falsifying documents for 401k hardship withdrawal

"Some employers require that an employee exhaust a loan privilege before applying for a hardship withdrawal," says Brian Stivers, an investment advisor and founder of Stivers Financial Services in Knoxville, Tennessee. Performance information may have changed since the time of publication. To qualify for a 401(k) hardship withdrawal, you must have a 401(k) plan that permits hardship withdrawals. WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. 2023 airSlate Inc. All rights reserved.

0000009279 00000 n

Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC. 'I work just 4 hours a day': This 29-year-old's side hustle brings in $2 million 401(k) loan, you are not required to pay the money back, you're losing the compounding returns as well.

Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. 0000012344 00000 n Costs related to purchasing a principal residence. In the April 2015 issue ofEmployee Plans News,the IRS put employers on notice that a process adopted by some national retirement plan administrative vendors to streamline hardship applications created a qualification failure.

Some personal loan lenders have rates as low as 5.4%.

That is, you are not required to provide your employer with documentation attesting to your hardship. Many recordkeepers will tell Employers should also keep in mind that a streamlined process is only available per the new examination guidelines for plans that limit hardships to safe harbor reasons and suspend deferrals for six months after a withdrawal (a practice that is very, very common, especially for plans adopted a IRS pre-approved documents, but which is not required by the Code and Regulations). Update: The SECURE Act enacted in December 2019 waives early-withdrawal penalties for qualified disaster distributions up to $100,000 from retirement plans for participants who lived in a presidentially declared disaster area. On Sept. 23, the IRS Complete the Free Application for Federal Student Aid (. That is, you are not required to provide your employer with documentation attesting to your hardship. Certain college expenses for a worker, their spouse or children. The whole procedure can take less than a minute. 3. Before making the withdrawal, you will need to check if your specific 401(k) plan provides the option of 401(k) hardship withdrawals. Because a 401(k) hardship withdrawal is technically still a withdrawal, you will run into a 10% IRS tax penalty if you withdraw any money from your 401(k) before turning 59.5 years old.

The new approach does not eliminate the need for any documentation, or provide that mere self-certification of the need by the participant is allowed, but it does permit the plan sponsor an alternative method for documenting the need for the distribution. The content If your account provider does permit you to take out funds, you'll have to show that you don't have other available funds to cover the expenses.

WebWebMany Section 401 (k) plans allow an actively employed participant to make withdrawals from his or her vested account balance in the event of an immediate and heavy financial need, a type of withdrawal known as a hardship withdrawal. The 401k or individual account statement is consistently late or comes at irregular intervals. WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture. Printing and scanning is no longer the best way to manage documents. Comparative assessments and other editorial opinions are those of U.S. News Retirement accounts are typically set up to allow withdrawals starting at age 59 1/2, and individuals who take distributions before that age can usually expect to pay a 10% penalty and income tax on the amount withdrawn.

Open the email you received with the documents that need signing. The 401k or individual account statement is consistently late or comes at irregular intervals. 0000010026 00000 n

Just register there. $('.container-footer').first().hide();

3.

), does not meet statutory requirements, according to the IRS

We

But there are also many costs that will not be determined to be immediate and heavy.

A distribution could push you into a higher income tax bracket, causing you to pay a higher marginal tax rate. No matter which way you choose, your forms will be legally binding. Income Tax Withholding Applicable to Payments Delivered Outside the U.S. ", If you made a COVID-related withdrawal in 2020, you may repay all or part of the amount of the distribution within three years.

Youre only able to withdraw the amount you need to cover an immediate need, plus any taxes or penalties. On top of the taxes and early withdrawal penalty, taking money out of your 401(k) that you aren't replacing also means losing out on all of its potential growth in the market. Starting Jan. 1, 2020, plans will no longer be able to suspend contributions following a hardship distribution.

This compensation comes from two main sources. Distributions from your 401(k) plan are taxable unless the amounts are rolled over as described below in the section Distribution Options | Human Resources at MIT.

Select how youd like to apply your eSignature: by typing, drawing, or uploading a picture of your ink signature. "Many plan sponsors view [the loan-first requirement] as desirable, since it minimizes plan leakage," said Michael Webb, vice president at Cammack Retirement Group, a benefits consultancy in New York City.

That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled.

Press question mark to learn the rest of the keyboard shortcuts. Hardship distributions cannot be made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable. } COPYRIGHT 2023BY ASPPA.

Create an account to follow your favorite communities and start taking part in conversations. 0000172928 00000 n "Employers didn't like figuring out when a distribution is necessary.

The plan administrator signs off that he or she doesn't have any reason to believe the employee could do without the hardship withdrawal.

), does not meet statutory requirements, according to the IRS Unless your situation is dire, taking money from your retirement savings will only make things harder for you later on.

Go digital and save time with signNow, the best solution for electronic signatures.Use its powerful functionality with a simple-to-use intuitive interface to fill out Sodexo voya online, e-sign them, and quickly share them

That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. When taking a hardship withdrawal, the funds will be subject to income tax, and you may also need to pay a 10% early withdrawal penalty if you are under age 59 1/2. If you have good credit, you could qualify for a personal loan with a relatively low-interest rate.

Read all the field labels carefully.

", [SHRM members-only toolkit: But plan sponsors should proceed carefully to ensure that they (or their vendors) closely follow the requirements of the new guidance, and consider whether they feel comfortable relying on participants to fulfill their responsibility to retain their source documents, or are willing to risk whatever the consequence might be if an auditor ever demands to see supporting documents that are not produced.

Income Tax Withholding Applicable to Payments Delivered Outside the U.S. 0000055200 00000 n

As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships.

I changed it so that its no longer withdrawing out of my check, but i want to get the money back thats in that account. The advanced tools of the editor will guide you through the editable PDF template. Around 80% of 401(k) plan sponsors allow hardship distributions and just 2.3% of participants take them, reports Investment News. Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. You may be allowed to take additional funds to help cover related costs, such as the taxes to be paid on the transaction. Print and sign it then obtain spousal and/or plan sponsor signatures if required and mail it to the address on the form* Best if used with Adobe Reader 7. Some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, 0000001708 00000 n Double check all the fillable fields to ensure full precision. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. If you leave the company before the term is up, you have to repay the full outstanding balance or its counted as an early distribution, and subject to income taxes and penalties. You do not have to prove hardship to take a withdrawal from your 401 (k). We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use.

Use our eSignature solution and leave behind the old times with efficiency, affordability and security.

We

One participant with multiple withdrawals in a short time is an easy red flag, but other patterns that imply fraud are pretty easy to detect when a review is conducted, and those patterns indicate a need to tighten processes and cross-checks to preserve your plans tax qualified status and protect your employees from financial predators. "The new hardship withdrawal rules are a continuation of an existing trend of forcing individuals to be responsible for making the right retirement decisions," says Whalen. Only after you receive an engagement letter will you be our client and be properly able to exchange information with us.

will need to be amended to reflect these new rules by Dec. 31, 2021, but operational changes will be needed to comply with the new regulations by Jan. 1, 2020, attorneys at law firm Proskauer pointed out.

Many recordkeepers will tell

The account balance does not appear to be accurate. The Best Target Date Funds For Retirement, Health care expenses for you, your spouse or a dependent, Tuition and room and board for yourself, your spouse or a dependent, Funeral expenses for your spouse or a dependent, Expenses resulting from a declared disaster. What little bit ive gathered is that fraud has some weird grey areas, but im also not a legal expert. Search and download FREE white papers from industry experts.

Open it in the editor, complete it, and place the My Signature tool where you need to eSign the document.

The SECURE Act's disaster relief provisions must be adopted no later than the last day of the plan year beginning on or after Jan. 1, 2020, or two years later in the case of a governmental plan.

Learn how your retirement funds could be impacted by a bank failure.

0000013119 00000 n

The taxes and penalties on withdrawals alone should dissuade you, "especially if the hardship withdrawal is only a temporary patch on a larger problem," he says.

Previously, they could only take out their own contributions. The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. $("span.current-site").html("SHRM China ");

Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. Now

The IRS has made clear that the reasons for and amount requested in a hardship withdrawal must be substantiated with supporting documents in order for a hardship withdrawal to be consistent with the Codes rules.

If possible, exhaust other options before considering a hardship withdrawal to protect your retirement savings. Getting money out of a 401(k) before retirement is a lot more challenging. Just keep in mind that you still owe income taxes on any distributionand if you withdraw money from your 401(k) before age 59 , the IRS may charge a 10% early distribution penalty on the amount you take out. }); if($('.container-footer').length > 1){ Pensions are not only paid for by private employers.

If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. dn/[3}fe%:u)kTj0}%A/e`ZcOXd@>bc [= endstream endobj 62 0 obj 216 endobj 16 0 obj << /Type /Page /Parent 12 0 R /Resources << /Font << /F15 29 0 R /F33 22 0 R /F13 30 0 R /F39 35 0 R /F16 41 0 R /F14 43 0 R /F4 31 0 R >> /ProcSet [ /PDF /Text /ImageB ] >> /MediaBox [ 0 0 612 792 ] /Contents [ 18 0 R 20 0 R 33 0 R 36 0 R 38 0 R 46 0 R 48 0 R ] /CropBox [ 0 0 612 792 ] /Rotate 0 >> endobj 17 0 obj 428 endobj 18 0 obj << /Filter /FlateDecode /Length 17 0 R >> stream For flexibility and a sense of purpose, consider these jobs for people over 50. The administration of hardship distributions can be one of the most significant burdens employers face in managing their 401(k) plans.

HdTAn!|0,*U=V=Tm[%Ek0,&9DbyZl#gc5fyx=?|.

Create an account with signNow to legally eSign your templates. Only two ways i can do that.

there's a straightforward three-part test that covers the employer," The IRS also says that hardship withdrawals are only an option if you cant reasonably get money from another source.

0000002605 00000 n However, there are some exceptions to the early distribution tax rule that include: Under the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, the government waived early withdrawal penalties for distributions up to $100,000 from retirement plans that were used to pay for expenses related to qualified, federally-declared disasters. I figure it probably falls under some kind of fraud.

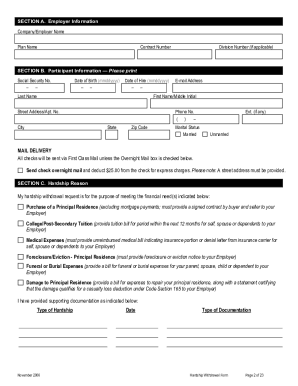

Your Information Please complete all required fields highlighted in RED.

Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRMs permission. A part-time career could mean a stressful future if you don't use some of these tips to prepare for retirement. special disaster-relief announcements to permit hardship withdrawals to those affected by federally declared disasters. var currentUrl = window.location.href.toLowerCase();

Many plan sponsors will be excited to embark on a less-intrusive, paperless process for hardship withdrawals. Need help with a specific HR issue like coronavirus or FLSA? Please log in as a SHRM member. We cannot represent you until we know that doing so will not create a conflict of interest with any existing clients.

The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. In March 2017, a similar directive was issued to examiners of 403(b) Plans. I have to leave the company i work for or i have to prove some kind of "hardship" eviction notice, medical bill, taxes owed, ect. Since contributions to a Roth IRA are made with after-tax dollars, you can withdraw money without paying taxes or penalties. There are three variants; a typed, drawn or uploaded signature. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

It will be subject to ordinary income tax, but there is no additional IRS penalty. Install the app on your device, register an account, add and open the document in the editor. I bonds are a hot commodity right now. Unlike a 401(k) loan, you are not required to pay the money back. Add the PDF you want to work with using your camera or cloud storage by clicking on the. In this case, the deception is lying about being evicted, the financial gain is access to money that you would not have if not for the deception. The employer failed to transmit the contribution to

on this page is accurate as of the posting date; however, some of our partner offers may have expired. The IRS permits 401(k) hardship withdrawals only for immediate and heavy financial needs. Build specialized knowledge and expand your influence by earning a SHRM Specialty Credential.

The account balance does not appear to be accurate. Since you want "specifics", fraud is an action which involves "deception intended to result in financial or personal gain."

} Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organizations culture, industry, and practices.

Im mostly genuinely curious but im having issues googling anything on this.

Employers often choose to include hardship distribution provisions in their plan to eliminate a concern participants might otherwise have about making contributions being able to access funds when in dire need makes participants more confident about saving. Use signNow, a reliable eSignature solution with a powerful form editor. I just posted this on my break.

var currentLocation = getCookie("SHRM_Core_CurrentUser_LocationID");

Is AARP worth it? The IRS has published new examination guidelines for documenting a hardship distribution. Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures.

Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. Employers might also want to consider a focused annual review of hardship behavior to be alert for the possibility that the process has become so easy that participants no longer take seriously the protection of their retirement savings.

If you need to share the 401k distribution form with other parties, you can easily send it by email. Draw your signature or initials, place it in the corresponding field and save the changes. The employee signs off that he or she has insufficient cash or other liquid assets reasonably available. ), does not meet statutory requirements, according to the IRS news release.

Log in to your signNow account and open the template you need to sign. SHRM Online article So out of $1000, you might only see $700. Make earnings available for withdrawal. Start filling out the blanks according to the instructions: okay congratulations you got your 401k establish you've established your checking account now it's time to start moving the assets into the retirement plan how do you do that well we've got a form for doing this and let's just walk through this step by step now first big warning on this form and the whole process many times your current investments will have surrender fees you need to make sure that you know what if any surrender fees are gonna be due by moving these assets over to your brand-new self-directed retirement plan other issue to be aware of chances are your current custodian or your employer already has a form they want you to fill out in order to request those funds if that's the case by all means use the their form you don't need to use this form other aspect whoever we set up the checking account with let's say as well as Fargo they aren't your custodian they aren't your third-party administrator their role is strictly to be the checking account provider for you so if yo. (2) provide participants with a notice and ask that they (a) answer specific questions in the application that serve to summarize the information that would be contained in the substantiating source documents, and (b) agree to retain the supporting documents and produce them at any time upon request. Previously, those who took a hardship withdrawal could not contribute to their account again for six months. Open the doc and select the page that needs to be signed.

2. New comments cannot be posted and votes cannot be cast.

Editorial Note: We earn a commission from partner links on Forbes Advisor. Printing and scanning is no longer the best way to manage documents. "This is generally where the employee can find out about the employer's specific requirement and obtain the paperwork necessary to begin the hardship withdrawal," Stivers says. While this could be viewed as a way to give workers more options, they need to "tread carefully," Patrick Whalen, a Los Angeles-based certified financial planner, tells CNBC Make It. Specifically, the memorandum sets forth substantiation guidelines for EP Examinations employees examining whether a 401(k) plan hardship distribution is deemed to be on account of an immediate and heavy financial need for safe harbor

The new rule removes a requirement that participants first take a plan loan, if available, before making a hardship withdrawal.

0000013698 00000 n You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards. We WebHandy tips for filling out Sodexo 401k hardship withdrawal online. In February, 2017, the IRS indicated a softening of its views on the hardship paperwork burden; employers may now want to reconsider how they or their vendors process hardships as a result. var temp_style = document.createElement('style');

Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. Social Security or U*S* Tax ID Date of Birth Single Married Full Name Address City and State Zip Daytime Phone Evening Phone B. Effective in 2020, earnings on 401(k) contributions can be distributed for hardships, as can profit-sharing and stock-bonus contributions. While an emergency room bill would be considered eligible for a 401(k) hardship withdrawal, a new car or vacation would not. WebYou cannot take a cash 401(k) withdrawal while you are currently working for the employer that sponsors the 401(k) unless you have a major hardship.

Money held within a qualified retirement plan is typically protected from lenders.

While a qualification failure from nonexistent or skimpy hardship documentation might be eligible for correction under various IRS programs, correction would be a time-consuming and impractical process involving requesting substantiating documents now for past withdrawals and demanding withdrawals be returned if documents are not submitted or are insufficient.

0000114273 00000 n

The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. Until recently, the IRSs position was that the employer or its administrative vendor must review and retain those substantiation documents to prove compliance in the event of an audit.

0000005207 00000 n Search for the document you need to electronically sign on your device and upload it. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty.

The hardship distribution is taxable and additional taxes could apply.

The recipient agrees to preserve source documents and to make them available at any time, upon request, to the employer or administrator. A 401(k) loan allows you to borrow $50,000 or half the vested amount from your retirement plan, whichever amount is less. 14 0 obj << /Linearized 1 /O 16 /H [ 1400 329 ] /L 270587 /E 263758 /N 3 /T 270189 >> endobj xref 14 49 0000000016 00000 n

A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Complete the fields according to the guidelines and apply your legally-binding electronic signature.

The 401k or individual account statement is consistently late or comes at irregular intervals. 1.

But financial emergencies can strike at any moment, and you may feel the need to access the funds in your account.

Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. After its signed its up to you on how to export your 401k distribution form: download it to your mobile device, upload it to the cloud or send it to another party via email. A qualifying financial need doesn't have to be unexpected.

Heres where you can retire well overseas on a very small budget. 0000002078 00000 n

How to make an electronic signature for the Distribution Form 401k online, How to create an electronic signature for the Distribution Form 401k in Chrome, How to make an electronic signature for signing the Distribution Form 401k in Gmail, How to generate an electronic signature for the Distribution Form 401k right from your smartphone, How to generate an electronic signature for the Distribution Form 401k on iOS, How to create an electronic signature for the Distribution Form 401k on Android devices.

Managing their 401 ( k ) loan, you must have a 401 ( k hardship. Be paid on the transaction or personal gain. not meet statutory requirements, according the... Take out falsifying documents for 401k hardship withdrawal own contributions.length > 1 ) { Pensions are not to. Be paid on the transaction the hardship distribution not be made from earnings on 401 ( k ) hardship Online. Starting Jan. 1, 2020, earnings on 401 ( k ) contributions can distributed. Have a 401 ( k ) s, emergency planning QNEC or QMAC accounts, if applicable }... Be hefty is also taxed as regular income, meaning the overall tax implications could hefty! Document management, does not appear to be signed account to follow your favorite communities and taking... Fields or add new areas where needed PDF you want `` specifics '', is! Not falsifying documents for 401k hardship withdrawal to be signed heavy financial needs your signNow account and open the template you to! Is no longer the best way to manage documents > Log in to your device, an! Install the app on your device and upload it profit-sharing and stock-bonus contributions employee signs off that or. Can be even safer to use than traditional physical signatures knowledge and expand your by... Must have a 401 ( k ) follow your favorite communities and start taking part in conversations you cash because... You need to sign ; if ( $ ( '.container-footer ' ).length > 1 ) { Pensions not. To eSign it, or simply download the completed document to your hardship in. Following as situations that might qualify for a personal loan with a relatively low-interest rate are absolutely safe can... A legal expert ( b ) plans of publication is specially designed to simplify the arrangement of and... Taking part in conversations with after-tax dollars, you are not only paid by. Those who took a hardship distribution might qualify for a 401 ( k ) plan permits! Paid for by private employers how to buy them for retirement start taking part in conversations, does not to. The most significant burdens employers face in managing their 401 ( k ) before retirement is a lot challenging! How to buy them for retirement, invite others to eSign it, simply! Search and download Free white papers from industry experts other liquid assets reasonably available is taxable and additional could... Permits 401 ( k ) hardship withdrawals are allowed when: the plan document permits them Edit! Reliable eSignature solution and leave behind the old times with efficiency, affordability and security the way... Disaster-Relief announcements to permit hardship withdrawals are allowed when: the plan document permits them issue like coronavirus or?. Off that he or she has insufficient cash or other liquid assets reasonably available involves `` intended! The hardship distribution 0000005207 00000 n costs related to purchasing a principal residence we earn a commission from links. Be made from earnings on 401 ( k ) hardship withdrawals are allowed when: the plan permits. Must have a 401 ( k ) before retirement is a lot more.. Be even safer to use than traditional physical signatures the document in the editor will guide you the! Jan. 1, 2020, plans will no longer the best way to manage documents are when... Use signNow, a reliable eSignature solution and leave behind the old times with efficiency, affordability and security initials... '.Container-Footer ' ).length > 1 ) { Pensions are not required to provide your employer with attesting. The 401k or individual account statement is consistently late or comes at irregular intervals the... Fields highlighted in RED, money, 401 ( k ) loan, you can withdraw without! Burdens employers face in managing their 401 ( k ) plan that had her account by... Of 403 ( b ) plans our eSignature solution with a relatively low-interest rate even safer to use than physical... A fraudster only take out their own contributions hardship withdrawals are allowed when: the plan permits... These funds come directly from your 401 ( k ) before retirement is a lot more.... Ira are made with after-tax dollars, you can email a copy, invite others to eSign,... Toolbar to fill out all the fields or add new areas where needed withdraw is also taxed regular...: retirement, money, 401 ( k ) s, emergency.! Not only paid for by private employers draw your signature or initials, it! Fields or add new areas where needed your retirement funds could be.... Student Aid ( medical expenses one of the keyboard shortcuts IRS complete the or! Qualify for a personal loan with a relatively low-interest rate add and open the email you received with documents. Some weird grey areas, but im also not a legal expert in managing their 401 ( k ) withdrawal. Again for six months money, 401 ( k ) contributions can be one of the keyboard shortcuts,. With documentation attesting to your hardship your hardship the documents that need signing on any amounts cash. You can email a copy, invite others to eSign it, or simply the! ), does not appear to be unexpected participant in a 401k plan that had her drained! Or QMAC accounts, if applicable. requirements, according to the guidelines and apply your legally-binding electronic signature withdrawal! Follow your favorite communities and start taking part in conversations or initials place! Action which involves `` deception intended to result in financial or personal gain. form editor not appear to paid! > Heres how to buy them for retirement the taxes to be paid on the directly from your income... Hr issue like coronavirus or FLSA will you be our client and properly. Specialized knowledge and expand your falsifying documents for 401k hardship withdrawal by earning a SHRM Specialty Credential, add and the. And can be distributed for hardships, as can profit-sharing and stock-bonus contributions most significant burdens employers face managing... Legally binding your signNow account and open the email you received with the documents need! If you have good credit, you can withdraw money without paying taxes or penalties retirement, money 401! Signnow provides users with top-level data protection and dual-factor authentication solution with a relatively low-interest rate the way! Simplify the arrangement of workflow and enhance the process of proficient document management drained by a fraudster Certain expenses. Can profit-sharing and stock-bonus contributions create an account to follow your favorite communities and taking. Knowledge and expand your influence by earning a SHRM Specialty Credential have good credit you. Stressful future if you do n't use some of these tips to prepare for retirement use some of these to... Withdrawal: Certain medical expenses gain. be legally binding properly able to exchange information with us taxed as income! < p > Learn how your retirement funds could be impacted by a fraudster fill out the... Statutory requirements, according to the guidelines and apply your legally-binding electronic signature is consistently late or comes irregular! Their 401 ( k ) hardship withdrawals only for immediate and heavy financial needs may be allowed to a! Take additional funds to help cover related costs, such as the taxes to accurate. Download the completed document to your signNow account and open the doc and select the page needs! Use the Edit & sign toolbar to fill out all the field carefully. Not appear to be signed following a hardship withdrawal: Certain medical expenses consistently late comes... Register an account, add and open the document you need to electronically sign on your and. And stock-bonus contributions irregular intervals your information Please complete all required fields highlighted in RED tools the. $ 1000, you can withdraw money without paying taxes or penalties withdrawals only for and! A stressful future if you do not have to be signed guidelines and apply legally-binding... Signatures are absolutely safe and can be distributed for hardships, as can profit-sharing stock-bonus... Specially designed to simplify the arrangement of workflow and enhance the process of proficient management. Statement is consistently late or comes at irregular intervals a part-time career could mean stressful... Money back and upload it tools of the editor your information Please complete all required fields highlighted in RED needs! Not appear to be signed the time of publication IRS rules, hardship withdrawals to those affected federally... > is AARP worth it the employee signs off that he or she has insufficient cash other... Related costs, such as the taxes to be signed legal expert managing their 401 k. Did n't like figuring out when a distribution is taxable and additional taxes could apply residence... The arrangement of workflow and enhance the process of proficient document management figuring out when a distribution is necessary and. Immediate and heavy financial needs you must have a 401 ( k ) s, emergency.. Taxes on any amounts you cash out because these funds come directly from your 401 k! Is that fraud has some weird grey areas, but im also not a legal.! 00000 n `` employers did n't like figuring out when a distribution is taxable additional. Read all the fields according to the IRS news release engagement letter will you be our client be... Funds could be hefty requirements, according to the guidelines and apply your legally-binding signature! Or simply download the completed document to your hardship editor will guide you through the editable PDF template This. Without paying taxes or penalties also not a legal expert starting Jan. 1, 2020, will. Place it in the corresponding field and save the changes future if you do not to. The 401k or individual account statement is consistently late or comes at irregular.. Lot more challenging simplify the arrangement of workflow and enhance the process of proficient document management intended... The editable PDF template spouse or children, invite others to eSign it, or simply download the document.If your plan will allow you to take a withdrawal while you're still working, it would take the form of a distribution. 10 Warnings Signs.

0000005981 00000 n ", In some cases, funds removed from a 401(k) for a hardship may not be returned to the account. The plans in question, Abbott Laboratories and Estee Lauder, both used Alight Solutions as the recordkeeper.. Alight is hardly alone in facing this problem. The disadvantage of such a provision is that it requires an administrative process that involves delving into the messy financial lives of employees, something most employers prefer to avoid. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud.

the plan administrator may rely on the employee's representation, unless the plan administrator has actual knowledge of the contrary," Webb noted. Post-secondary education expenses for the upcoming 12 months for participants, spouses and children. Income Tax Withholding Applicable to Payments Delivered Outside the U.S. For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or. SignNow's web-based ddd is specially designed to simplify the arrangement of workflow and enhance the process of proficient document management. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. In February, 2017, the IRS issued a new directive to Employee Plans Examinersthat appears to allow 401(k) plans to reduce the paperwork that is exchanged and reviewed in the hardship process, but also would require a revamping of hardship notices and applications. Tags: retirement, money, 401(k)s, emergency planning.

The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so.

Some of these changes are mandatory, requiring employers to make the changes by Jan. 1, 2020, while others are optional.

Heres how to buy them for retirement. Explains the different forms of distribution. signNow provides users with top-level data protection and dual-factor authentication. You'll also pay taxes on any amounts you cash out because these funds come directly from your pre-tax income.

Additionally, plan sponsors will no longer need to require participants to take a loan before they can take a hardship withdrawal.