ancillary probate massachusetts

If the property was still owned at the time of death, a death certificate would need to be recorded and then the beneficiary named in the TOD would take title without the need of an ancillary probate. However, when the estate is intestate (when there is no will) and the home-state personal representative is not qualified to act in Florida, the order of preference for the appointment of a personal representative under Floridas intestacy statute will apply. For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. Failure to list a tenancy renders the owners as tenants in common each would own their 50% interest, but the deceased owners interest passes to their heirs upon death and must go thru Probate for the interest to be conveyed. However, ancillary probate is often unavoidable if a decedent left certain property in another state that must pass through probate. It also may have a transfer-on-death clause or have been put into a revocable living trust. Ancillary probate is an additional probate proceeding that needs to be filed when a person dies owning assets in a state or country that is not their state or country of residence. If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. Unfortunately, Massachusetts is not a state that allows a TOD to convey real estate after death. In order to pass a clean title to the buyers, a formal probate proceeding is required. This secondary proceeding is required where the deceased left property or assets in more than one state, and because each state has different property laws, a probate proceeding must be made in each state where property is located. Treas. If a decedent does not reside in the state where the drafting attorney practices, the attorney should not prepare an estate plan to reflect the laws of the state where he practices, because the plan eventually will be governed by the laws of the state where the decedent is domiciled. Weatherby & Associates, PC, Providing a Secure Future for a Special Needs Child in an Uncertain Economy. "Beneficiary Deeds in Montana." Stat. Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. 202104-1(a)(1). JeFreda R. Brown is a financial consultant, Certified Financial Education Instructor, and researcher who has assisted thousands of clients over a more than two-decade career. This is an issue I often find with time-share owners. Maine is phasing out its inheritance tax until June 30, 1986, when it will be abolished altogether. Reg. Ancillary Probate involves starting an entirely new probate procedure in most circumstances. He hasexperience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation. Past results and testimonials are not a guarantee, warranty, or prediction of the outcome of your case, and should not be construed as such. Ancillary Probates in Florida Probate is the court process to settle a decedent's estate. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement.  The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. Rptr. DURING THE PAST 10 years, investments in the United States by foreign investors have risen dramatically, and attorneys are frequently asked to prepare estate plans or to give planning advice, to aliens. For this reason, some state laws do not require further ancillary Proceedings to transfer effective legal title to personal property. In addition, attorneys should become familiar with the administrative and situs rules of each jurisdiction. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts Is Your Retirement Nest Egg in Danger of Flying the Coop? When a decedent is not a resident of the United States, the principal administrative proceeding will be begun in his country of domicile, and ancillary proceedings need only be instituted in those states in the United States where he has left property. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Not all states handle property in multiple countries this way, so check with a local estate planning attorney to make sure. 4. Find probate lawyers Questions Legal Guides Resources Recently asked questions View more questions Asked in Rosamond, CA | Oct 5, 2022 The best way to accomplish this is to avoid probate altogether. Please contact our friendly lawyers to Schedule a Consultation. WebAncillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. WebInformal probate is an administrative probate process that can be faster if you meet all the requirements. The information presented should not be construed to be legal advice nor the formation of a lawyer/client relationship. Even those attorneys who represent only United States citizens frequently encounter jurisdictional difficulties when faced with the administration of property located in several states. When married owners divorce, the tenancy by the entirety is severed, so upon divorce their tenancy automatically changes to one of tenants in common. For example, Donovan, as the executor of his fathers estate, opens a probate case in Indiana, where his father primarily resided. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. Ancillary Probate in Tennessee. Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. In addition, separate gift tax treaties with Australia and Japan are in effect. We are here to help! Para nosotros usted es lo ms importante, le ofrecemosservicios rpidos y de calidad. The property, additionally, must always be probated in the state in which it is located.

The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. Rptr. DURING THE PAST 10 years, investments in the United States by foreign investors have risen dramatically, and attorneys are frequently asked to prepare estate plans or to give planning advice, to aliens. For this reason, some state laws do not require further ancillary Proceedings to transfer effective legal title to personal property. In addition, attorneys should become familiar with the administrative and situs rules of each jurisdiction. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts Is Your Retirement Nest Egg in Danger of Flying the Coop? When a decedent is not a resident of the United States, the principal administrative proceeding will be begun in his country of domicile, and ancillary proceedings need only be instituted in those states in the United States where he has left property. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Not all states handle property in multiple countries this way, so check with a local estate planning attorney to make sure. 4. Find probate lawyers Questions Legal Guides Resources Recently asked questions View more questions Asked in Rosamond, CA | Oct 5, 2022 The best way to accomplish this is to avoid probate altogether. Please contact our friendly lawyers to Schedule a Consultation. WebAncillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. WebInformal probate is an administrative probate process that can be faster if you meet all the requirements. The information presented should not be construed to be legal advice nor the formation of a lawyer/client relationship. Even those attorneys who represent only United States citizens frequently encounter jurisdictional difficulties when faced with the administration of property located in several states. When married owners divorce, the tenancy by the entirety is severed, so upon divorce their tenancy automatically changes to one of tenants in common. For example, Donovan, as the executor of his fathers estate, opens a probate case in Indiana, where his father primarily resided. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. Ancillary Probate in Tennessee. Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. In addition, separate gift tax treaties with Australia and Japan are in effect. We are here to help! Para nosotros usted es lo ms importante, le ofrecemosservicios rpidos y de calidad. The property, additionally, must always be probated in the state in which it is located.  WebIf you are in the need of help with a Florida Ancillary Administration proceeding, contact our experienced Florida Probate Lawyers. Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. Counsel may wish to recommend a foreign corporation to hold United States property, so long as he understands the potential estate tax and income tax problems inherent in holding property in this manner. The filing of the ancillary probate is to gain access to the out-of-state property. These real estate profiles, blogs and blog entries are provided here as a courtesy to our visitors to help them A knowledgeable attorney can help guide you through the ancillary probate administration process and ensure that all of your loved ones assets are appropriately and efficiently distributed. Trusts, Wills, and Estate Planning: Facts You Should Know. Please let us know how we can improve this page. If you need assistance, please contact the Probate and Family Court. A probate case is typically opened in the state in which the decedent primarily resided.

WebIf you are in the need of help with a Florida Ancillary Administration proceeding, contact our experienced Florida Probate Lawyers. Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. Counsel may wish to recommend a foreign corporation to hold United States property, so long as he understands the potential estate tax and income tax problems inherent in holding property in this manner. The filing of the ancillary probate is to gain access to the out-of-state property. These real estate profiles, blogs and blog entries are provided here as a courtesy to our visitors to help them A knowledgeable attorney can help guide you through the ancillary probate administration process and ensure that all of your loved ones assets are appropriately and efficiently distributed. Trusts, Wills, and Estate Planning: Facts You Should Know. Please let us know how we can improve this page. If you need assistance, please contact the Probate and Family Court. A probate case is typically opened in the state in which the decedent primarily resided.  Estate of Tutules, 204 Cal. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. What you want to see on the deed is: John W. Doe and Mary W. Doe, husband and wife as tenants by the entirety; or John W. Doe and Mary W. Doe as joint tenants. That would be a major complication. "What Is Ancillary Probate? The biggest downside of ancillary probate is the cost of going through probate two or more times. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. Condominium Trust Cannot Be Assessed Fees for Public Utilities Making Reasonable Modifications and Accommodations for Residents With Disabilities, Commercial Landlords Reasonable Discretion to Grant or Deny Tenants Assignment of Lease, A Refresher on Adverse Possession and Prescriptive Easements, Supreme Judicial Court Rules That Anti-Litigation Provision in Condominium Documents Offends Public Policy When Invoked by Developer, Appeals Court Requires Unanimous Unit Owner Consent To Expand Over Existing Exclusive Use Area, Devils in the DetailsDefining Fair Market Rent in Commercial Lease Extension Option Provisions, Supreme Judicial Court Considering Whether Anti-Litigation Provision In Condominium Documents Offends Public Policy, DEP Escrow Requirements for Repair and Replacement of Wastewater Treatment Facilities, Accommodating Reasonable Accommodations for Service and Emotional Support Animals, Traps for the Unwary Condominium Board Concerning Employees, Supreme Judicial Court Denies Developers Application for Review of Appeals Court Decision Concluding That Developers Partially-Constructed Units May Be Taxed.

Estate of Tutules, 204 Cal. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. What you want to see on the deed is: John W. Doe and Mary W. Doe, husband and wife as tenants by the entirety; or John W. Doe and Mary W. Doe as joint tenants. That would be a major complication. "What Is Ancillary Probate? The biggest downside of ancillary probate is the cost of going through probate two or more times. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. Condominium Trust Cannot Be Assessed Fees for Public Utilities Making Reasonable Modifications and Accommodations for Residents With Disabilities, Commercial Landlords Reasonable Discretion to Grant or Deny Tenants Assignment of Lease, A Refresher on Adverse Possession and Prescriptive Easements, Supreme Judicial Court Rules That Anti-Litigation Provision in Condominium Documents Offends Public Policy When Invoked by Developer, Appeals Court Requires Unanimous Unit Owner Consent To Expand Over Existing Exclusive Use Area, Devils in the DetailsDefining Fair Market Rent in Commercial Lease Extension Option Provisions, Supreme Judicial Court Considering Whether Anti-Litigation Provision In Condominium Documents Offends Public Policy, DEP Escrow Requirements for Repair and Replacement of Wastewater Treatment Facilities, Accommodating Reasonable Accommodations for Service and Emotional Support Animals, Traps for the Unwary Condominium Board Concerning Employees, Supreme Judicial Court Denies Developers Application for Review of Appeals Court Decision Concluding That Developers Partially-Constructed Units May Be Taxed.

A .mass.gov website belongs to an official government organization in Massachusetts. I hope to use my 40 years of hands-on real estate experience to assist you and your Massachusetts Buyers and Sellers. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. | Last reviewed March 26, 2008. 10 E. Main St., Ste. 505Waukegan, IL 60085, 22 E. Washington St., Ste. Join our newsletter to stay up to date on the latest legal news and firm updates. Is Breach of Fiduciary Duty a Crime in Florida. 20.2104-1(a)(2). After appropriate deductions and credits are taken, this tax is imposed on estates larger than approximately $50,000, at rates that begin at six percent and reach a maximum of 30 percent for that portion of the estate in excess of $2 million.

WebPETITION FOR INFORMAL PROBATE OF WILL APPOINTMENT OF PERSONAL REPRESENTATIVE PURSUANT TO G.L. But you should expect to pay most of the following common fees along the way: In some states, an executor will be allowed to file their executor authorization (sometimes called their "letters") from the first state along with a copy of the will, if any, instead of petitioning the second court for authorization. The tax is reported on Form 706NA. The executor must then begin ancillary probate in every state where property was owned by the deceased person. For purposes of probate, real estate is governed by the state in which it is situated, not by the state in which the owner resided. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Real property located within the United States.  Please limit your input to 500 characters. We are here to help! As of 2017, 27 states allow a property owner to record a TOD to allow real estate to pass outside of probate, and several more are considering adoption. Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site. While most state laws are in accord, an attorney should check carefully every jurisdiction in which the client's personal and real property is located to determine whether those jurisdictions require administration of that property. Care must be taken to provide for delays as a contingency in the P and S, or there could be litigation problems with the putative Buyers. Some page levels are currently hidden. The court In this article, we answer the question"what is ancillary probate?" on ActiveRain. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. The executor typically must also file a copy of the will with the second court. and "what happens someone dies owning property in multiple states in multiple states?". There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it. There are some exceptions to this. For a free consultation, call (786) 761-8333 or visit: https://rmolawyers.com. Ancillary courts sometimes accept authorizations provided to the executor by the domiciliary court so the executor doesn't have to go through the dual process of applying for another authorization. Ann. This cooperation can shorten the ancillary probate proceeding. Many of our clients are going through difficult times in their lives when they reach out to us. This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Please do not include personal or contact information. Oops! The estates of United States citizens and alien residents are taxed identically under the Internal Revenue Code ("Code") -- to which all section references. As of 1983, 21 states -- including Arizona, California, Florida, Massachusetts, Nevada, Texas, and Washington -- do not impose a tax on the gift or inheritance of any person or estate. They're something you can touch or hold in your hands, like real estate, automobiles, artwork, and jewelry. However, Donovans father also owned a small vacation home in Florida. I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? What Constitutes Undue Pressure or Influence in Florida? Mary is granted the time-share in the divorce. In contrast, the law considers real estate to live where the real estate is located. Real estate that is located outside the jurisdiction of the probate court where a decedent lived cannot be handled as part of the primary probate. Rather, a separate process will need to be conducted in that other state. Even if there is only one parcel located out of state, the need for that second process can drive up costs precipitously, and inevitably there will be added delays and complications for the fiduciary. Misconceptions sometimes exist among practitioners concerning the tax treatment of resident, as opposed to non-resident, aliens. A Notice of Ancillary Administration is a notice that a Florida personal representative must file when an ancillary administration has been commenced in another state, as required by Florida Probate Rule 5.065(b). The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. You can open an estate bank account, but you can't take money from it or close the decedent's account to fund it. Many of our clients are going through difficult times in their lives when they reach out to us. Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales.

Please limit your input to 500 characters. We are here to help! As of 2017, 27 states allow a property owner to record a TOD to allow real estate to pass outside of probate, and several more are considering adoption. Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site. While most state laws are in accord, an attorney should check carefully every jurisdiction in which the client's personal and real property is located to determine whether those jurisdictions require administration of that property. Care must be taken to provide for delays as a contingency in the P and S, or there could be litigation problems with the putative Buyers. Some page levels are currently hidden. The court In this article, we answer the question"what is ancillary probate?" on ActiveRain. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. The executor typically must also file a copy of the will with the second court. and "what happens someone dies owning property in multiple states in multiple states?". There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it. There are some exceptions to this. For a free consultation, call (786) 761-8333 or visit: https://rmolawyers.com. Ancillary courts sometimes accept authorizations provided to the executor by the domiciliary court so the executor doesn't have to go through the dual process of applying for another authorization. Ann. This cooperation can shorten the ancillary probate proceeding. Many of our clients are going through difficult times in their lives when they reach out to us. This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Please do not include personal or contact information. Oops! The estates of United States citizens and alien residents are taxed identically under the Internal Revenue Code ("Code") -- to which all section references. As of 1983, 21 states -- including Arizona, California, Florida, Massachusetts, Nevada, Texas, and Washington -- do not impose a tax on the gift or inheritance of any person or estate. They're something you can touch or hold in your hands, like real estate, automobiles, artwork, and jewelry. However, Donovans father also owned a small vacation home in Florida. I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? What Constitutes Undue Pressure or Influence in Florida? Mary is granted the time-share in the divorce. In contrast, the law considers real estate to live where the real estate is located. Real estate that is located outside the jurisdiction of the probate court where a decedent lived cannot be handled as part of the primary probate. Rather, a separate process will need to be conducted in that other state. Even if there is only one parcel located out of state, the need for that second process can drive up costs precipitously, and inevitably there will be added delays and complications for the fiduciary. Misconceptions sometimes exist among practitioners concerning the tax treatment of resident, as opposed to non-resident, aliens. A Notice of Ancillary Administration is a notice that a Florida personal representative must file when an ancillary administration has been commenced in another state, as required by Florida Probate Rule 5.065(b). The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. You can open an estate bank account, but you can't take money from it or close the decedent's account to fund it. Many of our clients are going through difficult times in their lives when they reach out to us. Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales.

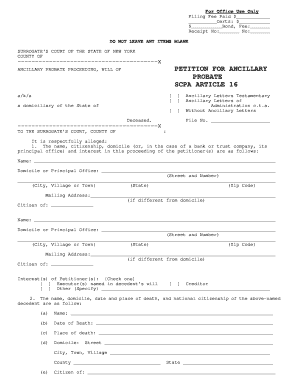

Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. The federal government imposes taxes on the estate of any deceased person who is a resident of the United States or who leaves property located within the United States. The petition must include specific information and documentation supporting the request for ancillary letters of administration to be issued. Unless the will has specifically waived the requirement, the personal representative will need to Decedent was a Florida resident and it appears no probate is required in Florida, as all assets were titled in decedent's living trust. Upon your death, the named successor can sell or transfer the property to the beneficiaries by recording a deed into them. Please limit your input to 500 characters. WebMassachusetts Court System Probate and Family Court forms for wills, estates, and trusts A collection of court forms related to wills, estates, and trusts for use in Probate and WebAncillary Probate to Satisfy Claim of Creditor After a foreign will has been admitted to probate, full ancillary probate can be avoided in many situations. Share sensitive information only on official, secure websites. In time-share situations, the Estate stops paying the yearly maintenance fees and lets the Resort conduct a friendly foreclosure, providing a death certificate and probate information to resort counsel so the time-share resort can send the required foreclosure sale notices to all heirs having an interest in the property. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. If an executor is allowed to bypass filing an entirely new probate petition this way, they are often known as a "foreign executor." TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Stay up-to-date with FindLaw's newsletter for legal professionals. The Personal Representative of the Estate needs to sell the secondary property. Wills and Estates Small Estates Massachusetts. Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. ActiveRain, Inc. takes no responsibility for the content in these profiles, Think of these as rights to a certain asset and/or the income it produces, such as patents, copyrights, or bank or retirement accounts. Weatherby & Associates is a reputable law firm serving greater Hartford CT. We understand the complexities of the law and can provide the expert advice a, Copyright 2023 A lock icon ( He can be reached at 508-628 About RMO LLP serves clients in Los Angeles, Santa Monica, Ventura, Santa Barbara, San Francisco, Orange County, San Diego, Kansas City, Miami, and communities throughout California, Florida, Missouri, and Kansas. Step-By-Step Guide to Opening a Probate Estate. Ancillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located. WebThus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. If John died without a Will, then Mary must obtain cooperation and pay to open a probate proceeding as well in order to have the time-share administered and Johns interest conveyed to Mary. Instead of owning a property solely in your name, title properties that will likely be subject to probate in joint tenancy, tenancy by the entirety, or community property with right of survivorship; Put the property into a revocable living trust; or, Issue a transfer-on-death (TOD) deed, which is sometimes referred to as a beneficiary deed. The United States also imposes a tax on the gross estates of non-resident aliens.  that are written by the members of this community. How do I file for probate in Massachusetts? Because theres no standardized probate court fee schedule across the nation, just like attorney fees, the cost will differ depending on where you are. You should consult an attorney for advice about your specific legal matter. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. and "what happens someone dies owning property in multiple states in multiple states?"

that are written by the members of this community. How do I file for probate in Massachusetts? Because theres no standardized probate court fee schedule across the nation, just like attorney fees, the cost will differ depending on where you are. You should consult an attorney for advice about your specific legal matter. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. and "what happens someone dies owning property in multiple states in multiple states?"