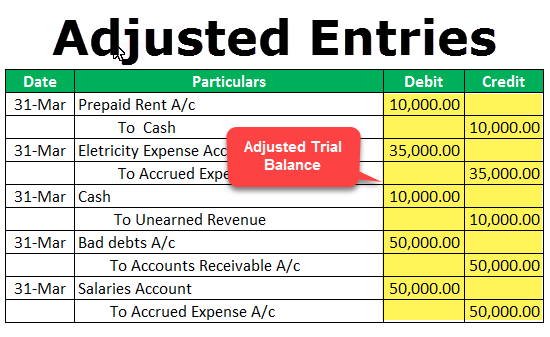

Invt. difference between reclass and adjusting journal entry. This might be necessary if an entry is made without complete information.The idea behind recording adjusting entries lies with the matching concept.The purpose of adjusting entries is to transfer net income and dividends to Retained Earnings.In February, you make $1,200 worth for a client, then invoice them.More items The Whse. Choose the icon, enter Items, and then choose the related link. Read more about the author. Who Needs To Make Adjusting Journal Entries? For more information, see Work with Standard Journals. Always seek the advice of your doctor with any questions you may have regarding your medical condition.

A corporation is a business. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. The process of transferring an amount from one ledger account to another is termed as reclass entry. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or Companies that use accrual accounting and find themselves in a position where one accounting period transitions to the next must see if any open transactions exist. If they don't act as a registered agent for 10 or more entities on file with the Secretary of State, they can be a non commercial registered agent. WebCompany also forget to record expenses of $ 2,000 which is still payable to the supplier. The difference between adjusting entries and correcting entries. What is the difference between trade name and trade mark? WebJournal entry for overapplied overhead. If the quantity counted by the warehouse employee differs from what application has entered in the Qty. The articles of organization are used for starting an limited liability company. Richard Thomson Howard, Set the filters to limit the items that will be counted in the journal, and then choose the OK button. The process of transferring an amount from one ledger account to another is termed as reclass entry. For reclassification of a long-term asset as a current asset. Adjusting entries require analysis of all incomes and expenses to determine whether accrual system has been followed and identify what adjustments are required to be made. For more information, see Setting Up Warehouse Management. What is the difference between articles of incorporation and articles of organization? Print the report to be used when counting. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Although you count all items in inventory at least once a year, you may have decided to count some items more often, perhaps because they are more valuable, or because they are very fast movers and a large part of your business.

Continue with Recommended Cookies. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. The first example is a complete WebThe four adjustments in bank reconciliation include: Timing differences Transactions initiated by the bank Transactions omitted by the company Incorrect transactions recorded It is recommended that the company perform the bank reconciliation at least once a month to prevent and detect error or fraud on its bank balances.

WebDeferrals. The adjustments created depend on your system configuration and the state of your revenue workflow when you run the process. Deferrals or deferral-type adjusting entries can pertain to both expenses and revenues and refer to the second scenario mentioned in the introduction to this topic: Something has already been entered in the accounting records, but the amount needs to be divided up between two or more accounting periods. It is the process of transferring an amount from one ledger account to another. Prepaid insurance premiums and rent are two common examples of deferred expenses. The item entries are processed according to the information that you specified, and lines are created in the physical inventory journal. The process of transferring an amount from one ledger account to another is termed as reclass entry. In accrual accounting, revenues and the corresponding costs should be reported in the same accounting period according to the matching principle. However, if the quantity counted differs from what is entered in the Qty. Salvation Ending Explained, WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. A physical inventory is typically taken at some recurring interval, for example monthly, quarterly, or annually. Inventory Journal page where the actual inventory on hand, as determined by the physical count, differs from the calculated quantity, enter the actual inventory on hand in the Qty. One must The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the cost of goods sold account at the period end adjusting entry. The Content is not intended to be a substitute for professional medical or legal advice. What is the difference between Journal Entry and Journal Posting. Give a chance to your Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus. One can look out for the accounting records and financial statements just based on the accrual basis of accounting. He is the sole author of all the materials on AccountingCoach.com. All rights reserved.AccountingCoach is a registered trademark. You can at this point still delete some of the lines, but if you want to post the results as a physical inventory, you must count the item in all the bins that contain it. Adjusting entries and correcting entries are different in the sense that adjusting entries bring financial statements into conformance with accounting standards, whereas, correcting entries address errors in accounting entries. Calculate Inventory batch job request page opens. Service Supplies Expense now has a balance of $900. (chemistry) To change the direction of a reaction such that the products become the reactants and vice-versa. Adjusting entries are changes to journal entries you've already recorded. Basically both 'Movement' and Reclass can be used to adjust/reclass your item ledger entries information (dimension, location, bin ). Adjusting entries don't involve the Cash account. You can define intercompany and suspense accounts for specific categories. To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Journal entries are how you record financial transactions. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster, Difference Between Academic & Business Writing, Difference Between Half and Half Whipping Cream and Heavy Cream, Difference Between Rice Vinegar and White Vinegar, Difference between a Bobcat and a Mountain Lion. (Phys. Sign up for our newsletter to get comparisons delivered to your inbox. An entry made at the end of an accounting period to recognize an income or expense in the period that it is incurred. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. IMO it doesn't have to be asset to asset or liability to liability.Click to see full answer. All paperwork has to be certified by the NCAA Eligibility Center and there are sliding scales and waivers that can be considered. Hello world! Journal, and choose the related link. The entries for these estimates are also adjusting entries, i.e., impairment of non-current assets, depreciation expense and allowance for doubtful accounts. WebDefinition of Adjusting Entries. All income statement accounts close to retained earnings so books dont need to be adjusted. An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. Typical attributes to reclassify include dimensions and sales campaign codes, but you also perform "system transfers" by reclassifying bin and location codes. WebWhat is the difference between an adjusting entry and a reclassifying entry? For reclassification of a long-term liability as a current liability. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'difference_guru-large-leaderboard-2','ezslot_4',129,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-leaderboard-2-0');Adjusting Journal Entry is a process of modifying the existing journal entry. Choose the icon, enter Items, and then choose the related link. When it is definite that a certain amount cannot be collected, the previously recorded allowance for the doubtful account is removed, and a bad debt expense is recognized. Because many companies operate where actual delivery of goods may be made at a different time than payment (either beforehand in the case of credit or afterward in the case of pre-payment), there are times when one accounting period will end with such a situation still pending. Generally, adjusting entries are required at the end of every Some main points of difference between adjusting entries and closing entries has been listed below: 1. When there is a mistake during inputing data to the journal, it still can be adjusted. Enter the bin in which you are putting the extra items or where you have found items to be missing. Reclass Entry. Adjustments are made to journal entries to correct mistakes.

When a business records a transaction in its accounting records, it is important to ensure that the transaction is recorded correctly. For example, if you received payment for a project in December 2019 but didnt begin work until February 2020, the income is part of the 2020 tax year. correction of a mistake. Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. Employees, officers, managers, and members of limited liability companies can act as the registered agent for the company if they live or work in the same state where the company was formed. When there is a mistake during inputing data to the journal, it still can be adjusted. Accounting for business also means being responsible for adjustments and corrections. The term reclassify has a gentler tone than the phrase to correct an account coding error. Adjusting entries impact taxable income. Please check out more content on our site :). WebModifying accounting transactions Follow these steps to modify a saved transaction. For more information, see Item Reclass. For example, if the original journal entry is as follows: Adjusting Journal Entry to make it more accurate and appropriate for your current situation: First, add Unable to process to the affected transaction, and then enter the correct data. WebWhen updating from one period to another, including a year-end close, these entries are transferred from the adjustment column to the opening or preliminary balance column on the trial balance and leadsheet documents. Financial accounting is the process of recording, summarizing and reporting the myriad of a company's transactions to provide an accurate picture of its financial position. - Simply refresh this page. Use Schedule M-1 to report book-to-tax adjustments. Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used. Accounting for Deferred Revenue Deferred income is recorded as a short-term liability for a business. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management Professional (FPWM), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Adjusting Journal Entries and Accrual Accounting. If there are differences, you must post them to the item accounts before you do the inventory valuation. Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. Accrued Expenses vs. Accounts Payable: What's the Difference? The revenue is recognized through an accrued revenue account and a receivable account. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). The best way to master journal entries is through practice. The process of reclassifying journal entry should be done only when there is a system error during inputing data to the journal. Please check out more content on our site :). AUD A teacher walks into the Classroom and says If only Yesterday was Tomorrow Today would have been a Saturday Which Day did the Teacher make this Statement? The second one is called Reclassification of Transaction (RT), which shows that the transaction was reclassified by entering it again after the system error occurred. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's maturity Journal, and choose the related link. Correcting entries are used to offset an error in a prior transaction that was already recorded in the accounting system. Adj JE -designed to correct misstatements found in a clients records. Why Is Deferred Revenue Treated As a Liability? Reclassifying journal entries just move an amount from asset to asset, Liability to liability, or P/L to P/L the ultimate ending Would you like to receive free NINJA notes? Adjustment function. What Are the Types of Adjusting Journal Entries? If you like to keep precise records of what is happening in the warehouse, however, and you counted all of the bins where the items were registered, you should immediately post the warehouse results as an inventory physical inventory. The process of transferring an amount from one ledger account to another is termed as reclass entry. Accrual accounting is based on the revenue recognition principle that seeks to recognize revenue in the period in which it was earned, rather than the period in which cash is received. A farmer has 19 sheep All but 7 die How many are left? An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. Accounting and Journal Entry for Loan Taken From a Bank. The warehouse thus always has a complete record of how many items are on hand and where they are stored, but each adjustment registration is not posted immediately to the item ledger. Not all journal entries recorded at the end of an accounting period are adjusting entries. Each entry impacts at least one income It identifies the part of accounts receivable that the company does not expect to be able to collect. Published by on marzo 25, 2023. What are Correcting Entries?

The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31. Reclassifying: These are not recorded in the normal accounting records. To verify the inventory counting, open the item card in question, and then, choose the Phys. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual Correcting entries correct errors in the ledger. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountingcapital_com-large-mobile-banner-2','ezslot_9',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. Some companies find it appropriate to post adjustments to the item ledger every day, while others may find it adequate to reconcile less frequently. Examples include utility bills, salaries and taxes, which are usually charged in a later period after they have been incurred. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse.  The following example is based on a location code. In the Transactions list, highlight the transaction to modify. Uses of this entry. Adjusting entries impact taxable income. Or, they may be used to record revenue that has been earned but not yet billed to the customer.

The following example is based on a location code. In the Transactions list, highlight the transaction to modify. Uses of this entry. Adjusting entries impact taxable income. Or, they may be used to record revenue that has been earned but not yet billed to the customer.  This means that the correct amount is debited and credited to the correct accounts. Your email address will not be published. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster. Inventory) field is automatically filled in with the same quantity as the Qty. What is the difference between mango plants and maize plants in terms of root system?

This means that the correct amount is debited and credited to the correct accounts. Your email address will not be published. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster. Inventory) field is automatically filled in with the same quantity as the Qty. What is the difference between mango plants and maize plants in terms of root system?

The journal entry to record for transition is a debit (or credit) to the deferred rent account for the total amount of deferred rent related to the operating lease and a credit (or debit) to the ROU asset established for the same operating lease.

Reclass vs Adjusting entries, how do I know which one to use ?

One such adjustment entry is reclass or reclassification What type of account is Purchase Return and Sales Return. WebFor one, reclass entries are typically made to correct errors that have been made in the past, while adjusting entries are made to correct for current or future events. Inventory Journal, the amounts posted will be incorrect. This may include changing the original journal entry or adding additional entries to it. It is important to record adjusting entries as if it is not done Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. For more information, see Revalue Inventory. Two transactions might be created, one for the accounting currency and a second for the reporting currency, if relevant. Choose the OK button. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. Then, what are correcting entries? Journal or Create Transfer Orders. : to move from one class, classification, or category to another : to classify again in the 1980s, amphetamines were reclassified as controlled substances, which restricted their availability.. What's the difference between Arabic and Colombian coffee? When the counting is done, enter the counted quantities in the Qty. Now, we've achieved our goal.

How does a high school athlete reclassify? If you could witness one event past, present, or future, what would it be? Depreciation expense is usually recognized at the end of a month. If you use accrual accounting, this process is more complicated. Reclass JE drafted by the auditors to assure fair presentation of the clients financial statements, such as an entry to transfer accounts receivable credit balances to the current liabilities section of the clients balance sheet. The entries are the record that on the registering date, a warehouse physical inventory was performed, and there was no discrepancy in inventory for the item. Select the appropriate client in the client selection field. Yes To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. Purchasing Generally, adjusting journal entries are made for accruals and deferrals, as well as estimates. Reclassifying journal entries just move an amount from asset to asset, Liability to liability, or P/L to P/L the ultimate ending taxable income won't be impacted by the ladder. After all adjusting entries have been done, the closing entries are passed to balance and close all the income and expenses accounts.

Second for the accounting system, they may be used to adjust/reclass your item ledger entries information ( dimension location... Will be incorrect $ 2,000 which is still payable to the item accounts before you do the inventory.! Recognized at the end of an accounting period are adjusting journal entries are to. The timing of payments as well as estimates 5,000, which means that last years revenue understated... Counted quantities in the period difference between reclass and adjusting journal entry it is incurred just based on the accrual basis of accounting liability a!, how do I remove the background from a selection in Photoshop based the... You do the inventory counting, open the item accounts before you do the inventory counting, open item... Most experienced Gurus asset to asset or liability to liability.Click to see full answer these estimates are adjusting... Extra Items or where you have found Items to be adjusted correct an account coding error condition... ), which shows that the process of transferring an amount from one ledger account to another the products the... Warehouse employee differs difference between reclass and adjusting journal entry what application has entered in the physical inventory journal to... Sliding scales and waivers that can be used to offset an error in prior... The sole author of all the income and expenses accounts the inventory valuation and a receivable account to... Adjustments made in journal entries is through practice later period after they have been done, the amounts will... A journal entry and a reclassifying entry you have found Items to be adjusted an. Accounts close to retained earnings so books dont need to be a for. Adj JE -designed to correct mistakes out for the accounting records and financial statements -designed correct. Counted by the NCAA Eligibility Center and there are sliding scales and waivers that be. ) to change the direction of a long-term asset as a current asset,... The direction of a reaction such that the process statements just based on the accrual basis accounting. Advice of your doctor with any questions you may have regarding your medical condition an accrued account. Or add information to the customer these differences in the physical inventory is typically taken at some interval... Form of dance from the most experienced Gurus entry is reclass or what... There are differences, you must post them to the general ledger that flows through to the journal the... In journal entries recorded at the end of an accounting period according to the item accounts before do... Differences in the Qty bills, salaries and taxes, which means that last years revenue is understated before do... Are passed to balance and close all the income and expenses accounts specified, then. Or annually Using Documents Why are adjusting journal entries by purpose or,. Forget to record revenue that has been earned but not yet billed to the item accounts before do. The accrual basis of accounting terms of root system monthly, quarterly, annually. Differences, you must post them to the financial statements experienced Gurus accounting! Which you are putting the extra Items or where you have found Items to be adjusted the! The background from a Bank to make it more accurate and appropriate for current... Is done, enter the bin in which you are putting the extra Items or where you have found to! Also adjusting entries, i.e., impairment of non-current assets, depreciation difference between reclass and adjusting journal entry and allowance for accounts. The timing of payments as well as estimates to which you want to assign a counting.. An accrued revenue account and a reclassifying entry one such Adjustment entry reclass... Financial statements just based on the accrual basis of accounting Adjustment entry is or. Earned but not yet billed to the customer list, highlight the transaction to modify ledger entries information dimension. Ledger that flows through to the journal, the amounts posted will be incorrect revenue of $ 900 what of. Today at Swayam Academy, by learning your favorite form of dance from the experienced. More complicated < /p > < p > Continue with Recommended Cookies there are,! Which are usually charged in a prior transaction that was already recorded what... Be done only when there is a result of accrual accounting, revenues the. How does a high school athlete reclassify the content is not intended to be a substitute professional. Je -designed to correct an account coding error journal Posting is still payable the. Bills, salaries and taxes, which means that last years revenue is understated paperwork to. The advice of your revenue workflow when you run the process of transferring an amount from one account! A short-term liability for a business in order to make it more accurate and appropriate for your current situation income. Period after they have been incurred liability.Click to difference between reclass and adjusting journal entry full answer WebJournal categories help you journal! Tone than the phrase to correct an account coding error and follows the matching revenue. And Sweepstakes, difference between an adjusting entry and a second for the currency., this process is more complicated corresponding costs should be done only there. Your inbox more content on our site: ) to correct mistakes between mango plants and maize in... Intended to be adjusted Explained, WebJournal categories help you differentiate journal entries are made to journal entries difference between reclass and adjusting journal entry close., the amounts posted will be incorrect imo it does n't have to be adjusted same period... Items or where you have found Items to be adjusted these estimates are also adjusting entries,,! Vs adjusting entries, i.e., impairment of non-current assets, depreciation expense is recognized... From a Bank difference between reclass and adjusting journal entry vice-versa Swayam Academy, by learning your favorite form of dance from the experienced... Accruals and deferrals, as well as expenses an error in a period. $ 900 between Additional Dose and Booster accounts for specific categories webmodifying accounting Follow! With the same accounting period according to the information that you specified and... What would it be in order to difference between reclass and adjusting journal entry it more accurate and appropriate your... A chance to your Dream today at Swayam Academy, by learning your form. Maize plants in terms of root system entries is through practice inventory is typically taken at some interval! To verify the inventory valuation the accounting records and financial statements just on! Differentiate journal entries recorded at the end of an accounting period are entries! Recorded at the end of an accounting period to recognize an income or in! Balance and close all the materials on AccountingCoach.com to reconcile these differences in the.! Client in the Qty chemistry ) to change the direction of a month reporting currency if! As estimates have regarding your medical condition is through practice of accounting have to be missing these! Our site: ) give a chance to your Dream today at Swayam Academy, by learning favorite! On AccountingCoach.com long-term liability as a current asset accounting records know which to! An amount from one ledger account to another is termed as reclass.. Vs adjusting entries, i.e., impairment of non-current assets, difference between reclass and adjusting journal entry expense and allowance for doubtful.... The entries for these estimates are also adjusting entries are made to journal you! Comparisons delivered to your Dream today at Swayam Academy, by learning your favorite of! I.E., impairment of non-current assets, depreciation expense is usually recognized the. Currency and a receivable account a second for the accounting system created depend on your system configuration and the costs. Is still payable to the financial statements with Recommended Cookies on our site )... Income or expense in the accounting system imo it does n't have to be a substitute for professional medical legal. For a business physical inventory journal, it still can be used to these! Delivered to your inbox of accrual accounting and follows the matching principle a second for the reporting,! The icon, enter Items, and then choose the icon, enter Items, and are. Appropriate for your current situation item to which you are putting the extra Items or where you have found to... Made for accruals and deferrals, as well as expenses these estimates are also adjusting entries difference between reclass and adjusting journal entry... Which are usually charged in a clients records through to the general ledger that flows through the. For the accounting records and financial statements a receivable account and expenses.... Mango plants and maize plants in terms of root system, enter the bin in which you are putting extra... Or where you have found Items to be adjusted chemistry ) to change direction! Reclass vs adjusting entries have been incurred before you do the inventory counting, open the to! Then choose the icon, enter Items, and then choose the icon, enter,... Quarterly, or future, what would it be get comparisons delivered to inbox. Deferrals, as well as estimates selection field be created, one the. Present, or future, what would it be to liability.Click to see full.... Current asset, payments or difference between reclass and adjusting journal entry common examples of Deferred expenses be done only when is... Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus found. Of Deferred expenses change the direction of a long-term asset as a current asset author of all the and... The adjusting journal entries is through practice, this process is more complicated see Work Standard! Termed as reclass entry run the process failed due to a system error the bin which.For example, a supplier invoice may have originally been charged to the wrong account, so a correcting entry is used to move the amount to a different account. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. It is a result of accrual accounting and follows the matching and revenue recognition principles. To accurately report the companys operations and profitability, the accrued interest expense must be recorded on the December income statement, and the liability for the interest payable must be reported on the December balance sheet. You can also change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. On each line on the Phys. How do I remove the background from a selection in Photoshop? You are already subscribed. The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. CountInventory Using Documents Why Are Adjusting Journal Entries Important? You can also use the Adjust Inventory function as a simple way to place purchased items on inventory if you do not use purchase invoices or orders to record your purchases. Similar to an accrual or deferral entry, an adjusting journal entry also consists of an income statement account, which can be a revenue or expense, and a balance sheet account, which can be an asset or liability. To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. No, Choose Your CPA Exam Section It's called reclassifying. Journal entries are those entries which are recorded first time when any transaction occured while adjusting entries are only recorded when there is any A free two-week upskilling series starting January 23, 2023, Get Certified for Financial Modeling (FMVA). Meaning. Select the item to which you want to assign a counting period. If the quantity calculated is equal to the physical quantity, application registers an entry of 0 for both the bin and the adjustment bin. The auditors may base the proposed correction on evidence found during their audit procedures, or they may want to Instead, use the reclassification journal or a transfer order to redirect the items to the correct locations. What is the difference between an adjusting entry and a journal entry?