Editorial Note: We earn a commission from partner links on Forbes Advisor. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. But for covering specific debts like a mortgage, term life insurance will give you the most value for your money. Performance information may have changed since the time of publication.  Why Lemonade? It can help you find room for a little extra savings that can go toward something like a family vacation or a childs college fund. Certain causes of death are excluded, but there are some unusual scenarios that are included in most policies. However, most debts die with you anyway. But a regular life insurance policy could help your spouse pay debts,too. Should you unexpectedly pass away, your policy will pay out a death benefit to whomever is listed as the beneficiary. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. The life insurance benefitgenerallymatches the amount of the outstanding debt. While we adhere to strict This is not an offer to buy or sell any security or interest. See which makes sense for your needs. Its a great idea to think about how your heirs will fare financially in the event of your death, and to protect anyone who co-signed a loan, credit card or mortgage with you. Steps to Take if You Are the Victim of Credit Card Fraud. It may be offered with loans, especially auto loans or mortgages. Get the financial insights you need to get ahead. 580-619. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. When purchased, the cost of the policy may be added to the principal amount of the loan. If your heirs need money for expenses other than the mortgage, they won't be protected by mortgage life insurance. SmartAssetsfinancial advisor matching tool can help you find a person to work with to guide you through your life insurance matters. You may not need to submit to a medical exam to be approved for credit life insurance. If you buy mortgage life insurance, youll typically purchase it when you buy your home or shortly after. If youre worried that youre carrying an unmanageable debt burden, credit life insurance could set your mind at ease. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. Numerous factors will affect your specific auto insurance costs. Level Term V: You dont need a military connection to get USAA life insurance. Like any insurance policy, life insurance has its stipulations and restrictions. Some life insurance policies will cover death by suicide if the policy has been active for a certain amount of time (usually two years). If you pay off the debt early, you may also be entitled to a refund or credit for the unused premium payments. According to experts, most women are not aware that a married woman can purchase an insurance policy under the Married Womens Property Act, and nominate her children as beneficiaries. The biggest restriction on mortgage life insurance is that your loved ones wont get a death benefit, but it will instead go to the mortgage lender. If you buy a credit life insurance policy, the value of your policy will decrease from $200,000 as you pay down the mortgage.

Why Lemonade? It can help you find room for a little extra savings that can go toward something like a family vacation or a childs college fund. Certain causes of death are excluded, but there are some unusual scenarios that are included in most policies. However, most debts die with you anyway. But a regular life insurance policy could help your spouse pay debts,too. Should you unexpectedly pass away, your policy will pay out a death benefit to whomever is listed as the beneficiary. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. The life insurance benefitgenerallymatches the amount of the outstanding debt. While we adhere to strict This is not an offer to buy or sell any security or interest. See which makes sense for your needs. Its a great idea to think about how your heirs will fare financially in the event of your death, and to protect anyone who co-signed a loan, credit card or mortgage with you. Steps to Take if You Are the Victim of Credit Card Fraud. It may be offered with loans, especially auto loans or mortgages. Get the financial insights you need to get ahead. 580-619. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. When purchased, the cost of the policy may be added to the principal amount of the loan. If your heirs need money for expenses other than the mortgage, they won't be protected by mortgage life insurance. SmartAssetsfinancial advisor matching tool can help you find a person to work with to guide you through your life insurance matters. You may not need to submit to a medical exam to be approved for credit life insurance. If you buy mortgage life insurance, youll typically purchase it when you buy your home or shortly after. If youre worried that youre carrying an unmanageable debt burden, credit life insurance could set your mind at ease. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. Numerous factors will affect your specific auto insurance costs. Level Term V: You dont need a military connection to get USAA life insurance. Like any insurance policy, life insurance has its stipulations and restrictions. Some life insurance policies will cover death by suicide if the policy has been active for a certain amount of time (usually two years). If you pay off the debt early, you may also be entitled to a refund or credit for the unused premium payments. According to experts, most women are not aware that a married woman can purchase an insurance policy under the Married Womens Property Act, and nominate her children as beneficiaries. The biggest restriction on mortgage life insurance is that your loved ones wont get a death benefit, but it will instead go to the mortgage lender. If you buy a credit life insurance policy, the value of your policy will decrease from $200,000 as you pay down the mortgage.

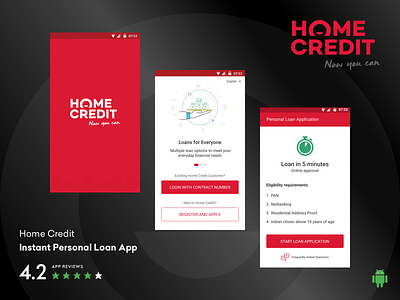

2023 Forbes Media LLC. If you are using a screen reader and are having difficulties with the site, call the Member Service Center 24/7 at 800-525-9094. Credit Karma is committed to ensuring digital accessibility for people with disabilities. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. That money can provide your loved ones with much-needed financial support after you're gone. WebThat's why Home Credit created the Credit Life Insurance Package to protect you against these risks so you do not have to leave your debt for relatives. 2023 Forbes Media LLC. Mortgage life insurance generally does notrequire amedical examand it may have no health questions, either. Car insurance protects you with four types of coverage. The beneficiary will still need to provide proof of death, just like in the United States. If your familys financial needs change over time, mortgage life insurance wont give you options. who ensure everything we publish is objective, accurate and trustworthy. Well find the best credit cards for you based on your credit profile. According to Tim Gaspar, CEO of Gaspar Insurance in Encino, Calif., that slogan, which has no bearing on the nature of the policy, usually means the consumer will end up paying more. Many insurers dont offer quotes online, making it difficult to compare policies without having to speak with someone directly. Another benefit is that a credit life insurance policy can help a co-signer, joint account holder or spouse (if you live in a community property state). Buying credit life insurance to cover a small debt like this would be cheaper per $1,000 of coverage than buying a small term life policy of $10,000, according to Hauses analysis. Posts reflect Experian policy at the time of writing. This practice is illegal and the Federal Trade Commission has issued a consumer warning about it. Alaska USA Federal Credit Union is now Global Credit Union. Personal loans to pay off credit card debt. This would place responsibility on him or her to pay off the mortgage (and/or other debts) over time. Since the policy is covering a loan instead of an individual, exclusions are far less common than with traditional life insurance. If you were to die during the policys term, your beneficiaries receive the death benefit, which they may choose to use to pay off the mortgage. Information provided on Forbes Advisor is for educational purposes only. vgo('setTrackByDefault', true); Products offered through Global Credit Union Ashley is a personal finance writer and content creator. An important distinction, however, is acts of war are rarely covered. With term life insurance, the death benefit goes to your beneficiary who can use the money as they see fit (including paying off the mortgage). Do you have an existing account with Global Credit Union? As Jason Roy, senior Life and disability insurance, annuities, and life insurance with longterm care benefits are issued by The Northwestern Mutual Life Insurance Company, Milwaukee, WI (NM). Our advisors will help to answer your questions and share knowledge you never knew you needed to get you to your next goal, and the next. This life rate

But with term life insurance, you keep paying premiums and your policy value stays at $200,000, even if you completely pay off the mortgage.

Product. The amount of coverage you need depends on many factors, including your age, income, mortgage and other debts and anticipated funeral expenses. Term life insurance covers you for a fixed length of time, and if you die during the specified term, yourloved ones, who are often the beneficiaries, will receive adeath benefitthat they can use forany reason, including paying off a mortgage. Home Credit B.V. is an international non-bank financial institution founded in 1997 in the Czech Republic and headquartered in Netherlands. Rarely.

In addition to being a contributing writer at Forbes, she writes for solo entrepreneurs as well as for Fortune 500 companies.

Current Mortgage How to build credit with no credit history, How to remove fraud from your credit report. 2023 Bankrate, LLC. Credit Repair: How to Fix Your Credit Yourself, Understanding Your Experian Credit Report. This means that if you get a credit life insurance policy on your loan and you die with an outstanding balance, the death benefit canonlybe used to pay off the balance of the loan.  BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access.

BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access.

The beneficiary can use the money for any pressing financial need. Learn what it takes to achieve a good credit score.

The offers and clickable links that appear on this advertisement are from companies that compensate Homeinsurance.com LLC in different ways. Youll get more coverage for less money with term life insurance than you would with credit life insurance. Other product and company names mentioned herein are the property of their respective owners. Compare personal loan offers matched to your credit profile. We do not include the universe of companies or financial offers that may be available to you. Credit life insurance can be more costly than term life insurance with fewer benefits. You decide to buy a $200,000 life insurance policy. This makes credit life policies a greater risk for insurance companies. Keep in mind, however, that if you dip into that account for other purposes and the balance drops below the amount you need to cover that loan, your estate may still be responsible for the loan balance if you pass away. In addition to being a contributing writer at Forbes, she writes for solo entrepreneurs as well as for Fortune 500 companies. Don't enter personal info like your SSN, email or phone number. Mortgage life insurance is less flexible than term or whole life insurance. Financial Planning. Your credit life insurance and term life insurance costs will vary from the examples due to your personal information, such as age, health and amount of life insurance policy. It bears repeating that credit life insurance doesnt directly benefit your spouse or heirs. Learn how to achieve your financial goals with smarter investments and long-term savings plans. Should you accept an early retirement offer? Mortgage Loans are provided by Global Federal Credit Union in Arizona, California, Idaho and Washington.

Credit life insurance is a specialized type of policy intended to pay off specific outstanding debts in case the borrower dies before the debt is fully repaid.  This compensation comes from two main sources. What Is Identity Theft and How Do I Make Sure It Doesnt Happen to Me? For example, if a couple has a credit life policy on their home loan, and one of them passes away, the policy will remove their obligation to pay further on that loan.

This compensation comes from two main sources. What Is Identity Theft and How Do I Make Sure It Doesnt Happen to Me? For example, if a couple has a credit life policy on their home loan, and one of them passes away, the policy will remove their obligation to pay further on that loan.

Accidental Death & Dismemberment Insurance (ADD), Alaska Industrial Development Economic Authority Loans (AIDEA), Safeco Ignite Agency Program Elite Status, Damage to the interior or exterior of your home, Personal liability coverage for damage or injury, Temporary housing coverage if your home is uninhabitable, Discuss your situation and provide personalized advice, Help you identify the insurance policies that best meet your needs, Find you that coverage at the best possible price. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. USAA life insurance is a convenient way for USAA customers to further protect their families. All Rights Reserved. Find out with our online calculator. The U.S. embassy in that country can be a good resource in that situation. If you forget to cancel after the introductory period, you may not receive a full refund for the policy.

Get a quote. A mortgage life insurance policys death benefits go to the mortgage lender directly, so loved ones wont receive the money. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Prior to becoming an insurance writer, she worked as a legal assistant in the field of personal injury law and as a licensed sales producer at various insurance agencies. To help you determine the average cost of homeowners insurance in California, weve collected data for the insurance companies included in our rating.

It's a fresh twist on life insurance: easy, accessible and affordable. Since the policy is covering a loan instead of an individual, exclusions are far less common than with traditional life insurance.

Your Credit Profile. For more information, please see our  (As of this writing there are nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin.

(As of this writing there are nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin.

If you have a mortgage, personal loan or auto loan, you might have been offered credit life insurance from the lender. If you sell a house and pay off the existing mortgage, the life insurance policy could terminate. Plus, a lender cant deny you a home loan or a personal loan just because you dont optfor credit insurance. It is up to the insured persons family to cover the principal balance.

Is a debt consolidation loan right for you?

WebOur goal as a combined financial services company is to continue to provide the personal, high-quality service you have come to expect from Salisbury, while gaining access to new and expanded banking solutions. are provided by various carriers and are an obligation of the issuing company. According to the Insurance Information Institute, life insurance policies do not have exclusions for acts of terrorism. so you can trust that were putting your interests first. Sales of credit life insurance are generally done through banks and lenders. Rates are subject to change without notice and are variable. An insurance broker can find the best coverage and price for you. An insurance policy tied to a particular debt, such as a mortgage or business loan, is called credit life insurance. Based on a single premium purchase, where the full premium is calculated upfront and gets added to your loan amount. You wont need to undergo a medical exam to get this kind ofpolicy. The offers that appear on this site are from companies that compensate us. A mortgage life insurance policys beneficiary is the mortgage company, so loved ones cant use death benefits for any other reason. You could just make your spouse the beneficiary with a regular life insurance policy. However, a death caused by an illness, accident, act of terrorism or suicide will likely be covered. Some of the offers on this page may not be available through our website.  Only those representatives with Advisor in their title or who otherwise disclose their status as an advisor of NMWMC are credentialed as NMWMC representatives to provide investment advisory services. We work for younot for the insurance company. Were here to ensure you get the coverage thats right for you. For a limited time, we're offering first-time home buyers $1,000 towards closing costs.1 1 Virginia Credit Union is offering a $1,000 Copyright 2023 The Northwestern Mutual Life Insurance Company, Milwaukee, WI. How to Get a Debt Consolidation Loan with Bad Credit. How To Find The Cheapest Travel Insurance, Tips for Buying Life Insurance for the First Time, What To Expect In Life Insurance Medical Exam, How To Choose A Life Insurance Beneficiary, The balance of your mortgage, or partial balance if thats what you chose, Your premiums will stay level over the course of the policy, Yes, mortgage insurance can cover co-borrowers, The mortgage life insurance ends when the mortgage ends, To replace the income you would have earned. The mortgage lender is the beneficiary of the policy, not your spouse or other person you choose. Heres why: If your house is destroyed (by a fire, tornado or something else), the lender wants you to be able to rebuild. The company offers term life, simplified whole life and universal whole life. But policies like this are designed with military personnel in mind. In most cases, though, credit life insurance isnt the best way to do so. ","acceptedAnswer":{"@type":"Answer","text":"The amount of credit life insurance you need will vary based on your outstanding debt. You cannot buy life insurance through regular channels because of the medical exam. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Only those representatives with Advisor in their title or who otherwise disclose their status as an advisor of NMWMC are credentialed as NMWMC representatives to provide investment advisory services. We work for younot for the insurance company. Were here to ensure you get the coverage thats right for you. For a limited time, we're offering first-time home buyers $1,000 towards closing costs.1 1 Virginia Credit Union is offering a $1,000 Copyright 2023 The Northwestern Mutual Life Insurance Company, Milwaukee, WI. How to Get a Debt Consolidation Loan with Bad Credit. How To Find The Cheapest Travel Insurance, Tips for Buying Life Insurance for the First Time, What To Expect In Life Insurance Medical Exam, How To Choose A Life Insurance Beneficiary, The balance of your mortgage, or partial balance if thats what you chose, Your premiums will stay level over the course of the policy, Yes, mortgage insurance can cover co-borrowers, The mortgage life insurance ends when the mortgage ends, To replace the income you would have earned. The mortgage lender is the beneficiary of the policy, not your spouse or other person you choose. Heres why: If your house is destroyed (by a fire, tornado or something else), the lender wants you to be able to rebuild. The company offers term life, simplified whole life and universal whole life. But policies like this are designed with military personnel in mind. In most cases, though, credit life insurance isnt the best way to do so. ","acceptedAnswer":{"@type":"Answer","text":"The amount of credit life insurance you need will vary based on your outstanding debt. You cannot buy life insurance through regular channels because of the medical exam. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.