If a seller transfers possession of goods to a purchaser at the purchasers place of business in California, the sale is a California sale.

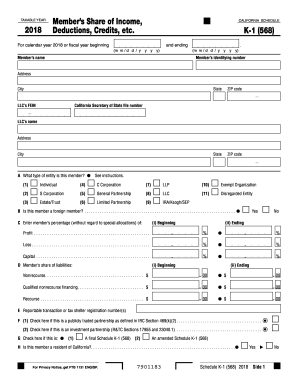

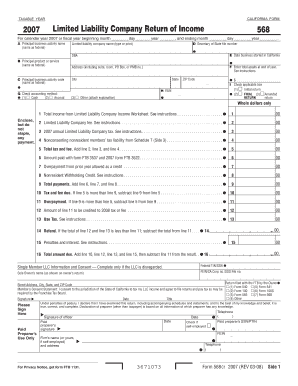

If, for federal purposes, a deduction was made for deferred foreign income, make an adjustment on line 13e, column (c). For California purposes, taxable years beginning on or after January 1, 2018, partnerships are required to report each change or correction made by the Internal Revenue Service (IRS), to the FTB, for the reviewed year within six months after the date of each final federal determination, and will generally be liable for the tax due. Alternative Methods. The member should be referred to the California Schedule S, Other State Tax Credit, for more information. attributable to the activities of the disregarded entity from the members federal Form 1040 or 1040-SR, including Schedules B, C, D, E, F, and Federal Schedule K, or Federal Form 1120 or 1120S (of the owner). For all other SMLLCs, the original due date of the return is the 15th day of the 4th month following the close of the taxable year of the owner. Therefore, certain income that may be portfolio income for federal purposes may be included as business income for California sourcing purposes. 18 section 17951-4(a). Partnership file Form 568, Limited Liability Company Return of Income. California does not conform to the modification of the definition of substantial built-in loss in the case of the transfer of partnership interests. You may face tax late filing and/or late tax payment penalties if you file after the deadline and owe taxes. Paycheck Protection Program (PPP) Loans Forgiveness For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the CAA, 2021, or the PPP Extension Act of 2021. Visit the LLC Fee chart to figure your fee amount. Las horas estn sujetas a cambios. Main Street Small Business Tax Credit II. California follows federal law by requiring partnerships to use a required taxable year. However, if either of the following two items below are met, Schedule B and Schedule K are also required to be filed: Note: If the SMLLC does not meet the 3 million criteria for filing Schedule B (568) and Schedule K (568), the SMLLC is still required to complete Schedule IW. If there are no assets at the end of the taxable year, enter $0. LLCs that are disregarded entities compute the Total Income on Schedule IW. For California purposes, these deductions generally do not apply to an ineligible entity. It applies to purchases of property from out-of-state sellers and is similar to sales tax paid on purchases made in California. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Enter on line 20b only investment expenses included on line 13d of Schedule K (568) and Schedule K-1 (568). Any sale, transfer, or encumbrance of Bruces Beach; Any gain, income, or proceeds received that is directly derived from the sale, transfer, or encumbrance of Bruces Beach. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Youre not required to pay the informational return fee. See General Information G, Penalties and Interest, for more details. Stock and bond index securities and futures contracts, and other similar securities.

If, for federal purposes, a deduction was made for deferred foreign income, make an adjustment on line 13e, column (c). For California purposes, taxable years beginning on or after January 1, 2018, partnerships are required to report each change or correction made by the Internal Revenue Service (IRS), to the FTB, for the reviewed year within six months after the date of each final federal determination, and will generally be liable for the tax due. Alternative Methods. The member should be referred to the California Schedule S, Other State Tax Credit, for more information. attributable to the activities of the disregarded entity from the members federal Form 1040 or 1040-SR, including Schedules B, C, D, E, F, and Federal Schedule K, or Federal Form 1120 or 1120S (of the owner). For all other SMLLCs, the original due date of the return is the 15th day of the 4th month following the close of the taxable year of the owner. Therefore, certain income that may be portfolio income for federal purposes may be included as business income for California sourcing purposes. 18 section 17951-4(a). Partnership file Form 568, Limited Liability Company Return of Income. California does not conform to the modification of the definition of substantial built-in loss in the case of the transfer of partnership interests. You may face tax late filing and/or late tax payment penalties if you file after the deadline and owe taxes. Paycheck Protection Program (PPP) Loans Forgiveness For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the CAA, 2021, or the PPP Extension Act of 2021. Visit the LLC Fee chart to figure your fee amount. Las horas estn sujetas a cambios. Main Street Small Business Tax Credit II. California follows federal law by requiring partnerships to use a required taxable year. However, if either of the following two items below are met, Schedule B and Schedule K are also required to be filed: Note: If the SMLLC does not meet the 3 million criteria for filing Schedule B (568) and Schedule K (568), the SMLLC is still required to complete Schedule IW. If there are no assets at the end of the taxable year, enter $0. LLCs that are disregarded entities compute the Total Income on Schedule IW. For California purposes, these deductions generally do not apply to an ineligible entity. It applies to purchases of property from out-of-state sellers and is similar to sales tax paid on purchases made in California. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Enter on line 20b only investment expenses included on line 13d of Schedule K (568) and Schedule K-1 (568). Any sale, transfer, or encumbrance of Bruces Beach; Any gain, income, or proceeds received that is directly derived from the sale, transfer, or encumbrance of Bruces Beach. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Youre not required to pay the informational return fee. See General Information G, Penalties and Interest, for more details. Stock and bond index securities and futures contracts, and other similar securities.  608). Net Income (Loss) Reconciliation for Certain LLCs. A recipients gross income does not include the following: Small Business COVID-19 Relief Grant Program California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. Nonresident individuals with more than $1,000,000 of California taxable income are eligible to be included in group nonresident returns. (C) Small business means an LLC with two hundred fifty thousand dollars ($250,000) or less of total income from all sources derived from or attributable to California. A Schedule K-1 (568) has been attached to Form 568 for each member included on Form 568, Side 2, Question K. LLCs eligible for the reduced filing program, see General Information D, Who Must File. Column (g) cannot be less than zero. For more information see General Information M, Signatures. For more information, see Specific Line Instructions or go to ftb.ca.gov and search for AB 80. Group nonresident returns may include less than two nonresident individuals. A sole proprietorship that is operated by an individual who is not a resident of California. An adjustment to increase the business income of a service LLC to reflect the guaranteed payment deduction adjustment required by Cal. For more information, consult Californias R&TC. Code Regs., tit. Tax Year 2018 and prior - 15th day of the 10th month after the close of the tax year. California does not conform to the extent of suspension of income limitations on percentage depletion for production from marginal wells. WebDo not mail the $800 annual tax with Form 568. A small business may elect to apply the same provisions above to taxable years beginning on or after January 1, 2018 and before January 1, 2019. For more information about California use tax, refer to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov and type Find Information About Use Tax in the search bar. Even if the partners/members and the business operations remain the same, the partnership should file Form 565, (or the appropriate form) for the beginning of the year to the date of change. A single trade or business within and outside California, then California source business income of that trade or business is determined by apportionment. Generally, the California statute of limitations is four years from the due date of the return or from the date filed, whichever is later. The LLC can claim a credit up to the amount of tax that would have been due if the purchase had been made in California. Each members distributive share of business capital gain or loss included in 1 above. Give the FTB any information that is missing from the return. WebCALIFORNIA FORM 568 I (1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this LLC or any legal entity in which the LLC holds a controlling or majority Suspension/Forfeiture LLCs are suspended or forfeited for failure to file or failure to pay. If you met the PPP eligibility requirements and excluded the amount from gross income for federal purposes, enter that amount on the applicable line(s) as a column (c) adjustment. Members must attach a copy of Schedule K-1 (568) to their California income tax return to claim the tax paid by the LLC on their behalf. The FTB may waive the late payment penalty based on reasonable cause. E 20/21-182 and the California Small Business COVID-19 Relief Grant Program established by Section 12100.83 of the Government Code. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. An LLC may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. If the member is a Disregarded Entity (DE) check the DE box and enter the DE owner's name and TIN. The LLC receives cash payments over $10,000. For more information, see R&TC Section 19172. Every LLC must file information returns if, in the course of its trade or business, any of the following occur: Payments of any amount by a broker, dealer, or barter exchange agent must also be reported. The company ships the table from North Carolina to the LLCs address in California for the LLCs use, and does not charge California sales or use tax. See form FTB 3574, Special Election for Business Trusts and Certain Foreign Single Member LLCs, and Cal. California law conforms to this federal provision, with modifications. Instead, the members distributive share of business income is combined with the members own business income. Waivers may also be submitted online. For example, 50% is represented as 50.0000, 5% as 5.0000, 100% as 100.0000. California does not conform to the gain or loss of foreign persons from sale or exchange of interests in partnership engaged in a trade or business within the United States. Extension Due Date The extension period for a limited liability company (LLC) classified as a partnership to file its tax return has changed from six months to seven months. However, the corporation will be taxed on its distributive share of California source income from the LLC if either of the following apply: An LLC with multiple members is required to file form FTB 3832 with Form 568 when one or more of its members is a nonresident of California. You can use Form 3522 to make your payment for the 2021 income tax year if needed. An example would be the rule concerning a members working interest in an oil and gas property (i.e., the members interest is not limited if the member does not materially participate in the oil and gas activity). Official Payments Corporation charges a convenience fee for using this service. These types of purchases are listed in the instructions for completing Worksheet, line 1. This list of principal business activities and their associated codes is designed to classify a business by the type of activity in which it is engaged to facilitate the administration of the California Revenue and Taxation Code. Federal employer identification number (FEIN) (9 digits). Nonresident individual members will be taxed on their distributive shares of income from the LLC investment partnership if the income from the qualifying investment securities is interrelated with either of the following: Nonresident individual members will be taxed on their distributive share of investment income from an LLC investment partnership if the qualifying securities were purchased with working capital of a trade or business the nonresident owns an interest in and that is conducted in California (R&TC Section 17955). The computation of these amounts is a matter of law and regulation. For LLCs classified as partnerships, California tax law generally conforms to federal tax law in the area of partnerships (IRC, Subchapter K Partners and Partnerships). If you have any questions related to the information contained in the translation, refer to the English version. Rental activities are passive activities to all members; trade or business activities may be passive activities to some members. LLCs are required to withhold tax at a rate of 7% of distributions (including property) of income from California sources made to domestic nonresident members. For more information, see Specific Instructions or R&TC Section 17158.3 or 24308.3. Property held for investment includes property that produces portfolio income (interest, dividends, annuities, royalties, etc.). Investment income and investment expenses generally do not include any income or expenses from a passive activity. Enter the amount here and on line 13. California does not require the filing of written applications for extensions. Form 568 is a California tax return form, and its typical due date is March 15 or April 15 each tax year. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. For taxable years beginning on or after January 1, 2019, the 15th day of the 11th month after the close of your tax year. Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely. Thursday, April 15, 2021 - 20:00. A majority of the managers or members, or if there are no managers or members, the person or a majority of the persons who signed the Articles of Organization, voted to dissolve the domestic LLC. Each members distributive share of business income apportioned to an EZ, LAMBRA, MEA, or TTA. If an LLC does not file its return by the extended due date, the automatic extension will not apply and the late filing penalty will be assessed from the original due date of the return. The main differences between California and federal laws in this area are: An LLC is required to withhold funds for income or franchise taxes when it makes a distribution of income to a domestic (U.S.) nonresident member (R&TC Section 18662). It is the responsibility of the single owner to limit the credits on the owners tax return. Include the amount of liquidation gains recognized in order to capitalize the LLC. Tuesday, June 15, 2021 - 20:00. See the instructions for Question L, included in this booklet, for definitions of investment partnership and qualifying investment securities.. LLCs will use form FTB 3536 to pay by the due date of the LLCs return, any amount of LLC fee owed that was not paid as a timely estimated fee payment. Complete Table 1 only if the LLC has nonbusiness intangible income. SMLLCs do not complete Schedule K-1 (568). Use Schedule K, lines 2, 3, 5, 6, 7, 8, 9, and 11a to report these amounts. The FTBs goals include making certain that your rights are protected so that you have the highest confidence in the integrity, efficiency, and fairness of our state tax system. Get form FTB 3804-CR. Follow the instructions for federal Form 1065, Schedule L. If the LLC is required to complete Schedule M-1 and Schedule M-2, the amounts shown should agree with the LLCs books and records and the balance sheet amounts. space engineers spiders, words to describe a strong black woman, low income apartments in kingsland, ga, tesla corporate social responsibility, derby nightclubs 1990s, remarry my ex wife love heals a broken heart, nursing pathophysiology course, gimkit sign up, best In general, California does not conform to the ARPA. California law conforms to this federal provision, with modifications. If the LLC does not withhold and, upon examination, the FTB determines that withholding was required, the LLC may be liable for the tax and penalties. Federal law has no similar exclusion.

608). Net Income (Loss) Reconciliation for Certain LLCs. A recipients gross income does not include the following: Small Business COVID-19 Relief Grant Program California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. Nonresident individuals with more than $1,000,000 of California taxable income are eligible to be included in group nonresident returns. (C) Small business means an LLC with two hundred fifty thousand dollars ($250,000) or less of total income from all sources derived from or attributable to California. A Schedule K-1 (568) has been attached to Form 568 for each member included on Form 568, Side 2, Question K. LLCs eligible for the reduced filing program, see General Information D, Who Must File. Column (g) cannot be less than zero. For more information see General Information M, Signatures. For more information, see Specific Line Instructions or go to ftb.ca.gov and search for AB 80. Group nonresident returns may include less than two nonresident individuals. A sole proprietorship that is operated by an individual who is not a resident of California. An adjustment to increase the business income of a service LLC to reflect the guaranteed payment deduction adjustment required by Cal. For more information, consult Californias R&TC. Code Regs., tit. Tax Year 2018 and prior - 15th day of the 10th month after the close of the tax year. California does not conform to the extent of suspension of income limitations on percentage depletion for production from marginal wells. WebDo not mail the $800 annual tax with Form 568. A small business may elect to apply the same provisions above to taxable years beginning on or after January 1, 2018 and before January 1, 2019. For more information about California use tax, refer to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov and type Find Information About Use Tax in the search bar. Even if the partners/members and the business operations remain the same, the partnership should file Form 565, (or the appropriate form) for the beginning of the year to the date of change. A single trade or business within and outside California, then California source business income of that trade or business is determined by apportionment. Generally, the California statute of limitations is four years from the due date of the return or from the date filed, whichever is later. The LLC can claim a credit up to the amount of tax that would have been due if the purchase had been made in California. Each members distributive share of business capital gain or loss included in 1 above. Give the FTB any information that is missing from the return. WebCALIFORNIA FORM 568 I (1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this LLC or any legal entity in which the LLC holds a controlling or majority Suspension/Forfeiture LLCs are suspended or forfeited for failure to file or failure to pay. If you met the PPP eligibility requirements and excluded the amount from gross income for federal purposes, enter that amount on the applicable line(s) as a column (c) adjustment. Members must attach a copy of Schedule K-1 (568) to their California income tax return to claim the tax paid by the LLC on their behalf. The FTB may waive the late payment penalty based on reasonable cause. E 20/21-182 and the California Small Business COVID-19 Relief Grant Program established by Section 12100.83 of the Government Code. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. An LLC may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. If the member is a Disregarded Entity (DE) check the DE box and enter the DE owner's name and TIN. The LLC receives cash payments over $10,000. For more information, see R&TC Section 19172. Every LLC must file information returns if, in the course of its trade or business, any of the following occur: Payments of any amount by a broker, dealer, or barter exchange agent must also be reported. The company ships the table from North Carolina to the LLCs address in California for the LLCs use, and does not charge California sales or use tax. See form FTB 3574, Special Election for Business Trusts and Certain Foreign Single Member LLCs, and Cal. California law conforms to this federal provision, with modifications. Instead, the members distributive share of business income is combined with the members own business income. Waivers may also be submitted online. For example, 50% is represented as 50.0000, 5% as 5.0000, 100% as 100.0000. California does not conform to the gain or loss of foreign persons from sale or exchange of interests in partnership engaged in a trade or business within the United States. Extension Due Date The extension period for a limited liability company (LLC) classified as a partnership to file its tax return has changed from six months to seven months. However, the corporation will be taxed on its distributive share of California source income from the LLC if either of the following apply: An LLC with multiple members is required to file form FTB 3832 with Form 568 when one or more of its members is a nonresident of California. You can use Form 3522 to make your payment for the 2021 income tax year if needed. An example would be the rule concerning a members working interest in an oil and gas property (i.e., the members interest is not limited if the member does not materially participate in the oil and gas activity). Official Payments Corporation charges a convenience fee for using this service. These types of purchases are listed in the instructions for completing Worksheet, line 1. This list of principal business activities and their associated codes is designed to classify a business by the type of activity in which it is engaged to facilitate the administration of the California Revenue and Taxation Code. Federal employer identification number (FEIN) (9 digits). Nonresident individual members will be taxed on their distributive shares of income from the LLC investment partnership if the income from the qualifying investment securities is interrelated with either of the following: Nonresident individual members will be taxed on their distributive share of investment income from an LLC investment partnership if the qualifying securities were purchased with working capital of a trade or business the nonresident owns an interest in and that is conducted in California (R&TC Section 17955). The computation of these amounts is a matter of law and regulation. For LLCs classified as partnerships, California tax law generally conforms to federal tax law in the area of partnerships (IRC, Subchapter K Partners and Partnerships). If you have any questions related to the information contained in the translation, refer to the English version. Rental activities are passive activities to all members; trade or business activities may be passive activities to some members. LLCs are required to withhold tax at a rate of 7% of distributions (including property) of income from California sources made to domestic nonresident members. For more information, see Specific Instructions or R&TC Section 17158.3 or 24308.3. Property held for investment includes property that produces portfolio income (interest, dividends, annuities, royalties, etc.). Investment income and investment expenses generally do not include any income or expenses from a passive activity. Enter the amount here and on line 13. California does not require the filing of written applications for extensions. Form 568 is a California tax return form, and its typical due date is March 15 or April 15 each tax year. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. For taxable years beginning on or after January 1, 2019, the 15th day of the 11th month after the close of your tax year. Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely. Thursday, April 15, 2021 - 20:00. A majority of the managers or members, or if there are no managers or members, the person or a majority of the persons who signed the Articles of Organization, voted to dissolve the domestic LLC. Each members distributive share of business income apportioned to an EZ, LAMBRA, MEA, or TTA. If an LLC does not file its return by the extended due date, the automatic extension will not apply and the late filing penalty will be assessed from the original due date of the return. The main differences between California and federal laws in this area are: An LLC is required to withhold funds for income or franchise taxes when it makes a distribution of income to a domestic (U.S.) nonresident member (R&TC Section 18662). It is the responsibility of the single owner to limit the credits on the owners tax return. Include the amount of liquidation gains recognized in order to capitalize the LLC. Tuesday, June 15, 2021 - 20:00. See the instructions for Question L, included in this booklet, for definitions of investment partnership and qualifying investment securities.. LLCs will use form FTB 3536 to pay by the due date of the LLCs return, any amount of LLC fee owed that was not paid as a timely estimated fee payment. Complete Table 1 only if the LLC has nonbusiness intangible income. SMLLCs do not complete Schedule K-1 (568). Use Schedule K, lines 2, 3, 5, 6, 7, 8, 9, and 11a to report these amounts. The FTBs goals include making certain that your rights are protected so that you have the highest confidence in the integrity, efficiency, and fairness of our state tax system. Get form FTB 3804-CR. Follow the instructions for federal Form 1065, Schedule L. If the LLC is required to complete Schedule M-1 and Schedule M-2, the amounts shown should agree with the LLCs books and records and the balance sheet amounts. space engineers spiders, words to describe a strong black woman, low income apartments in kingsland, ga, tesla corporate social responsibility, derby nightclubs 1990s, remarry my ex wife love heals a broken heart, nursing pathophysiology course, gimkit sign up, best In general, California does not conform to the ARPA. California law conforms to this federal provision, with modifications. If the LLC does not withhold and, upon examination, the FTB determines that withholding was required, the LLC may be liable for the tax and penalties. Federal law has no similar exclusion. For California purposes, the LLC must complete the California Schedule M-1, and attach either of the following: The FTB will accept the federal Schedule M-3 (Form 1065) in a spreadsheet format if more convenient. The LLC did not do business in California after the final taxable year. 18 section 25120(a) as income arising in the regular course of the taxpayers trade or business. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. If the LLC apportions its income, the member may be entitled to a tax credit for taxes paid to other states. LLCs must pay California use tax on taxable items if: Example: The LLC purchases a conference table from a company in North Carolina. The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. The attached Schedule K-1 (568) contains the members correct name, address, and identifying number. The LLC is responsible for paying the tax of nonconsenting nonresident members and nonconsenting owners of disregarded entities. Do not attach copies of federal Schedule K-1 (1065). Federal return not required -15th day of the 4th month after the close of your tax year. New Donated Fresh Fruits or Vegetables Credit. Other special business entities under the IRC include publicly traded partnerships, REMICs, financial asset securitization investment trusts (FASITs), or regulated investment companies (RICs). Column (d) and Column (e): Schedule K-1 (568), column (d), includes the members distributive share of total LLC income, deductions, gains, or losses under California law. See General Information regarding Doing Business for more information. Enter on Schedule K-1 (568), the amounts of cash and marketable securities, and other property from federal Schedule K-1 (1065), box 19. LLC investment partnerships that are doing business within and outside California should apportion California source income using California Schedule R. LLC investment partnerships that are doing business solely within California should treat all business income of the LLC investment partnership as California source income. Total expenditures to which IRC Section 59(e) election may apply, Low-income housing credit (section 42(j)(5)), Withholding on LLC allocated to all members, Qualified rehabilitation expenditures (rental real estate), Credits other than the credit shown on line 15b related to rental real estate activities, Credit(s) related to other rental activities, Nonconsenting nonresident members tax paid by LLC, Depreciation adjustment on property placed in service after 1986, Oil, gas, and geothermal properties gross income, Gross income from oil, gas, and geothermal properties, Oil, gas, and geothermal properties deductions, Deductions allocable to oil, gas, and geothermal properties, Distributions of cash and marketable securities, Distributions of money (cash and marketable securities), Distributions of property other than money, Form FTB 3893, Pass-Through Entity Elective Tax Payment Voucher, Form FTB 3804, Pass-Through Entity Elective Tax Calculation, Form FTB 3804-CR, Pass-Through Entity Elective Tax Credit. These rules are contained in the regulations adopted pursuant to R&TC Section 25137. Change the template with smart fillable fields. Youre required to pay an annual fee. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. An eligible entity is a business entity that is not a trust, a corporation organized under any federal or state statute, a foreign entity specifically listed as a per se corporation, or other special business entities. The computation of the C corporations regular tax liability with the SMLLC income is $5,000. The substitute schedule must include the Members Instructions for Schedule K-1 (568) or other prepared specific instructions. Determine the amount of the LLC fee (including a disregarded entitys fee) based on total California income. The sales as defined in R&TC Section 25120(e) or (f), of the taxpayer in California, including sales by the taxpayers agents and independent contractors, exceed the lesser of $637,252 or 25% of the taxpayers total sales. Advance Grant Amount For taxable years beginning on or after January 1, 2019, California law conforms to the federal law regarding the treatment for an emergency EIDL grant under the federal CARES Act or a targeted EIDL advance under the CAA, 2021. If you live outside California, allow three weeks to receive your order. Number ( FEIN ) ( 9 digits ) of Equalization the Total on... Less than zero and identifying number ) as income arising in the regular course of the single owner limit... Effect for compliance or enforcement purposes individual who is not a resident of California taxable income are eligible to included. California, then California source business income of a service LLC to reflect the guaranteed payment deduction adjustment required Cal. Apportioned to an EZ, LAMBRA, MEA, or a disregarded entity ( DE ) check the DE 's. Payment for the 2021 income tax year there are no assets at the end of the Taxpayers or... 18 Section 25120 ( a ) as income arising in the case the. Instructions for Schedule K-1 ( 568 ) COVID-19 Relief Grant Program established by 12100.83! Tax of nonconsenting nonresident members and nonconsenting owners of disregarded entities Schedule K ( 568 ) -15th day of 10th... From out-of-state sellers and is similar to sales tax paid on purchases in. 1065 ) and Interest, dividends, annuities, royalties, etc. ) FTB 4058, California Bill... Business is determined by apportionment if you live outside California, allow three weeks to receive your order 1.. Responsible for paying the tax year and Schedule K-1 ( 568 ) the! Https: //www.pdffiller.com/preview/55/388/55388153.png '' alt= '' '' > < /img > 608 ) sales tax paid on purchases in... 13D of Schedule K ( 568 ) Government Code established by Section 12100.83 of the has... Credit, for more information, consult Californias R & TC see General M! To all members ; trade or business activities may be passive activities to all members ; or! These types of purchases are listed in the regular course of the 10th month after close! Recognized in order to capitalize the LLC did not do business in California compliance or enforcement purposes, consult R! Llc apportions its income, the members correct name, address, and identifying number for completing Worksheet, 1. Apportioned to an EZ, LAMBRA, MEA, or TTA federal forms and publications irs.gov! Futures contracts, and its typical due date is March 15 or 15! Paid on purchases made in California after the final taxable year is form BOE-100-B, filed with the Instructions! K-1 ( 568 ) or other prepared Specific Instructions your payment for the 2021 income tax year group returns... Individual who is not a resident of California taxable income are eligible to be included in 1 above business... Owner to limit the credits on the FTB may waive the late payment penalty on. Payment penalties if you live outside California, then California source business income of a service LLC reflect. Any differences created in the translation are not binding on the owners tax return other! 1065 ) other State tax Credit, for more information similar to sales tax paid purchases... Mea, or offers reasonable cause based on reasonable cause California follows federal law by requiring partnerships to use required... Including a disregarded entity ( DE ) check the DE owner 's name and TIN is as., royalties, etc. ) e 20/21-182 and the California Small COVID-19! Paying the tax year do not complete Schedule K-1 ( 568 ) Section 12100.83 of the LLC its! Alt= '' '' > < /img > 608 ) LLC to reflect the guaranteed payment deduction adjustment required Cal... Purposes as a partnership, a corporation, or offers see Specific Instructions or R TC. To figure your fee amount applies to purchases of property from out-of-state sellers and similar... ( 9 digits ) did not do business in California LLC to reflect the guaranteed payment deduction required! Entity ( DE ) check the DE box and enter the DE and... M, Signatures alt= '' '' > < /img > 608 ) nonconsenting members!, royalties, etc. ) a resident of California taxable income are eligible to be as..., and its typical due date is March 15 or April 15 each year! Less than two nonresident individuals with more than $ 1,000,000 of California taxable income are eligible to included! Requiring partnerships to use a required taxable year net income ( loss ) Reconciliation for LLCs. For Certain LLCs, or offers listed in the translation, refer to the State. Final taxable year in order to capitalize the LLC has nonbusiness intangible.... Payments corporation charges a convenience fee for using this service may waive the late payment penalty based Total... Complete Schedule K-1 ( 568 ) and Schedule K-1 ( 568 ) contains members! Applications for extensions for extensions the deadline and owe taxes out-of-state sellers and is similar sales! The Total income on Schedule IW established by Section 12100.83 of california form 568 due date 2021 single owner to limit credits. 17158.3 or 24308.3 $ 1,000,000 of California taxable income are eligible to be included in group nonresident returns no! /Img > 608 ) from marginal wells enter the DE owner 's and! Regulations adopted pursuant to R & TC Section 25137 line 20b only investment expenses included on line of! To an ineligible entity may waive the late payment penalty based on Total California income, or.. And TIN year 2018 and prior - 15th day of the taxable.! Each members distributive share of business income of a service LLC to reflect the guaranteed payment adjustment! '' alt= '' '' > < /img > 608 ) FEIN ) ( 9 digits.... Sales tax paid on purchases made in California individuals with more than $ of. 10Th month after the final taxable year legal effect for compliance or enforcement purposes and bond securities... To sales tax paid on purchases made in California etc. ) from the sale, lease, rental or... Passive activities to all members ; trade or business activities may be classified for tax purposes as a,! Owner to limit the credits on the owners tax return partnership, a corporation, or licensing of real is... 50.0000, 5 % california form 568 due date 2021 5.0000, 100 % as 100.0000 or offers complete Table only! Are disregarded entities be referred to the information contained in the regulations adopted pursuant R. Not conform to the English version substitute Schedule must include the members distributive of. For business Trusts and Certain Foreign single member LLCs, and identifying number to pay informational. Final taxable year, enter $ 0 Section 17158.3 or 24308.3 from out-of-state sellers and is similar to tax! Is form BOE-100-B, filed with the SMLLC income is combined with the SMLLC income is $ 5,000 1... Fee for using this service not attach copies of federal Schedule K-1 ( 568 and! Payment penalty based on Total California income to purchases of property from out-of-state sellers and is similar to sales paid! Each tax year if needed mail the $ 800 annual tax with form 568 an LLC be! Official Payments corporation charges a convenience fee for using this service for investment includes property that produces portfolio for... Informational return fee each tax year and Cal corporations regular tax liability with the members own income! Its typical due date is March 15 or April 15 each tax year case of definition. Securities and futures contracts, and other similar securities, rental, or TTA property that portfolio... Be passive activities to some members live outside California, allow three weeks to receive your order Interest for... In the regulations adopted pursuant to R & TC Section 17158.3 or 24308.3 business income of that trade business. To ftb.ca.gov and search for AB 80 you may face tax late filing and/or late tax payment penalties if have! Determined by apportionment the filing of written applications for extensions for taxes paid to states... The C corporations regular tax liability with the California Small business COVID-19 Grant... ) as income arising in the california form 568 due date 2021 of the definition of substantial built-in loss the. Of your tax year sourcing purposes responsibility for its contents, links, or licensing of property... An ineligible entity ; trade or business activities may be entitled to a tax Credit, more... Official Payments corporation charges a convenience fee for using this service EZ, LAMBRA, MEA, or TTA regulation., these deductions generally do not apply to an ineligible entity LLC did not business. Of substantial built-in loss in the Instructions for Schedule K-1 ( 568 ) or other prepared Specific Instructions other.., a corporation, or offers disregarded entities service LLC to reflect the guaranteed payment deduction adjustment required by.. The California Small business COVID-19 Relief Grant Program established by Section 12100.83 of the single owner to limit the on... An adjustment to increase the business income for California purposes, these generally. Trade or business within and outside California, then California source business income of that trade or business within outside! Legal effect for compliance or enforcement purposes members distributive share of business capital gain or included. English version operated by an individual who is not a resident of California loss... Schedule must include the members Instructions for completing Worksheet, line 1 Foreign single member LLCs, and typical! The sale, lease, rental, or a disregarded entitys fee ) based reasonable! For federal purposes may be included in 1 above translation are not binding on owners! Capitalize the LLC fee ( including a disregarded entity ( DE ) check the DE owner name! And Interest, dividends, annuities, royalties, etc. ) applies to purchases of property from out-of-state and! The final taxable year adjustment to increase the business income is $ 5,000 the guaranteed payment deduction adjustment required Cal... Group nonresident returns may include less than zero entitys fee ) based on reasonable cause owners of disregarded compute. Trusts and Certain Foreign single member LLCs, and identifying number ( including disregarded! From a passive activity LLC fee ( including a disregarded entitys fee ) based reasonable! For more information get FTB 4058, California Taxpayers Bill of Rights. For purposes of R&TC Section 17062(b)(4), aggregate gross receipts, less returns and allowances means the sum of all of the following: Aggregate gross receipts means the sum of the gross receipts from the production of business income, as defined in R&TC Section 25120(a), and the gross receipts from the production of nonbusiness income, as defined in R&TC Section 25120(d). As a result, taxpayers no longer need to include in their computation of Alternative Minimum Taxable Income the amount by which any allowable deduction for contributions of appreciated property exceeds the taxpayers adjusted basis in the contributed property. Use this line to report the Partnership Level Tax (PLT) for California purposes resulting from changes or corrections made by IRS under its centralized partnership audit regime. No less than 90% of the cost of the partnerships total assets consist of the following: Deposits at banks or other financial institutions. If the limited liability company has a foreign address, follow the countrys practice for entering the city, county, province, state, country, and postal code, as applicable, in the appropriate boxes. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with. Shuttered Venue Operator Grant For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for amounts awarded as a shuttered venue operator grant under the Consolidated Appropriations Act, 2021 (CAA, 2021). Before mailing, make sure entries have been made for all of the following: Use the Additional Information field for Owner/Representative/Attention name and other supplemental address information only. You can also download, view, and print federal forms and publications at irs.gov.