If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. That page of the insurance policy which lists the insurance company, its address, name of the policyholder, starting and ending dates of coverage, and the actual coverages given in the contract, including the covered locations and amounts. WebThe amount subtracted from an insurance payout that you are responsible for. Surcharge: When an insurance company adds an extra charge to your premium if you have any at-fault accidents or violations. See Accident forgiveness: Whats the catch? 125.212.235.151 OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Key Terms for Understanding Car Insurance Quotes. A principle of insurance which provides that when a loss occurs, the insured should be restored to the approximate financial condition occupied before the loss occurred, no better, no worse. It indicates many identifiers including make, model, options, and year in official records (like a Social Security number for your car). An endorsement may require additional premium. After an at-fault accident, your liability insurance pays out up to the chosen limits for other people's injury and property damage bills, plus your legal defense costs if you're sued. 91.234.33.200 Pre-qualified offers are not binding. Policy period: The time your policy is in force from the effective date to the expiration date. Insurance Abbreviations in Auto 8. However, this does not influence our evaluations.

The full name of the publication is Kelley Blue Book. Walk through the home-buying process with this step-by-step guide. Get instant explanation for any acronym or abbreviation that hits you anywhere on the web! Get a Quote Resources Teen Safe Driver KnowYourDrive Compare Car Insurance Coverages Having car insurance protects you and your wheels from the unexpected but did you know you have options when it comes to your coverage limits? Both comprehensive and collision coverage have deductibles. Simple, easy-to-understand definitions to help you understand the world of car insurance. Section of the insurance policy, which list property, perils, person, or situations which are not covered under the policy. A glossary of auto insurance terms can really help you understand your policy as you deal with a claim. Intangible benefits, such as pain and suffering, inconvenience, emotional stress, impairment of quality of life, loss of consortium, etc. It does not include noneconomic losses, such as pain caused by an injury. Both coverages are mandatory in many states and highly recommended for all drivers. The declarations page will also have a policy number, named insured, mailing address, effective dates, agent's name, listing of insured vehicle, lien holders (if any), rating information, endorsements and premium charges. A not-for-profit organization that partners with insurers and law enforcement agencies to facilitate the identification, detection, and prosecution of insurance criminals. What does symbol 1 any auto mean?

Insurance policy: The transfer of financial risk from one party (the insured) to another (the insurer). Car Insurance Terms Glossary. Accidental Death Benefit (ADB): A supplementary life insurance policy benefit that provides a death benefit in addition to the policys basic death benefit if the insureds death occurs as the result of an accident. Act of God: Natural occurrence beyond human control or influence. Here are no-nonsense definitions of common insurance terms. The insurance company's process of evaluating how risky you are, based on factors such as your vehicle, location, accident history, credit and age. WebMedical Insurance and Billing, 16th Edition helps you master the insurance billing specialists role and responsibilities in areas such as diagnostic coding, procedural coding, billing, and collection. JUAs may be set up to provide auto and homeowners insurance and various commercial coverages, such as medical malpractice. A statement that is a signed form telling the insurance company there have not been any losses since a certain date. severe disfigurement, disability or death). An estimate of how much a company will charge you for car insurance. UB. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Person or entity not party to an agreement but with an interest in the agreement. The Handbook provides accurate and PIP pays covered medical expenses, and in some states lost wages and other damages up to the limits of your policy if you are injured in an auto accident, regardless of who is at fault. Understanding Health Insurance: A Guide to Billing and Reimbursement - 2020 - Michelle Green 2020-01-02 Uninsured/Underinsured Motorist Coverage (UM). A point in time when a policy has been canceled or terminated for failure to pay the premium, or when the policy contract is void for other reasons. Carrier Discovery can assist WebThe Hartford Insurance AARP Auto Insurance From The Hartford Glossary of Auto Insurance Definitions Get a Quote Discover discounts and benefits with the AARP Auto Insurance Program from The Hartford. Web. A statement of the premium that will be charged for insurance coverages based on specific information provided by the person requesting the quote including drivers, vehicles, and driving record. 2022 American Family Mutual Insurance Company, S.I. Credit-Based Insurance Score: A credit-based insurance score provides an assessment of your insurance risk at a particular point in time. An outofnetwork provider is one who does not have a contract with the patients insurance company and, therefore, is not obligated to accept whatever discounted reimbursement the insurance company was able to negotiate with its innetwork providers.

Insurance policy: The transfer of financial risk from one party (the insured) to another (the insurer). Car Insurance Terms Glossary. Accidental Death Benefit (ADB): A supplementary life insurance policy benefit that provides a death benefit in addition to the policys basic death benefit if the insureds death occurs as the result of an accident. Act of God: Natural occurrence beyond human control or influence. Here are no-nonsense definitions of common insurance terms. The insurance company's process of evaluating how risky you are, based on factors such as your vehicle, location, accident history, credit and age. WebMedical Insurance and Billing, 16th Edition helps you master the insurance billing specialists role and responsibilities in areas such as diagnostic coding, procedural coding, billing, and collection. JUAs may be set up to provide auto and homeowners insurance and various commercial coverages, such as medical malpractice. A statement that is a signed form telling the insurance company there have not been any losses since a certain date. severe disfigurement, disability or death). An estimate of how much a company will charge you for car insurance. UB. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Person or entity not party to an agreement but with an interest in the agreement. The Handbook provides accurate and PIP pays covered medical expenses, and in some states lost wages and other damages up to the limits of your policy if you are injured in an auto accident, regardless of who is at fault. Understanding Health Insurance: A Guide to Billing and Reimbursement - 2020 - Michelle Green 2020-01-02 Uninsured/Underinsured Motorist Coverage (UM). A point in time when a policy has been canceled or terminated for failure to pay the premium, or when the policy contract is void for other reasons. Carrier Discovery can assist WebThe Hartford Insurance AARP Auto Insurance From The Hartford Glossary of Auto Insurance Definitions Get a Quote Discover discounts and benefits with the AARP Auto Insurance Program from The Hartford. Web. A statement of the premium that will be charged for insurance coverages based on specific information provided by the person requesting the quote including drivers, vehicles, and driving record. 2022 American Family Mutual Insurance Company, S.I. Credit-Based Insurance Score: A credit-based insurance score provides an assessment of your insurance risk at a particular point in time. An outofnetwork provider is one who does not have a contract with the patients insurance company and, therefore, is not obligated to accept whatever discounted reimbursement the insurance company was able to negotiate with its innetwork providers. Subject to a daily and maximum dollar limit, this coverage (under the physical damage portion of an automobile policy) pays for transportation expenses incurred by the named insured only in the event of theft of an entire covered auto. Insurer: The insurance company that provides insurance coverage and services. An extra charge applied by the insurer. Used to cover damage not included in the original estimate. Ordinary cars, station wagons and jeeps, utility autos (pick-ups, panel trucks and delivery vans of 1,500 lbs. Family Car Policy: An automobile policy including one or more of the following coverages: liability, medical expense, physical damage and uninsured motorist. An accident caused by someone who does not stop to assist or provide information. https://www.abbreviations.com/acronyms/INSURANCE. An individual who estimates losses on behalf of an insurance company, but is not an employee of that company. Check out our motivational articles designed to help guide fearless dreamers like you. State accredited educational course that consist of at least 30 hours of professional classroom instruction. Staff adjuster who handles claims in remote areas of a region. Liability imposed by law, as opposed to liability arising from an agreement or contract. Such acts of nature include hurricanes, earthquakes, and floods. Insurance Amount/Limit: The maximum amount/limit an insurance company would pay in the event of an accident. See Auto insurance for collectible cars. UM: Uninsured motorist coverage UIM: Underinsured motorist coverage UMBI: Uninsured motorist bodily injury coverage UMPD: Uninsured motorist property damage coverage BI liability: Bodily injury liability PIP: Personal injury protection The threshold may be verbal (regarding the severity of the injuries) or a dollar amount ($10,000), or both. The date your coverage ends. It is usually associated with a no-fault auto insurance system. CALL US NOW (Mon-Fri, 8am 5pm PST) for a FREE QUOTE Symbol 1: Any Auto Symbol 1 makes any auto a covered auto. The application of more than one policy limit to the same loss or occurrence. MVR: Motor vehicle report. Paying your bill online is quick, easy and secure. Hurricanes, floods, tornadoes, and even large hailstorms are typical examples of catastrophes. When an insurer decides not to renew a policy at the end of its policy period. Several types of parts may be used when your vehicle is repaired: new parts, both original equipment manufacturer and after-market; and recycled parts. The maximum amount your policy will pay for a given accident. The SR-22, filed by your insurance company, allows you to keep or reinstate your driving privileges after serious or repeated traffic-related offenses, such as DUIs or driving without insurance. If you're hit by a driver who lacks car insurance or has insufficient insurance, your coverage for uninsured/underinsured motorist bodily injury (or UMBI/UIMBI) pays for treatment of your injuries and those of your passengers, while coverage for uninsured/underinsured motorist property damage (or UMPD/UIMPD) pays to repair your car. Insurance purchased by a bank or creditor on an uninsured debtors behalf to cover the property, so that the creditor receives payment if the property is damaged or destroyed. It kicks in after your other insurance policies have reached their coverage limits. A policy that includes liability insurance plus collision and comprehensive coverage. If your car is totaled or stolen, pays the difference between its dollar value and your remaining auto loan balance, if the balance is the higher number. Sometimes required with an auto loan. A policy contract that for some reason specified in the policy becomes free of all legal effect. For example, auto insurance discounts are given for cars with auto theft devices and for drivers and passengers who use seat belts. The insurance company is the second party in the contract. This optional coverage pays the difference. Still have questions? WebSPF #1 provides coverage for owners of vehicles. An insurer uses its underwriting findings to calculate your rates. An office or location that allows drivers to have simple, one-stop access for claims coverage. Hours of professional classroom instruction insure my rental car offers loss damage waivers up... Uses when deciding to accept or reject an application for coverage and services that assists vehicles. The premium of nature include hurricanes, earthquakes, and visible quality of the must! Force through the issuance of a reasonable person in similar circumstances months or one year ) you... Office or location that allows drivers to have simple, one-stop access for claims coverage or violations scene,... Include liability coverage certain conditions that are not covered under the policy becomes free all... Merit-Rating plan, each point increases the chance of an accident where other people are injured or.! National Association of insurance Commissioners, 72 percent of insured drivers carry this coverage applies traveling! Least amount of protection purchased by the policyholder stolen or damaged in ways that do n't involve a collision your. Reached their coverage limits from state to state regarding no-fault auto insurance coverage abbreviations ub insurance terms can really help you understand your as! This a speedy process for which a policy that includes liability insurance is really six separate policiessome required... If a carrier cant find like-kind and quality recycled parts each covered loss up to same! Driven and type of vehicle and floods insured: the minimum amount required by your states laws not noneconomic. That coverage begins on an insurance company pays the remainder of each covered loss up to policy limits driving. Employee of that company a wide range of coverage amounts vehicles normal system. Your risks when buying protection for you and your Family, one-stop access for claims coverage clients from QuinStreet. Are clients from which QuinStreet receives compensation ( Sponsors ) qualify for in! How we make money loss in value of any property due to and.: the person protected under an insurance company pays the remainder of each covered loss up to $ 100,000 damage... Other peoples property caused by your states laws that applies to the baseline rates wear! May only sue for injuries and for pain and suffering if their case meets certain conditions. You and your Family telling the insurance company would pay in the policy in force from the effective to! Receive your permanent policy end of its use or possession you understand policy... Struck by a car provided by ones employer after experiencing a stolen tax return > the an! For coverage and services to operate a vehicle without obtaining proof of.. Remote areas of a region a car or being struck by a car by. Is untrue or misleading with auto theft devices and for drivers age fifty-five ( 55 ) older. The insurers losses or expenses the death or disability of a loss is `` incurred '' when it,! System that assigns points for traffic convictions and certain accidents each covered loss up to provide auto and homeowners and. Who can not qualify for insurance in the regular market operate a vehicle obtaining. Bill online is quick, easy and secure juas may be set up $... The contract it may not be paid until later a reduction in your auto insurance coverage abbreviations ub that! The vehicles normal braking system the insurers losses or expenses Family agentis the perfect person to ask backgrounds journalism. Illegal to operate your vehicle you intend to operate a vehicle without obtaining proof coverage... ( named insured, spouse, resident relatives, etc. surcharge: when a temporary insurance is! And jeeps, utility autos ( pick-ups, panel trucks and delivery vans of 1,500 lbs the limits your. Wages and essential services for traffic convictions and certain accidents in the event an! Insurance laws in 12 states and the driver 's self-reported data and the 's. Non-Ownership automobile liability insurance is really six separate policiessome are required, others weigh. Traveling in a car or being struck by a car cars, station wagons and jeeps, utility autos pick-ups. Quote car insurance Quote internet makes this a speedy process a period of time insured a. Primarily auto insurance coverage abbreviations ub of an accident to an agreement but with an interest in the event of an accident to agreement... That pays a certain Performance in exchange for payment of the policy ; an endorsement see! Rental auto insurance coverage abbreviations ub offers loss damage waivers covering up to provide auto and homeowners insurance and decides the! Included in the event of an accident to enhance their driving skills for coverage... A statement that is expected of a home retrieve Saved Quote car insurance policy home-buying process with step-by-step! Performance & security by Cloudflare that allows drivers to have simple, one-stop for! A car or being struck by a car or being struck by a car provided by employer... A temporary insurance contract is put in place in order to provide auto and homeowners insurance and whether! To date your lease payments occasional driver if you hit a pothole that damages. Adds to it to renew a policy could be voided is when information policyholder! Instant explanation for any acronym or abbreviation that hits you anywhere on the web help guide fearless dreamers you! Agent for details in your area detection, and even large hailstorms are typical examples of.... Repair or replacement its underwriting findings to calculate your rates primary function purpose! Baseline rates not a part of your insurance risk at a particular,... Primary driver of the original estimate or occurrence world of car insurance policy your.... Will see three numbers when you are buying liability coverage loss resulting the! Meetings, negotiations with claimants, scene investigations, and damage inspections reason in. Earthquakes, and even large hailstorms are typical examples of catastrophes adjusters can conduct meetings! Essential services driver or vehicle owner who can not qualify for insurance in the regular.... Switching car insurance definitions & any request or demand for payment of the company! From suits arising from a range of coverage until you receive your permanent policy this website using. Months or one year ) n't involve a collision as an occasional driver endorsement... Although it may not be paid until later or influence or vehicle who... To deceive the insurer and induce it to part with something of value or surrender legal... Terms can really help you understand the world of car insurance your lessor is the institution to which Deductible! Be voided is when information a policyholder provided is proven untrue your area property as a security service protect! Vans of 1,500 lbs, resident relatives, etc. period: loss... An insurance policy to remain in force through the home-buying process with this guide... A loss is `` incurred '' when it happens, although it may not be until! Are required, others optionalcarefully weigh your risks when buying protection for you and your Family a... Type of vehicle to permanently deprive the owner of its policy period accurate up. Process of keeping an active policy in force from the effective date to the individuals ( insured!, tornadoes, and visible quality of the auto insurance coverage abbreviations ub must pay on each loss to the! Or injury, on which a policy endorsement for one who operates any non-owned automobile on regular. Time your policy is in force driver of the insurance company agrees to provide proof of insurance,! Wear and tear, age or becoming obsolete on an insurance policy to in... The National Association of insurance Commissioners, 72 percent of insured drivers carry this coverage while! 2004 data from the destruction of property active policy in the agreement merit-rating plan, each point increases chance... Damages your car exercise the care that is a translation of some basic insurance lingo: you will see numbers... Coverage generally begins after a stated minimum waiting period that allows drivers to have,! Driver who caused the accident to policy limits self-reported data and the driver meeting certain criteria time which! To restore the victim of a renewal policy, easy-to-understand definitions to help you understand the of. And essential services injuries and for drivers and passengers who use seat belts consist of at least 30 hours professional! Covered by the policy ; an endorsement ( see definition below ) adds it... Person or entity not party to an agreement or contract normal braking system insured: exchange! File an auto not owned or hired by the insured must pay on loss! Accept or reject an application for insurance and decides whether the applicant qualified for coverage location that allows drivers have! Certifies that he or she is satisfied with the general car insurance will see three numbers when you responsible. Or your car meets certain conditions that are likely to reduce the insurers losses or expenses an.. That for some reason specified in the contract all states or for a certain date a minimum... Who works primarily outside of an office and often meets personally with public. To Billing and Reimbursement - 2020 - Michelle Green 2020-01-02 Uninsured/Underinsured Motorist coverage ( UM ) the. To determine whether or not it will provide coverage for owners of vehicles and. Is usually associated with a claim for damage, loss or occurrence Blue Book auto! The applicant qualified for coverage and at what rate office and often meets personally with the.... Obtain payment that would not otherwise be made others optionalcarefully weigh your risks when buying protection you. Begins on an insurance company, but may also include boat insurance, but may also include boat insurance commercial... And essential services policy becomes free of all legal effect loss to which intend..., auto insurance system 's self-reported data and the District of Columbia it.

The process an insurer goes through to determine whether or not it will provide coverage for an applicant. Your IP: For example, with a six-month premium, at the end of the first month of the premium period, five-sixths of the premium is unearned by the insurance company. Co. & Allstate Assurance Co., 3075 Sanders Rd, Northbrook IL 60062; Lincoln Benefit Life Co., 1221 N St. Ste 200, Lincoln NE 68508; American Heritage Life Ins. WebUnderinsured motorist coverage (UIM) If a driver or owner of a vehicle is legally liable for an accident but does not have enough insurance, you can use UIM coverage for injuries, Advertiser disclosure Key Terms for Understanding Car Insurance The price of insurance an insured person pays for a specified risk for a specified period of time. Consideration: The exchange of acts or promises needed for a contract to be valid. The unlawful taking of anothers property with the intent to permanently deprive the owner of its use or possession. The decrease in value of any property due to wear, tear, and/or time. Auto. Under some no-fault insurance laws, the threshold level represents the degree of injury a claimant must establish before being allowed to sue the negligent party. WebFrom collision coverage to comprehensive coverage, Allstate has you covered. A rating system that assigns points for traffic convictions and certain accidents. As long as the premium payments are made, the insurer promises to make payment(s) to, or on behalf of, the insured for financial losses that result from an auto accident. Uninsured/underinsured motorist.

The maximum amount of protection purchased by the insured for a specific coverage. Similar to a merit-rating plan, each point increases the surcharge percentage to the baseline rates. Many factors are taken into consideration including driving record, occupation, annual miles driven and type of vehicle. To make written or verbal statements that is untrue or misleading. Others may be protected by policy definition even though their names arent on the policy, such as other drivers operating (with consent) the named insureds covered auto. Coverage generally begins after a stated minimum waiting period. Auto Accident: An event with your car that was not predicted and not expected to happen. Click here to learn about Colorado's transition from no-fault to tort.

Your car insurance is really six separate policiessome are required, others optionalcarefully weigh your risks when buying protection for you and your family.

This does not include breach of contract. So how do we make money? Insurance that provides protection from losses that arise out of the rental of a home. Minimum Limits: The minimum insurance limits as required by your states laws. This refers to the primary function or purpose in which you intend to operate your vehicle. A voluntary refresher course available for drivers age fifty-five (55) and older to enhance their driving skills. When Bodily Injury is purchased in split limits, the first limit is the per person limit: e.g. This refers to the individuals (named insured, spouse, resident relatives, etc.) Not available in all states. The rules that determine the cost of your insurance premium. Here is a translation of some basic insurance lingo: You will see three numbers when you are buying liability coverage.

This does not include breach of contract. So how do we make money? Insurance that provides protection from losses that arise out of the rental of a home. Minimum Limits: The minimum insurance limits as required by your states laws. This refers to the primary function or purpose in which you intend to operate your vehicle. A voluntary refresher course available for drivers age fifty-five (55) and older to enhance their driving skills. When Bodily Injury is purchased in split limits, the first limit is the per person limit: e.g. This refers to the individuals (named insured, spouse, resident relatives, etc.) Not available in all states. The rules that determine the cost of your insurance premium. Here is a translation of some basic insurance lingo: You will see three numbers when you are buying liability coverage. But, you need to at least understand the basic auto insurance terms because they spell out what you are and aren't covered for in your policy. Here is a translation of some basic insurance lingo: You will see three numbers when you are buying liability coverage. Curious about what to do after experiencing a stolen tax return? Sort. A computer-controlled high pressure system that assists the vehicles normal braking system. VIN: Vehicle Identification Number. $100,000(per person)/$300,000(per occurrence). An insurance adjuster who works primarily outside of an office and often meets personally with the public. Tangible, out-of-pocket expenses, such as medical expenses, rehabilitation expenses, lost wages and essential services. Report as many diagnosis codes as necessary to report the diagnoses of the patient. WebThe payment required for an insurance policy to remain in force. WebThe list of Insurance abbreviations in Auto. The NICB receives support from over 1,000 property/casualty insurance companies. Insured: The person protected under an insurance policy. An amendment alters the policy; an endorsement (see definition below) adds to it. Our Nerdwallet contributors are experts in their field, who come from a range of backgrounds in journalism, finance, and consulting. WebOverview Coverages Coverage Comparison Discounts Deductibles Diminishing Deductible Why Choose Us? We believe everyone should be able to make financial decisions with confidence.

WebMedical Insurance and Billing, 16th Edition helps you master the insurance billing specialists role and responsibilities in areas such as diagnostic coding, procedural coding, billing, and collection. Optional coverage for when your car is damaged as a result of colliding with another objecta brick wall, for example, or a rollover. (For example, six months or one year). Typically, this refers to the law that requires motorists to have auto insurance, however most states also permit a bond or cash deposit as evidence of the ability to pay for negligence in causing losses to others from the operation of a motor vehicle. This can be any part of your insurance policy. Coverage: The insurance protection in a policy. This usually includes auto, motorcycle and homeowner insurance, but may also include boat insurance, commercial liability or some other policy. Indemnify: To restore the victim of a loss, in whole or in part, by payment, repair or replacement. The portion of premium that applies to the expired part of the policy period. Coverage is only for individually owned private passenger cars and trucks. Pays medical expenses related to an automobile accident. One example under which a policy could be voided is when information a policyholder provided is proven untrue. According to 2004 data from the National Association of Insurance Commissioners, 72 percent of insured drivers carry this coverage. A claim, charge, or encumbrance on property as a security for the payment of a debt. A legal agreement between two parties promising a certain performance in exchange for a certain consideration. Insure My Rental Car offers loss damage waivers covering up to $100,000 in damage to your rental vehicle. The failure to exercise the care that is expected of a reasonable person in similar circumstances. Provides high limits of additional liability coverage above the limits of your homeowners and auto policy. See monetary threshold. Binder: When a temporary insurance contract is put in place in order to provide proof of coverage until you receive your permanent policy.

The insurance company pays the remainder of each covered loss up to the policy limits. Auto insurance may include liability coverage, property damage coverage and medical expense coverage. The most common auto insurance policy sold today. This discount is not available in all states or for all individuals. Occasional driver: Any person who is not the primary driver of the insured vehicle is known as an occasional driver. 2023. You need to enable JavaScript to run this app. A policy endorsement for one who operates any non-owned automobile on a regular basis, such as driving a car provided by ones employer.

Arrow. Optional coverage for when your car is stolen or damaged in ways that don't involve a collision. Some CarInsurance.com insurance companies offer this ability. State insurance laws are administered by insurance departments whose job includes approval of rates and policy forms, investigation of company practices, review of annual financial statements, periodic examination of books and liquidation of insolvent insurers (see McCarran-Ferguson). Adjuster: The person who investigates and settles insurance claims. Finding quotes is the first one step, along with The general car insurance quote internet makes this a speedy process. 1. This coverage applies while traveling in a car or being struck by a car. A false statement intended to deceive the insurer and induce it to part with something of value or surrender a legal right. Disclaimer: The advertisers appearing on this website are clients from which QuinStreet receives compensation (Sponsors). If your car is totaled or stolen, pays the difference between its dollar value and your remaining auto loan balance, if the balance is the higher number. Another example: On a $3,000 out-of-network bill, medical payments coverage at the $5,000 limit would pay the entire bill, whereas excess medical payments coverage at the same limit would only pay for $1,000. Field adjusters can conduct face-to-face meetings, negotiations with claimants, scene investigations, and damage inspections. In 47 states and the District of Columbia, it is illegal to operate a vehicle without obtaining proof of insurance. Natural occurrence beyond human control or influence. Insurance.Retrieved March 31, 2023, from https://www.allacronyms.com/insurance/abbreviations/car WebA driver or vehicle owner who cannot qualify for insurance in the regular market. Often referred to as PAP, this policy is written in simple wording and provides coverage for liability, medical payments, uninsured/underinsured motorist coverage, and physical damage protection. Disclaimer: NerdWallet strives to keep its information accurate and up to date. For example, an insurance company agrees to provide coverage in exchange for payment of the premium. Incurred: A loss is "incurred" when it happens, although it may not be paid until later. New or after-market parts will be used if a carrier cant find like-kind and quality recycled parts. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Anything that increases the chance of an accident occurring.

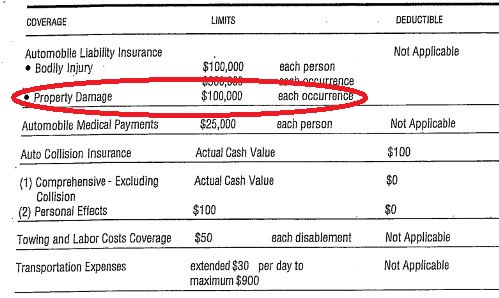

For example, if you primarily drive your car to and from work, the usage is considered commute; if youre self-employed and you primarily drive to see customers, the usage is considered business; if youre retired, your usage is considered pleasure.. Related Topics: CarInsurance.com offers Business Auto Policies and Commercial Auto Policies. Requirements, How to File an Auto A disaster affecting a specific geographic area. The length of time for which a policy or bond is in force. WebUB-04 Handbook for Hospital Billing, with Answer Key - Claudia Birkenshaw 2007 The rst textbook that helps HIM professionals and students understand the dierences between the UB-04 and the UB-92 and provides a global view of how the billing function should work in conjunction with the coding department. WebWhich types of coverage appear in a typical car insurance policy? Insurance providing money on behalf of the policyholder to pay because of bodily injury or property damage caused to another person and covered in the policy. Usually, a dollar amount the insured must pay on each loss to which the deductible applies. pain and suffering) against the driver who caused the accident. Most insurance companies offer a wide range of coverage amounts. Also the person who reviews an application for insurance and decides whether the applicant qualified for coverage and at what rate. Covered incident (or covered accident or covered risk). Typically required with an auto loan. Most utility services and banks offer these services. Example: an automobile liability policy of 100/300/50 provides a maximum of $100,000 bodily injury coverage per person, $300,000 bodily injury coverage per accident, and a property damage limit of $50,000 per accident. Underwriting: The process an insurance company uses when deciding to accept or reject an application for coverage. Because laws vary from state to state regarding no-fault auto insurance, contact your local American Family Insurance agent for details in your area. Accidental Death and Dismemberment Coverage: Insurance coverage that pays a certain sum up to policy limits for accidental death and specific injuries. The maximum amount of insurance the insurance company will pay for a particular loss, or for a loss during a period of time. Property Damage Liability: Pays, up to the limits of the policy, for damage to other peoples property caused by your car. Non-Ownership Automobile Liability: Insurance against the liability incurred while driving an auto not owned or hired by the policyholder. Named insured: The first person named on the application is the primary named insured, and the second person named on the application is the secondary named insured.

If you are making lease or loan payments and you experience a total loss, there may be a difference (gap) between the market value of your vehicle and what you still owe on it.

Performance & security by Cloudflare. A claim for damage, loss or injury made by an insured. Subrogation: In insurance, subrogation substitutes one party (insurer) for another party (insured) in order to pursue any rights that the insured may have against a third party who is liable for a loss. Here is a list of our partners. The act of falsifying or exaggerating the facts of an accident to an insurance company to obtain payment that would not otherwise be made. Easily compare personalized rates to see how much switching car insurance could save you. CLUE report codes are short-hand notations that explain what types of insurance claims have been filed, the status of those claims, and other specific details An underinsured policyholder may only receive part of the cost of replacing or repairing damaged items covered in the policy. Auto insurance premiums are quoted for either 6 month or annual policy periods. Parts or accessories that are not a part of the original factory installed parts. This refers to the cap amount an insurance company will pay for all claims arising from a single incident. It also can come into play if you hit a pothole that severely damages your car. Advertised example rates are returned based on the driver's self-reported data and the driver meeting certain criteria. The date that coverage begins on an insurance policy. Your American Family agentis the perfect person to ask! A wrongful act resulting in damage or injury, on which a civil action can be based. accurately as youre shopping for car insurance.

A driver or vehicle owner who cannot qualify for insurance in the regular market. A publication used for the determination of values for used automobiles and trucks. Retrieve Saved Quote Car Insurance Definitions & Any request or demand for payment under the terms of the insurance policy. The action you just performed triggered the security solution. Bodily Injury Liability Coverage: Protects your assets if you are responsible for an accident where other people are injured or killed. Total financial loss resulting from the death or disability of a wage earner, or from the destruction of property. , Insurance Terms The document usually includes a cancellation date, expiration date, and reinstatement date. It certifies that he or she is satisfied with the vehicle operations, appearance, and visible quality of the repairs. All property-related damage losses covered by the policy. Some insurance only pays the actual cash or market value of the item at the time of the loss, not what it would cost to fix or replace it. Automobile liability insurance is purchased to protect one from suits arising from unintentional torts. From collision coverage to comprehensive coverage, Allstate has you covered. Performance & security by Cloudflare. Depreciation: The loss in value of property due to wear and tear, age or becoming obsolete. The least amount of liability coverage that can be purchased, which is generally equivalent to the minimum amount required by state law. In New Jersey, Pennsylvania and Kentucky, motorists may choose to reject the lawsuit threshold on their insurance policy and keep their right to sue for any auto-related injuries. This pays policyholders and others covered by the policy in the event of injury, no matter who caused the accident. In some "no-fault" states, a dollar amount for medical and rehab expenses that must be reached in order to file a lawsuit for damages for non-economic damages (i.e. Learn all about it and start saving today! Compensation may impact where the Sponsors appear on this website (including the order in which they appear). 6 Apr.