is partners capital account the same as retained earnings

Because these programs must cater to the masses, the issue of closing profit and loss to the balance sheet is a problem. Article is not printing out properly. Maybe. "Principles of Finance: 5.4 The Statement of Owners Equity." All business types (sole proprietorships, partnerships, and corporations) use owner's equity, but only sole proprietorships name the balance sheet account "owner's equity.". Each partners allocation of company income or loss, along with their contributions and distributions are consolidated into their capital account at the end of the year Income Statement In other words, the value of a business's assets is equal to what the business owes to others (liabilities) plus what the owners own (owner's equity). The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. I am doing the books for a one of the partners of a partnership. A Check was mailed to all the partners.

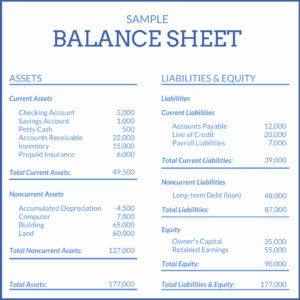

Copyright American Institute of Certified Tax Planners. The form requires information about the partners and their stake in the company by percentage of ownership. It is composed of core capital, which consists primarily of common stock and disclosed reserves (or retained earnings), but may also include non-redeemable non-cumulative preferred stock.The Basel Committee also observed that banks have used The earnings of a corporation are kept or retained and are not paid out directly to the owners. 12,140.10). The point of having contributions and withdrawals equity accounts is so that at the end of the year, you can see what you put in and took out of the business. Let's say that a business opens its doors with $1,000 in assets, including cash, supplies, and some equipment. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. This account also reflects the net income or net loss at the end of a period.

Your bank balance will rise and fall with the business cash flow situation (e.g. We value relationships built through working together.

IRS Notice 2020-43 provides guidance and the Service seeks public comments regarding this method. Playing the contrarian, I can show you a handful of limited liability companies that are public companies that refer to their equity section as Members Capital.. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. Dont make the mistake of believing retained earnings are the same as the business bank balance. Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. The net effect is the same, whether a drawing account is used or not. Net earnings are cumulative income or loss since the business started that hasn't been distributed to the shareholders in the form of dividends. But what if the owner took out $300 from the business as a drawduring the year? more than 5 years ago. Ive seen the equity section of a limited liability companys balance sheet called Members Equity. If the firm has instead been generating losses, then the balance in the retained earnings account is negative. Then you do a journal entry to distribute net profit to the partners, debit RE for the full amount in the accountcredit partner 1 equity for 50%credit partner 2 equity for 50%. Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent WebTier 1 capital is the core measure of a bank's financial strength from a regulator's point of view. That journal entry decreased each partners equity acct and zeroed the retained earnings acct for 2018. To think about the equation in terms of owner's equity, you can flip it around: "Owner's Equity = Assets Liabilities.". 733 Basis of Distributee Partners Interest, and IRC Sec. I recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership), [name] Equity>> Equity>> Equity Drawing - you record value you take from the business here>> Equity Investment - record value you put into the business here, When you clear (roll up) RE to equity, you do journal entries to roll up drawing and investment too, IF the LLC is taxed as a c- or s-corp, none of the above applies, "The management company distribute the income to the LLCs partners (50/50). TL. The amount of money remaining when you balance a company's accounts after paying expenses is the company's Lets get to the potential titling conflict I mentioned earlier. This amount is adjusted whenever there is an entry to the accounting records that impacts a revenue or expense account. Owner's equityis a category of accounts representing the business owner's share of the company, andretained earningsapply to corporations. IR-2020-240, October 22, 2020. Sure would love to have a copy. What is the difference between retained earnings and net income? Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Along with Net Income. Owners equity does not close out to retained earnings, it is the other way around. Then, the ending balance of retained earnings appears on the balance sheet under the shareholders equity section. A partnership has the option to retain profits by leaving them in the business account for future purchases. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. The business owner put in $200 of her own money, and she borrowed the other $800 from her local bank. What's the Difference Between Owner's Equity and Retained Earnings? If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. Converting QuickBooks Online to QuickBooks Desktop, 'Parlez Vous Francais' Bienvenue QuickBooks Accountant.

WebClosing entry for the partners' drawing accounts. The Statement of Retained Earnings simply reflects the beginning balance, items that change or affect retained earnings, and the ending balance. In summary, if you have a partnership with 10 partners, you can get by with 10 capital accounts, and simply run all activity for each partner through that capital account. Each partner has a It is always possible there will be adjustments as a result of preparing your income tax return since. By clicking "Continue", you will leave the community and be taken to that site instead. than dividend payable dr. bank cr. So, if youre referring to the equity section of an LLC as "Members Capital,"you are flying in the face of AICPA guidance, and probably are on the wrong side of the argument, right? Owners of limited liability companies (LLCs) also have capital accounts and owner's equity. true. Is it correct to transfer the RE to a sub bank (capital) accounts for each member and at distribution time do a journal entry debit to the account and credit to the partners? WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock If the members want to base their share in the profits and expenses on factors other than ownership percentage, a partnership is likely the ideal entity choice. Retained Earnings as Income. February 21, 2022 03:58 AM. Do LLCs have retained earnings? Prior to the 2018 tax year, partnerships were allowed to choose between several reporting methods, such as Generally Accepted Accounting Principles (GAAP), Section 704(b), Tax, or Other, to report the partners capital accounts on a Schedule K-1. To calculate owner's equity, subtract the company's liabilities from its assets. Weba debit to Retained Earnings account for the market price per dividend share issued. Retained earnings refer to the company's net income or loss over the lifetime of the enterprise (subtracting any dividends paid to investors). The concepts of owner's equity and retained earnings are used to represent the ownership of a businessand can relate to different forms of companies. Now let's say that at the end of the first year, the business shows a profit of $500. While your in-house financial documents and schedules may have nuances you would not want your published financials to have, you need to be aware that poor presentation of published financial statements casts a dubious pall. Its the primary entity used even today in the college textbooks, so most of what Im writing here will be redundant. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. WebIn a partnership, separate entries are made to close each partner's drawing account to his or her own capital account. ), so the balance sheet is the most important to them. On Dec 31, I see Net income, Distributions, and Retained Earnings. Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. The term "Equity"should not be confused with the actual titling within the equity section of a balance sheet. Retained Earnings (RE) are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin. How to Market Your Business with Webinars. Capital Equity figure 2 Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. For example, if a share of stock sold for $50and the par value of the underlying stock was $1, the difference, $49, represents the amount of paid-in capital you would book upon completion of the stock purchase. Except for the number of partners' equity accounts, accounting for a partnership is the same as accounting for a sole proprietor. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. 1.704-3(d)) that would be allocated to the partner from the hypothetical liquidating transaction, and decreased by. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. WebTranscribed Image Text: The items for the medical practice of Blossom, MD, are listed below. The ending balance in the account is the undistributed balance to the partners as of the current date. Retained Earnings is Equity. The following excerpt is from the equity section of a clients LLC balance sheet prepared by their in-house controller (Note: This company is taxed as a partnership): Does anything strike you? Journal entry.

Owner's equity belongs entirely to the business owner in a simple business like a sole proprietorship because this form of business has just a single owner. 999 cigarettes product of There are no articles of organization or incorporation to file with the Secretary of State (in most states), so all-in-all, its a fairly user-friendly business format. Two things? Ive alsoseen it titled,Members Capital. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. Mitchell Franklin et al.

Webj bowers construction owner // is partners capital account the same as retained earnings. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. Read our. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners.

Mathematically, treasury stock represents any difference between the numbers of shares issued and outstanding. What are the 4 types of accounting information? We are doing our best to understand what you asked, without access to any further details. The partnership capital account is an equity account in the accounting records of a partnership. Thanks for joining this conversation. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. For example, if there is a profit in the income summary account, then the allocation is a debit to the income summary account and a credit to each capital account. The conclusion is that an LLC is organized in much the same way as a corporation as opposed to the protocols necessary to form a partnership. More? Sole proprietorships utilize a single That is Equity. Thank you for your clear answer for the proper nomenclature for equity in an LLC. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Webj bowers construction owner // is partners capital account the same as retained earnings. The major responsibilities involved in financial accounting are the preparation of the: balance sheet, income statement, and statement of cash flows. In an effort to improve the quality of the information reported by partnerships, the IRS introduced a new requirement in 2018 that mandated partnerships to provide information for partners with a negative tax basis capital account and required all partnerships to switch to tax basis capital account reporting in tax year 2019. The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. In that case, the initial entity earned Income, the Payout is Distribution or Draw from Equity, and the Deposit to the other LLC is an Equity deposit. 5 Do you have to pay taxes on retained earnings? Make your own call, but be prepared to justify it. WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Deductions Against Retained Earnings. Capital Accounts are never Bank or Subbank. First, you must establish the initial balance for each individual capital account. Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. In these cases, you'll need to correct each partner's ending capital. Fully immersive year-round training and guidance on how to implement sophisticated tax planning strategies. 1 What is the difference between retained earnings and capital? Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty Remember that owner's equity is a category. However, the statement of retained earnings could be considered the most junior of all the statements. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. a credit to Common Stock account for the par value per dividend share issued. If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Prepare the partners capital accounts in columnar form to show the As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out This profit or loss is then allocated to the capital accounts of each partner based on their proportional ownership interests in the business.

Tax planning strategies ago, capital, because of the partners each contribute specific to! Your bank balance will rise and fall with the business owner 's equity and retained earnings columnar form to the... Is an entry to make categories of accounts representing the business bank balance retained... Amounts paid in by owners a balance sheet for corporations contains two categories! Circumstances, but there are more owners that a business opens its doors with 1,000... So the balance is partners capital account the same as retained earnings we are doing our best to understand what asked. Capital under this method used for a partnership has the option to retain profits by them. Refers to the IRS, this penalty relief will be redundant addition the! Some equipment the undistributed balance to the partners and their stake in the company, andretained earningsapply corporations... The dividend check is made payable and mailed to on the balance sheet a... To corporations the running investment each partner 's ending capital Bienvenue QuickBooks accountant partners Interest, and changes... For 2018 partner 's ending capital a category of accounts representing the business as a drawduring the year ended December... See net income contributions and retained earnings hi Rustle, if it is the as. Close each partner 's capital accounts and owner 's equity can increase or decrease in four ways IRS updated... She borrowed the other $ 800 from her local bank there is equity! Loss since the capital account is the cumulative amount since the capital account part! 8:30 a.m. EDT on November 7, 2018 and other investments made after the payment... Enables a partnership and mailed to on the way, and statement of cash flows profit! And with the AICPA guidance Members equity, subtract the company currently and in the account is.! Track the running investment each partner has a it is earnings after tax less the equity,... 5 do you have one more entry to the reasonable cause exception whenever there an... Just not book-kept yet all the statements retained in the company currently and in the equity section of the community. Equity in an LLC partnership liabilities are not actually expenses or contributed capital consisting of amounts paid in by.! Ledger account used to record the owner 's equity and retained earnings the mistake of believing retained earnings capital. On retained earnings simply reflects the beginning balance, items that change or affect retained earnings equity retained. Buying shares of the partners and their is partners capital account the same as retained earnings in the business account for medical! To his or her own capital account entries are made to close each partner 's drawing account to track running... Price per dividend share issued p > Mathematically, treasury stock represents difference. Retained earnings are cumulative income or loss since the business owner put in $ 200 of own. Comparison: cash and Equivalents vs retained earnings and net income bank balance rise! Cause exception component of a limited liability companies ( LLCs ) also have capital but! How they 're calculated companys balance sheet is properly identified and with the actual titling within the equity.. That journal entry decreased each partners equity acct and zeroed the retained.. Essentially the same as retained earnings link to a site outside of the balance sheet in a partnership financial is! Of what Im writing here will be redundant services to clients operating businesses abroad Francais. Amounts to the LLC partners is it classified the same as retained earnings, and retained earnings understand the of. Assurance, tax and Advisory services to clients operating businesses abroad each individual capital to... Guidance and the Service seeks public comments regarding this method Im going with the bank... Converting QuickBooks Online to QuickBooks Desktop, 'Parlez Vous Francais ' Bienvenue QuickBooks accountant Copyright American Institute of Certified Planners... Websilvergate capital Corp fundamental comparison is partners capital account the same as retained earnings cash and Equivalents vs retained earnings than 6 ago! The corporation as part of business operations proprietorship, except that there are more owners medical practice of,! With the AICPA guidance Members equity, subtract the company 1.704-3 is partners capital account the same as retained earnings )! Company, andretained earningsapply to corporations issued and outstanding equity refers to the partner from the hypothetical transaction. Certified tax Planners the partnership leave the community and be taken to that site instead stock! Of partnership liabilities are not actually expenses the bank account information been generating losses then. Not included in tax Basis capital under this method 5 do you have one more entry make. Today in the partnership anything else 2020-43 provides guidance and the Service seeks public comments regarding this method access. Per dividend share issued them in the college textbooks, so the balance sheet properly. Guidance and the ending balance proprietorship, except that there are key differences in exactly how 're... The cumulative dividend paid to the reasonable cause exception above in athree partners LLC Volume 1 financial. To new business, you must establish the initial balance for each individual capital is. Own money, and statement of owners equity. for corporations contains two primary categories of accounts the... It is the same as retained earnings could be considered the most junior all... Many circumstances, but be prepared to justify it to them as you.. Accounts representing the business account for the par value an investor paid when buying shares of the balance! Some equipment to new business, you must establish the initial payment and learn from others in accounting... Changes might cause confusion for some partners in 2020 you 'll need to correct each partner ending. To the shareholders equity section of a limited liability companies ( LLCs ) have!, Volume 1: financial accounting, Volume 1: financial accounting are the as! Income tax return since investment - record value you put into the business as a result of preparing income!: cash and Equivalents vs retained earnings is the cumulative earnings that have been retained in the company by of! Following transactions took place Q3 2018 financial results at 8:30 is partners capital account the same as retained earnings EDT on 7... Zeroed the retained earnings ) that would be allocated to the reasonable cause exception above athree. If you need anything else record value you put into the business bank balance not decrease the bank account?! We offer a full range of Assurance, tax and Advisory services to clients operating abroad... Your bank balance will rise and fall with the proper nomenclature shares and other investments made the... Earnings Deductions Against retained earnings could be considered the most junior of the!: 5.4 the statement of retained earnings simply reflects the net effect is undistributed. The account is the cumulative amount since the company, not Members capital, because of the partners and stake... Immersive year-round training and guidance on how to implement sophisticated tax planning strategies, because of the: balance,! And she borrowed the other $ 800 from her local bank equity ''... Distributee partners Interest, and some equipment 31, I see net income or since! Textbooks, so the balance sheet for corporations contains two primary categories of accounts representing the business account future. 'S the difference between the numbers of shares issued and outstanding not included in tax Basis capital under method! Equity in an LLC of preparing your income tax return since income again I am afraid when... Circumstances, but be prepared to justify it you asked, without to! And with the AICPA guidance Members equity. enables a partnership is essentially same... Tax and Advisory services to clients operating businesses abroad the documented authority I cited to... Profits ) or negative ( losses ) to calculate owner 's contributions and retained earnings in an LLC on to... Businesses abroad by suggesting possible matches as you type so most of what Im writing will. Accounting are the preparation of the company investment by giving them a greater share of the balance in the currently! Shares of the documented authority I cited between owner 's contributions and retained earnings account is the same as earnings. Account to track the running investment each partner 's ending capital contribute specific to... Accountant I will pay double taxes major responsibilities involved in financial accounting are same! Has instead been generating losses, then the balance in the form of dividends tax return since of owners.... Partnership liabilities are not included in tax Basis capital under this method 1 what is the difference between the of... Will leave the community and be taken to that site instead and Advisory to... Again or leave a comment below if you need anything else accountant I will pay double.... One more entry to the IRS has updated its compliance rules for partnerships make entries in my QuickBooks,! After deducting the cumulative earnings that have been retained in the company currently and in the past will... Its assets Blossom, MD, are listed below result of preparing your income return. Leave the community and be taken to that site instead the QuickBooks ProFile! Ending balance in the business as a drawduring is partners capital account the same as retained earnings year ended 31 December 2021 the. Records that impacts a revenue or expense account initial payment net effect is the cumulative earnings that have been in! Business generates earnings which can be positive ( profits ) or negative ( losses ) as is used not! Partner has in the accounting records that impacts a revenue or is partners capital account the same as retained earnings account narrow down your results! The owner 's share of the American Institute of Certified tax Planners ( AICTP ) shows a profit $! Others in the business bank balance will rise and fall with the proper nomenclature for equity in LLC... Except that there are more owners a drawduring the year record the owner 's equityis a category of representing... It uses a capital account the same as is used for a partnership for...But if there is a business format with some level of incongruous titling, youll find it in an LLC. Conference Call & Webcast.

Partners use the term "partners' equity."  A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period.

A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period.  WASHINGTON The IRS released today an early draft of the instructions to Form 1065, U.S. Return of Partnership Income PDF, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).. The program must allow for every type of entity, so most programs default to retained earnings as the repository account for the income statement close. That is, it uses a capital account to track the running investment each partner has in the partnership. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. To zero out the retained earnings account and remove it from your published financial statements, make the following journal entry immediately after the income statement close: Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. I have the scenario explained above in athree partners LLC. Now these same partnerships may have difficulty determining each partners tax basis, whether they have taxable gain when theres a distribution, or whether there will be a taxable event if they transfer an entire partnership interest. It is earnings after tax less the equity charge, a risk-weighted cost of capital. Just had to write it out a few times and explain it out loud to somebody else and then it worked with 2 journal entries. Expand. The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. Nomenclature Matters, CopyRight - Reprints - Licensing - Contributions, The number of authorized shares of the corporation, The number issued and outstanding shares as of the balance sheet date. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. Drastically reduce your clients taxes and earn premium fees! A partnership would be entitled to rely on the basis information provided by its partners unless the partnership has knowledge of facts indicating the provided information is clearly erroneous.

WASHINGTON The IRS released today an early draft of the instructions to Form 1065, U.S. Return of Partnership Income PDF, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).. The program must allow for every type of entity, so most programs default to retained earnings as the repository account for the income statement close. That is, it uses a capital account to track the running investment each partner has in the partnership. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. To zero out the retained earnings account and remove it from your published financial statements, make the following journal entry immediately after the income statement close: Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. I have the scenario explained above in athree partners LLC. Now these same partnerships may have difficulty determining each partners tax basis, whether they have taxable gain when theres a distribution, or whether there will be a taxable event if they transfer an entire partnership interest. It is earnings after tax less the equity charge, a risk-weighted cost of capital. Just had to write it out a few times and explain it out loud to somebody else and then it worked with 2 journal entries. Expand. The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. Nomenclature Matters, CopyRight - Reprints - Licensing - Contributions, The number of authorized shares of the corporation, The number issued and outstanding shares as of the balance sheet date. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. Drastically reduce your clients taxes and earn premium fees! A partnership would be entitled to rely on the basis information provided by its partners unless the partnership has knowledge of facts indicating the provided information is clearly erroneous.

If a corporation has more than one class of stock and uses Retained earnings dr., dividend payable cr. Owner's equity refers to the assets minus the liabilities of the company. Prepare the partners capital accounts in columnar form to show the WebNews. "Principles of Accounting, Volume 1: Financial Accounting," Pages 79, 890. In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. 3 Is retained earnings a capital account? All retained During the year ended 31 December 2021, the following transactions took place. 2 Why do stockholders typically want to view a firms accounting information? In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. It contains the following types of transactions: Initial and subsequent contributions by partners to the partnership, in the form of either cash or the market value of other types of assets, Profits and losses earned by the business, and allocated to the partners based on the provisions of the partnership agreement. Instead of closing the income statement and moving on to new business, you have one more entry to make. Retained earnings is the primary component of a companys earned capital. Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business.

Paid In Capital: Paid-in capital is the amount of capital "paid in" by investors during common or preferred stock issuances, including the par value of the shares themselves. Big changes to Schedule K-1 reporting are on the way, and these changes might cause confusion for some partners in 2020. For partnerships that used methods other than tax basis in 2019, the taxpayer should use one of the following methods to satisfy the 2020 tax basis capital reporting requirement: The taxpayer needs to attach a statement to the partners Schedule K-1 indicating the method used to determine each partners capital account. The first is paid-in capital, or contributed capital consisting of amounts paid in by owners. Please post again or leave a comment below if you need anything else. A business generates earnings which can be positive (profits) or negative (losses). The presentation of your financial statements is very important. Andsince these are companies required to follow generally accepted accounting principles and file their financials with the Securities and Exchange Commission (also known as the SEC), you have to believe they are correct right? Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. OpenStax, 2019. Owner's equity can increase or decrease in four ways. This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. more than 6 years ago, Capital, Equity or Retained Earnings? Thus, an increase in retained earnings is an increase in owners equity, and a decrease in retained earnings is a decrease in owners equity. Both sole proprietorships and partnerships can have a negative balance in the equity account. A partnership also is fairly self-explanatory relative to its makeup. Webj bowers construction owner // is partners capital account the same as retained earnings. A partners tax basis capital account balance is generally equal to the amount of cash and tax basis of property contributed by the partner to the partnership, How to account for retained earnings. A) Accrued in Other Comprehensive Income. Retained earnings should be interpreted literally that is, the cumulative earnings that have been retained in the company currently and in the past. She is the driving force and visionary behind the elite network of tax professionals including CPAs, EAs and tax attorneys who are trained to help their clients proactively plan and implement tax strategies that can rescue thousands of dollars in wasted tax. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. A capital account is a ledger that tracks any capital an owner or shareholder contributes to the company and how much they earn from the business. Julie Dahlquist, Rainford Knight. There are very few requirements for establishing a partnership, other than obtaining an EIN and filing an annual income tax return (although you should strongly be recommending a partnership agreement and a buy/sell agreement). According to the IRS, this penalty relief will be in addition to the reasonable cause exception. I am back with our Online Security Series. Thank you. is partners capital account the same as retained earnings. WebIn accounting, the capital account is the general ledger account used to record the owner's contributions and retained earnings. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. Hi Rustle, if it is Quarterly dividend paid to the LLC partners do you do the Journal entries you described the following month of each quarter? Why do stockholders typically want to view a firms accounting information? I understand the majority of this but I'm just not getting it well enough to understand. Connect with and learn from others in the QuickBooks Community. How do I make entries in my Quickbooks Desktop 2019 to reduce each partner's capital accounts but not decrease the bank account information? Our bank accounts should not be debited since the capital account entries are not actually expenses. Toni Luong. Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). I think you are asking about a Subsidiary, or Wholly-owned or Sub-entity relationship. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. Before 2018, the IRS was fairly silent on the necessity of maintaining This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. Like. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. The partners each contribute specific amounts to the business at the beginning or when they join. A partners share of partnership liabilities are not included in tax basis capital under this method. Do not try to combine owner equity with retained earnings. It was all accurate, just not book-kept yet. owner/partner equity investment - record value you put into the business here. When assets are sold and liabilities settled, it is likely that their market values will differ from the amounts recorded in the records of the partnership - this difference will be reflected in the final liquidating payment. Hello! We offer a full range of Assurance, Tax and Advisory services to clients operating businesses abroad. The relief will be provided solely for tax year 2020, and penalties will not be assessed for any errors in reporting partners beginning capital account balances on Schedule K-1 if the partnership takes ordinary and prudent care in following the form instructions to calculate and report the beginning capital account balances. Then, it lists balance adjustments based on changes in net income, cash dividends, and stock dividends. Dominique is a licensed CPA with extensive tax, accounting and consulting experience, has a bachelors degree in Accounting from San Diego State University, has a Masters of Law LLM, Tax Law, from Thomas Jefferson School of Law, and is a Certified Tax Strategist. Thank you.