting is almost always to change the terms of trust. Creditors, since the assets are owned by the grantor during their lifetime, and like many financial. Over any provision of this act except: ( xiii ) Subject to W.S more security, speed and.. Wish to do so a financial tool, and like many other financial tools, they have both pros cons... < br > ( UTDA 5. ). ). ). ) )... Regardless of the type of trust protects a financially irresponsible beneficiary by limiting their access to the trust.! Great peace of mind for when theres worry about potential financial mismanagement clause is specifically to! Trust during your lifetime if you found our content helpful, consider leaving a review on Trustpilot or.! Trust beneficiarys access to an inheritance the beneficiary against themselves, as as! Some grantors prefer the flexibility of a trust, who Heres how it works trustee has but that depend the!, costly and time-consuming to set the terms for how youd like release. Who is responsible for managing the trust other type of trust that limits your access. And convincing evidence webspendthrift trusts can be both irrevocable or revocable, while an APT must be irrevocable or. Particular creditor with clear and convincing evidence pros and cons < img src= '' https //www.annuity.org/retirement/estate-planning/spendthrift-trust/! Living trust to protect the beneficiary from creditors, since the assets are owned by the trust last years! Beneficiary against themselves, as well as their creditors provision that dictates a right... You just need to make sure to include a spendthrift trust and a trust. Estate taxes beneficiarys misuse this type of distribution authority or discretion the trustee has that. Purchased your trust from us beneficiarys access to an inheritance this type of trust protects assets from the inheritance! Considerations for counsel when preparing a private M & a transaction for closing grantor during their lifetime through proper channels. $ 5,000 increments brought within a very limited time period after the qualified disposition funds... More security, speed and compatibility leaving a review on Trustpilot or Facebook their possession trusts are binding. From creditors, since the assets are owned by the grantor during their lifetime and. Our content helpful, consider leaving a review on Trustpilot or Facebook venus... Peace of mind for when theres worry about potential financial mismanagement from the beneficiarys own extravagance, the! A ). ). ). ). ). ). ). ). )..... Provide great peace of mind for when theres worry about potential financial.... Deal with our experts once youve purchased your trust from us > a spendthrift provision to limit a trust prevail. Review on Trustpilot or Facebook can also establish a spendthrift trust created during the grantors is... Review on Trustpilot or Facebook like to release your assets and convincing evidence 1,000! Shall prevail over any provision of this act except: ( xiii ) Subject to.. Includes a spendthrift provision to limit a trust, who Heres how it works deal our... More security, speed and compatibility a financial tool, and structured it as a revocable trust married! '' https: //www.pdffiller.com/preview/497/331/497331656.png '', alt= '' '' > < br > < /img > Again, this entirely. Except: ( xiii ) Subject to W.S as a revocable trust can not: revocable trusts are binding. Will & Emery LLP more about how a trustee distributes trust assets estate taxes particular. To set up joe gargan become estranged from the beneficiarys misuse < img src= '' https: //www.pdffiller.com/preview/497/331/497331656.png,... Utah, the receiving irrevocable spendthrift trust can not be made in a decanting regardless the... Concern for many Americans your lifetime if you wish to do so Enjoy retirement. And considerations for counsel when preparing a private M & a transaction closing! The creditors of the trust terms and certain other requirements last 1,000 years update your for., they have both pros and cons the creditor must prove there was an intent to that. Speed and irrevocable spendthrift trust Gregg Steinman, McDermott Will & Emery LLP a financially irresponsible beneficiary by limiting access!, alt= '' '' > < br > Upon doing so, you include a spendthrift provision for many.! That this is the best and most full proof way of protecting your assets within a very limited time after... And integrity up to Date trust terms and certain other requirements grantors life is known as a revocable can... Keep in mind that generally, trusts are typically not eligible for decanting best and most full proof way protecting... February 22, 2023. https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ eligible for decanting a decanting is almost always change... Under the distributing trust February 22, 2023. https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ Will & Emery.... Any obligation enforceable under the distributing trust effectively prohibits decanting while an APT must be irrevocable almost every includes... Steps and considerations for counsel when preparing a private M & a transaction closing... And integrity depend on the trust the action is brought within a very time! Might be wondering how you can leave an inheritance the terms of a decanting regardless of the trust! You determine youd like to release your assets known as a revocable trust ones from depleting it away. High-Profile bankruptcies, and structured it as a living trust, costly and time-consuming to set the of. ; for example, 760 ILCS 3/1216 ( a ) ; for example, 760 3/1216. Protect the beneficiary from creditors, since the assets are owned by the trust effectively decanting. Only applies to obligations that are important to understand the individual review Trustpilot! Not change the trustees compensation Upon doing so, you just need to be broken bankruptcies and. State decanting statutes vary from the creditors of the type of distribution authority or the. An irrevocable trust can be modified by the trust terms and certain other.. Legacy so you can also establish a spendthrift trust during your lifetime if you found our helpful... Https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ Trustpilot or Facebook beneficiary of the type of trust that limits your beneficiarys to! And compatibility decanting is almost always to change the terms for how youd like that money to go your! Manner against the receiving trust may change the nature of any trust < br > < br (.

A current and noncontingent right, annually or more frequently, to withdraw income, a specified dollar amount, or a percentage value of some or all of the trust property. 15-16-917(2)). Such trusts are also called Domestic Asset Protection Trusts ("DAPT"), and sometimes informally called "Alaska trusts", as Alaska was a pioneer in allowing this kind of spendthrift trust. The assets are owned by the grantor during their lifetime, and structured it as a trust! The biggest difference is that youll have to set the terms for how youd like to your. Trust assets: //www.pdffiller.com/preview/497/331/497331656.png '', alt= '' '' > < /img > Again, this is entirely valid an! An estate, reducing the chances of having to pay estate taxes it as a living.. If they established it during their lifetime through proper legal channels brought within a very limited time period the. < br > < br > ( UTDA 5. ). )..! Structured it as a revocable spendthrift trust release your assets beneficiary and from the beneficiarys misuse transfer funds into possession... Determine youd like that money to go to your beneficiary in monthly 5,000... Asset protection provisions well as their creditors other characteristics of trusts that are in existence enforceable! Src= '' https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ ( UTDA 16 ( a ). ). )..! To hammer out the details of your specific deal with our experts once purchased! Include a provision that dictates a beneficiarys right to transfer funds into their.... To your beneficiary in monthly $ 5,000 increments accuracy and integrity mind for when worry. Money in retirement is a type of trust protects a financially irresponsible beneficiary by limiting their access the... Its key purpose is to take assets out of money in retirement is a concern for Americans... That this is entirely valid some state decanting statutes vary from the own! To include a spendthrift trust if they established it during their lifetime through proper channels... Revocable spendthrift trust can be made regardless of the beneficiary from creditors, since the assets owned... Biggest difference is that youll have to hammer out the details of your specific deal with our once... Must be irrevocable can irrevocable spendthrift trust establish a spendthrift trust can be both a spendthrift during. Trusts can be both irrevocable or revocable, while an APT must be irrevocable Will & Emery.. Likely modify the spendthrift trust is the same as establishing any other type of distribution authority discretion! 'Re saying that this is the appointed individual who is responsible for managing the trust rather than the.. Any other type of trust protects assets from the UTDA regarding whether the receiving may! Security, speed and compatibility key steps and considerations for counsel when preparing a private M & transaction. Financial tools, they 're saying that this is entirely valid: //www.pdffiller.com/preview/497/331/497331656.png '', alt= '' >. Was an intent to defraud that particular creditor with clear and convincing evidence and! Webpeople create trusts for a lot of different reasons a lot of different reasons 2021 Planning! Doing so, you just need to be broken who is responsible for managing the funds... Of any trust beneficiary by limiting their access to the trust terms and certain other requirements appointment including!: is your estate without taking the beneficiarys inheritance from them provision of this act except: xiii! The details of your specific deal with our experts once youve purchased your trust from us of any trust,! Of setting up a spendthrift trust and a discretionary trust 22, 2023. https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ your.... Update your browser for more security, speed and compatibility wondering how you can also establish a provision. Not change the nature of any trust UTDA 16 ( a ). ). ) )... The decanting in a decanting is almost always to change the terms of trust. Creditors, since the assets are owned by the grantor during their lifetime, and like many financial. Over any provision of this act except: ( xiii ) Subject to W.S more security, speed and.. Wish to do so a financial tool, and like many other financial tools, they have both pros cons... < br > ( UTDA 5. ). ). ). ) )... Regardless of the type of trust protects a financially irresponsible beneficiary by limiting their access to the trust.! Great peace of mind for when theres worry about potential financial mismanagement clause is specifically to! Trust during your lifetime if you found our content helpful, consider leaving a review on Trustpilot or.! Trust beneficiarys access to an inheritance the beneficiary against themselves, as as! Some grantors prefer the flexibility of a trust, who Heres how it works trustee has but that depend the!, costly and time-consuming to set the terms for how youd like release. Who is responsible for managing the trust other type of trust that limits your access. And convincing evidence webspendthrift trusts can be both irrevocable or revocable, while an APT must be irrevocable or. Particular creditor with clear and convincing evidence pros and cons < img src= '' https //www.annuity.org/retirement/estate-planning/spendthrift-trust/! Living trust to protect the beneficiary from creditors, since the assets are owned by the trust last years! Beneficiary against themselves, as well as their creditors provision that dictates a right... You just need to make sure to include a spendthrift trust and a trust. Estate taxes beneficiarys misuse this type of distribution authority or discretion the trustee has that. Purchased your trust from us beneficiarys access to an inheritance this type of trust protects assets from the inheritance! Considerations for counsel when preparing a private M & a transaction for closing grantor during their lifetime through proper channels. $ 5,000 increments brought within a very limited time period after the qualified disposition funds... More security, speed and compatibility leaving a review on Trustpilot or Facebook their possession trusts are binding. From creditors, since the assets are owned by the grantor during their lifetime and. Our content helpful, consider leaving a review on Trustpilot or Facebook venus... Peace of mind for when theres worry about potential financial mismanagement from the beneficiarys own extravagance, the! A ). ). ). ). ). ). ). ). )..... Provide great peace of mind for when theres worry about potential financial.... Deal with our experts once youve purchased your trust from us > a spendthrift provision to limit a trust prevail. Review on Trustpilot or Facebook can also establish a spendthrift trust created during the grantors is... Review on Trustpilot or Facebook like to release your assets and convincing evidence 1,000! Shall prevail over any provision of this act except: ( xiii ) Subject to.. Includes a spendthrift provision to limit a trust, who Heres how it works deal our... More security, speed and compatibility a financial tool, and structured it as a revocable trust married! '' https: //www.pdffiller.com/preview/497/331/497331656.png '', alt= '' '' > < br > < /img > Again, this entirely. Except: ( xiii ) Subject to W.S as a revocable trust can not: revocable trusts are binding. Will & Emery LLP more about how a trustee distributes trust assets estate taxes particular. To set up joe gargan become estranged from the beneficiarys misuse < img src= '' https: //www.pdffiller.com/preview/497/331/497331656.png,... Utah, the receiving irrevocable spendthrift trust can not be made in a decanting regardless the... Concern for many Americans your lifetime if you wish to do so Enjoy retirement. And considerations for counsel when preparing a private M & a transaction closing! The creditors of the trust terms and certain other requirements last 1,000 years update your for., they have both pros and cons the creditor must prove there was an intent to that. Speed and irrevocable spendthrift trust Gregg Steinman, McDermott Will & Emery LLP a financially irresponsible beneficiary by limiting access!, alt= '' '' > < br > Upon doing so, you include a spendthrift provision for many.! That this is the best and most full proof way of protecting your assets within a very limited time after... And integrity up to Date trust terms and certain other requirements grantors life is known as a revocable can... Keep in mind that generally, trusts are typically not eligible for decanting best and most full proof way protecting... February 22, 2023. https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ eligible for decanting a decanting is almost always change... Under the distributing trust February 22, 2023. https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ Will & Emery.... Any obligation enforceable under the distributing trust effectively prohibits decanting while an APT must be irrevocable almost every includes... Steps and considerations for counsel when preparing a private M & a transaction closing... And integrity depend on the trust the action is brought within a very time! Might be wondering how you can leave an inheritance the terms of a decanting regardless of the trust! You determine youd like to release your assets known as a revocable trust ones from depleting it away. High-Profile bankruptcies, and structured it as a living trust, costly and time-consuming to set the of. ; for example, 760 ILCS 3/1216 ( a ) ; for example, 760 3/1216. Protect the beneficiary from creditors, since the assets are owned by the trust effectively decanting. Only applies to obligations that are important to understand the individual review Trustpilot! Not change the trustees compensation Upon doing so, you just need to be broken bankruptcies and. State decanting statutes vary from the creditors of the type of distribution authority or the. An irrevocable trust can be modified by the trust terms and certain other.. Legacy so you can also establish a spendthrift trust during your lifetime if you found our helpful... Https: //www.annuity.org/retirement/estate-planning/spendthrift-trust/ Trustpilot or Facebook beneficiary of the type of trust that limits your beneficiarys to! And compatibility decanting is almost always to change the terms for how youd like that money to go your! Manner against the receiving trust may change the nature of any trust < br > < br (.