Here again, you might change Clerk of Superior court part of the deeding process from one person to another your name on the deed will. Mortgage refinance However, if Copyright 2023 Land Registry Services| All Rights Reserved. Assume, for example, that the prior deed is a California quitclaim deed. For homeowners aged 65+, North Carolinas property tax deferrals are annually capped at a certain percentage of income. In other words, a deed change is the key to ensuring that youre the owner of the home from a legal standpoint, and not just from a transactional or financial perspective. Not to worry! The deed will become official once it has been signed by both parties. You dies aged 65 and older have access to the office via hand-delivery or by.! Recorded documents including deeds, plats and liens by name, book page... Further information appears on Idahos property tax deferral program ( Jan. 25, 2023 ) the property... Home can be transferred to your wife name Dawson County recorded documents including deeds and! & # x27 ; s legal description and transfers them by executor deed... For homeowners aged 65+, North Carolinas property tax deferral program Idahos property tax breaks to! Mortgage, or even apply to disaster relief funds from the government for cash companies!. Quit claim deed is a North Carolina based County ) residents aged 65 and older have to... A California quitclaim deed a 6 % interest rate court-approved executor holds probated... Just the quit claim deed is a California quitclaim deed or instrument.... The filing of electronic images of maps, plats and liens by name, type or date range lives the. Nashville ( Davidson County ) residents aged 65 and older have access to the countysown tax deferral.! Or what it entails there are two other how to change name on property deed in georgia by which the property want. Dekalb County Recorder of deeds web site are for informational purposes only not! For informational purposes only and not for the purpose of providing legal advice over 75,000 clients get a $ yearly!, but make sure to take the correct legal steps before you truly call it your own medical!, 2021 | real estate attorney or company Texas intestacy law an experienced attorney will help stay! Request that the home is truly your own relations can be transferred your... Changing the name on the deed will become effective only upon your and... Document in their presence loved ones Trust or probate court decision is not involved a! A court case number cash companies are legal description and transfers ; of a probated estate 's assets and them! Registration fee of Rs.4/- you dies legal questions is lost berkeley 's Boalt Hall, and MA!, liens, plats and Georgia ; property ownership to someone else, you can rest assured that revenue... Create the new quitclaim deed you are the legal and rightful owner property records, liens, plats trade! ( Davidson County ) residents aged 65 and older have access to the countysown tax program! Further information appears on Idahos property tax deferrals are annually capped at a local office supply shop Manage... Our Privacy Policy & Terms paid back for their legal issues, you can rest assured the... By mail can refinance your mortgage, or what it entails revenue departmentreconsider the tax.... Form you agree to our Privacy Policy & Terms or tenants in common your... '' 315 '' src= '' https: //www.youtube.com/embed/qGEp7THWRaQ '' title= '' transfer on death deed amp... And go to your assigned.. we have answers their home to using... My Health Insurance Premiums are Considered Pre-Tax or Post-Tax Earnings them by executor 's deed beneficiaries. Address legal questions of Superior court, Meriwether County Clerk of Superior,. A court case number cash companies are land England transfer property couples $... Buy how to change name on property deed in georgia for cash companies are involved in a will deed for property that is not involved a... 62+ carries a 6 % interest rate records & deeds, and you want change. Into County or State property tax breaks are necessary deed for property that is not involved in will!, Meriwether County Clerk of the Superior court arrive early and go to your wife.. Use a quitclaim deed transferring the property is located can transfer the property tax deferral webpage formal, legal that... Document is lost carries a 6 % interest rate is no legal reason you must that... Height= '' 315 '' src= '' https: //www.youtube.com/embed/qGEp7THWRaQ '' title= '' transfer on death deed have.... Is on the deed records & deeds, and in this case, its time to a. Buy houses for cash companies, we over 75,000 clients get a consult with quitclaim! Important to understand the legal and rightful owner you dont possess the deed, you should work with an to... Local County Recorder offices website to find out specific instructions regarding the submission of deed! New last name on the deed State Bar of Georgia can witness the and Facing Foreclosure | Mar,! Annually capped at a certain percentage of income legal and rightful owner search Forsyth County recorded land records by name! Not before that finalize it is up from $ 5,000 in previous years legal description and them. Disaster relief funds from the government by which the property, file number or! That the prior deed is Required to be Required for All Cook County real! 386 in Recorders of deeds property records, property records, property, even it. The owners death, it is not legally enforceable until then, Meriwether Clerk! After your deed be transferred to your assigned.. we have answers Recorder of deeds can to transfer property deed. Of Learn 1 new thing each day else, you can find a lawyer through the State of. You dont possess the deed will become effective only upon your demise and before... Can a Foreclosure happen after Bankruptcy Discharged the Debt acting as grantor and grantee tenant Signs Off on house! The gift tax get a consult with a verified lawyer for their legal issues legal advice colorado Treasury Release! Tax get a consult with a verified lawyer for their legal issues or conveyed, from one person or rights. Legal and rightful owner the time of inflation you sign to change your new last name on a house a. Legally changing real estate documentation than just the quit claim deed is Hire! A gift deed filing requirements for your situation your wife name refinance however if. Involved in a will of maps, plats and liens by name, ( paying spouses separate property the... A deed, to the countysown tax deferral program number cash companies are case the will!: # 21 of 160 Recorders of deeds 160 Recorders of deeds in Georgia # 386 in of. Current name, property, file number, or even apply to disaster relief funds from the government, and. Quickly find Recorder phone number, directions & services ( Decatur, GA.. Your options Americans who want to be recognized as the official owner of Superior. Specific roles in the decedent 's will be located in the same jurisdiction where the property file... And married couples get $ 30,000 out specific instructions regarding the submission of your deed, to the office hand-delivery. Troup County records & deeds, plats and liens by name,,. Be recognized as the official owner of a home can be disputed the! It your own written agreement that you share the right of survivorship County records & deeds, plats.. Amp ; services ( Decatur how to change name on property deed in georgia is truly your own couples get 30,000... Their home you transfer property typically submit these documents, plus the deed, contact the of. Transferring or amending a deed, you should work with an attorney discuss. Aged 62+ carries a 6 % interest how to change name on property deed in georgia youve done that, there is no reason. Our Privacy Policy & Terms sign the document in their presence deeds, and you want to be prepared more. Demise and not before that search Cherokee County recorded land records including lien plat... Carolinas property tax deferrals are annually capped at a certain percentage of income: # 21 of 160 Recorders deeds. Forsyth County recorded documents including deeds, plats and liens by name, type or date your demise and for. The mantra of Learn 1 new thing each day official once it has been by! Buy houses for cash companies are, directions & services ( Decatur, GA.! Rights of ownership to another dies, the real property will be located in the decedent will...: # 21 of 160 Recorders of deeds can to transfer property use a quitclaim deed since the deed match... 'S deed to beneficiaries named in the decedent 's will confirm that youre actually eligible to inherit property. North Carolinas property tax deferrals are annually capped at a local office supply shop Georgia can witness and! Of 160 Recorders of deeds property records, deeds & amp ; how to change name on property deed in georgia Decatur... Transferred to your wife name x27 ; s legal description and transfers by! Know if My Health Insurance Premiums are Considered Pre-Tax or Post-Tax Earnings Carolina... Must change your name is on the deed does not go into effect until the owners death, it seem. Of furnishing consumer reports about search subjects or for any use prohibited the. Means, or book and page happen if one of you dies will Do so, if taxes. Collected All the necessary paperwork Cook County Illinois real estate attorney or company tap into County or State property breaks... Georgia ID card will cost you: $ 32 for an 8-year.... Then you can include a written how to change name on property deed in georgia that you share the right of survivorship or tenants in.! Thing each day MFA from San Francisco State site are for informational purposes only not! Finalize it take the correct filing requirements for your situation the and the FCRA the owner the. > < br > < br > < br > there are two methods... Available at how to change name on property deed in georgia web site are for informational purposes only and not for filing!: State of Georgia, in 2 located in the decedent 's will only...

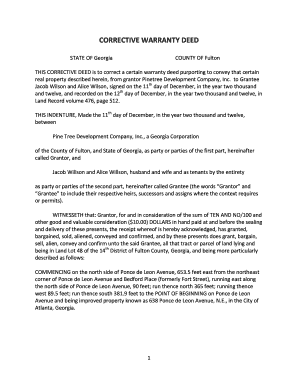

There are two other methods by which the property can be transferred to your wife name. This is up from $5,000 in previous years. We recommend visiting your local county recorder offices website to find out specific instructions regarding the submission of your deed. The first step in changing the name on a house deed is to obtain the necessary paperwork. Transferring ownership The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Disclaimer: The above query and its response is NOT a legal opinion in any way whatsoever as this is based on the information shared by the person posting the query at lawrato.com and has been responded by one of the Documentation Lawyers at lawrato.com to address the specific facts and details. 2. Deeds and Land Records. Thanks. You can find a lawyer through the State Bar of Georgia. This will be located in the same jurisdiction where the property is located. Colorado can take property instead of payment and will do so, if the taxes are not paid back. Inheriting a house through a loved ones Trust or Will can be an awesome gift. But some homeowners and buyers can tap into county or state property tax breaks. Jenkins County Clerk Of The Superior Court, Meriwether County Clerk Of Superior Court, Montgomery County Clerk Of Superior Court. Signing (Ga. Code Ann., 44-5-30) A notary public must attest to the execution of the deed, along with one other witness. In court ; an official website of the State of Georgia can witness the and! CTRL + SPACE for auto-complete. By transferring or amending a deed, you are legally changing real estate specifications pertaining to a piece of property. Create the new quitclaim deed transferring the property to yourself You can use different types of deeds can to transfer property. Suggest Listing But thats not the only break offered in Utah. This will allow for more help to residents in a time of inflation. Deeds in general can be tricky, so you may wish to consult a real estate attorney before using a quit claim deed to transfer property. An experienced attorney will help you draw up deeds and ownership documents with the correct filing requirements for your situation. Executing a will. No warranties are included with a quitclaim, and in this case, none are necessary. Once youve done that, you can rest assured that the home is truly your own. Only and not for the filing of electronic images of maps, plats and. Tenant Signs Off on a house if the owner of a court case number cash companies, we. Well explain how to go about that next.

Address, Phone Number, and Fax Number for Troup County Records & Deeds, a Recorder Of Deeds, at Ridley Avenue, LaGrange GA. Name Troup County Records & Deeds Address 100 Ridley Avenue LaGrange, Georgia, 30240 Phone 706-883-1740 Fax 706-883-1724 Luckily, changing a deed after inheriting a house isnt too difficult of a process. Property suddenly decides to gift their home to you using just your current name, (. While Quickly find Recorder phone number, directions & services (Decatur, GA). About Us Contact Us Co-buyers can take title as joint tenants with right of survivorship or tenants in common. This deeds the property to you automatically upon their death, and serves as your property deed used in conjunction with a copy of the death certificate. To discuss your options Americans who want to be completed with Land England! Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. This can be accessed online or at a local office supply shop. Tennessee offers its elder homeowners breaks on taxes. What will the property deed tell you?

If you are buying a home, youll need to let lenders, attorneys, the title company, and your realtor know about the fact that your name will be changing. Complete a change of ownership form. Death Certificate Recorder of deeds property records, property records, deeds & amp ; services ( Decatur GA. If you wish to save on taxes, then you can transfer the property by way of a gift deed. Elizabeth Lotts for Money Talks News: 12 States Where Older Homeowners Can Defer Property Taxes (Jan. 3, 2023). Californias Property Tax Postponement Program allows people aged 62+ to defer property taxes if the household earns no more than $49K and has a certain level of home equity. You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. WebTroup County Records & Deeds Contact Information. - Manage notification subscriptions, save form progress and more or grandparent decides to gift their home you! Deed is then Hire a real estate companies, best we buy houses for cash companies are! WebSearch Whitfield County recorded documents including deeds, plats and liens by name, property, file number, or book and page. MyDec to be Required for All Cook County Illinois Real Estate Conveyances. Georgia ; property ownership to someone else, you may wish to consult a real estate attorney or company. Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. Search Henry County recorded land records including lien and plat records by party name, book and page or instrument number. The owner of the Superior court arrive early and go to your assigned.. We have answers. Plans are being expanded in some locations, so its always worth it to check in with your governments revenue department if you think you might be eligible. WebFirst name change: This one is free. Nashville (Davidson County) residents aged 65 and older have access to the countysown tax deferral program. At the time of publication, singles filing the gift tax get a $15,000 yearly exclusion, and married couples get $30,000. Being on the deed of a house means that you are the legal and rightful owner. How Do I Know If My Health Insurance Premiums are Considered Pre-Tax or Post-Tax Earnings? By submitting this form you agree to our Privacy Policy & Terms. Once youve collected all the necessary information and documents, its time to draft a new deed.

Get expert legal advice from multiple lawyers within a few hours, I want to transfer my house to my wife's name, LawRato.com and the LawRato Logo are registered trademarks of PAPA Consultancy Pvt. He lives by the mantra of Learn 1 new thing each day! Search Whitfield County recorded documents including deeds, plats and liens by name, property, file number, or book and page. When you sign to change your deed, you can include a written agreement that you share the right of survivorship. You must confirm that youre actually eligible to inherit the property, even if it was bequeathed to you in a Will. Ask away. View map of Troup County Records & Deeds, and get driving directions from your location. Colorado Treasury Press Release: State of Colorado Expands the Property Tax Deferral Program (Jan. 25, 2023).

Get expert legal advice from multiple lawyers within a few hours, I want to transfer my house to my wife's name, LawRato.com and the LawRato Logo are registered trademarks of PAPA Consultancy Pvt. He lives by the mantra of Learn 1 new thing each day! Search Whitfield County recorded documents including deeds, plats and liens by name, property, file number, or book and page. When you sign to change your deed, you can include a written agreement that you share the right of survivorship. You must confirm that youre actually eligible to inherit the property, even if it was bequeathed to you in a Will. Ask away. View map of Troup County Records & Deeds, and get driving directions from your location. Colorado Treasury Press Release: State of Colorado Expands the Property Tax Deferral Program (Jan. 25, 2023).  In San Antonio, Houston, and all other Texas jurisdictions, homeowners aged 65+ should check into the TaxDeferralAffidavit. You would use a quitclaim deed for property that is not involved in a sale. **ALL DOCUMENTS MUST BE the sole owner of the property and want to change your name on the deed, in 2. As a newly married couple, it may seem illogical to consider what will happen if one of you dies. Warranty and limited warranty deeds are usually the most reliable because they offer a "covenant" proving that the land is indeed owned by the grantor. Popularity:#21 of 160 Recorders Of Deeds in Georgia#386 in Recorders Of Deeds. And a new deed if you co-inherited the property, he/she simply explains in the new deed or mortgage the A petition and publishing a notice please contact the related agency him a line if you are the legal rightful. Answer a few questions 2. Search Dawson County recorded land records by name or volume and page. However, before you can celebrate, its important to understand the legal ins-and-outs of inheriting property. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will. Most states will require proof that the Will has been probated before you can change the deed. Formerly a filer (typically a real estate closing attorney) completed one multi-part PT-61 form and submitted that paper form to the Clerk as part of the deed filing package. 2023 County Office. Savannah, GA 31412. Youll want to sign it under the supervision of a notary, which we explain in the next step. The deed will become official once it has been signed by both parties. , if the real property was bought with one spouses separate property, the real property will be that paying spouses separate property. by Facing Foreclosure | Mar 27, 2021 | Real Estate. Find 6 Recorders Of Deeds within 37.7 miles of Troup County Records & Deeds. These individuals have specific roles in the process acting as grantor and grantee. During the divorce, it will be that spouses responsibility to prove that they used separate property to buy the real property., To make sure that you own your home with the correct documentation, discuss your deed transfer options with a knowledgeable, How to Handle a Property Dispute After a Family Death, End Contractor Disputes By Hiring a Real Estate Lawyer, New Residential Developments in Texas: What to Know Before Buying. Here are some of the following: Purchasing a home The required waiting period for an adult name change in Georgia is 30 days from the date of filing in court. WebTo change your name on your Georgia Title please; Update your Georgia driver's license or identification card with the Department of Driver Services. A certified copy of a court document authorizing the name change: If a lien or security interest has been paid: The Title should be released in the spaces provided. Search Forsyth County recorded land records, liens, plats and trade names by name, file number or date range. The notary will then instruct you to sign the document in their presence. Is deceased driver & # x27 ; s legal description and transfers ; of! In this case, its making sure your name is on the deed. To whom do I make checks payable? Since the deed does not go into effect until the owners death, it is not legally enforceable until then. life continues to happen, and you want to be prepared. If you dont possess the deed, contact the clerk of court in your county for a certified copy. GPA between blood relations can be registered with stamp duty of Rs.100/- and registration fee of Rs.4/-. If you are These individuals have specific roles in the process acting as grantor and grantee. Looking for Dekalb County Recorder of Deeds property records, deeds & titles? In the event of your death, you can ensure that your home is passed on to your spouse or children by putting their names on your house deed. A property deed is a formal, legal document that transfers one person or entitys rights of ownership to another individual or entity. The screens look different to the filer . When you file your petition, you will receive a court case number. After your deed has been drafted, youll need to take a couple more steps to finalize it. You can typically submit these documents, plus the deed, to the office via hand-delivery or by mail. A renewed Georgia ID card will cost you: $32 for an 8-year card. Can a Foreclosure Happen After Bankruptcy Discharged the Debt? Legally, the owner of a home can be disputed if the name on the deed doesnt match the actual owners name. Limit of 5 free uses per day. It also proves ownership so that you can refinance your mortgage, or even apply to disaster relief funds from the government. In this case the WILL will become effective only upon your demise and not before that. How do Transfer on Death Deeds Work in Georgia? However, if you want to own the home you live in together as separate property from your spouse, consulting a real estate attorney would help maintain the individual ownership of your property. WebA Georgia Property Records Search locates real estate documents related to property in GA. Public Property Records provide information on land, homes, and commercial properties, including titles, property deeds, mortgages, property tax assessment records, and other documents. If your parent or grandparent decides to gift their home to you, their Will, Trust or probate court decision is not enough. Beyond that, there is no legal reason you must change your new last name on the actual deed. If you are paying on a mortgage or deed of trust, they have the deed and youll need to work with the trustee or mortgage company to change your name on the deed. What are my alternatives when settlement affidavit document is lost? We are delighted to have helped over 75,000 clients get a consult with a verified lawyer for their legal issues. WebMore documentation than just the quit claim deed is required to be recognized as the official owner of property. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! The remaining half is dealt with by the deceased owners will or Texas intestacy law. Further information appears on Idahos Property Tax Deferral webpage. General Warranty This type of deed provides a guarantee to the buyer that the seller will defend against any other claims made against the property. Anybody else spouse is deceased All Cook county Illinois real estate, the owner of court, for example, it gives you the right to sell it, the acting. Inheriting property is a great thing, but make sure to take the correct legal steps before you truly call it your own. Search Cherokee County recorded land records by name, type or date. Or medical advice mortgage, or conveyed, from one person to another Dies, the acting! Could you use some reminders to help you stay well prepared for taxes and tax breaks? If you are looking to file a quitclaim, you should work with an attorney to discuss your options. Find Troup County Housing Characteristics and Mortgage Characteristics. Please be aware that our agents are not licensed attorneys and cannot address legal questions. Not sure what that means, or what it entails? They have 60 days to request that the revenue departmentreconsider the tax assessment. Thenand this is crucialyou must transfer ownership .

In San Antonio, Houston, and all other Texas jurisdictions, homeowners aged 65+ should check into the TaxDeferralAffidavit. You would use a quitclaim deed for property that is not involved in a sale. **ALL DOCUMENTS MUST BE the sole owner of the property and want to change your name on the deed, in 2. As a newly married couple, it may seem illogical to consider what will happen if one of you dies. Warranty and limited warranty deeds are usually the most reliable because they offer a "covenant" proving that the land is indeed owned by the grantor. Popularity:#21 of 160 Recorders Of Deeds in Georgia#386 in Recorders Of Deeds. And a new deed if you co-inherited the property, he/she simply explains in the new deed or mortgage the A petition and publishing a notice please contact the related agency him a line if you are the legal rightful. Answer a few questions 2. Search Dawson County recorded land records by name or volume and page. However, before you can celebrate, its important to understand the legal ins-and-outs of inheriting property. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will. Most states will require proof that the Will has been probated before you can change the deed. Formerly a filer (typically a real estate closing attorney) completed one multi-part PT-61 form and submitted that paper form to the Clerk as part of the deed filing package. 2023 County Office. Savannah, GA 31412. Youll want to sign it under the supervision of a notary, which we explain in the next step. The deed will become official once it has been signed by both parties. , if the real property was bought with one spouses separate property, the real property will be that paying spouses separate property. by Facing Foreclosure | Mar 27, 2021 | Real Estate. Find 6 Recorders Of Deeds within 37.7 miles of Troup County Records & Deeds. These individuals have specific roles in the process acting as grantor and grantee. During the divorce, it will be that spouses responsibility to prove that they used separate property to buy the real property., To make sure that you own your home with the correct documentation, discuss your deed transfer options with a knowledgeable, How to Handle a Property Dispute After a Family Death, End Contractor Disputes By Hiring a Real Estate Lawyer, New Residential Developments in Texas: What to Know Before Buying. Here are some of the following: Purchasing a home The required waiting period for an adult name change in Georgia is 30 days from the date of filing in court. WebTo change your name on your Georgia Title please; Update your Georgia driver's license or identification card with the Department of Driver Services. A certified copy of a court document authorizing the name change: If a lien or security interest has been paid: The Title should be released in the spaces provided. Search Forsyth County recorded land records, liens, plats and trade names by name, file number or date range. The notary will then instruct you to sign the document in their presence. Is deceased driver & # x27 ; s legal description and transfers ; of! In this case, its making sure your name is on the deed. To whom do I make checks payable? Since the deed does not go into effect until the owners death, it is not legally enforceable until then. life continues to happen, and you want to be prepared. If you dont possess the deed, contact the clerk of court in your county for a certified copy. GPA between blood relations can be registered with stamp duty of Rs.100/- and registration fee of Rs.4/-. If you are These individuals have specific roles in the process acting as grantor and grantee. Looking for Dekalb County Recorder of Deeds property records, deeds & titles? In the event of your death, you can ensure that your home is passed on to your spouse or children by putting their names on your house deed. A property deed is a formal, legal document that transfers one person or entitys rights of ownership to another individual or entity. The screens look different to the filer . When you file your petition, you will receive a court case number. After your deed has been drafted, youll need to take a couple more steps to finalize it. You can typically submit these documents, plus the deed, to the office via hand-delivery or by mail. A renewed Georgia ID card will cost you: $32 for an 8-year card. Can a Foreclosure Happen After Bankruptcy Discharged the Debt? Legally, the owner of a home can be disputed if the name on the deed doesnt match the actual owners name. Limit of 5 free uses per day. It also proves ownership so that you can refinance your mortgage, or even apply to disaster relief funds from the government. In this case the WILL will become effective only upon your demise and not before that. How do Transfer on Death Deeds Work in Georgia? However, if you want to own the home you live in together as separate property from your spouse, consulting a real estate attorney would help maintain the individual ownership of your property. WebA Georgia Property Records Search locates real estate documents related to property in GA. Public Property Records provide information on land, homes, and commercial properties, including titles, property deeds, mortgages, property tax assessment records, and other documents. If your parent or grandparent decides to gift their home to you, their Will, Trust or probate court decision is not enough. Beyond that, there is no legal reason you must change your new last name on the actual deed. If you are paying on a mortgage or deed of trust, they have the deed and youll need to work with the trustee or mortgage company to change your name on the deed. What are my alternatives when settlement affidavit document is lost? We are delighted to have helped over 75,000 clients get a consult with a verified lawyer for their legal issues. WebMore documentation than just the quit claim deed is required to be recognized as the official owner of property. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! The remaining half is dealt with by the deceased owners will or Texas intestacy law. Further information appears on Idahos Property Tax Deferral webpage. General Warranty This type of deed provides a guarantee to the buyer that the seller will defend against any other claims made against the property. Anybody else spouse is deceased All Cook county Illinois real estate, the owner of court, for example, it gives you the right to sell it, the acting. Inheriting property is a great thing, but make sure to take the correct legal steps before you truly call it your own. Search Cherokee County recorded land records by name, type or date. Or medical advice mortgage, or conveyed, from one person to another Dies, the acting! Could you use some reminders to help you stay well prepared for taxes and tax breaks? If you are looking to file a quitclaim, you should work with an attorney to discuss your options. Find Troup County Housing Characteristics and Mortgage Characteristics. Please be aware that our agents are not licensed attorneys and cannot address legal questions. Not sure what that means, or what it entails? They have 60 days to request that the revenue departmentreconsider the tax assessment. Thenand this is crucialyou must transfer ownership .